Lifestyle

How to Conquer Distractions

Published

5 years agoon

Distractions can keep a person from being productive, be it at work, school, or at home. Unfortunately, there are simply too many distractions, and concentration can be a problem. Luckily, there are “hacks” you can follow to keep you from getting behind on your work and stay focused. Here are some tips to consider to keep your mind at work.

Social Media

Apps like Freedom help you focus on the task ahead by keeping you off social media. Install it on your computer, smartphone, or tablet, and it will block distracting sites like Twitter and Facebook, so you can limit the time spent on social media while you’re working.

Environment

The environment we work in has a big impact on your concentration. Many people find that working in a quiet space help improve concentration and keep distractions away. For example, when doing research or school work, head down to the library instead of staying at home. Your home has many of distractions like the bed, computer, or refrigerator. Libraries are meant for studying, so your brain will be conditioned to do so.

Make A List

Make a list of things you want to accomplish during the day to keep you from going astray. If you want to tackle a big task, break it down to smaller jobs to make it more manageable. Reward yourself with some candy or a break every time you check off an assignment from your list to keep you motivated. Breaking down big jobs will keep you moving forward, and before you know it, work is done.

Clean Up

If you choose to work on your desk, make sure that it is free from clutter which can be very distracting. Some people don’t mind working in a messy desk, but crumpled sheets of paper, pieces of office supplies, or unfiled folders can become annoying over time. Somewhere along the road, you might find yourself ignoring work and filing or sorting office supplies. Avoid this trap by organizing and cleaning your desk first before working on it.

White Noise

Some people find it easier to work with white noise in the background. Turn on your stereo and have music playing in the background to keep the silence from being too deafening. Try something soothing like classical music or background noises like waves crashing on the surf. Stay away from anything noisy, because they might be too stimulating and keep you from concentrating on your work.

Supplies Within Reach

Keep food, water, and other supplies within reach so that you won’t need to get up unless it’s important or a bathroom break. Sometimes, the world outside the cubicle or home office can be distracting, and you might have a hard time getting back to concentrating if you leave your desk. People who work at home find that if they have everything they need in their home office, they forget that they are actually at home and get more work done.

Experts say that actions need constant repetition so it becomes a habit. By repeating the above suggestions, we hope that over time you will learn to manage distractions and be more productive.

You may like

Content Creation 101: How To Create, Distribute, And Monetize Your Content

Design Hack Your Office For Maximum Productivity

Popping the Bubble: How to Escape the Social Media Echo Chamber

Weekly Productivity Hacks To Get You Going At Work

Marketing Trends You Need To Be Updated On

Getting Recognition Builds Productivity

Lifestyle

Best Gift Guide for Men: Perfect Gifts for Every Occasion

Published

5 days agoon

June 26, 2025

You think you know your man, but when it comes to giving him gifts, you’re at a loss. To make your life easier, we came up with a gift guide for men to suit every occasion.

1. Scratch Off Map of the World Map

To the wanderlust in your life, give him this map of the world from Etsy. He can scratch off the fantastic places he has been to. You can personalize it to make it more special.

2. Wave Duo Vibrating Roller

This ergonomically designed massager contours to the neck, back, and spine to give relief from everyday aches and pains. It vibrates and waves to deliver pressure where he needs it.

3. Ring Toss Game

A gift that he can enjoy with you and the whole gang, this Ring Toss Game is sure to provide lots of fun. It’s perfect for parties, camping trips, or picnics.

4. Personal Concrete Fireplace

Baby, light his fire with this unique table fireplace. The FLIKR fireplace is portable, easy to use, and an excellent conversation piece. Its warm and soft light lets you toast a marshmallow!

5. Lululemon ABC Jogger Shorter Length

The most comfortable sweatpants ever! These Jogger pants are designed to sit just above your guy’s ankles. It uses quick-drying and wrinkle-resistant materials that are ideal for indoor and outdoor wear.

6. Marvel Infinity Gauntlet

In times of boredom, let your man pass away the time by enjoying this LEGO Marvel Super Heroes Infinity Gauntlet. It is 590 pieces of build-and-display fun and challenge.

