Lifestyle

My Students, the Movie Stars: an Interview with the Kids behind “Moonlight”

Published

4 years agoon

When I ditched my New York City desk job to become a middle school teacher at an under-resourced school in Miami, I had a variety of expectations. Based on my own haunting middle school experience, I braced myself for everything from questionable school lunches and paper airplanes to red pen markings and the smell of Axe body spray. However, watching my own students become Hollywood celebrities in the feature film “Moonlight” (this year’s Best Picture) was certainly not on my list.

I can distinctly remember when Jaden Piner (who plays the role of Kevin) came to me in the beginning of the 2015 school year to tell me that he would be missing school the following week to begin shooting a small local film. “What kind of excuse is that?” I thought, “He’d better finish all of his make-up work.” Fast forward one year later and that small “local film” has just won the Academy Award for Best Picture.

After getting permission from their agents (you remember your agent from 7th grade, right?) I met with Alex (who plays the role of Chiron) and Jaden (Kevin) to ask them a few questions about their experience filming Moonlight and their journey into the Hollywood spotlight. Here’s what they had to say:

Thanks so much for joining me guys. To start off, what experiences have you had that inspired you to start acting?

Jaden: My first experience happened two or three weeks before 6th grade, I performed in a skit for my grandma’s sermon since she’s a preacher. I had never acted before but I decided to just be myself and act natural. People were laughing and crying in the crowd and I realized how much I loved it so I decided to apply for the drama program at Norland Middle.

Alex: I never really had any experiences with acting, I kind of just picked it up. Ever since I was in elementary school my mom always said I was too hyper, so we thought it was a good way to express myself.

How would your friends describe you? Natural born Hollywood actor?

Jaden: My friends would describe me as the funny light skinned one or the short one. They definitely don’t frame me as a movie star, they keep me regular and keep me humble. They would say I’m funny, always willing to try new things and hopefully that I’ve always been a good friend.

Alex: My friends would say I’m small, cool and funny. My friends have all treated me the same since all of this started, and to be honest, they have kept me grounded. It doesn’t matter where I’m at, an Oscar awards party, or sitting in class, they treat me the same no matter what.

Describe what it has been like to balance your role as a student and an up-and-coming actor?

Jaden: Balancing acting and school has been kind of hard: tons of late nights, auditions all of the time etc. Sometimes I stay up at night practicing for an upcoming role. Some of my school is now online it’s much easier to balance now.

Alex: It was very hard at the beginning as we spent so much time filming and traveling. I felt like when ever I would come back to school with all of my make-up work, I would have to leave again and the cycle would start all over. Over time I learned how to balance things out, and I am very thankful for the role of my friends in supporting me.

Moonlight captures a Miami that is unfamiliar to an audience who expects the typical star-studded, glamorous perception of the city. Considering the Miami that you grew up in and what is portrayed in the film, what do you think is most special about Miami?

Jaden: The thing that is most special about Miami is the beauty and uniqueness of the neighborhoods. You can drive through any area and get a totally different kind of people and culture that you’re not going to find if you limit yourself to just thinking about the beach.

Alex: The people of Miami are the most special. The beaches and city are nice but without the people it wouldn’t truly be Miami. In Miami people are so expressive, just walk through Wynwood and look at the graffiti. In Miami they speak up for themselves and make their voices heard.

What would you want people to know about your community that other people might not know?

Jaden: I want people to know that Miami Gardens is not a bad neighborhood even though it could be seen that way. You see things on the news, shootings, robberies, fights but they don’t like to show the good things. There’s actually a lot of talent here and I’m glad that I can be proof of that and inspire others. When Moonlight came out people were asking me how they can start acting.

Alex: I want people to know that Miami Gardens is not just bad stuff just like Miami isn’t all about the beach and big buildings. Miami is actually very inspiring and full of leaders. I think that is why Moonlight is popular, because it makes the unseen, seen.

How can you relate to your on-screen character being that you’re both kids growing up in Miami?

Jaden: Kevin and I are both athletic. We both want to help other kids overcome their fears and feel comfortable, to be their true selves and not be shy.

Alex: I actually didn’t really grow up in Miami, I’m from New York City originally but Chiron is a lot quieter than me. There’s a lot of people getting bullied out there, luckily I haven’t experienced that too much but if I could say anything it’s that it’s got to stop.

What scene from the film impacted you the most?

Jaden: The scene where teenage Chiron hits the bully with the chair. It shows that you can overcome your fears.

