Lifestyle

Scams To Avoid During The Holidays

Published

6 years agoon

The Holidays is a special time and makes us more aware of our blessings and the needs of other people. It is during this time of the year that many people choose to give a part of that blessing to people who are needy. Unfortunately for us, it is also the time for unscrupulous people to come out of the woodwork to take advantage of this generous spirit. Giving during the Holidays is good and it is encouraged. However, it is also better to be vigilant to ensure that the right people benefit from the generosity. Here are some charity scams to avoid during the holidays.

Fake Charities

During the Holidays, giving is at its peak. It is no wonder then that charities sprout like mushrooms during this time of year. While there are many legitimate charities, be wary of fake charities that aim to take advantage of people’s generosity. If you want to give to charitable institutions, give to those who make a public record of donations. The Salvation Army or Toys for Tots are good examples. In order to weed out fake charities, limit your donations to charities that provide financial statements. Check your local business bureau or the chamber of commerce for documentation.

Unfamiliar Websites

Just like fake charities, websites should be taken with caution during the Holiday Season. The FBI cautions shoppers not to shop on websites that look dubious, do not have SSL certificates, or have third party payment systems. Most of these sites are easy to spot since most of them offer products at unbelievable discounts. If it sounds too good to be true, it’s probably a scam. The authorities also warn against wiring money as payment, because once money is wired, it cannot be recovered again.

Be wary of emails from e-commerce sites too. Some of them contain links that lead you to purchase products at big discounts. The problem occurs when you pay and they ask for your credit card information. These sites are setup to fish for information so that the scammers can use your financial information later on.

Social Media Mash Ups

Social media is a popular way to connect, which is why it is now a popular way to dupe people out of their hard earned cash. Social media is now being used by scammers to plant malware in your computer. Users of social media should refrain from accepting friend requests from people they do not know.

Aside from malware and viruses, scammers also use social media to monitor your whereabouts. If you frequently post what you’re doing or post purchases, they can use this information to track you down and possibly rob you. Think Kim Kardashian and France before posting anything sensitive online.

Apps

Did you know that downloading fake apps can lead to scams? When you download an app, it requests permission to access information about you that’s already stored on your mobile device. If you download a fake app, it can use this information such as your credit card details to buy products. To avoid downloading fake apps, use apps of trusted developers and to look for reviews before installing.

Lifestyle

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Published

17 hours agoon

July 11, 2025

Even if COVID-19 remains present after two years, it’s not stopping people from going on beach vacations. After all, cases aren’t as high as before, and many people have been vaccinated against the virus. And when it comes to beach vacations, it means more swimming and fun water activities, such as snorkeling, watching dolphins on the boat, and parasailing. We often get carried away with these activities, and unfortunate incidents befall us. One of those unavoidable incidents is accidentally dropping your smartphone into the ocean or sea. You’ve worked so hard to buy the device, only for it to slip away into the ocean. There’s a possibility that you can still retrieve it, though. But what do you do after you drop your smartphone in the ocean? Here’s what you need to do.

Look For Your Phone

You can still retrieve your phone from the ocean IF you accidentally dropped it in a shallow part of it. Use your feet or hands to feel for the phone. And if you have a net or something to scoop it up, do that too.

However, Do NOT in ANY CIRCUMSTANCES try to retrieve your phone IF it fell somewhere deep. You need to accept the fact that it’s long gone and is now with the sea. If this happens, contact your mobile phone provider immediately if you have a plan with them. They could help you with reassigning your old number to a new phone.

Switch the Phone Off and Leave it to Dry

Once you retrieve your phone, turn it off immediately. Unfortunately, you won’t be able to take snaps for your Instagram or create videos for TikTok. However, this is a necessary measure once it’s out of the water. Plus, make sure to dry it with a clean towel. Since you’re still at the beach and a few hours away from civilization, this is your best bet in ensuring your phone doesn’t take any more damage.

Remember the uncooked rice myth? Yeah, that’s not true. It’s no longer recommended to put your phone in uncooked rice because it will cause further corrosion. In an old interview, David Naumann said in the USA today that if you drop your smartphone in the ocean, you can put it inside a Ziplock bag. You’ll add purified water there and a pinch of baking soda. Baking soda is necessary to counter corrosion.