7. LARQ Bottle PureVis™

Give your guy the gift of the world’s first self-cleaning water bottle and water purification system. This LARQ Bottle PureVis gets rid of up to 99% of bio-contaminants, making it safe for hot or cold drinks.

8. The Daily Carry-On with Pocket from Away

Let him travel with style using Away’s The Daily Carry-On with Pocket. Its roomy interior lets him carry multiple items while the pocket can hold his laptop and other essentials.

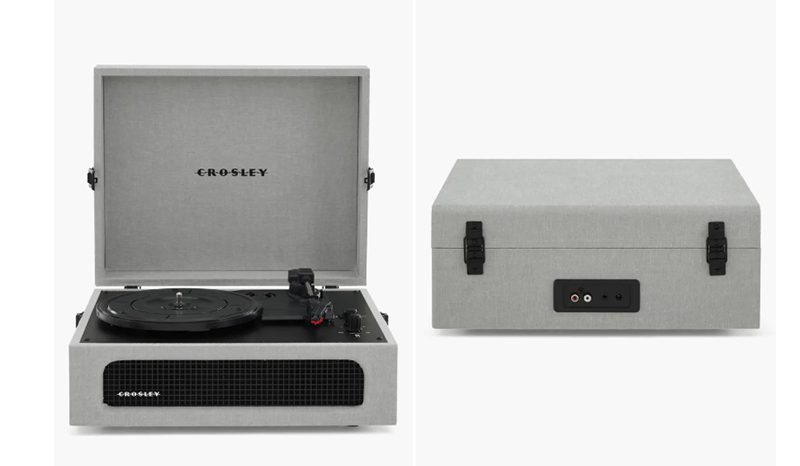

9. Crosley Radio Cruiser Deluxe Turntable

This vintage-looking turntable has the technology to play his records. The Crosley Voyager Record Player is lightweight and ready to play your 33 1/3, 45, and 78 RPM records anytime, anywhere.

10. Bowers & Wilkins Black PX7 S2 headphones

To complement the turntable above, give him these Black PX7 S2 headphones by Bowers & Wilkins. It has a noise-canceling feature that will let him get lost in his music.

11. Dad Grass Hemp CBD Pre-Rolled Joints

For a totally legit way of escaping reality, these Dad Grass Hemp CBD Pre-Rolled Joints are perfect! Let him relax after a stressful day at the office with a soothing CBD experience.

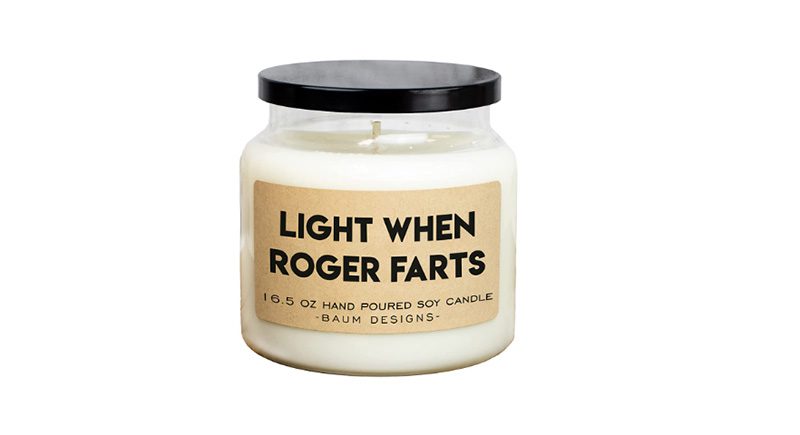

12. Personalized Light When Name Farts Soy Candle

Give him the laugh of his life with this Personalized Light When Name Farts Soy Candle. Place his name on this eco-friendly, carbon-neutral, and all-natural soy wax candle.

13. Steve McQueen Folding Sunglasses from Persol

These cool and classy Steve McQueen-inspired folding sunglasses will surely add that extra dapper to any man in your life. Its polarized lenses come in four fabulous colors.

