Lifestyle

Habits Of A Successful Entrepreneur

Published

5 years agoon

Every entrepreneur is different, and there is no fixed rule to survive in the world of business. Entrepreneurs need to survive unprecedented challenges to achieve success. Entrepreneurs can transform themselves into a new person by adopting strict discipline and a willingness to turn every defeat into success.

Positive attitude

The determination and the positive attitude of the entrepreneur are pillars of long-term success. Whether you head a startup or an established enterprise, unprecedented challenges crop up from time to time. There can be significant financial difficulties too, but the entrepreneur should not give up.

Learn from mistakes

Every founder can face a major setback while taking risks for the troupe. He should admit the mistakes and take responsibility for the losses. After a setback, the entrepreneur should not give up and must learn from the mistakes. It is his responsibility to initiate correction strategy and try to put everything in order.

Measure your progress

It is very important to set some achievable goals for the company. The proprietor should keep track of these short-term and long-term goals regularly. The entrepreneur should also invest some quality time in studying the evolution of other similar businesses. If the business is going on the right track, you should implement other improvement plans accordingly. Remember, beating the competition is vital to becoming the market leader.

Plan your day

An entrepreneur has to focus on every aspect of his business and it is very common to miss out something vital and then regret later. Hence, it is important to plan your day in advance. An entrepreneur may have several interviews, meetings, engagements and other important tasks planned in a work day and it can get really hectic. However, you should also attempt to maintain some flexibility and keep some time aside to address urgent issues.

Effective networking skills

To attain success as an entrepreneur, one needs to be a great communicator. Networking is one of the least expensive ways to get your company noticed. Meet experts and gain knowledge about the latest trends in the industry you operate. As you meet other businesspersons, you can also find some apt solutions to the problems faced in your business. Attend networking events and speak about the goals and ambitions of your company.

Acquire and manage talent

Running a venture successfully is not a one-man show. You need to hire people who will contribute to the growth of your firm. When you hire people for your start-up, their collective goals, experience, and knowledge boost up the performance of the company. It’s also vital to retain the best talent and reward and recognize contributions.

Work harder and longer

Successful entrepreneurs are extremely focused and very composed to take the pressure. They have a vision and are known to tirelessly work to achieve success. They are always willing to learn and walk a step further for the growth of the company. So, the lifestyle of an entrepreneur should complement this demand. He must always be ready to accept challenges. As he is the flag-bearer of his company, he should keep track of all the departments of the business.

Investors always observe the knowledge and capability of the entrepreneur before they invest. The hunger for success and the willingness to grow continuously are the necessary qualities of a successful entrepreneur.

You may like

Wondering what to give your father, brother, or boyfriend for their upcoming birthdays? Or just thinking about what gadget to get yourself? Don’t worry about driving down to the nearest hardware or sports stores. You can definitely find one on Amazon. And don’t worry about searching as well. We’ve done the searching for you. Here are the top 10 gadgets for men you can buy from Amazon.

1. Nesting Grill Baskets

This nesting grill basket comes with a unique and removable wooden handle. It has a threaded connection to ensure secure attachment, never spilling your favorite vegetables. Plus, the handles can withstand supreme heat, allowing you to easily manage the grill. The grill is also made of food-grade 304 stainless steel, including the wire mesh. The best part is how easy to stow away this nesting grill basket, as it comes with removable handles!

Buy on Amazon

2. Multitool Pen

Whether buying a gift for your brother, father, son, or grandpa, you can never go wrong with this multitool pen. It’s a 6-in-1 multitool pen that comes with a bubble level, stylus pen, a ruler, a ballpoint pen, and two-headed screwdriver with a Phillips head and flathead. Of course, you’d also want to use this as a pen! It is made from durable aluminum material that offers a smooth writing experience.

Buy on Amazon

3. Multi-kitchen Gadget

This is the multi-kitchen tool you need that comes with six useful gadgets. You’ll get a grinder, a grater, a pizza cutter, a bottle opener, a herb stipper, and a swivel peeler. Don’t be deceived by its small size as the blades are made from 410 and 430 stainless steel to ensure smooth grating, slicing, and peeling. It’s also lightweight and easy to store. You can stack the gadgets on top of each other in any order, hang it on the kitchen cupboard, or put it inside a kitchen drawer.

