Startup Central

5 Best Health Insurance Options For Startups

Reviews

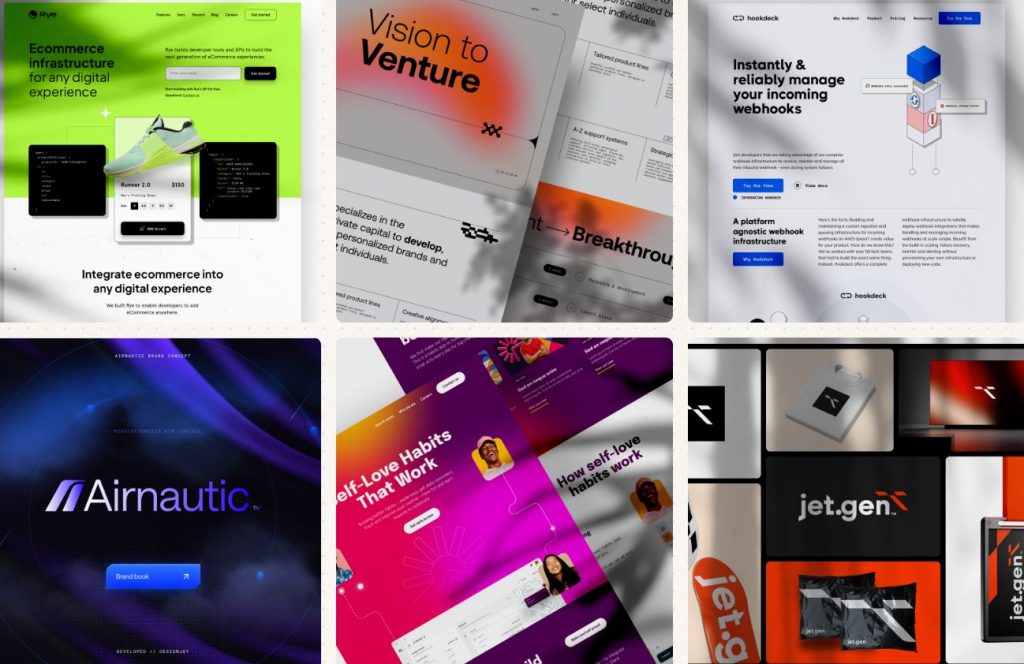

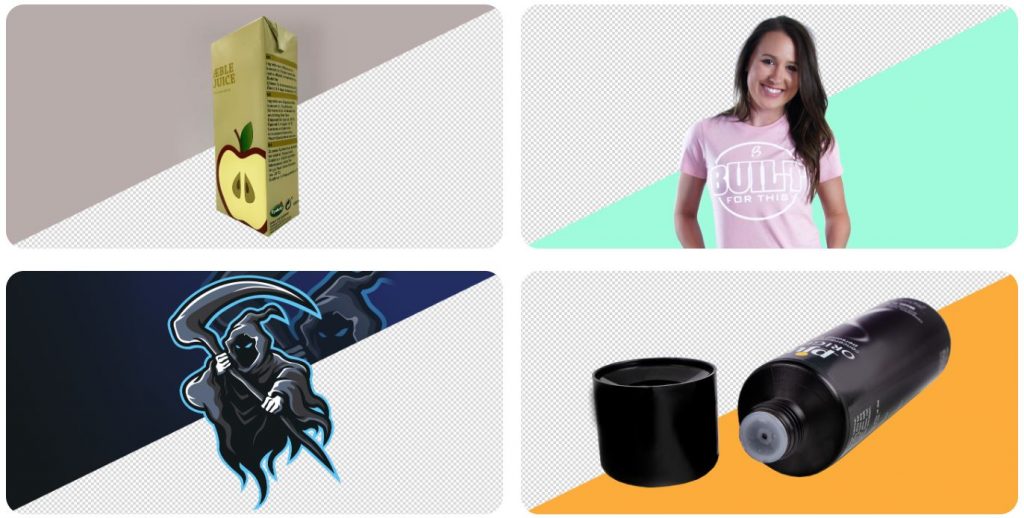