14. Mac Mighty Professional Hollow Edge Chef’s Knife

For the guy who knows his way around the kitchen, this Mac Mighty Professional Hollow Edge Chef’s Knife is the ideal gift. This lightweight knife is suitable for everyday use.

15. Craft Beer Club Subscription

The gift that keeps on giving—a subscription to the Craft Beer Club. Your man will get to enjoy twelve different bottles of beer from various breweries across the country.

16. TAG Heuer Connected Watch

If you want to give the gift of ultimate luxury, this TAG Heuer Connected Watch is a perfect choice. Swiss craftsmanship is all about class, style, and elegance.

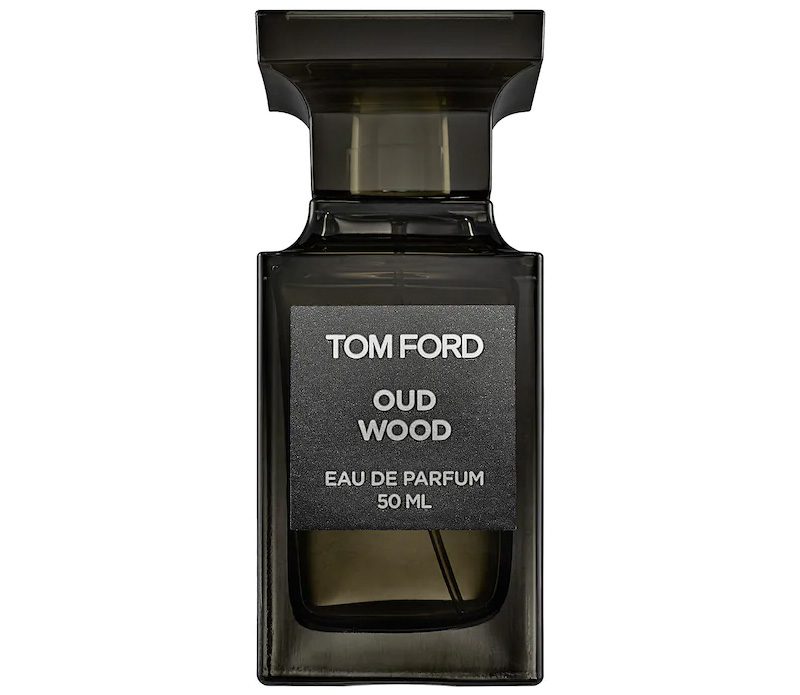

17. Oud Wood Parfum by Tom Ford

At work or play, this Oud Wood Parfum by Tom Ford will make him smell and feel charming and sophisticated. This is sure to make him more enjoyable to hug and cuddle with.

18. VANS Authentic 44 Deck DX

Add color to his wardrobe with this pair of VANS Authentic 44 Deck DX. Made with high-quality materials for extra comfort and style and a look that’s a classic.