Buy on Amazon

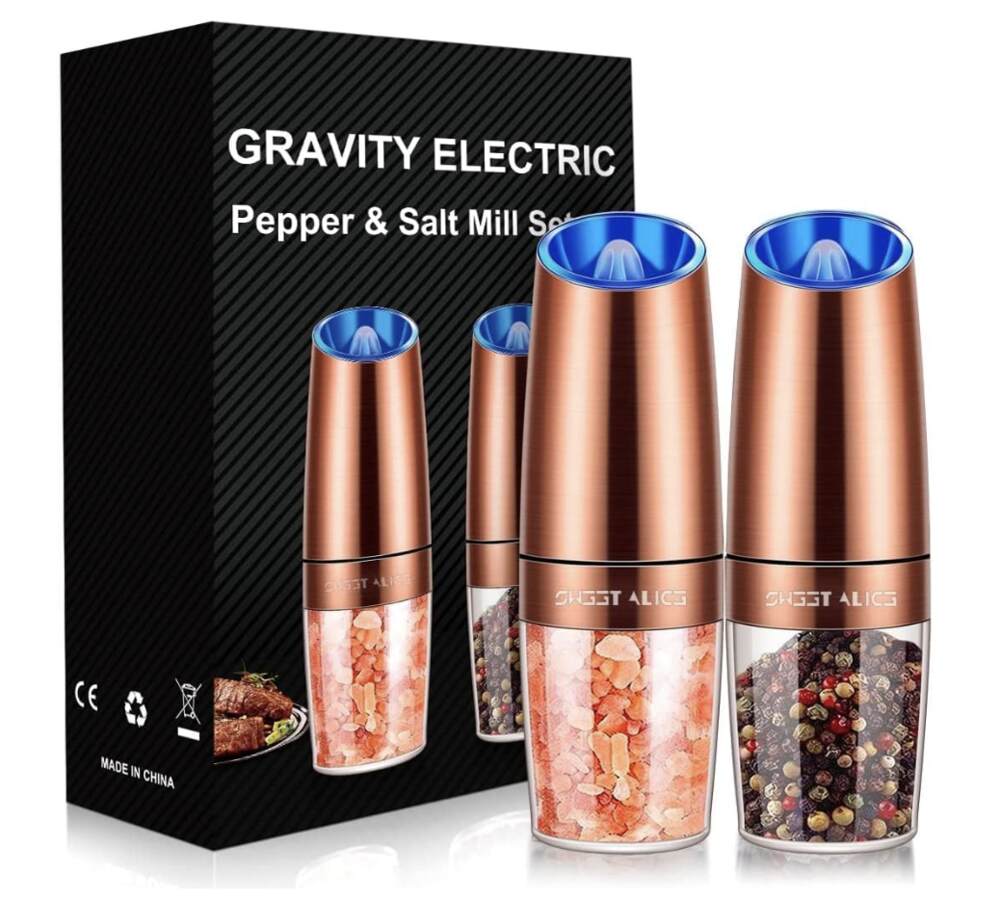

4. Pepper and Salt Grinder Set

This electric pepper and salt grinder set is everything you need in the kitchen. Cooking will be much easier with this set’s sensor switch that doesn’t require pressing a button. You can simply flip the grinder and get those spices working. It also comes with multiple grinding levels, from coarse to finely-ground spices. Buying this item means you can get a 100-day replacement and money-back guarantee.