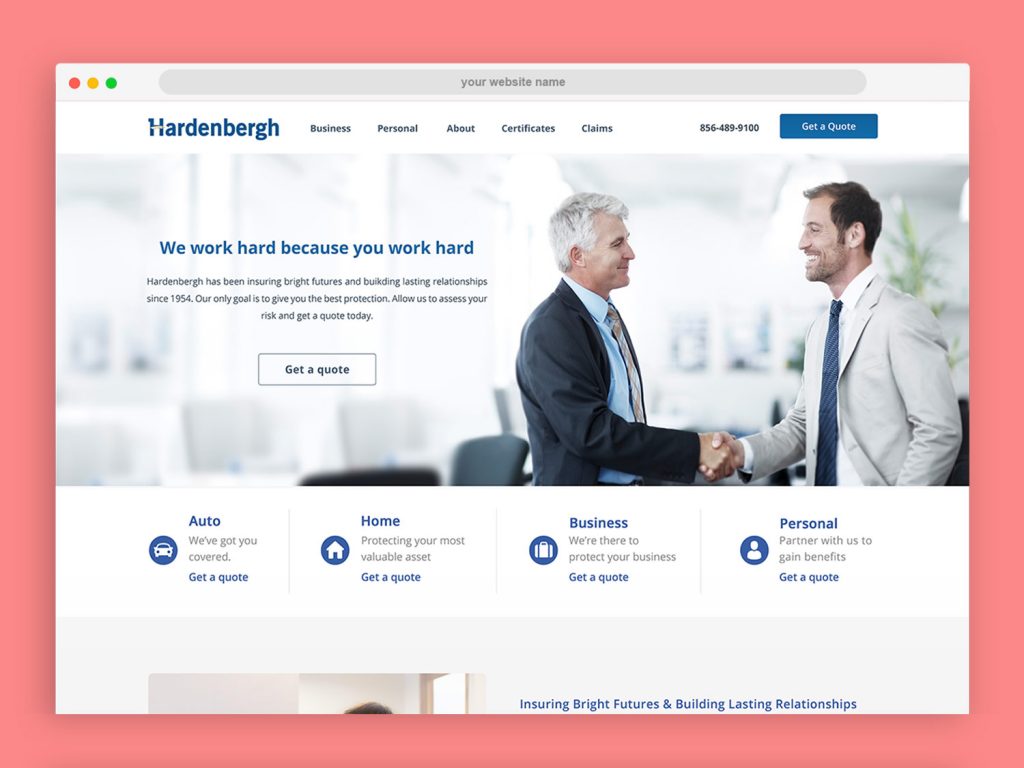

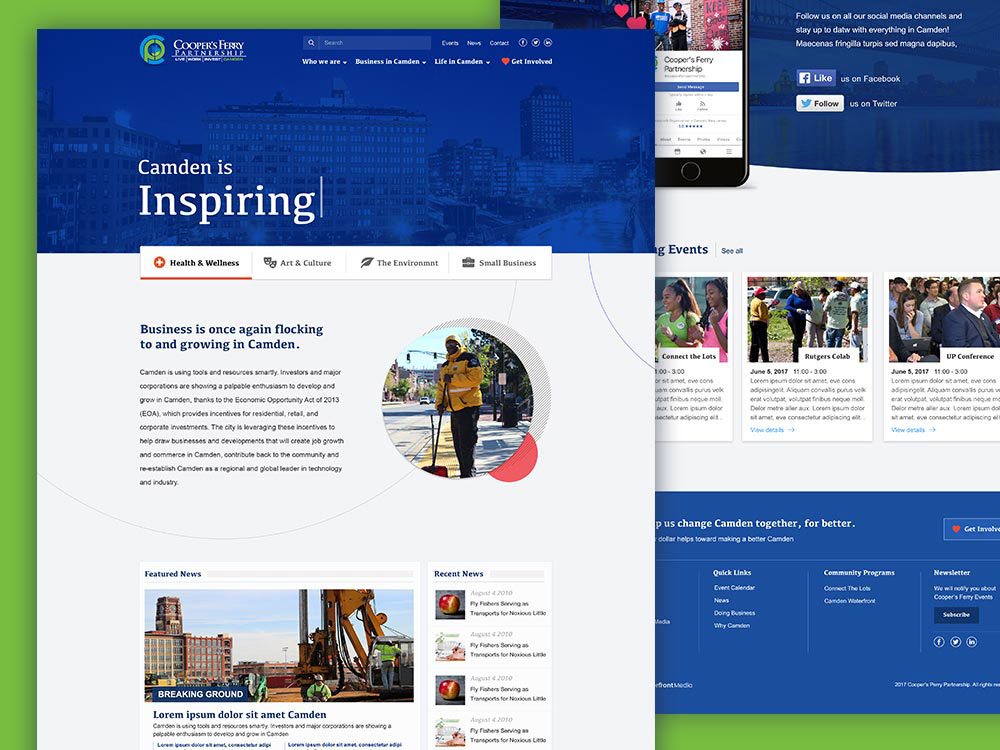

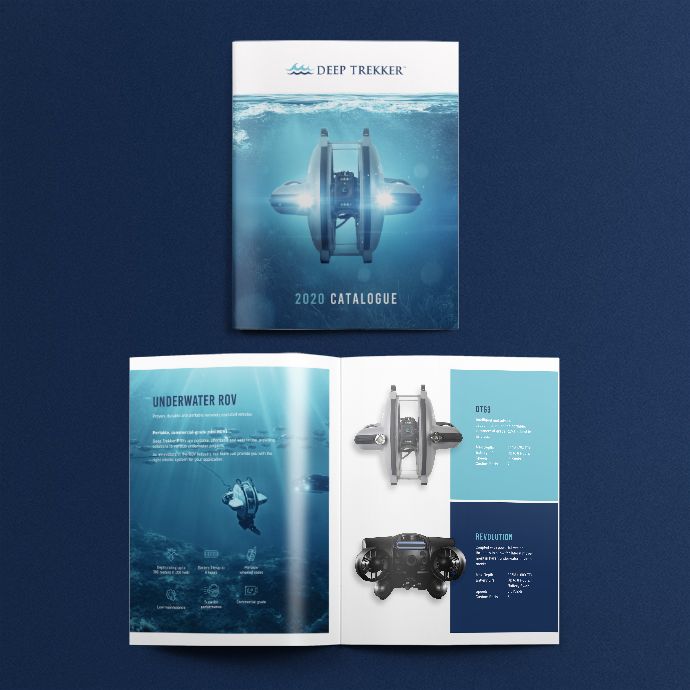

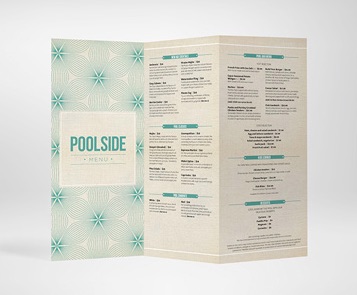

10 Design Pickle Alternatives to Get Even Better Designs

Business

Unlimited Graphic Design Companies Of 2023 + Promo Codes (Updated)