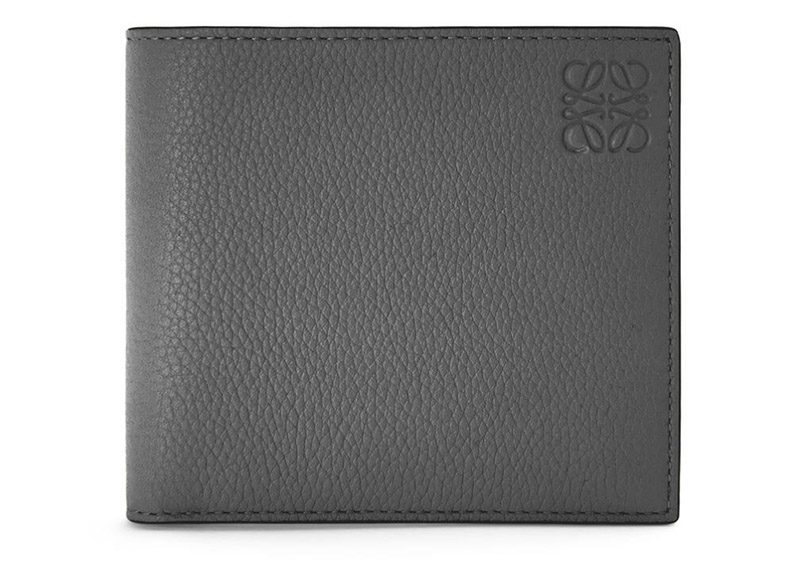

19. Loewe Bifold Wallet in Soft Grained Calfskin

Help him keep his billfolds in this uber-stylish wallet. The Loewe Bifold Wallet in Soft Grained Calfskin is the epitome of splendor and elegance without going overboard.

20. Bird Brew Seed Feeder

Don’t be fooled by the looks of this unique gift. This Bird Brew Seed Feeder will remind you of a tall bottle of booze, but in reality, it will fill the birdies’ tummies.

21. Whiskey Glasses with Raised Topographic Impression by Whiskey Peaks

For a unique and exciting gift, this set of Whiskey Glasses with Raised Topographic Impression takes the cake. Inside are impressions of the world’s most iconic mountains, making the drink a better experience for him and his friends.

22. Fuzzy Ink Beautiful Outdoor Starry Night Sky Art Print

For adventure lovers, this outdoor night sky print from Fuzzy Ink is a perfect gift! It will leave him dreaming about his next adventure. Cat not included.

23. Gingko Smart Moon Lamp

Show him you love him to the moon and back with this Smart Moon Lamp from Gingko. It adds light and warmth to his desktop or bedside table. Whether it’s a boat cruise or a day of spa pampering, this is something he’ll truly cherish.

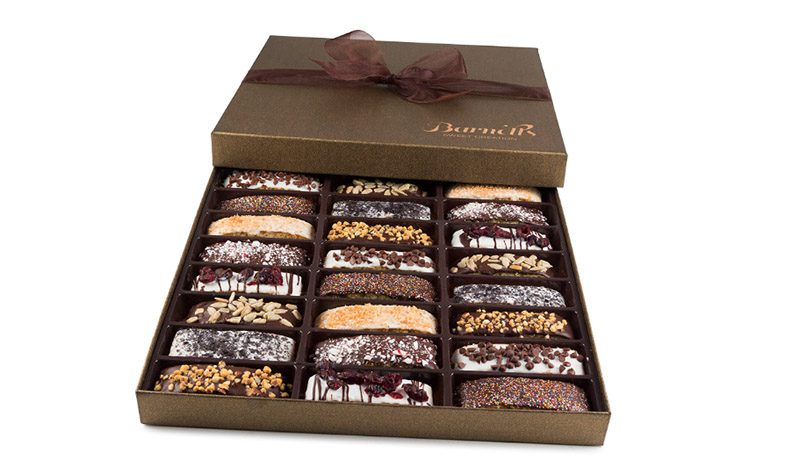

24. Barnett’s Gourmet Chocolate Biscotti Gift Basket

Let him enjoy decadence with this gift basket filled with Barnett’s gourmet chocolate biscotti. It’s two pounds of decadence that he can share and enjoy with you.

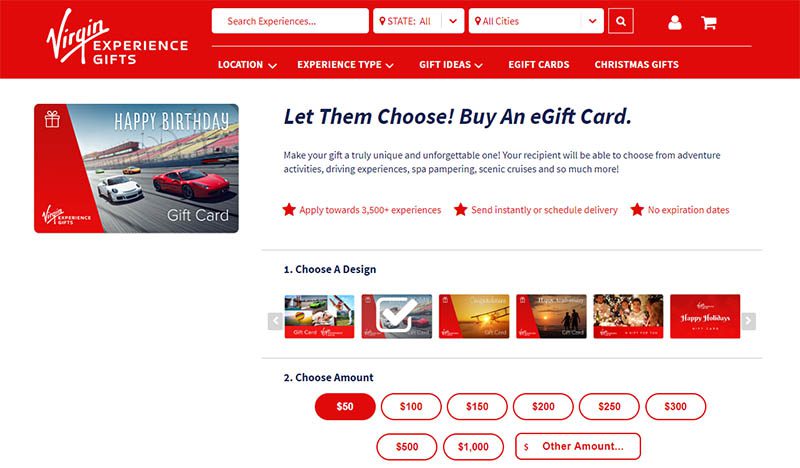

25. Choose Their Own Adventure eGift Card

If you find it hard to think about what to give, this Virgin Experience eGift card may just be the ticket. It lets them choose the adventure they want for a memorable and unique experience.

