Lifestyle

Tips To Control Holiday Spending

Published

6 years agoon

Christmas time comes once a year. It makes many people happy with all the gift giving and merry making. Some of the happiest people during the holidays are retailers because of all the shopping that usually begins after Thanksgiving and ends after Christmas. For many people, the holidays are spent spending money for gifts, vacations, and parties. Spending your money is alright, especially if you have it to spend. The problem is when you spend money you don’t have. This is overspending, and we have tips below to help you keep track of your money this holiday season.

How Much Can You Spend?

To keep yourself from overspending, figure out how much you can spend on gifts, decorations, entertainment, and travel. Once you find out how much you can afford without sacrificing the necessities, it will be easier to shop for gifts, decorations, host parties, or travel during the holidays. You can think of this as your budget. Since you know the budget, it is now time to exercise discipline and stick to the amount.

Find Ways To Save

Bargains, sales, and discounts are amazing during the holiday season. Buying discounted items is actually a great way to save during the holidays. You can start early by making a shopping list of all the people you need to buy gifts for. Once sales like Black Friday occurs, you can then browse for gifts online or head down to the shops to find gifts on discounted prices, buy-one-take one or those with freebies which you can also gift to other people.

Resist Temptation

You want to be generous now, but remember you have to pay for it (literally) later so resist all temptation to overspend. If you allotted a certain amount for a person, stick to that budget. If the other sweater looked more gorgeous, perhaps you can find a similar one that is on sale. Find alternatives for gifts and stay within range of your budget rather than overspend.

Use Cash

Spending using your credit card can make you uncontrollable, and most of the time, you end up spending more money than originally intended. The problem with credit cards is that you can pay it at a later date and rack up interest. Being in debt due to overspending can take a long time to reverse. To avoid this, always use cash to purchase your gifts, decorations, entertainment, or travel essentials for the holiday. This way, you can control spending, and if you don’t have cash, you can’t spend.

Give Yourself Incentives

Give yourself incentive to stick to the plan. Reward yourself by indulging a little. For example, at the end of Christmas, total everything. If you did not overspend, treat yourself to something you really wanted, like that handbag or that cashmere sweater. You can also reward yourself with a massage or a trip to the spa. Just remember not to overspend on your treat too.

Be Flexible

If you find that you’ve overspent, don’t beat yourself up too hard. Instead of dwelling on your guilt, find ways to come up with money so that your credit card or wallet won’t suffer too much. Spending on credit is easy but paying it will not be. You can either come up with ways to cut overhead a little bit or find an extra job to offset the charges.

You may like

Business

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Published

2 days agoon

July 4, 2025

What was once old is new again: mid century modern is back in style. From architecture to furniture, the postwar look is in, and the hype extends all the way to office chairs.

Do you need a mid century modern office chair in your life? If so, there’s plenty to choose from. Your office chair should be tailored to your style, whether you like luxury, utility, or something in between.

That’s why we’ve put together our 10 favorite places to find your ideal mid century modern office chair.

What is mid century modern design?

After World War II, spirits were high in the US, and new technology was taking the country by storm. Mid century modern refers to the design concepts that came about during this time.

As opposed to the frilly, ornate designs of classical furnishings, mid century modern designs are angular, material, and functional. Wood is a common design element, especially teak. Mid century modern furniture may also have materials like glass, vinyl, and metal. Designs are simple and geometric, with bold accent colors to make them pop.

The mid century modern aesthetic never really went away, but it’s made a noted comeback in recent years. Some have chalked it up to Boomer and Gen X nostalgia, others point to mid-century-set shows like Mad Men and The Marvelous Mrs. Maisel.

Why should I buy a mid century modern office chair?

Mid century modern is the perfect fusion of style and utility. If you want to cultivate an office space that commands respect without being ostentatious, mid century modern is the style for you.

When it comes to office chairs, an MCM one is often made with sturdy wood and vinyl. They combine the ergonomics of a modern office chair with old-fashioned grace.

If you’re concerned with utility and utility only, a more bog-standard office chair may suit you. But a mid century modern office chair is great for someone who wants to wow colleagues with a mature, thoughtful business space.

Where can I get a mid century modern office chair?