Bring It to A Pro ASAP

You can be tempted to fix your smartphone once you get home. But the best person to deal with this situation is a professional. It can be challenging to disassemble the phone, especially if you’re unfamiliar with the process. Once you’re back home, immediately take it to a repair shop and tell them that you accidentally dropped it in the ocean.

Preventive Measures

To prevent any data loss, why not back up your files on a cloud? That way, if you lose your phone or drop it in the ocean, you can still have your files when you get a new one.

And if you’re going to the beach, make sure to put the smartphone inside a waterproof bag. It will keep your phone dry and secure!

Unfortunately, this guy can no longer retrieve his phone. And this is why you need to take preventive measures to avoid a scenario like this.

And for other stories, news, or tips, read more here at Owner’s Mag!

You don’t have to wait for the holidays to surprise the special women in your life. You can browse through this gift guide to find the best gifts for women for any occasion. These unique and thoughtful presents are sure to put a smile on their faces.

1. Dearfoams Memory Foam Slipper

Jessica Plush Criscroos Slippers by Dearfoams make a gorgeous yet functional gift for your mom, wife, daughter, or friend on any occasion. They’ll surely appreciate your gesture of helping them say goodbye to achy feet with these lovely slippers.

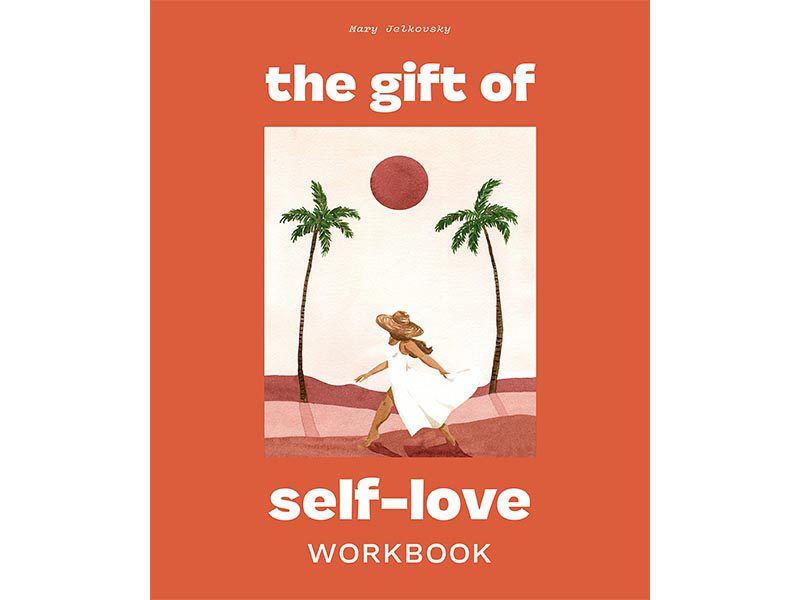

2. The Gift of Self-Love Workbook

Give your favorite gal this heartfelt and relatable book for her self-love journey. The bestselling paperback has quizzes, writing exercises, and a step-by-step guide to express their emotions, feel motivated, and increase their self-confidence.

3. Sephora Favorites Makeup and Skincare Set

For women who love makeup, here’s a gift set from Sephora. This Clean Me Up Makeup and Skincare Value Set includes eight must-have beauty products enriched with skin-loving ingredients. It also includes products from Glow Recipe, Tower 28, Olehenriksen, and more.

4. Akola Glow Unlock-it Bracelet

An unlock-it hinged bracelet, this unique and classy gift is ideal for all the special women in your life. It is perfect for all ages and styles, thanks to its timeless design. It features twin bezel-set designer crystal baguettes in a green emerald hue, engraved with the word GLOW.

5. Tulianna and Alejandra Garces Rosebud Earrings

Celebrate friendship, love, and romance with these pretty Birthstone Balloon Earrings by Tulianna and Alejandra Garces. The makers of these fancy earrings decided to cast colorful drops in a glassy eco-resin. Gift a set of these to someone special and show how much you love them.

6. Merokeety Knit Loungewear Set

Everyone needs comfy pajama sets to lounge around the house on a lazy weekend. So. grab a pair of this knitted casual nightwear from Merokeety. Besides, you could wear them separately, too, making it a perfect work-from-home OOTD.