Final Thoughts

No one knows your man better than you do. But sometimes, getting a unique gift can be mind-boggling. This men’s gift guide includes a wide array of one-of-a-kind items that are sure to be unforgettable. And for other men’s gift guides, check out more here at Owner’s Mag!

Lifestyle

Digital Nomads Flock To These 10 Amazing Tax-Free Cities

Published

1 week agoon

June 23, 2025

The rise of remote work has paved the way for many to gain freedom to live and work from anywhere in the world. But for many work-from-home advocates, the right destination can also mean gaining financial benefits aside from having their dream lifestyle. This is where tax-free cities for digital nomads come in. Maximize your earnings, reduce business expenses, and enjoy a high-quality lifestyle when you relocate to the ten best tax-free cities:

The Benefits of Living in a Tax-Free City

If you are a digital nomad looking for a change of scenery, you’ll get the following benefits when you move to these destinations:

- Tax Savings: For entrepreneurs and remote workers, you’ll save on taxes when you move to any of the cities included in this list. Without paying income taxes, you can keep more of your earnings.

- Business-Friendly Incentives: Many tax-free cities offer favorable corporate policies, residency programs, and economic incentives. Not only will you have the opportunity to work in a setting that suits your lifestyle, but you’ll also reap financial benefits.

- Improved Financial Freedom: Lower tax burdens offer greater financial flexibility. This enables you to enjoy a higher standard of living, travel for leisure, and invest in your future without excessive government deductions.

Top 10 Amazing Tax-Free Cities for Digital Nomads

1. Dubai, UAE

Photo Credit: Aleksandar Pasaric on Pexels

Emerging as one of the most attractive destinations for digital nomads, Dubai has a zero personal income tax policy and a thriving business environment. As part of the United Arab Emirates, Dubai offers a state-of-the-art infrastructure, fast internet, and a well-connected global hub with flights to the world’s major cities. The city’s Virtual Working Program grants digital nomads a one-year residency visa that lets them live in Dubai while working for an overseas company.

2. Bermuda

Famous for its stunning beaches with crystal-clear waters, the British Territory of Bermuda makes working remotely even better as it doesn’t impose income taxes. Its digital nomad visa has no income requirement but will ask to see your financial status. This is to prove that you can support yourself on the island without having a job there. It also allows foreign workers to live and work for up to one year. The abundance of outdoor activities, reliable internet, and plenty of co-working spaces provide an excellent balance of work and play.

3. Croatia

An increasingly popular destination for digital nomads, Croatia is a favorite destination for digital nomads. While it isn’t entirely tax-free, its tax policies and dedicated digital nomad visa exempt you from income tax on foreign-earned income. Remote workers who qualify for this country’s Digital Nomad Residence Permit can enjoy this benefit. In addition, Croatia’s low cost of living allows you to enjoy a Mediterranean lifestyle while working remotely.

4. Antigua and Barbuda

Photo Credit: Julia Volk on Pexels

A beautiful Caribbean nation, Antigua and Barbuda offers zero personal income tax for digital nomads. This twin-island nation has stunning beaches, warm weather, and a welcoming expat community that makes it an ideal place if you’re looking to embrace the island life. It introduced the Nomad Digital Residence (NDR) visa to attract more remote workers. This allows you to live and work for up to two years without paying local income taxes.

5. Panama

Thanks to its territorial tax system, Panama is now a popular destination for digital nomads and entrepreneurs looking to enjoy foreign-earned income that isn’t taxed. Its various visa options include the Short Stay Visa for Remote Workers, which lets you live and work for up to 18 months. It requires proof of employment or self-employment with a minimum income of $36,000. This nation offers modern infrastructure, high-speed internet, and an active expat community.