Alex: The scene where Chiron is learning to swim impacted me the most because it showed that no matter what job you have or where you come from you can still help somebody. Juan (Mahershala Ali) taught me how to swim in the scene and even though he was a drug dealer he was still a good person. That scene proved to me that people are complicated.

What does your role in this film make you think about what you want to do next?

Jaden: I want to keep acting, I really want it to be my career. My dream role would be to act in an action/superhero movie, those are my favorite.

Alex: For my next acting role, I am working on this new project called “The Chi” on Showtime. Next year I am hoping to work on a project in Africa. I plan to be an actor as my career. My dream role would be to act in “The Walking Dead.”

Thanks for speaking with us here guys. Finally I’m wondering, to whom do you credit your success?

Jaden: I credit my success to my drama teacher Mrs. Cidel and my mom and my teachers. I talk to them what about what’s happening next, and they help me to stay a step ahead and support my dreams.

*(cough, cough)… any specific teachers?*

You know I’ve got you Mr. Syros.

Alex: I credit my success to my mom and dad. My dad taught me how to be strong and mom and Mrs. Cidel kept pushing me to do what I had to do. They helped me along the way and set me up for success.

You may like

Lifestyle

BedStory® 12 Inch Memory Foam Hybrid Mattress

Published

2 days agoon

April 27, 2024By

Skylar Lee

Do you need a good night’s sleep but your mattress is ruining that? It’s time to find a brand-new mattress to relieve yourself of the stress of the day and doze off without a hitch. Learn more about the Bedstory 12-inch Memory Foam Hybrid Mattress and what people think about the product here!

BedStory

BedStory has helped millions of sleepers get quality sleep with their mattresses, pillows, and toppers. Since 1983, the company has sold its products to over 90+ countries. Plus, they ensure that only state-of-the-art technology makes it to their products to improve people’s sleep. Additionally, their product line is made in the USA, ensuring quality standards are met every time new products are manufactured.

Specifications

Price: $369.99 to 559.99 (tax included)

Mattress Sizes

The BedStory Memory Foam Hybrid Mattress comes in four sizes: twin, full, queen, and king. Plus, it comes in 12 or 14-inch sizes, too.

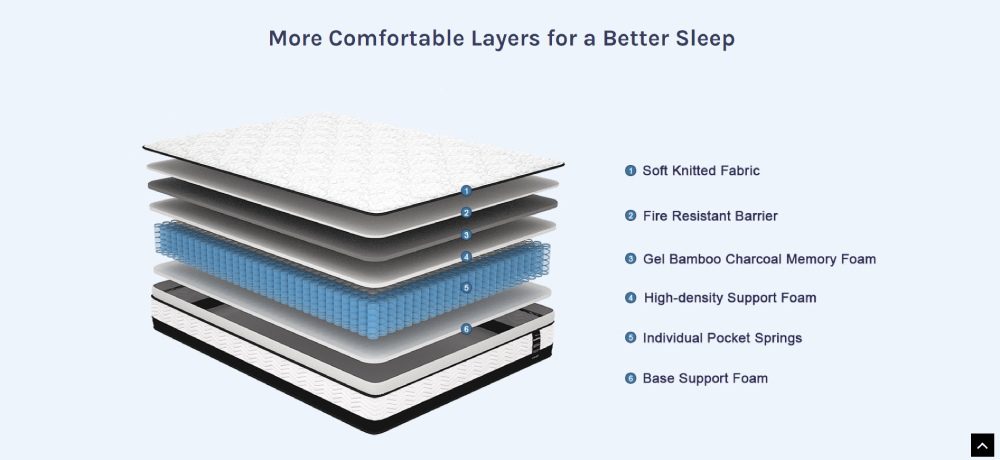

Mattress Layers

Have a restful sleep with six layers of comfort. The soft-knit fabric is on top that helps your mattress breathe. Plus, it keeps you cool while you sleep. It has a fire-resistant barrier and the gel bamboo charcoal memory foam. Plus, it has high-density foam, pocket springs, and base foam.

Lumbar Support

Have terrible back pain and want to alleviate it during sleep? BedStory has lumbar support embedded in its mattress. Pocket coils and orthopedic foam act as lumbar support while you slumber.

Cooler and More Refreshing Sleep

Their memory foam infuses gel and bamboo, making it feel cool on your body as you sleep soundly. It’s also made out of knitted fabric to let the mattress breathe. Additionally, you don’t have to worry about odors since it has moisture-wicking and odor-reducing properties. Plus, it also dissipates heat.

Motion Isolation

Do you or your partner toss and turn all night long and can’t get a wink of sleep? BedStory reduces the noise of joints shuffling all around. It’s all because the springs absorb any noise that could disturb your slumber.