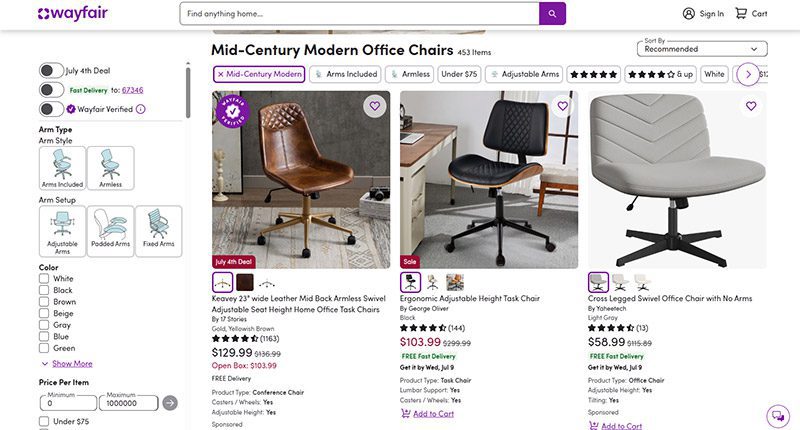

1) Wayfair

When it comes to furniture, Wayfair offers the best of both worlds. Their goods, including their mid century modern office chairs, are stylish and affordable. You can get a sturdy task chair for less than $100 or a more distinguished seat for less than $350.

MCM office chair examples: Dovray ($126), Bradford ($139), Lithonia ($133)

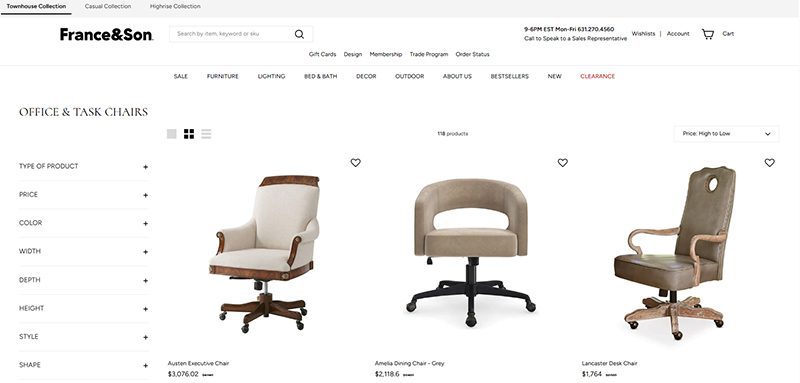

2) France & Son

Wayfair’s chairs are affordable, but France & Son is the perfect option for luxury shoppers. Their mid century modern office chairs are robust and sleekly designed. If you dress to impress and enjoy the finer things in life, these are the chairs for you.

MCM office chair example: Brooks ($695)

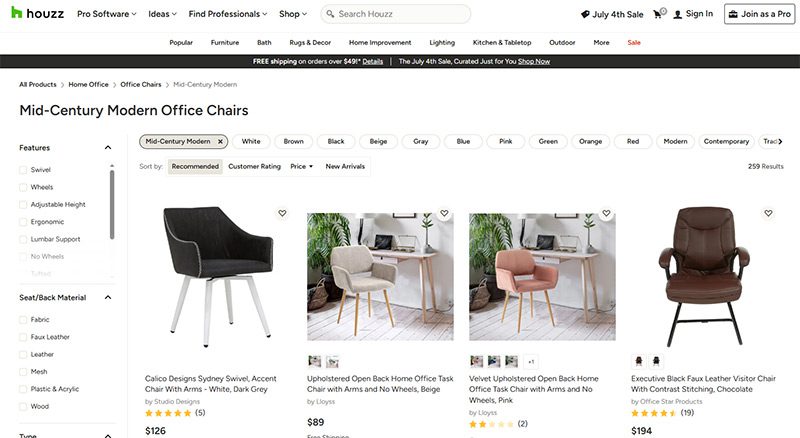

3) Houzz

Started as a community for people to share home decor tips, Houzz has become a great ecommerce platform for finding stylish furniture. They’re more known for home decor than desk chairs, but they have plenty of great, affordable finds if you know where to look.

MCM office chair examples: Arvilla ($173), Rathburn ($259)

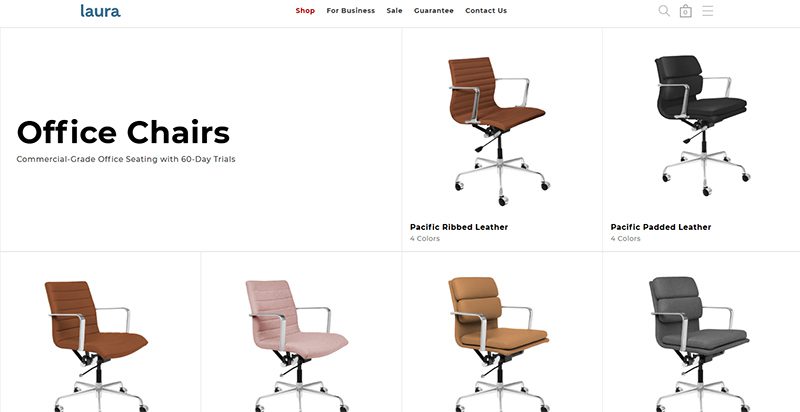

4) Laura Davidson

The Laura Davidson collection offers a fairly limited selection of classic office furniture. Still, there’s a reason they’re trusted by big-wigs like Apple, Disney, and Salesforce. Their chairs are sturdy and beautifully designed, reimagining classic Eames and Knoll designs.