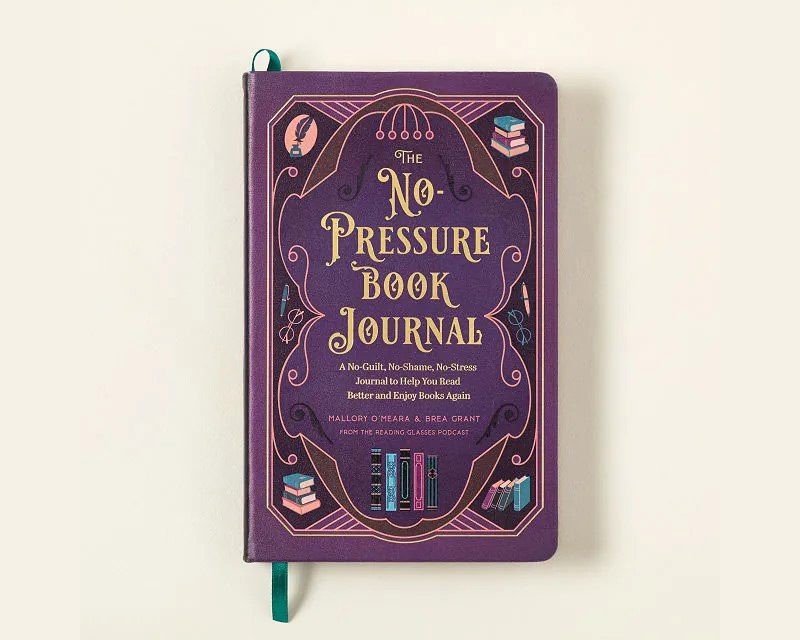

7. No-Pressure Reading for Fun Journal from Uncommon Goods

Enhance the joy of reading with this thoughtfully designed journal. This helps the bibliophiles in your life with tracking their reading, reflecting on their favorites, or rediscovering the fun in books.

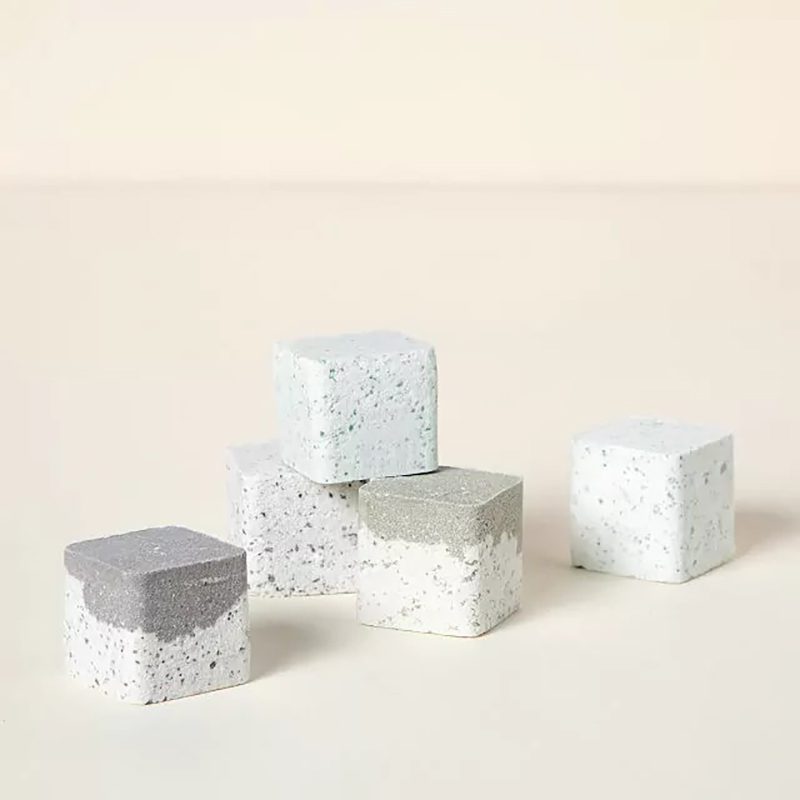

8. Bubble Soy Candles

Make your special someone smile by giving this scented cube-style candle in pastel colors. This lovely present is one of the cheapest yet most beautiful items in our women’s gift guides collection.