Buy on Amazon

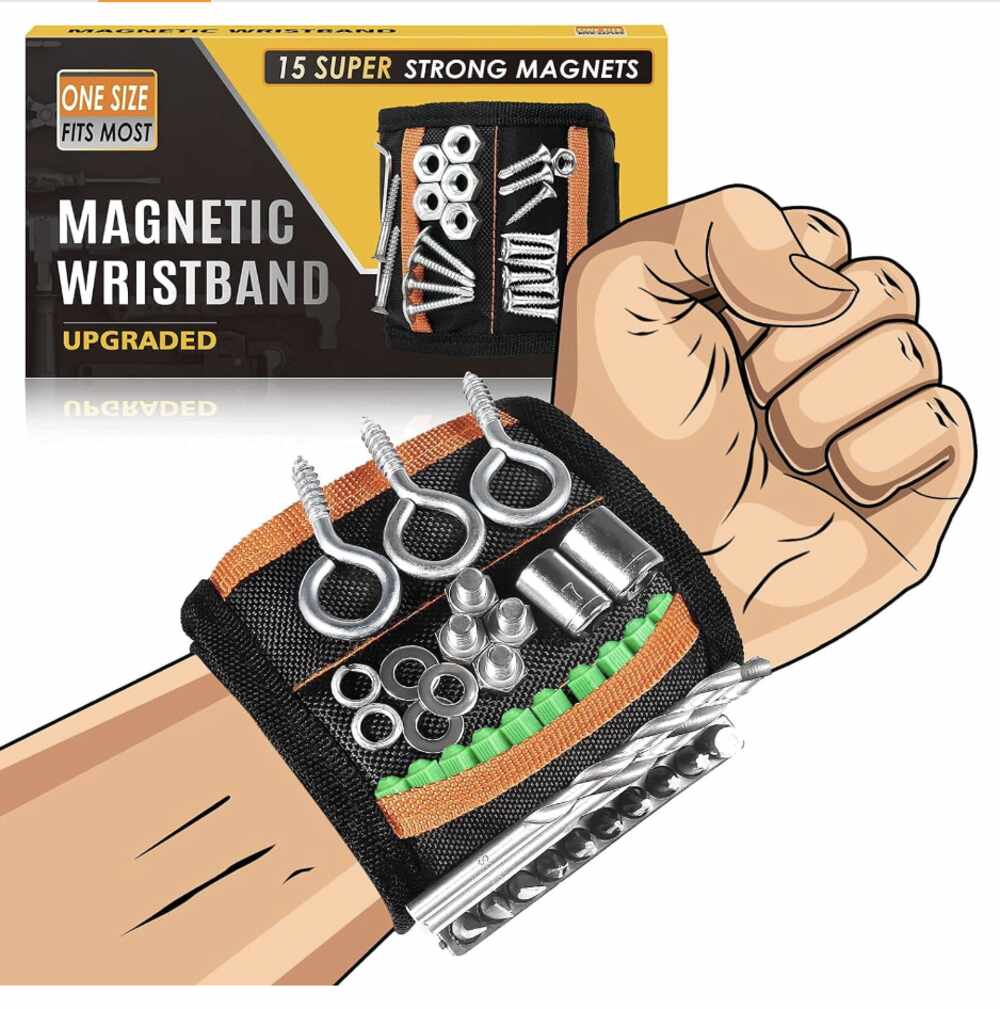

5. Magnetic Wristband for Tools

Looking for unique gifts for men? This magnetic wristband is perfect for dads, boyfriends, husbands, and handymen. Featuring 15 solid magnets and two small pockets, it securely holds screws, drill bits, and other metal tools, reducing trips to the toolbox. The adjustable Velcro ensures a snug fit for most wrist sizes. Weighing only 3 ounces, its lightweight and breathable design keeps your wrist comfortable. Ideal for DIY projects, this wristband saves time and effort by keeping essential tools within reach.

Buy on Amazon

6. Vegetable Chopper

If you’re thinking what to gift your guy friend who hates chopping veggies, this is the perfect gadget or kitchen tool. It has seven interchangeable inserts, including chopper and spiralizer blades, and it’s perfect for creating broad ribbons or thin spirals. Ideal for quick, healthy meal prep, the rust-resistant 420 stainless steel blades dice vegetables effortlessly. The soft grip handle and non-skid rubberized bottom ensure stability, while the catch tray and dishwasher-safe design make cleanup a breeze. Essential for any kitchen, this versatile tool comes with a 100% satisfaction guarantee.

Buy on Amazon

7. Wood Phone Docking Station

This multifunctional charging station and organizer is perfect for charging your phone and keeping daily essentials at hand. Made from solid ash wood with a non-toxic finish, its unique grain ensures each piece is distinct. The sturdy, polished stand fits any decor and includes wallets, glasses, watches, and more compartments. Easy to assemble, it’s compatible with all smartphones. Not only is it made from organic material, but it’s also packaged in an eco-friendly box, a perfect gift for men who are into sustainability.