MCM office chair examples: Rockefeller ($275), SOHO II Soft Pad ($450)

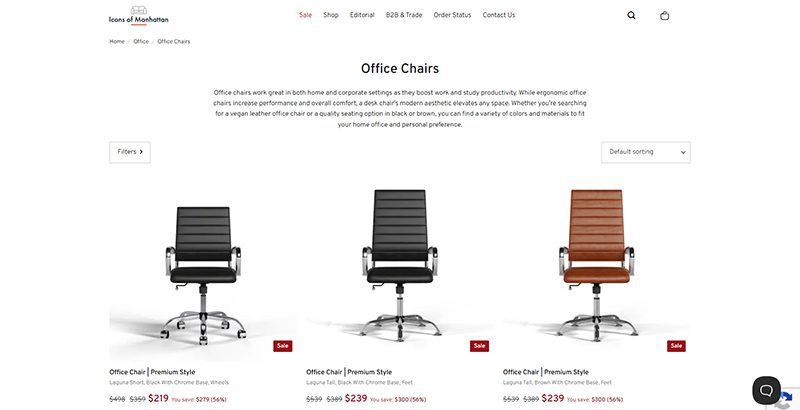

5) Icons of Manhattan

Icons of Manhattan has a simple philosophy: do one thing, and do it right. Their office chairs are handcrafted from premium materials and tailored to a mid-century modern style. If you want that Mad Men energy in your office (hopefully with a lot less angst), these are the chairs for you.

MCM office chair example: Ribbed Medium ($219)

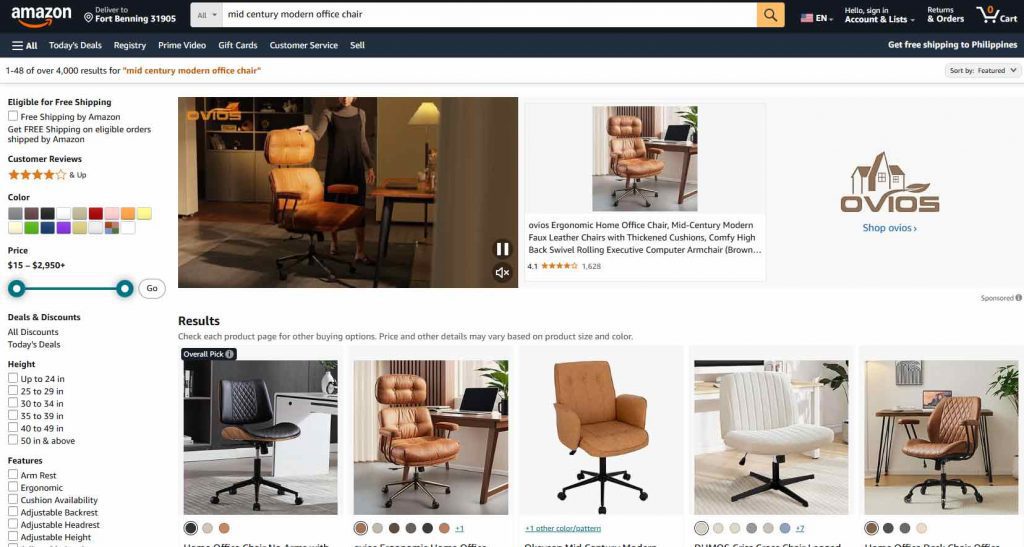

6) Amazon

Yes, the internet’s premier shopping destination has a robust collection of mid century modern office chairs. Like with most products, their selection of seats is vast and can be hit or miss. Still, they’ve got stunning chairs available for any style, whether you care about comfort, class, or ergonomics.