9. Mom Kindness Change-It-Up Clutch

Any woman will love the functionality of this clutch which can fit all her essentials. And the proceeds from every purchase go to Every Mother Counts, a nonprofit organization that promotes safe pregnancy and childbirth for every mother everywhere.

10. IUGA Navy Yoga Pants

These yoga leggings are a perfect present for women with an active lifestyle. It’s an ideal workout leggings made comfortable because of Four-way Stretch materials.

11. Pavoi Chunky Gold Hoop Earrings

These Hoop Earrings are always best sellers! This thick hoop earring is crafted to be lightweight for easy all-day wear. They are Hypoallergenic; Nickel and Lead-Free with Stainless Steel Post

12. Revlon One-Step Volumizer Enhanced 1.0 Hair Dryer and Hot Air Brush

With this Revlon revolutionary blow dryer brush, she can finish her hair in minutes. Surprise your significant other, sister, or best friend with this product that promises salon-quality results and less hassle of booking a pricey hair appointment.

13. Ztujo Purse Organizer

Your mom or friend who carries everything with her at all times 100 percent needs one of these organizational inserts for her bottomless pit of purse.

14. Senia Hot and Cold Facial Steamer

Show love for your favorite person by helping de-stress and regularly cleanse your skin. It has a calming nature of warm and cool mist and aromatherapy. Gift this wellness gadget to the woman you adore, and she’ll thank you for your thoughtfulness.

15. Masters Creative Custom Line Art Portrait

These custom line art portraits could be a perfect gift for those who love the minimalist look. Straight from the U.K, you can have it delivered as a digital file. Or have it printed on high-quality paper and shipped directly to you or the recipient.

16. Sophie Faux Fur Throw Blanket

This cozy blanket like this one from Anthropologie is a universal gift idea. This plush throw will keep her comfortable whether she’s always chilly or loves snuggling up on the couch. Plus, it comes in various colors you don’t usually find in faux fur blankets, including ochre, teal, mauve, and more.

17. Invigorate Shower Steamers Gift Set

Energize your giftee’s shower with this Invigorate Shower Steamer gift set. It contains essential oils and aromatherapy scents, including cedar, orange, and pine. This luxurious gift is made from natural ingredients and is handmade in California.

18. The Citizenry Aegean Cotton Bath Robe

This luxe bathrobe is the perfect gift for anyone who wants to feel at a hotel after a shower. It’s soft, absorbent, and has pockets that the recipient will love!

19. Flower Subscription

Give a gift that keeps on giving with this flower subscription. They’ll enjoy a new bouquet of mixed blooms each month for six months! Each arrangement is a work of art with some of the world’s most beautiful flowers. Get roses, sunflowers, hydrangeas, alstroemeria, and more.

20. mDesign Stackable Storage Box

Keep clutter under control by keeping favorite jewelry and accessories in one place. These stackable containers feature multiple compartments in various sizes providing plenty of options.

21. Coyuchi Dillon Organic French Terry Cardigan

You can never fail with comfortable loungewear as a present. This French terry cardigan, for example, is perfect for days when she doesn’t want to wear PJs or a robe but still wants to feel cozy. It’s made with organic cotton and has pockets for when she needs to stash lip balm or keep her hands warm.

22. Papier Colorblock Notebook

This notebook from Papier is a gem for bullet journaling enthusiasts. The colors, cover, and paper type are customizable in many ways. You can also get it personalized with the recipient’s full name, initials, or inspirational quote.

23. Crystal Green Beaded Bag

This cute handmade bag is made with natural beads and the perfect for holding your keys, wallet, and cards. It comes in a light green color that is semi-transparent, but totally eye-catching!

24. Custom Handwriting Necklace

Buy this dainty necklace customized in your own words and handwriting so she can carry it wherever she goes.

25. Rachael Ray Create Delicious Nonstick Cookware Set

These pots and pans are a perfect present for your wife, who loves to cook. The cookware set features PlatinumShield Technology enhanced non-stick reinforced to be nine times harder than titanium.

We hope you liked what we featured in this list of women gift guides. Enjoy your early holiday shopping! And if you want more gift ideas for your loved ones, check them out here at Owner’s Mag!

Business

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Published

1 week agoon

July 4, 2025

What was once old is new again: mid century modern is back in style. From architecture to furniture, the postwar look is in, and the hype extends all the way to office chairs.