Buy on Amazon

8. Nose Hair Trimmer

Nose hair won’t be a problem anymore if you have this nose hair trimmer at your beck and call. It’s also an excellent, easy gift for men that they’ll undoubtedly use. It’s a versatile 3-in-1 device with attachments for trimming nose hair, ear hair, eyebrows, and facial hair. Featuring a powerful 6500RPM motor and dual-edge blade, it ensures fast, painless hair removal. The USB rechargeable trimmer eliminates the need for AA batteries, offering convenience and portability. Its compact, energy-saving design is ideal for travel. Finally, IPX7 waterproof rating and removable trimmer head make cleaning easy.

Buy on Amazon

9. Keychain Screwdriver Tool

Do you frequently use a screwdriver? Then, this keychain screwdriver tool is a must-have! This key-shaped pocket tool is a 5-in-1 multi-function keychain screwdriver. It comes with a Cross and Flathead screwdriver, 8mm and 5mm Hex socket wrenches, and a bottle opener. It’s compact and versatile, ideal for tightening screws, opening bottles, and repairing various items like snowboards and bikes. Weighing only 2.3 ounces, it’s portable and perfect for outdoor activities. It’s made of durable chromium-vanadium steel, ensuring this tool will last for years!

Buy on Amazon

10. Universal Socket Tool

How about getting your male best friend this universal socket tool that makes life easier? This premium universal socket is a compact, well-constructed tool for Father’s Day and other special occasions. Its auto-adjust design fits standard 1/4” to 3/4” and metric 7 to 19 mm screws, nuts, and bolts. It also includes a 3/8″ power drill adapter for easy connection to drills and screwdrivers. Made from high-hardness chrome vanadium steel with 54 Chromoly steel pins, it adjusts to various fasteners instantly. Perfect for home maintenance and DIY enthusiasts, it comes with a satisfaction guarantee and 24-hour customer service.

Buy on Amazon

Lifestyle

Top 10 Affordable Gadgets for Women on Amazon

Published

1 week agoon

July 17, 2024By

Kai Kelis

Having the right gadgets could be a game-changer in your everyday routine! Smart gadgets and multi-purpose tools offer convenience, efficiency, and speed in everything you do. If you’re not sure where to start, grab these home gadgets for yourself or as gifts for mothers, sisters, or girlfriends. Here are the top 10 affordable gadgets for women you can buy on Amazon.

1. Music table lamp

Don’t mind playing some music while sleeping in ambient lighting? Then this music table lamp will make your sleep extra wonderful. It offers a touch-sensitive feature with four levels of brightness. It’s also a wireless charger, where you can plug your smartphone while it regains juice. The speaker comes with Bluetooth 5 technology for better connectivity. With its stylish design, you’ll never go wrong with this music table lamp as your mother’s or sister’s birthday gift.

Buy on Amazon

2. Portable neck fan

If you plan to travel to a tropical country as your next destination, staying comfortable under the sun is good. This portable neck fan will ensure you stay cool under the scorching heat. It features a bladeless design and increases cooling by 70 percent. It also comes with a 360-degree air outlet for better fanning. It resembles a headset, so people will never know you’re cool and comfy in hot weather. Use this gadget for four to nine hours on three multiple-fan speeds.

Buy on Amazon

3. Cellphone stand

Whether you’re a busy bee in the kitchen or just enjoy binging on movies from your mobile phone, this cellphone stand will make your life easier. You can prep and cook your favorite meals without interrupting your movie! This phone stand also has a portable Bluetooth speaker, which delivers impeccable bass, crystal clear highs, and tight mids. You can also adjust the phone’s angle viewing to your preference. The back and bottom also come with anti-skid silicone, ensuring a reliable grip even on wet kitchen counters.

Buy on Amazon

4. Mini projector

This mini projector could be an excellent and unique birthday gift for the women in your life! Better yet, you can also use it at home during rainy nights. It offers the latest 1080p full HD resolution, providing sharp and clear images. Don’t be deceived by its small size. It offers an immersive viewing experience through a 200-inch projection screen. You don’t have to worry about connectivity, as it has multiple device connections, such as VGA, AV, HDMI, and USB.

Buy on Amazon

5. Electric spin scrubber

This electric spin scrubber is a must-have for all clean freaks! It’s a revolutionary cleaning tool that makes your tasks more manageable, especially for those with mobility issues. If you find bending and kneeling challenging, this gadget is for you. It has a powerful motor with a high-speed rotation of 580RPM. It’s easy to clean with a detachable rod and replaceable brush head. It also has seven replaceable brush heads, perfect for multiple cleaning needs.