Mattress Expansion

Since this is a bed in a box, it will take time for your brand-new mattress to expand to its original state. The BedStory mattress expands within 48 to 72 hours.

Delivery, Warranty, and Return

Expect your brand-new BedStory Mattress to arrive within 2 to 5 business days! The wait will all be worth it once it arrives at your doorstep.

Your BedStory Memory Foam Hybrid Mattress will have a 10-year warranty.

Regarding returns, you can try sleeping on the new mattress for 30 nights’ worth of sleep. However, if you’re not fully satisfied with the mattress, a return is possible within a 100-night window.

Certifications

You’ll be safe and sound when sleeping on a BedStory mattress since it’s CetriPUR-US and OEKO-TEX Certified. This ensures that you’re sleeping on a mattress without any harmful chemicals.

Recommended Bedframes

BedStory suggests that you can place the memory foam mattress on a platform, box spring, or slatted frame bedframe for an optimized sleeping experience. You want to make sure that you’re putting the bed on a solid bedframe to let the mattress expand properly and let you sleep without any disruptions.

The Ideal Sleepers

Like many products, the mattress isn’t a one-size-fits-all. Not everyone will enjoy their slumber with this mattress. However, it’s good to know who’ll love sleeping in this bed all day long.

- Light and sensitive sleepers

- Babies

- Elders

- People experiencing regular joint aches and pains

Maintaining The BedStory Mattress

Most beds last seven to ten years. After all, it’s expensive to change mattresses regularly. During your sleep tenure with BedStory, you can care for it to make your mattress last long. Here are tips from BedStory to help you maintain the mattress.

- Don’t eat on the bed

- Use a vacuum to remove dirt or debris

- Spot clean stains using detergent

- Put a mattress protector

- Rotate the mattress to avoid further wear and tear. Rotate it every 3 to 6 months

- Air out the mattress

- Don’t jump on the bed

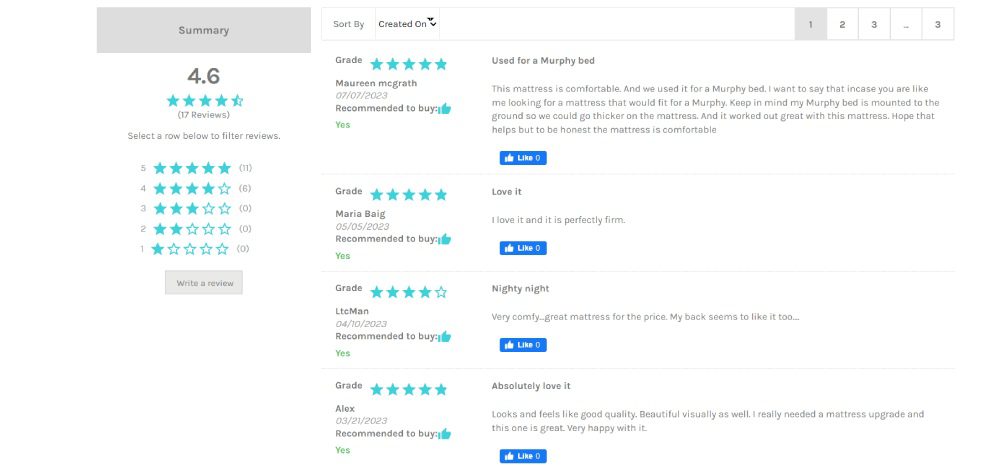

What Do Sleepers Think?

BedStory sleepers love the mattress firmness. It’s medium-firm, so if you’re looking for something soft, you’re better off buying a mattress topper to make it soft. Plus, some sleepers find it easy to sleep faster. Additionally, you don’t have to worry about aches and pains upon waking up or during the middle of the night.

However, BedStory isn’t for everyone. For instance, some sleepers find that the mattress doesn’t expand or inflate to its actual size. Other sleepers say that firmness isn’t enough for them. Plus, other sleepers experience aches and pains while sleeping on this mattress.

Final Thoughts

Choosing the BEST mattress is essential to getting a good night’s sleep. The BedStory Memory Foam Hybrid Mattress could be the next mattress to grace your bedframe. Many sleepers rave over the mattress since they sleep easier, faster, and better. Plus, some experience less or no pain upon waking up, which is a game-changer for many sleepers. Finally, it’s value for money considering the specs. You don’t need to change your mattress regularly. Plus, you can return the mattress if it’s not a good fit!