Do you need a mid century modern office chair in your life? If so, there’s plenty to choose from. Your office chair should be tailored to your style, whether you like luxury, utility, or something in between.

That’s why we’ve put together our 10 favorite places to find your ideal mid century modern office chair.

What is mid century modern design?

After World War II, spirits were high in the US, and new technology was taking the country by storm. Mid century modern refers to the design concepts that came about during this time.

As opposed to the frilly, ornate designs of classical furnishings, mid century modern designs are angular, material, and functional. Wood is a common design element, especially teak. Mid century modern furniture may also have materials like glass, vinyl, and metal. Designs are simple and geometric, with bold accent colors to make them pop.

The mid century modern aesthetic never really went away, but it’s made a noted comeback in recent years. Some have chalked it up to Boomer and Gen X nostalgia, others point to mid-century-set shows like Mad Men and The Marvelous Mrs. Maisel.

Why should I buy a mid century modern office chair?

Mid century modern is the perfect fusion of style and utility. If you want to cultivate an office space that commands respect without being ostentatious, mid century modern is the style for you.

When it comes to office chairs, an MCM one is often made with sturdy wood and vinyl. They combine the ergonomics of a modern office chair with old-fashioned grace.

If you’re concerned with utility and utility only, a more bog-standard office chair may suit you. But a mid century modern office chair is great for someone who wants to wow colleagues with a mature, thoughtful business space.

Where can I get a mid century modern office chair?

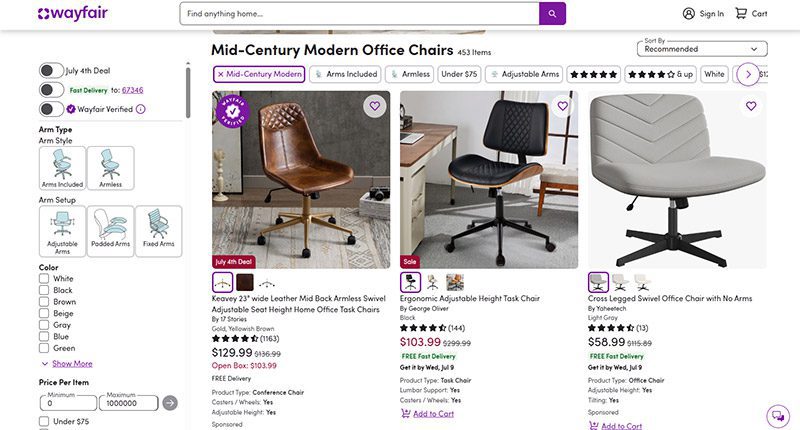

1) Wayfair

When it comes to furniture, Wayfair offers the best of both worlds. Their goods, including their mid century modern office chairs, are stylish and affordable. You can get a sturdy task chair for less than $100 or a more distinguished seat for less than $350.

MCM office chair examples: Dovray ($126), Bradford ($139), Lithonia ($133)

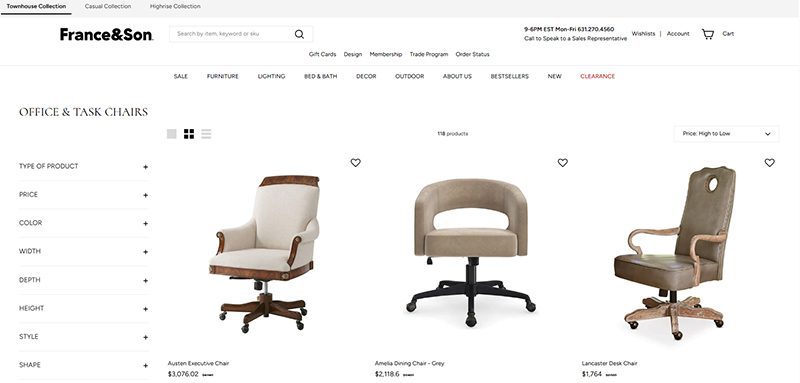

2) France & Son

Wayfair’s chairs are affordable, but France & Son is the perfect option for luxury shoppers. Their mid century modern office chairs are robust and sleekly designed. If you dress to impress and enjoy the finer things in life, these are the chairs for you.