MCM office chair examples: IDS Home Modern ($219), Art Leon MCM Swivel ($139)

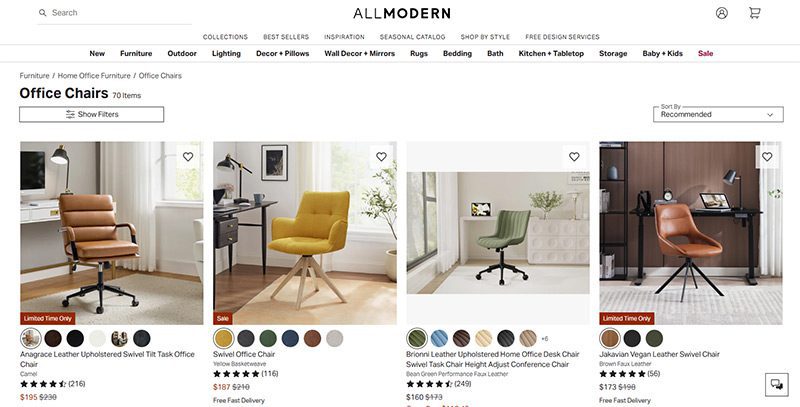

7) AllModern

AllModern’s collection of desk chairs and other furniture truly embodies the mid century modern spirit. Their work is tight, angular, and functional above all. They’re part of the Wayfair family and they traffic in a number of modern styles, but their sleek chairs are perfect for any mid century modern space.

MCM office chair examples: Frederick ($229), Kealey ($349)

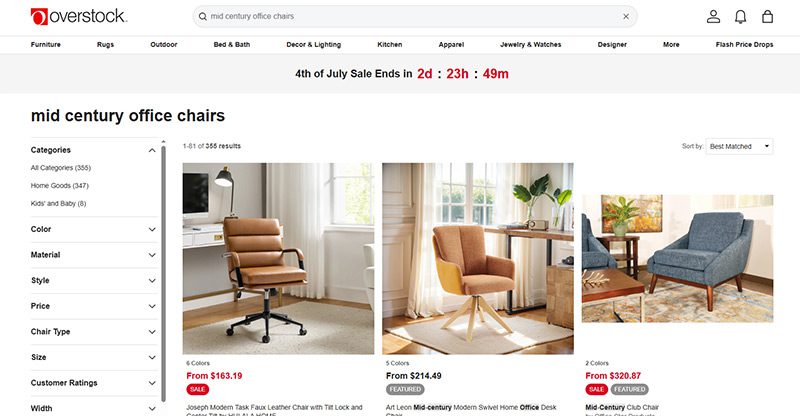

8) Overstock

Overstock is known as a one-stop shop for quality home goods at sub-wholesale prices. If you want a spiffy mid century modern office chair that won’t break the bank, they’re the first place to look. While they’re somewhat less reliable than the more upscale platforms on this list, their selection is massive.

MCM office chair example: Joseph Modern ($163)

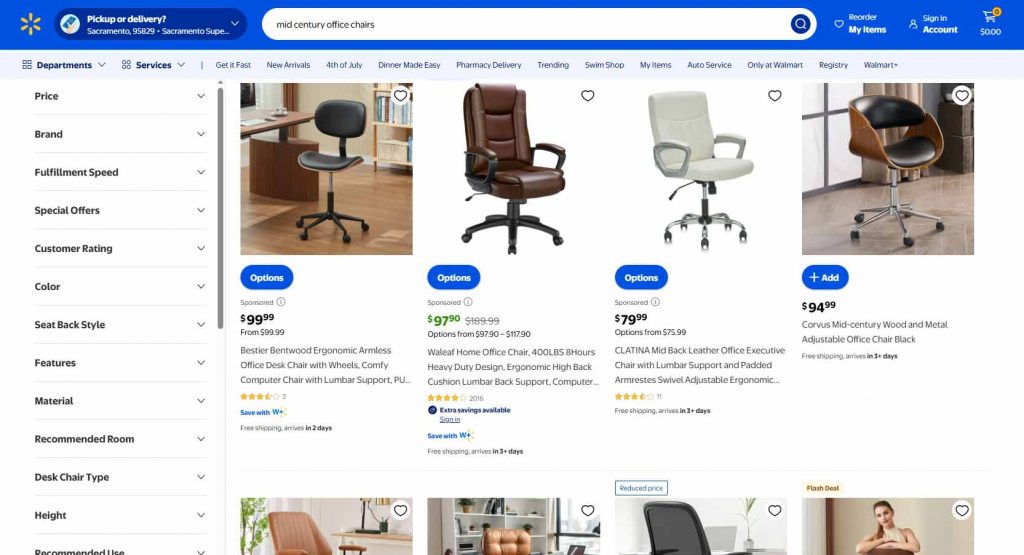

9) Walmart

Hayneedle’s selection of mid-century modern office chairs falls somewhere between the minimal Laura Davidson and the endless Amazon catalog. Their array of mid-century designs is affordable and versatile, with chairs that match almost any style. While they may be part of the Walmart family, these chairs are anything but second-rate.