Buy on Amazon

6. Sleep mask with headphones

Nothing beats an uninterrupted goodnight sleep to rejuvenate you for the next day’s activities. Grab this sleep mask with headphones for a comfortable and enjoyable sleep. Its bending cartilage design blocks out 99.99 percent of light and is perfect for side sleepers. Be in a comfortable sleeping position with the extra cushion. It’s made of 5A cotton, which is exceptionally soft and elastic. Plus, it has a 5.2 Bluetooth technology offering high-quality stereo music. Don’t worry about sleeping in or going on long flights. This can run on 10 hours of playtime!

Buy on Amazon

7. Electric makeup brush cleaner

Tired of always having to clean makeup brushes manually? Maybe it’s high time you buy this electric makeup brush cleaner on Amazon. This is also a perfect present for the female makeup artist in your family or circle of friends. It offers cutting-edge technology to ensure your makeup brushes get a thorough cleaning. Plus, it’s easy to use by turning the gadget on or off. From eyeshadow brushes to blush-on brushes, this electric makeup brush cleaner is suitable for all brush sizes and forms!

Buy on Amazon

8. Handheld portable fan

If you’re taking a trip that requires a lot of walking or hiking, this handheld portable fan will make it more comfortable. It offers four strong wind levels with an efficient brushless motor with seven blades. Plus, it has a multi-functional design that can be folded and stood on a table. Portability is also not an issue with its lightweight 4-ounce size. The quiet and sleek design won’t make it a hazard to carry around and use.

Buy on Amazon

9. Bluetooth shower speaker

Do you frequently enjoy singing in the shower? This Bluetooth shower speaker will make the shower experience even more enjoyable. It’s highly waterproof and significantly dust- and sand-resistant, making it perfect for beach trips! Get it covered in snow and mud and wash it afterward without any issues. It has IP67 protection and can withstand being completely submerged in water for up to a meter and up to 30 minutes. Apart from being reliably waterproof, it offers crystal clear sound that is distortion-free, nice, and crisp at maximum volume. Make it more fun with five LED light patterns to enjoy a light show while listening to your favorite tunes.

Buy on Amazon

10. Electric body hair trimmer

Are you looking for the perfect present for your hairy female friends? This electric body hair trimmer is one of the best gadgets for women and comes in a sleek and stylish design. It has two interchangeable heads. One is the precision trimming head that is perfect for removing hair in large areas of the body. Meanwhile, the round shaver head offers a smooth and close finish. It has a robust motor that makes hair trimming smooth and painless. Plus, it’s also easy to clean with washable and removable heads. Charge for 90 minutes via a USB connection and use for 90 minutes!

Buy on Amazon

Lifestyle

10 MUST-HAVE Eco-Friendly Gadgets in 2024

Published

4 weeks agoon

June 28, 2024By

Kai Kelis

The year 2023 set a new record for the highest global average temperatures, reaching 1.46°C above pre-industrial averages. This surpassed the previous record set in 2016 by 0.13°C.

With these records at an all-time high, many businesses and homeowners are making simple, eco-friendly tweaks. Although these solutions are deemed simple, the number of households and companies implementing them will undeniably make an impact.

Replacing your energy-consuming gadgets at home with eco-friendly gadgets is one step to sustainable living. Here are 10 environmentally-friendly gadgets to start with.

1. Solar-powered Chargers

Charge your gadgets with solar-powered chargers! Packing a solar-powered charger means you no longer have to rely on electricity when you run out of juice. If you live in a tropical country with sunlight on most months, then take advantage of the sun! It’s the best source of renewable energy. These chargers comprise solar panels that contain PV (photovoltaic) cell blocks that transform sunlight into electricity. Most solar-powered chargers contain 12 volts. However, some have the capacity of 24V, 36V, and so on.

2. EcoFlow River Portable Power Station

This is the outdoor and emergency portable battery pack for you. It’s fast charging with an EcoFlow X-Stream technology that lets you charge this gadget from zero to eighty percent in an hour. You can fully charge this in 90 minutes, which is four to five times faster than other battery packs. It also offers all the necessary ports, such as USB-A, pure sine wave AC outlet, and 12V DC car port. Last but not least, this portable battery pack is portable and lightweight, weighing only 6.3 pounds—easy to store in your backpack!