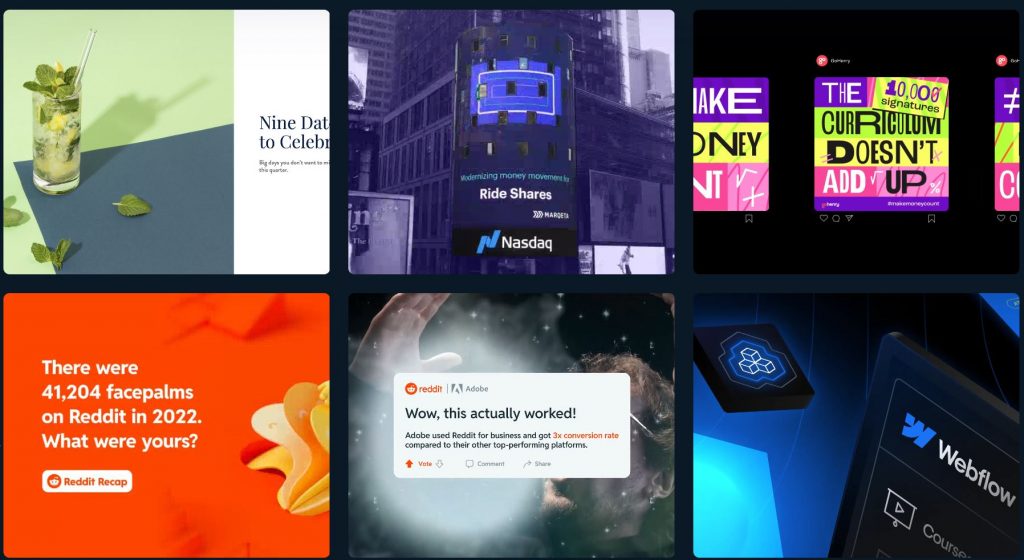

Unlimited graphic design services have become the go-to services of major brands like Uber, Buffer, 7/11, and more! You can follow in their footsteps by subscribing to an unlimited graphic design service since it allows businesses to scale anytime. Plus, it offers quick turnaround times without compromising quality. Besides those, it has a money-back guarantee and lets users cancel anytime without hassle.

If you can’t pick the best service, we have your back with this comprehensive list of the best unlimited graphic design services!

Which Provider Should You Choose?

We’ve done the homework and curated a list of Unlimited Graphic Design providers for you and also negotiated special deals on your behalf. You can see them all below and decide which one fits your business based on your needs.

Unlimited Graphic Design Providers

What Does Unlimited Graphic Design Mean?

These unlimited graphic design services have a monthly subscription business model. That means you can sign up and cancel whenever you like. What sets them apart from your typical freelancer, agency, or in-house designer is you gain access to a workflow that is designed to be quick and to the point.

You’ll communicate with their team through Trello, email, or an online platform. The option given is dependent on the company you choose. For example, only a small selection of services provide a custom built online platform for their customers.

Once you’re connected to their workflow, you can begin submitting as many design requests as you want. Although they all claim “unlimited”, it generally means you can “create” unlimited design requests. It doesn’t necessarily mean they’ll work on them all at once. Usually, they just work on one design at a time. When one completes, they start the next design.

The usual turnaround time is between 1 – 2 days, and that’s just for the first draft. It doesn’t mean your entire request is complete. If you don’t like it, you can request as many revisions as you want, and that will take more time. So it can take up to a week to actually get the design complete if you have a lot of revisions.

Another thing to keep in mind is content. You need to be able to have everything ready and provide all the content needed in order for their designers to get started.

How Does On-Demand Graphic Design Work?