Nothing makes your trip exciting than visiting the best adventure travel destinations. Adrenaline junkies are always on the lookout for places that offer thrilling experiences, beautiful landscapes and satisfying challenges. If you haven’t decided on the next travel adventure, here are 00 destinations you must look into.

1. New Zealand

New Zealand is known for its breathtaking landscapes and offers many adventurous activities. It’s one of the best places to try sky diving. Whether you want to go solo or do tandem sky diving, New Zealand is the next place to visit. You can enjoy a picturesque view over 144 islands in the Bay of Islands with Skydive Bay of Islands.

2. Nepal

If you’ve been dreaming about hopping on a place and trekking and climbing the mountains of the Himalayas, then book a trip to Nepal. This adventure activity is only for the experienced as Mount Everest isn’t for the faint of hearts. If you’re a novice climber, you can go as high as the Everest Base Camp or Annapurna Circuit. However, the more serious climbers will go as far as the peaks of Mount Everest and Annapurna.

3. Chile

South America boasts some of the best adventure travel destinations, including Chile’s Torres del Pain National Park. You can start ice hiking the Grey Glacier from the Refugio Grey, beginning with a 15-minute zodiac boat ride to glacier’s western arm. Once you walk the glaciers, you can revel in its size and beauty. Enjoy peering into the deep blue crevasses or explore the magnificent ice caves. The more advanced ice hikers can even do a vertical ice climb!

4. Costa Rica

If you’re looking into the next surf and beach travel destination, hop on a plane to Costa Rica. Bring your surfboards to Pura Vida and enjoy the rich culture and simply contagious vibes. The stunning coastlines are laden with surf camps for the novice and experienced surfers. You’ll also enjoy a few restaurants and chic cafes to go about your work day. You can surf Costa Rica all year round on its two coasts and enjoy warm waters and a tropical climate.

5. Australia

Australia offers both mountains and beaches for both the adventure seekers on these terrains. And it’s no surprise why The Great Barrier Reef gets more than 14 million recreational visitors yearly. Travelers enjoy fishing, sailing, boating, swimming, and snorkeling. But those who seek adrenaline rush go scuba diving in The Great Barrier Reef because it’s one of the best scuba diving destinationa in the world. It features an abundance of marine life divers won’t find in any other diving destinations.

6. South Africa

Experience the diverse wildlife in South Africa and indulge in activities like bungee jumping and shark cage diving. Marvel in the grandeur of these creatures and experience their presence up close inside a cage underwater. Visit South Africa’s popular shark cage diving hotspots like Port Elizabeth, Durban, Cape Town, Mossel Bay, and Gansbaai.

Where to next?

Traveling to adventure destinations requires careful planning and consideration to ensure a safe and enjoyable experience. Research your destination thoroughly, including local customs, weather conditions, and any travel advisories. Plan your itinerary and activities in advance, but also be flexible to accommodate unexpected changes. Assess your physical fitness level, prepare accordingly, and enjoy!

Lifestyle

Style Redefined: The 10 Best Men’s Apparel from SWET Tailor

Published

3 weeks agoon

April 5, 2024

Fashion trends come and go, but a timeless brand emerges that redefines style and excellence. SWET Tailor is established to create clothes for the modern guy. The company’s signature offerings include streamlined looks, comfortable designs, and muted tones with pops of color. Scroll down to explore the best men’s apparel from SWET Tailor that seamlessly merges comfort with elegance and individuality with global appeal.

1. SWET Jogger

Elevate your casual wardrobe with the SWET Jogger, perfect for your recreational lifestyle. SWET Jogger offers distinct quality and comfort. It is made from 100% Suprese™, a 96/4 cotton/spandex blend fabric by SWET Tailor.

The jogger pants have an adjustable detailed drawstring waistband and a stitch articulation detail at the knee panel. In addition, the back zipper closure pocket and side zip pockets make it more versatile.

SWET Jogger is available in eight colors and fits true to size from Small to XXL.

Price: $99

2. Fairway Jogger

Fairway Jogger features a “dress pants meets jogger” style. You don’t have to choose between a golf look or street style with this functional pant that looks great on and off the course. Made from an exceptionally lightweight fabric blend, it offers incredible comfort and style. Fairway Jogger has lined front and zipper back pockets with a hidden front zipper pocket.

Price: $119

3. All-In Polo

This classic polo is one of SWET Tailor’s Bestsellers. You can wear this ultra-comfortable top from meetings to dinners. Tuck it in or not, SWET Tailor-made the All-in Polo in the perfect length to be styled either way. It has an adjustable 3-button placket and a self-fabric reinforced collar for extra comfort. Plus, there are 11 colors you can choose from. With this comfort, we bet you’ll purchase more than one!