3. Google Nest Thermostat

The Google Nest Thermostat is one of the most reliable eco-friendly gadgets with an ENERGY STAR certification. It’s perfect for household or office use and helps optimize heat and cold in a space to reduce energy consumption. This thermostat shuts off when you leave, ensuring you don’t waste energy on cooling or heating an empty home or office. Another brilliant feature is the ability to control the thermostat temperature from a laptop, tablet, or phone through its remote control. It also offers HVAC monitoring and alerts you if something isn’t up to par with your heating and cooling equipment at home.

4. WakaWaka Power+

This is the eco-friendly tool you need for your outdoor adventures! The WakaWaka Power+ is a solar-powered flashlight and mobile phone charger tailored for off-grid areas. So, no more worrying about running out of juice when camping for days in the jungle! It has a sensitive solar panel on each device covered in naked solar film. This side of the solar panel absorbs even the dullest sunlight. The flashlights also come with twin LEDS with adjustable brightness between five and 75 lumens. Plus, the phone charger is at 2200mAh, which is perfect for a single charge on your Android or Apple phone!

5. LIFX LED Smart Bulbs

These energy-efficient bulbs are next level, with dimming features! The LIFX LED Smart Bulbs are the household bulb of your dreams where you can control light customization via the smartphone app. Polychrome technology bulbs can emit multiple colors simultaneously, enhancing room decor by shining different colors on a wall while providing white light. These bulbs offer voice control, scheduling, scenes, effects, and integration with Apple’s adaptive lighting, Alexa’s light alarms, and Google’s Sleep/Wake features. They are compatible with Alexa, Apple HomeKit/Siri, and Hey Google and are easy to set up. Just screw in, open your preferred app, and follow the prompts!

6. Hydrao Smart Shower Head

Whether building a new home or renovating an old one, make this a priority on your upgrade checklist. Replacing your old shower head with the Hydrao Smart Shower Head will save you money and make Mother Nature happy. This Smart shower head lets you track water usage, changing colors to remind users of shorter showers. This way, you reduce energy consumption for heating. It’s a plug-and-play eco-friendly device that doesn’t need a battery.

7. Sodastream

SodaStream allows users to make their carbonated water at home, eliminating the use of single-use plastic bottles and lowering transportation-related carbon emissions. With a simple button push, you can enjoy fresh sparkling water. The kit includes a sparkling water maker, a 60L CO2 cylinder, and a 1-liter dishwasher-safe bottle. It’s energy-efficient, powered by a CO2 cylinder that carbonates up to 60 liters of water. The easy-to-use snap-lock bottle insertion system makes carbonation quick. Compatible with all SodaStream flavors and bottles (except the glass carafe), SodaStream Art machines work exclusively with the Quick Connect CO2 cylinder.

8. Symphonized Bamboo Bluetooth Portable Speaker

This bamboo-made portable speaker is made of natural wood, offering premium sound. It provides crystal clear acoustics and deep bass due to natural wood’s properties. It’s also quick to connect and easy to use. Plus, it’s universally compatible with any Bluetooth-enabled device. You can enjoy up to six hours of playtime from this small speaker and fully charge it again in two hours!

9. BioLite CampStove 2

The BioLite CampStove 2 is a portable stove that transforms heat from burning wood into electricity, enabling device charging and reducing reliance on disposable batteries and fuel. It uses renewable biomass fuels like twigs and pinecones, creating smokeless flames ideal for cooking. A thermoelectric generator produces three watts of power for real-time charging and stores energy in a 3,200 mAh battery. The stove boils a liter of water in 4.5 minutes, features a USB port for device charging, and includes a pot stand, folding legs, and an LED FlexLight.

10. LifeStraw Filter Drinking Straw

This is the best stainless steel straw you can carry around that is environmentally efficient. It removes microplastics, dirt, cloudiness, and particles about 99.99%! It also protects you from parasites and bacteria! The reliable filter can be used with a thousand liters of water, estimated at one year of daily use. It’s made from high-quality stainless steel, and the mouthpiece is silicone-based. This reusable straw also only weighs three ounces and comes in a carry case.

7 AR Glasses for Gaming in 2024

8 Best AR Glasses You Must Have in 2024

Top 10 Gadgets for Men 2024 on Amazon

Top 10 Affordable Gadgets for Women on Amazon

10 Best 2024 Video Games Every Gamer Will Love

Top AI Personal Assistants by Big Companies