MCM office chair example: Brooks ($695)

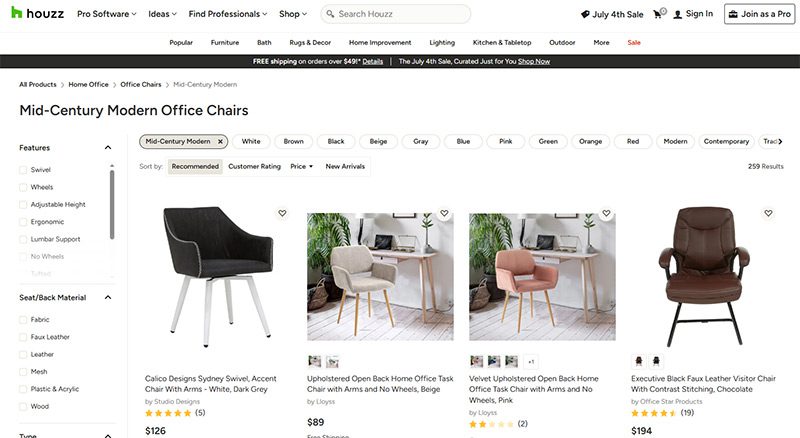

3) Houzz

Started as a community for people to share home decor tips, Houzz has become a great ecommerce platform for finding stylish furniture. They’re more known for home decor than desk chairs, but they have plenty of great, affordable finds if you know where to look.

MCM office chair examples: Arvilla ($173), Rathburn ($259)

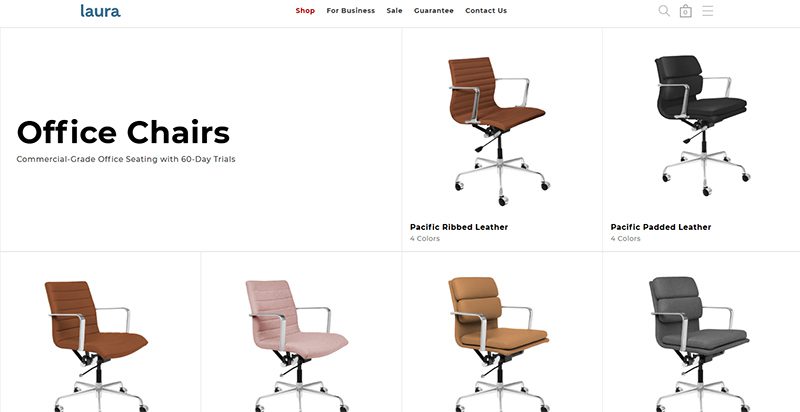

4) Laura Davidson

The Laura Davidson collection offers a fairly limited selection of classic office furniture. Still, there’s a reason they’re trusted by big-wigs like Apple, Disney, and Salesforce. Their chairs are sturdy and beautifully designed, reimagining classic Eames and Knoll designs.

MCM office chair examples: Rockefeller ($275), SOHO II Soft Pad ($450)

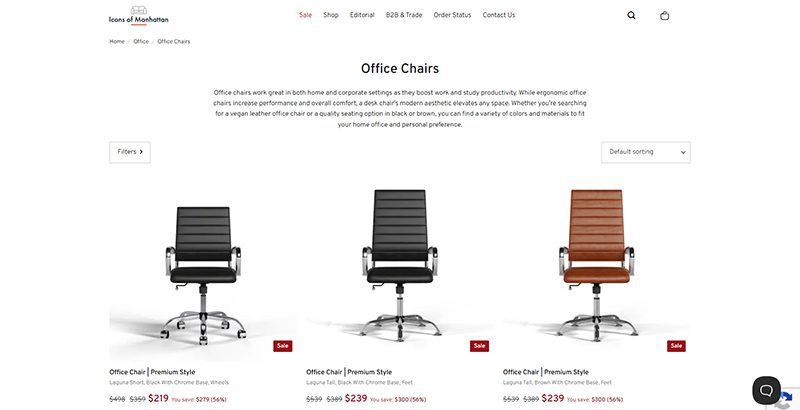

5) Icons of Manhattan

Icons of Manhattan has a simple philosophy: do one thing, and do it right. Their office chairs are handcrafted from premium materials and tailored to a mid-century modern style. If you want that Mad Men energy in your office (hopefully with a lot less angst), these are the chairs for you.