Price: $69

4. The Duo Jacket

Jackets are a men’s fashion staple. Update your collection with The Duo Jacket by SWET Tailor. It may look like a classic denim jacket, but it’s not. This jacket is made from an exceptional fabric blend and combines traditional design and comfort. The Duo Jacket is available in Black, Navy, and Denim Grey.

Price: $149

5. Lightweight SWET-Hoodie

From the jackets, let’s move to the trendy and functional hoodies. Stand out from the crowd with this crewneck sweatshirt in SWET Tailor’s 100% Suprese™ material. The hoodie has a custom-engineered 4-way stretch to recoil and rebound. It is lightweight enough to be styled under your favorite jacket.

Price: $99

6. Duo Joggers

This White Duo Joggers is a perfect addition to your closet as you anticipate wearing your whites in spring or summer. Thanks to their modern jogger style, you can wear them anytime, anywhere. It features an elastic waistband and cuff for an easy fit, belt loops for versatility, and an inner waist drawstring for a polished look.

Price: $129

7. Virtus Short

The Virtus Short is an effortless blending of classy and casual styles. The super lightweight fabric and sleek design make you want to own multiple pairs. Why not? SWET Tailor’s athleisure shorts are designed for comfort and style, always ready for your next adventure.

Price: $99

8. Stretch Fleece Zip Hoodie

The Stretch Fleece Zip Hoodie is a perfect choice if you’re a zip hoodie guy. It’s one of the best fleece hoodies on the market today. The Stretch Fleece Zip Hoodie has two front pockets for comfort and rib contrast trims for a modern look. Elevate your wardrobe essentials today by adding this hoodie to your closet.

Price: $99

9. Softest T-Shirt

This incredibly soft t-shirt guarantees a silky, lightweight feel. The Softest T-shirt is so comfortable you’ll never want to take it off. The rounded hem and short length help achieve a better fit that flatters any size. With 18 unique colors, you’ll start buying now and collect as many colors as you want!

Price: $49

10. The “Classics” Bundle

For an easy, convenient, and life-changing wardrobe upgrade, go for The “Classics” Bundle. With SWET Tailor’s men’s clothing bundles, we tick off the hassle out of your morning routine. Each set is packed with comfortable and versatile pieces designed to match perfectly with others.

The “Classics” Bundle includes:

- One SWET-Shirt

- One Pair of All-In Pants

- One Pair of Duo Pants

Price: $240

About SWET Tailor

SWET Tailor is an American company established to redefine casual wear for a modern lifestyle. They believe that style and comfort must come together. With that goal in mind, SWET Tailor created a comfortable and office-ready collection of athleisure wear. The company offers versatile, stylish options that seamlessly transition from casual to formal.

SWET Tailor vs Lululemon and Other High-End Brands

In the early days of the 20th century, there was only leisure. Then, as decades passed, came athletics. The popularity of sports such as golf, tennis, and jogging paved the way for a new clothing style—eventually, a clothing style known as athleisure was born. However, when athleisure was first introduced, the term was quite literal. It refers to athletic clothing to be worn at leisure.

Fast-forward to 2023, sportswear as fashion clothing is linked with cultures worldwide, paving the way for more brands offering these apparel collections.

SWET Tailor stands out in a competitive landscape alongside high-end brands like Lululemon. They are known for exceptionally high quality, good value clothing. Based on the reviews. Their clothing’s color survived several washes without fading.

While Lululemon and other premium brands have established themselves in the market, SWET Tailor differentiates itself in several key aspects, such as:

- Redefine style

- Craftmanship and detail

- Commitment to versatility that seamlessly adapts to various lifestyles

- Global appeal

While Lululemon and similar brands have their market presence, SWET Tailor’s commitment to quality positions it as a captivating choice for those seeking a distinctive wardrobe.

Can AI Chatbots Become Your Therapist?

BedStory® 12 Inch Memory Foam Hybrid Mattress

VSETT 9+ Electric Scooter Review (2024)

Ataman M2R Bullpup Air Gun Review

6 Top Adventure Travel Destinations

Roborock S8 Robot Cleaner 2024 Review

99Designs: An Honest Review From a Non-Designer

VSETT 9+ Electric Scooter Review (2024)

6 Top Adventure Travel Destinations

BedStory® 12 Inch Memory Foam Hybrid Mattress

Ataman M2R Bullpup Air Gun Review

Can AI Chatbots Become Your Therapist?