6. Grenada

Earning the moniker “Spice Isle” of the Caribbean, Grenada offers zero personal income tax for digital nomads. It has business-friendly policies, breath-taking landscapes, and a relaxed lifestyle, ideal for remote workers looking for financial and individual freedom. In lieu of a dedicated digital nomad visa, you can take advantage of its long-stay visa options or explore its Citizenship by Investment Program, which gives you the chance to obtain permanent residency.

7. Montserrat

Another tax-free Caribbean hideaway, Montserrat, is a favorite of many digital nomads thanks to its zero personal income tax. Its lush landscape, volcanic scenery, and friendly local community offer superb work-life balance away from the hustle and bustle of city life. Its digital nomad visa, the Montserrat Remote Work Stamp, lets you live and work in Montserrat for up to 12 months. All you need to do is provide proof of employment with an annual income of at least $70,000.

8. Barbados

Photo Credit: Blue Ox Studio on Pexels

Having positioned itself as a top destination for remote workers, Barbados offers zero personal income tax by introducing its Barbados Welcome Stamp. This visa lets you live and work in Barbados for up to 12 months, making it an excellent option for those looking for financial and lifestyle benefits. To qualify for the Welcome Stamp, you must earn at least $50,000 annually and provide proof of remote employment or self-employment. Its hassle-free application process lets you enjoy the duty-free import of personal belongings and many other benefits.

9. Anguilla

A dream destination for many digital nomads, Anguilla is another tax-free Caribbean paradise. It offers no personal income, capital gains, or corporate tax for individuals. It introduced the Work From Anguilla program to attract more location-independent professionals. This grants them a 12-month remote work visa and access to high-speed internet, modern infrastructure, and a relaxed, safe environment. Its pristine beaches, low population density, and welcoming community make it the perfect place for productivity and leisure.

10. Uruguay

Another South American hub for digital nomads, Uruguay offers a territorial tax system that does not impose a tax on foreign-earned income. In addition to letting you enjoy a stable and high-quality lifestyle, Uruguay provides a five-year tax holiday on foreign income, an appealing offer for long-term stays. Uruguay’s excellent infrastructure, reliable internet, and active expat community let you establish legal residency via the country’s Straightforward Residency Program.

Lifestyle

10 Adventure Travel Destinations You Don’t Want to Miss

Published

2 weeks agoon

June 20, 2025By

Kai Kelis

Packing for an adventure travel is the most exciting thing! You’ll find yourself prepping weeks before the scheduled trip. Aside from packing, researching things to pack and what to do before and during the adventure is essential. If you have an upcoming trip to one of these travel destinations, here’s a quick guide to prepare you for the trip of your life!

1. Everest Base Camp Trek in Nepal

Every mountaineer would probably jump on the first opportunity to trek Everest’s base camp in Nepal. It’s one of the most coveted hiking trips worldwide. The most experienced mountaineers can go all the way up to the summit. The Everest base camp hike is challenging for an average hiker due to altitude. It lasts 12 to 14 days with a total incline of 6015 meters. Although a guide isn’t required, it’s highly recommended. You can also opt for the Guest Houses along the way if you want to sleep comfortably with showers and restaurant facilities.

2. Ice Cave Exploration in Iceland

Iceland is a beautiful country full of greenery and glaciers. The Vatnajokull National Park is Iceland’s most popular place for ice cave explorations. You can either rent a car or ride the bus or mini-bus to get to Iceland’s glaciers. However, renting a car is the easiest way to get around Iceland and enjoy the scenery at your own pace. Make sure you plan a trip from November to March only because the glaciers are melted during summertime. Ice cave explorations are also day trips that don’t require you to spend overnight around the area.

3. Great Barrier Reef Dive in Australia

Australia boasts the most beautiful beaches in the world. It’s also a surf destination if you’re into watersports. However, you can embark on the biggest adventure travel of your life—diving the Great Barrier Reef. The reef extends 2,300 kilometers from north to south and comprises 2,900 individual coral reefs. It also has the largest natural structure, with more than 400 species of coral reefs.