MCM office chair example: Waleaf ($97)

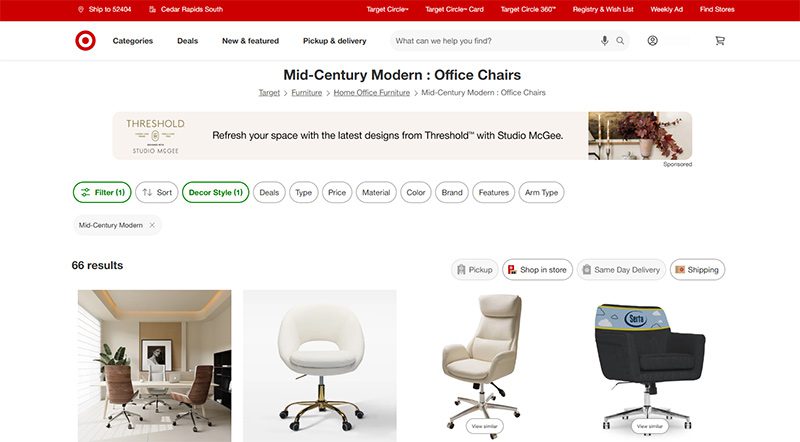

10) Target

Why splurge when you can save? As usual, Target is a hidden gem, offering a sturdy selection of mid century modern office chairs for some of the cheapest prices out there. Many of the chairs they offer are from the same designers as these other stores—Christopher Knight, LumiSource, Armen Living, etc.—at reduced prices.

MCM office chair example: Lombardi ($136)

Lifestyle

Best Gift Guide for Men: Perfect Gifts for Every Occasion

Published

1 week agoon

June 26, 2025

You think you know your man, but when it comes to giving him gifts, you’re at a loss. To make your life easier, we came up with a gift guide for men to suit every occasion.

1. Scratch Off Map of the World Map

To the wanderlust in your life, give him this map of the world from Etsy. He can scratch off the fantastic places he has been to. You can personalize it to make it more special.

2. Wave Duo Vibrating Roller

This ergonomically designed massager contours to the neck, back, and spine to give relief from everyday aches and pains. It vibrates and waves to deliver pressure where he needs it.

3. Ring Toss Game

A gift that he can enjoy with you and the whole gang, this Ring Toss Game is sure to provide lots of fun. It’s perfect for parties, camping trips, or picnics.

4. Personal Concrete Fireplace

Baby, light his fire with this unique table fireplace. The FLIKR fireplace is portable, easy to use, and an excellent conversation piece. Its warm and soft light lets you toast a marshmallow!

5. Lululemon ABC Jogger Shorter Length

The most comfortable sweatpants ever! These Jogger pants are designed to sit just above your guy’s ankles. It uses quick-drying and wrinkle-resistant materials that are ideal for indoor and outdoor wear.

6. Marvel Infinity Gauntlet

In times of boredom, let your man pass away the time by enjoying this LEGO Marvel Super Heroes Infinity Gauntlet. It is 590 pieces of build-and-display fun and challenge.

7. LARQ Bottle PureVis™

Give your guy the gift of the world’s first self-cleaning water bottle and water purification system. This LARQ Bottle PureVis gets rid of up to 99% of bio-contaminants, making it safe for hot or cold drinks.

8. The Daily Carry-On with Pocket from Away

Let him travel with style using Away’s The Daily Carry-On with Pocket. Its roomy interior lets him carry multiple items while the pocket can hold his laptop and other essentials.

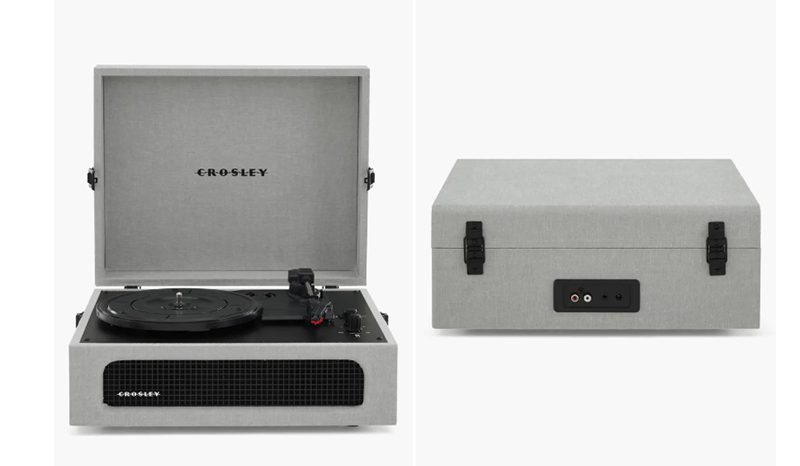

9. Crosley Radio Cruiser Deluxe Turntable

This vintage-looking turntable has the technology to play his records. The Crosley Voyager Record Player is lightweight and ready to play your 33 1/3, 45, and 78 RPM records anytime, anywhere.