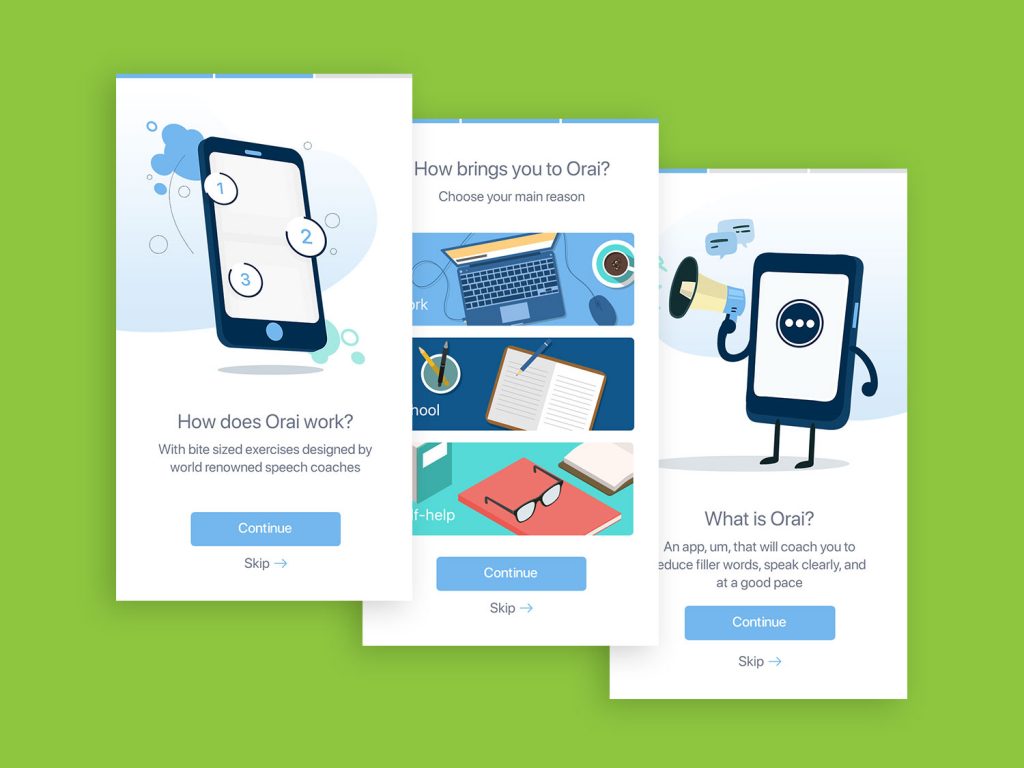

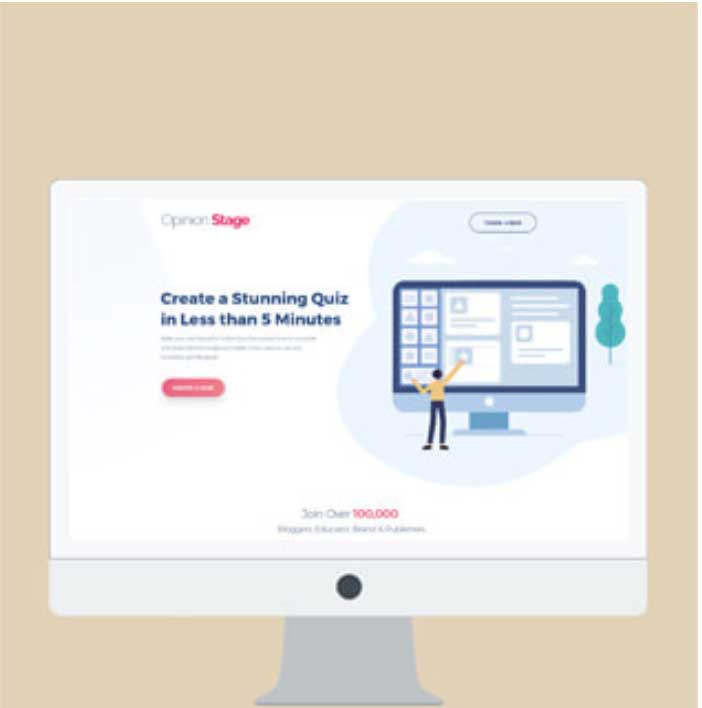

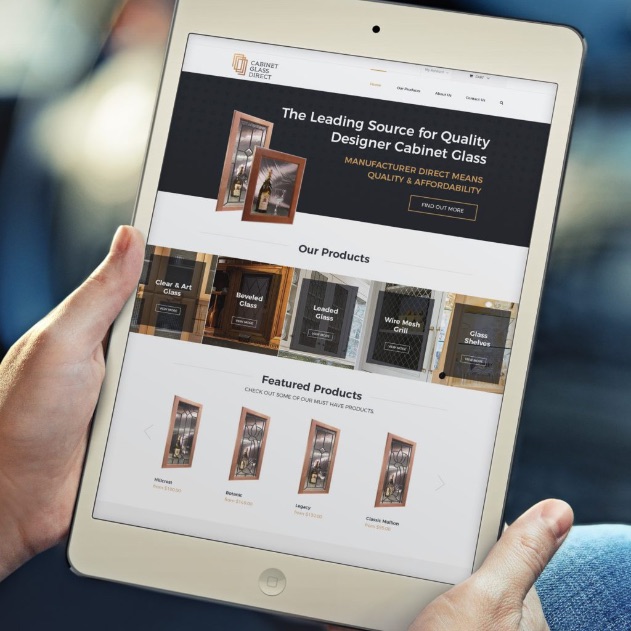

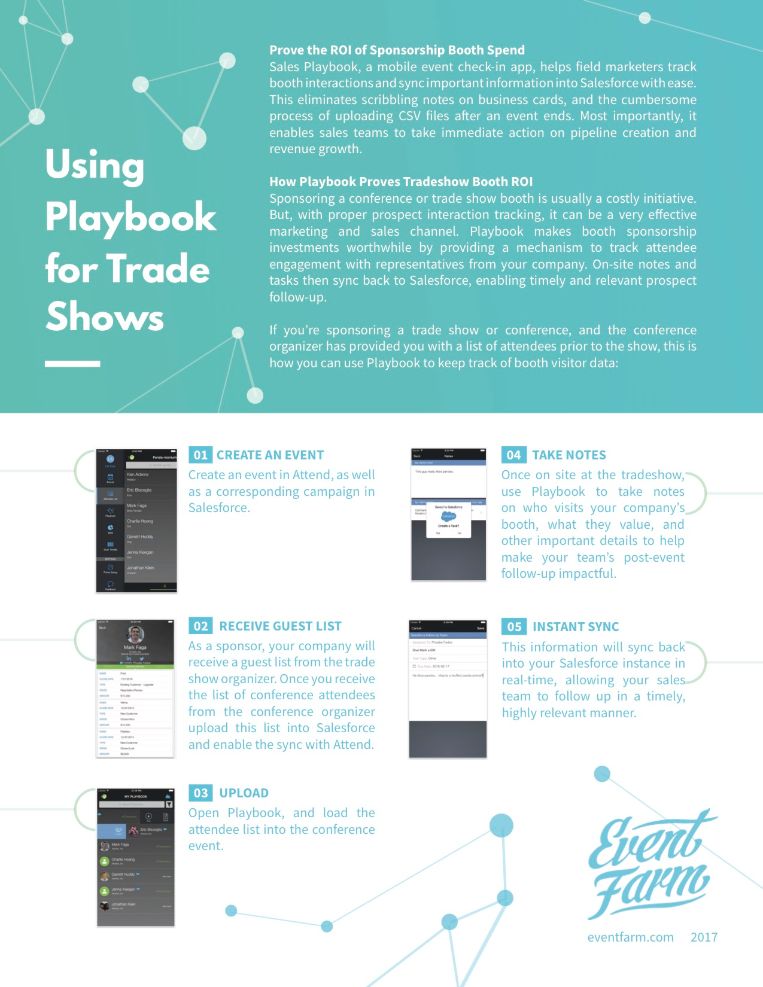

Most graphic design services listed above offer clients a bespoke design platform. For instance, Penji’s design tool is an all-in-one platform where designers, account managers, customers, and their team members can communicate and collaborate.

Although the steps in working with a graphic design company are similar, we’ll use Penji’s design software to share the step-by-step graphic design process.

1. Log in

Once you’ve selected the subscription plan, log in to your design tool and access your dashboard. Most of these tools are user-friendly with a minimal learning curve and prioritize user experience.

This example of Penji’s dashboard shows a list and thumbnails of ongoing design projects. The menu at the top shows the Active, Completed, Drafted, and On-hold projects.

Submitting a design brief is the first step in the on-demand graphic design process. To submit, click the +New Project button at the upper right side of the dashboard.

2. Fill in the title

Think of a relevant project title that will describe the design accurately. Writing an accurate title will make browsing through ongoing projects easier once you have a long list.

For instance, if you’re creating a company logo, you can write “Logo design” and specify the company or industry beside it if you’re handling multiple brands.