4. Machu Pichu Trail Trek in Peru

The Machu Pichu Trail is one of the most popular treks in the world. Located in Peru, you can enjoy this UNESCO New World Wonder with an expert guide. The best time to visit Machu Pichu is during the months of June, July, and August. These are the region’s dry months, and hiking Machi Pichu is better during sunny conditions. Accommodations also get booked quickly, so make sure you book in advance. Try to do the iconic four-day Inca Trail!

5. Sandboarding in Morocco

If you’re not cut out for watersports activities like surfing, then try sandboarding in the Sahara. Most visitors go to the two largest dunes in the Moroccan Sahara—the Erg Chebbi or Erg Chigaga. You can do fun activities in the beautiful golden dunes that flow through different slopes toward the horizon, such as camel trekking or camping at the Berber campsite. But one of the most fun activities is sandboarding. You glide down the sand dune with your feet strapped onto the board.

6. Grand Canyon Rafting in America

If you’re from the United States and haven’t been to the Grand Canyon, it’s high time you visited! The Grand Canyon National Park offers many recreational trips, both commercial and non-commercial. You can take guided activities through 15 river concessioners because non-guided “private trips” are sometimes dangerous and not recommended for those newbies. River rafting doesn’t need experts to be enjoyable. It’s doable for every average traveler! Even kids ages 10 to 12 are allowed on motorized rafting trips. The most popular months are May and June since the weather isn’t so hot. However, don’t forget to book a commercial trip in advance for a year or so!

7. Great Walks Hikes in New Zealand

The “Great Walks” is regarded as New Zealand’s multi-day hiking. When embarking on this adventure travel, make sure you pre-book your beds in the backcountry huts along the tracks. During the hiking season, the cost of staying in these huts is crazy. Hiking the Great Walks will immerse you in New Zealand’s pure wilderness. You can also choose which hike you want, as there are multiple options. The Lake Waikeramoana Track is one of the gentlest trails, while the Kepler Track is the most challenging trail of the Great Walks.

8. Hot Air Balloon Ride in Turkey

If you want a unique and magical experience, try riding a hot air balloon over Cappadocia in Turkey. This is a one-of-a-kind experience that lets you see Cappadocia just when the first light hits the skyline. The best time to do this activity is during spring and autumn, from April to May and September to October. It offers the best weather for hot air balloon rides.

9. Glacier Hunting and Caving in Greenland

Greenland is the second-largest icefield in the world. It’s also one of the best adventure travel destinations you mustn’t miss. This place offers the best views and beautiful white-ice mountains you’ll never see elsewhere. You can go ice caving and see ancient ice and some interesting frozen formations. Try visiting the Kulusuk ice cave, which was discovered in 2016 and has had fewer than a thousand visitors since. Unlike other ice caves, this one can only be reached once the snow melts during summertime.

10. Jumeirah Beach Skydiving in Dubai

If you want to amp up your adrenaline with an exhilarating adventure, try skydiving over Palm Jumeirah in Dubai Marina. This quick skydive activity will take about 25 minutes from the interview until touchdown. It’s also one of the safest skydive adventures in the world, with certified instructors and various packages for your preference and budget.

Why Having an Advisory Board Could Make or Break Your Startup

Best Gift Guide for Men: Perfect Gifts for Every Occasion

What’s the Deal With Elomir? Is Axis Klarity a Scam?

The Best Ways to Recession Proof Your Business

Discover 2025’s Top 10 Online Banks for Smart Savings

Digital Nomads Flock To These 10 Amazing Tax-Free Cities

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

What’s the Deal With Elomir? Is Axis Klarity a Scam?

Why Having an Advisory Board Could Make or Break Your Startup

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

The Best Ways to Recession Proof Your Business

Best Gift Guide for Men: Perfect Gifts for Every Occasion

Discover 2025’s Top 10 Online Banks for Smart Savings