10. Bowers & Wilkins Black PX7 S2 headphones

To complement the turntable above, give him these Black PX7 S2 headphones by Bowers & Wilkins. It has a noise-canceling feature that will let him get lost in his music.

11. Dad Grass Hemp CBD Pre-Rolled Joints

For a totally legit way of escaping reality, these Dad Grass Hemp CBD Pre-Rolled Joints are perfect! Let him relax after a stressful day at the office with a soothing CBD experience.

12. Personalized Light When Name Farts Soy Candle

Give him the laugh of his life with this Personalized Light When Name Farts Soy Candle. Place his name on this eco-friendly, carbon-neutral, and all-natural soy wax candle.

13. Steve McQueen Folding Sunglasses from Persol

These cool and classy Steve McQueen-inspired folding sunglasses will surely add that extra dapper to any man in your life. Its polarized lenses come in four fabulous colors.

14. Mac Mighty Professional Hollow Edge Chef’s Knife

For the guy who knows his way around the kitchen, this Mac Mighty Professional Hollow Edge Chef’s Knife is the ideal gift. This lightweight knife is suitable for everyday use.

15. Craft Beer Club Subscription

The gift that keeps on giving—a subscription to the Craft Beer Club. Your man will get to enjoy twelve different bottles of beer from various breweries across the country.

16. TAG Heuer Connected Watch

If you want to give the gift of ultimate luxury, this TAG Heuer Connected Watch is a perfect choice. Swiss craftsmanship is all about class, style, and elegance.

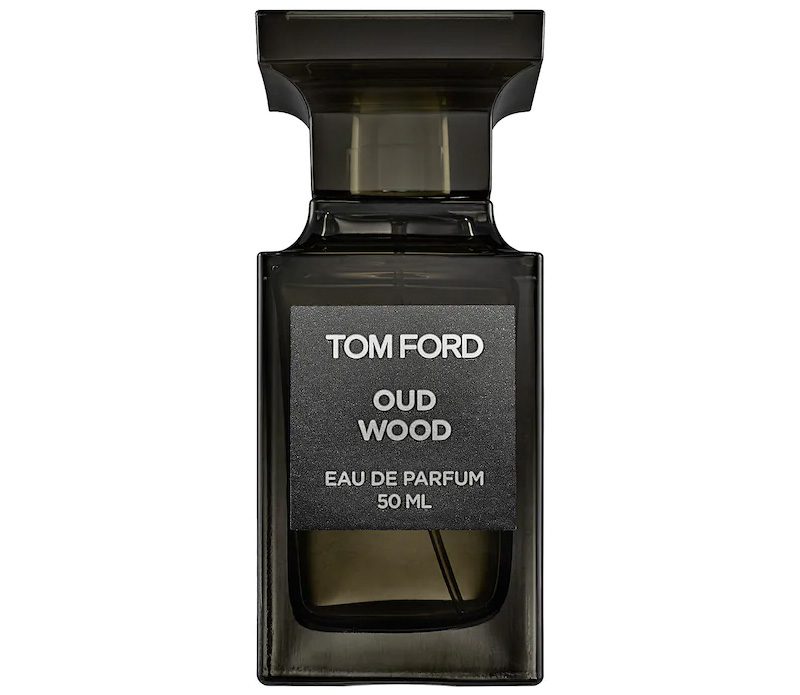

17. Oud Wood Parfum by Tom Ford

At work or play, this Oud Wood Parfum by Tom Ford will make him smell and feel charming and sophisticated. This is sure to make him more enjoyable to hug and cuddle with.

18. VANS Authentic 44 Deck DX

Add color to his wardrobe with this pair of VANS Authentic 44 Deck DX. Made with high-quality materials for extra comfort and style and a look that’s a classic.

19. Loewe Bifold Wallet in Soft Grained Calfskin

Help him keep his billfolds in this uber-stylish wallet. The Loewe Bifold Wallet in Soft Grained Calfskin is the epitome of splendor and elegance without going overboard.

20. Bird Brew Seed Feeder

Don’t be fooled by the looks of this unique gift. This Bird Brew Seed Feeder will remind you of a tall bottle of booze, but in reality, it will fill the birdies’ tummies.

21. Whiskey Glasses with Raised Topographic Impression by Whiskey Peaks

For a unique and exciting gift, this set of Whiskey Glasses with Raised Topographic Impression takes the cake. Inside are impressions of the world’s most iconic mountains, making the drink a better experience for him and his friends.