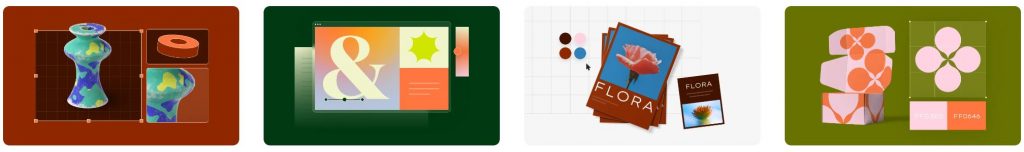

3. Choose from design categories

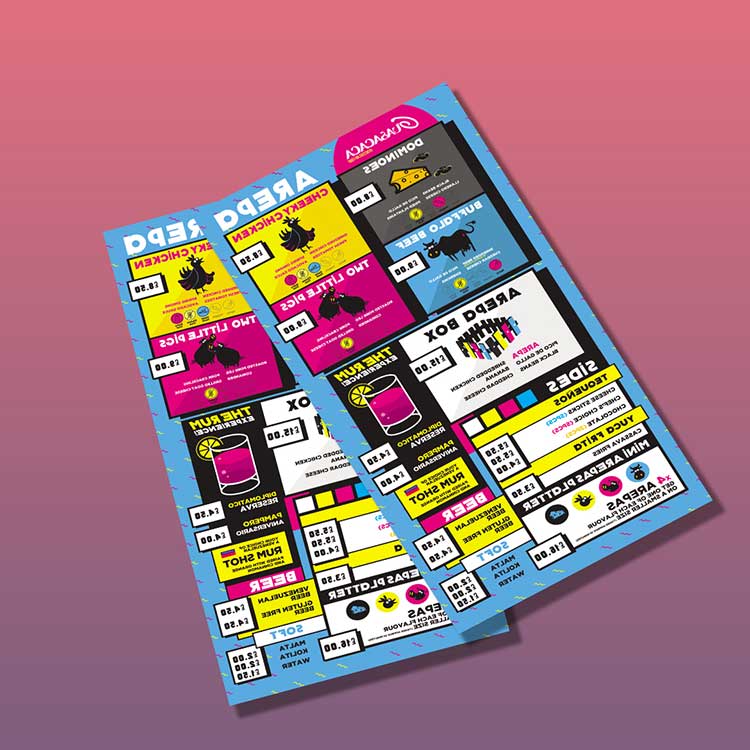

The next step is to choose from the many design categories. Most unlimited graphic design services have around 100+ design categories. Penji has 120+ design categories. Choose one that fits your project.

4. Write a design brief

This step is crucial when working with on-demand graphic designers, as this will make or break your project outcome. Writing a thorough, clear, and well-thought-out design brief makes it easier for designers to understand exactly what you want.

Penji’s design platform has a few reminders on the left side when writing design briefs. Ensure you follow the tips for a better design outcome.

5. Attach files and images for inspiration

Some customers can’t express themselves clearly through written instructions. You can attach files and images to support your written descriptions with visuals. Attaching sample logos also helps lead designers in the right direction. Attaching your competitors’ logos is also a way to make yours better.

You’ll also need to choose the source file type in this step or let designers pick for you.

6. Choose a brand style guide

Subscribing to unlimited graphic design services means you can request any visuals for multiple brands. Penji’s design tool lets you save and categorize your brand style guides in folders. This way, you only have to choose a branding guideline for designers to follow.

Once you’ve chosen the associated brand, click the Create project button to start the process.

7. Wait 24 to 48 hours

Although most on-demand graphic design services’ turnaround is 24 to 48 hours, some companies may take more than two days. This is due to complex projects like illustrations or web pages.

Wait for the first draft and ask for revisions until you’re 100 percent happy with the design. Download the source file, and you’re good to go!

Why Should You Sign Up for Unlimited Graphic Design Services

Subscribing to unlimited graphic design services is more convenient than hiring freelance designers. Here’s why:

- Work with vetted designers and choose from various skill sets. There is no need to search for another designer fit for a particular project. The company will assign you the most suitable designer.

- No need to worry about additional fees as you only have to pay fixed monthly rates and get unlimited designs. Revisions also come at no extra cost.

- You don’t have to worry about graphic designers going MIA and abandoning crucial projects. Each design project is managed by an account manager who will check if deadlines are met on time.

- Signing up and canceling subscriptions with on-demand graphic design services is easy. You can sign up if you need a stream of designs while setting up shop and cancel anytime without incurring cancellation fees.

- Fast 24 to 48-hour turnaround, which prevents any bottlenecks in your marketing campaigns.

- Request to change assigned designers if you’re unhappy with their work at no additional cost.

- Organize your projects and brand style guides if you request multiple brand designs. The custom design platforms make managing projects efficient and convenient.

Are they worth it?

If you have a lot of design needs, they’re definitely worth it. Being that it’s a monthly recurring investment, you’ll need to make sure that you have the need for an ongoing graphic design service. This graphic design service model is comparable to outsourcing a designer yourself, except much of all the management work is done by the company. The quality of designs and turnaround time also tends to be significantly better when outsourcing a designer yourself.