MCM office chair example: Ribbed Medium ($219)

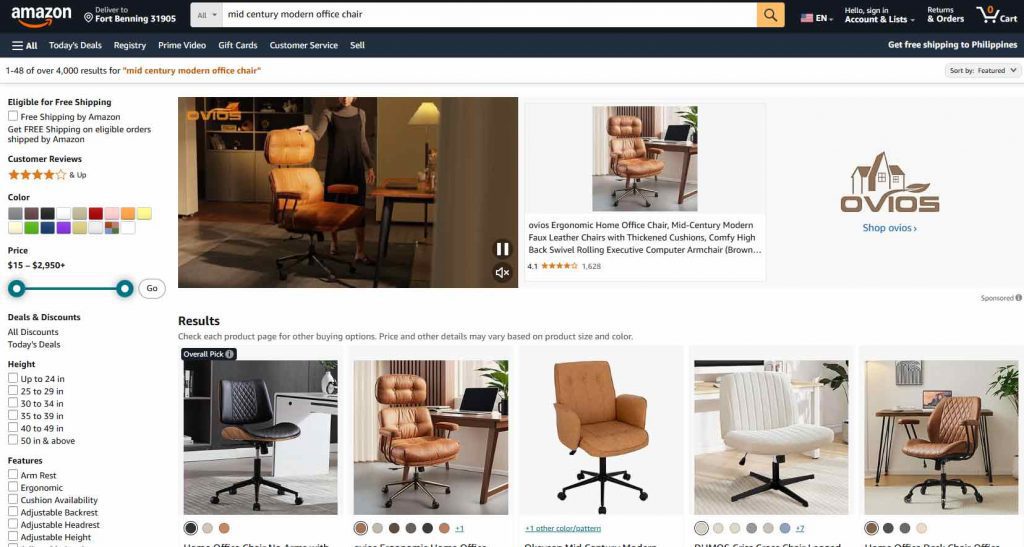

6) Amazon

Yes, the internet’s premier shopping destination has a robust collection of mid century modern office chairs. Like with most products, their selection of seats is vast and can be hit or miss. Still, they’ve got stunning chairs available for any style, whether you care about comfort, class, or ergonomics.

MCM office chair examples: IDS Home Modern ($219), Art Leon MCM Swivel ($139)

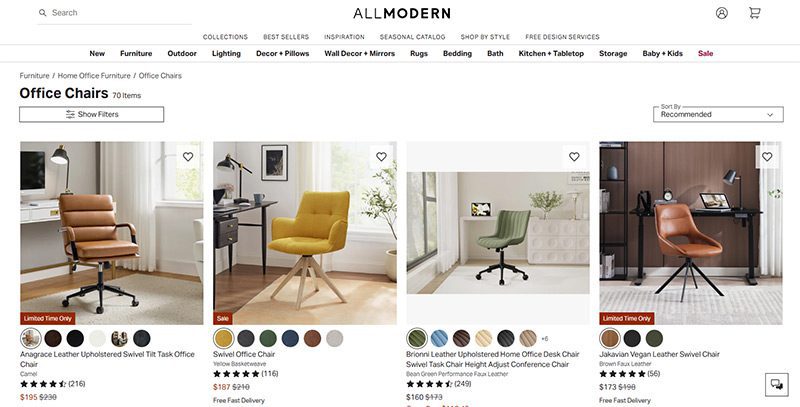

7) AllModern

AllModern’s collection of desk chairs and other furniture truly embodies the mid century modern spirit. Their work is tight, angular, and functional above all. They’re part of the Wayfair family and they traffic in a number of modern styles, but their sleek chairs are perfect for any mid century modern space.

MCM office chair examples: Frederick ($229), Kealey ($349)