22. Fuzzy Ink Beautiful Outdoor Starry Night Sky Art Print

For adventure lovers, this outdoor night sky print from Fuzzy Ink is a perfect gift! It will leave him dreaming about his next adventure. Cat not included.

23. Gingko Smart Moon Lamp

Show him you love him to the moon and back with this Smart Moon Lamp from Gingko. It adds light and warmth to his desktop or bedside table. Whether it’s a boat cruise or a day of spa pampering, this is something he’ll truly cherish.

24. Barnett’s Gourmet Chocolate Biscotti Gift Basket

Let him enjoy decadence with this gift basket filled with Barnett’s gourmet chocolate biscotti. It’s two pounds of decadence that he can share and enjoy with you.

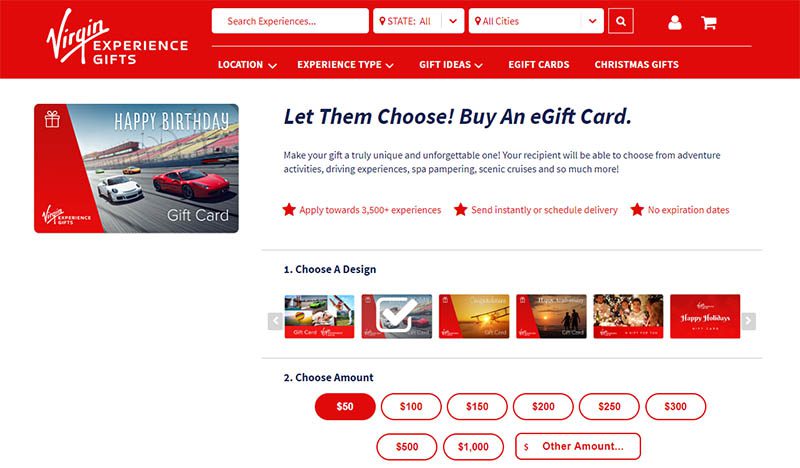

25. Choose Their Own Adventure eGift Card

If you find it hard to think about what to give, this Virgin Experience eGift card may just be the ticket. It lets them choose the adventure they want for a memorable and unique experience.

Final Thoughts

No one knows your man better than you do. But sometimes, getting a unique gift can be mind-boggling. This men’s gift guide includes a wide array of one-of-a-kind items that are sure to be unforgettable. And for other men’s gift guides, check out more here at Owner’s Mag!

Lifestyle

Digital Nomads Flock To These 10 Amazing Tax-Free Cities

Published

2 weeks agoon

June 23, 2025

The rise of remote work has paved the way for many to gain freedom to live and work from anywhere in the world. But for many work-from-home advocates, the right destination can also mean gaining financial benefits aside from having their dream lifestyle. This is where tax-free cities for digital nomads come in. Maximize your earnings, reduce business expenses, and enjoy a high-quality lifestyle when you relocate to the ten best tax-free cities:

The Benefits of Living in a Tax-Free City

If you are a digital nomad looking for a change of scenery, you’ll get the following benefits when you move to these destinations:

- Tax Savings: For entrepreneurs and remote workers, you’ll save on taxes when you move to any of the cities included in this list. Without paying income taxes, you can keep more of your earnings.

- Business-Friendly Incentives: Many tax-free cities offer favorable corporate policies, residency programs, and economic incentives. Not only will you have the opportunity to work in a setting that suits your lifestyle, but you’ll also reap financial benefits.

- Improved Financial Freedom: Lower tax burdens offer greater financial flexibility. This enables you to enjoy a higher standard of living, travel for leisure, and invest in your future without excessive government deductions.

Top 10 Amazing Tax-Free Cities for Digital Nomads

1. Dubai, UAE

Photo Credit: Aleksandar Pasaric on Pexels

Emerging as one of the most attractive destinations for digital nomads, Dubai has a zero personal income tax policy and a thriving business environment. As part of the United Arab Emirates, Dubai offers a state-of-the-art infrastructure, fast internet, and a well-connected global hub with flights to the world’s major cities. The city’s Virtual Working Program grants digital nomads a one-year residency visa that lets them live in Dubai while working for an overseas company.

2. Bermuda

Famous for its stunning beaches with crystal-clear waters, the British Territory of Bermuda makes working remotely even better as it doesn’t impose income taxes. Its digital nomad visa has no income requirement but will ask to see your financial status. This is to prove that you can support yourself on the island without having a job there. It also allows foreign workers to live and work for up to one year. The abundance of outdoor activities, reliable internet, and plenty of co-working spaces provide an excellent balance of work and play.

3. Croatia

An increasingly popular destination for digital nomads, Croatia is a favorite destination for digital nomads. While it isn’t entirely tax-free, its tax policies and dedicated digital nomad visa exempt you from income tax on foreign-earned income. Remote workers who qualify for this country’s Digital Nomad Residence Permit can enjoy this benefit. In addition, Croatia’s low cost of living allows you to enjoy a Mediterranean lifestyle while working remotely.

4. Antigua and Barbuda

Photo Credit: Julia Volk on Pexels

A beautiful Caribbean nation, Antigua and Barbuda offers zero personal income tax for digital nomads. This twin-island nation has stunning beaches, warm weather, and a welcoming expat community that makes it an ideal place if you’re looking to embrace the island life. It introduced the Nomad Digital Residence (NDR) visa to attract more remote workers. This allows you to live and work for up to two years without paying local income taxes.

5. Panama

Thanks to its territorial tax system, Panama is now a popular destination for digital nomads and entrepreneurs looking to enjoy foreign-earned income that isn’t taxed. Its various visa options include the Short Stay Visa for Remote Workers, which lets you live and work for up to 18 months. It requires proof of employment or self-employment with a minimum income of $36,000. This nation offers modern infrastructure, high-speed internet, and an active expat community.

6. Grenada

Earning the moniker “Spice Isle” of the Caribbean, Grenada offers zero personal income tax for digital nomads. It has business-friendly policies, breath-taking landscapes, and a relaxed lifestyle, ideal for remote workers looking for financial and individual freedom. In lieu of a dedicated digital nomad visa, you can take advantage of its long-stay visa options or explore its Citizenship by Investment Program, which gives you the chance to obtain permanent residency.

7. Montserrat

Another tax-free Caribbean hideaway, Montserrat, is a favorite of many digital nomads thanks to its zero personal income tax. Its lush landscape, volcanic scenery, and friendly local community offer superb work-life balance away from the hustle and bustle of city life. Its digital nomad visa, the Montserrat Remote Work Stamp, lets you live and work in Montserrat for up to 12 months. All you need to do is provide proof of employment with an annual income of at least $70,000.

8. Barbados

Photo Credit: Blue Ox Studio on Pexels

Having positioned itself as a top destination for remote workers, Barbados offers zero personal income tax by introducing its Barbados Welcome Stamp. This visa lets you live and work in Barbados for up to 12 months, making it an excellent option for those looking for financial and lifestyle benefits. To qualify for the Welcome Stamp, you must earn at least $50,000 annually and provide proof of remote employment or self-employment. Its hassle-free application process lets you enjoy the duty-free import of personal belongings and many other benefits.

9. Anguilla

A dream destination for many digital nomads, Anguilla is another tax-free Caribbean paradise. It offers no personal income, capital gains, or corporate tax for individuals. It introduced the Work From Anguilla program to attract more location-independent professionals. This grants them a 12-month remote work visa and access to high-speed internet, modern infrastructure, and a relaxed, safe environment. Its pristine beaches, low population density, and welcoming community make it the perfect place for productivity and leisure.

10. Uruguay

Another South American hub for digital nomads, Uruguay offers a territorial tax system that does not impose a tax on foreign-earned income. In addition to letting you enjoy a stable and high-quality lifestyle, Uruguay provides a five-year tax holiday on foreign income, an appealing offer for long-term stays. Uruguay’s excellent infrastructure, reliable internet, and active expat community let you establish legal residency via the country’s Straightforward Residency Program.

Top 12 Uses for The Metaverse That Will Change Your Life

Top 10 Best Places to Buy a Mid Century Modern Office Chair

The Best Online Payroll Services [Updated for 2025]

Top 10 Small Business Organization Tools for 2025

8 Best Equipment for YouTube Every Content Creator Needs

Merck Seagen Buyout: What to Know About the Deal

The Rise and Fall of Juul: Once a Silicon Valley Darling, Now Banned by FDA

What’s the Deal With Elomir? Is Axis Klarity a Scam?

Why Having an Advisory Board Could Make or Break Your Startup

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

8 Best Equipment for YouTube Every Content Creator Needs

The Rise and Fall of Juul: Once a Silicon Valley Darling, Now Banned by FDA

The Best Ways to Recession Proof Your Business

Trending

- Business2 days ago

Top 10 Best Places to Buy a Mid Century Modern Office Chair

- Technology3 days ago

8 Best Equipment for YouTube Every Content Creator Needs

- Technology3 days ago

Top 10 Small Business Organization Tools for 2025

- Technology1 day ago

Top 12 Uses for The Metaverse That Will Change Your Life

- Business2 days ago

The Best Online Payroll Services [Updated for 2025]