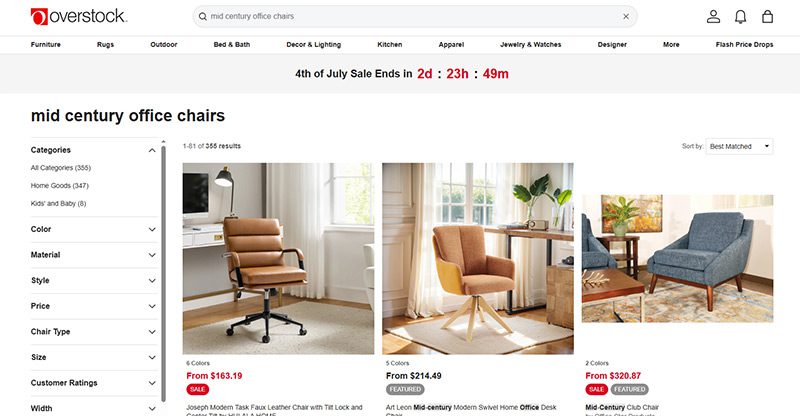

8) Overstock

Overstock is known as a one-stop shop for quality home goods at sub-wholesale prices. If you want a spiffy mid century modern office chair that won’t break the bank, they’re the first place to look. While they’re somewhat less reliable than the more upscale platforms on this list, their selection is massive.

MCM office chair example: Joseph Modern ($163)

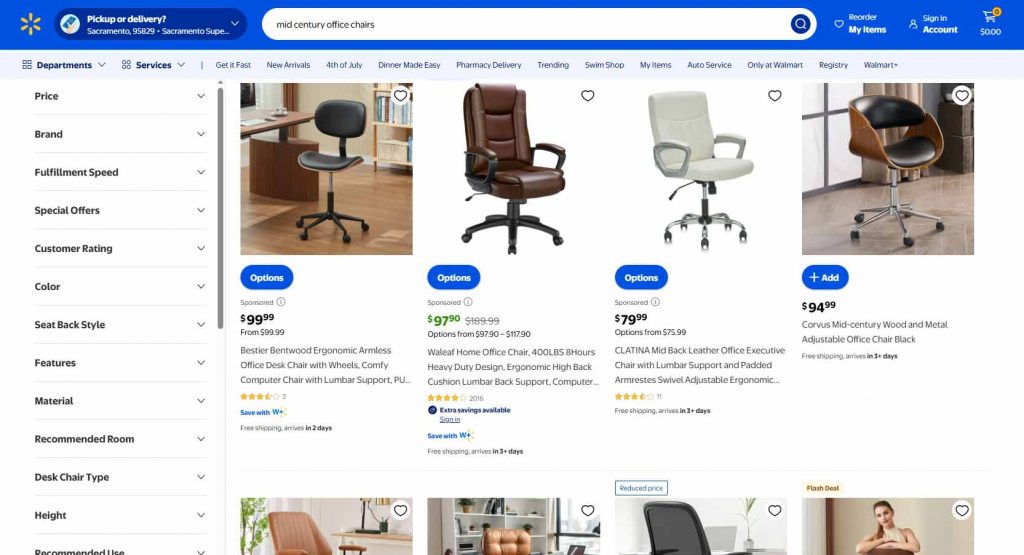

9) Walmart

Hayneedle’s selection of mid-century modern office chairs falls somewhere between the minimal Laura Davidson and the endless Amazon catalog. Their array of mid-century designs is affordable and versatile, with chairs that match almost any style. While they may be part of the Walmart family, these chairs are anything but second-rate.

MCM office chair example: Waleaf ($97)

10) Target

Why splurge when you can save? As usual, Target is a hidden gem, offering a sturdy selection of mid century modern office chairs for some of the cheapest prices out there. Many of the chairs they offer are from the same designers as these other stores—Christopher Knight, LumiSource, Armen Living, etc.—at reduced prices.

MCM office chair example: Lombardi ($136)

What Is Tiktok Pink Sauce? The Viral Condiment, Explained

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Gift Guide: 25 Best Gifts for Women for All Occasions

History of the NBA: The Success Behind the Big League

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Top 12 Uses for The Metaverse That Will Change Your Life

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Top 10 Best Places to Buy a Mid Century Modern Office Chair

History of the NBA: The Success Behind the Big League

8 Best Equipment for YouTube Every Content Creator Needs

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Top 10 Small Business Organization Tools for 2025

Top 12 Uses for The Metaverse That Will Change Your Life

Trending

- Entertainment1 day ago

History of the NBA: The Success Behind the Big League

- Reviews2 days ago

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

- Lifestyle17 hours ago

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

- Lifestyle1 day ago

Gift Guide: 25 Best Gifts for Women for All Occasions

- Top Stories17 hours ago

What Is Tiktok Pink Sauce? The Viral Condiment, Explained