Business

Digital Marketing Statistics: Surprising Facts You Need To Know

Published

4 years agoon

Nowadays, digital marketing statistics soar high as our digital trend continues to evolve. As a result, 2021’s digital marketing landscape has become more competitive than ever. Marketers are eager to stay ahead of the game as they take advantage of the search engine optimization and social marketing perks. However, the majority pays attention to prioritize personalized and a more integrated customer experience. This approach can be complex as consumers express concerns about data privacy.

Below is a compilation of digital marketing statistics to help you execute your strategies for 2021.

Digital Marketing Statistics: A Competitive Industry

As digital marketing rises, digital advertising spendings also soar high. This 2021, the overall digital ad spending worldwide will reach more than $389 billion. According to eMarketer:

- As we enter 2021, our worldwide digital ad spending will experience 2.4% growth.

- Experts foresee that our global digital ad spending will bounce back with at least 17% growth throughout the year.

Due to the ongoing competition between brands, we all know the increase in demand for digital ads will be reflected in its price. Currently, the average CPA or cost per action is worth $49 for every paid search. Meanwhile, the average cost for every display ad is now worth $75.

As for social media ads, the US reached more than $43 billion worth spending last 2020. It shows a 20% increase compared to 2019. Going back, the sudden increase in ad spending is due to the effect of COVID-19 on our eCommerce. Indeed, all of us experience first-hand how businesses scramble to enter the online market.

As a result, it completely changed the eCommerce industry, closely affecting digital marketing and ad spendings. As businesses managed to establish their footing rapidly, the eCommerce industry continues to evolve. According to the ROI Revolution, it is expected to surpass all our expectations until 2025 and is expected to bring in more than $843 billion worth of sales this year.

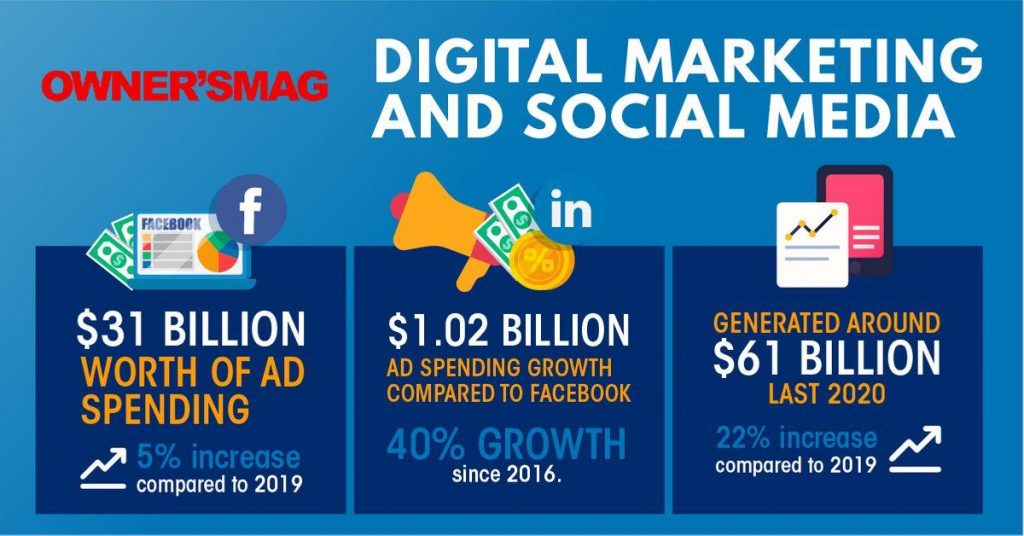

Digital Marketing and Social Media

According to Business Insider, US Facebook ads exceeded more than $31 billion worth of ad spending. It represents at least a 5% increase compared to 2019.

According to eMarketer, the ad spending in LinkedIn reached more than $1.02 billion. Compared to Facebook’s ad spending growth, LinkedIn experienced a 40% growth since 2016. It shows that LinkedIn proves to be one of the growing advertising channels for professionals worldwide, especially for B2B marketers.

Mobile Ads

- In general, mobile display ads generated around $61 billion last 2020. It showcased at least a 22% increase compared to 2019 (eMarketer).

- According to Statista, mobile ad spending worldwide will reach more than $247 billion by 2022.

Digital Marketing Strategies

According to Dialogtech, marketers are using ineffective marketing strategies. Here are a few digital marketing statistics that show marketer’s ineffective approach.

- As per HubSpot’s statistics, only 61% of marketers are convinced to have an effective marketing strategy. On the other hand, even though most marketers doubt their approach, they still invest large amounts for digital ad spendings.

- Proving the ROI is the number one concern for at least 40% of marketers (HubSpot).

- According to Forrester, 58% of marketers find targeting and segmenting their audience as challenging. It shows their frustration to acquire first-party resources. Due to this, marketers fail to deliver a personalized approach for consumer experiences.

- Meanwhile, 57% of marketers admit that it’s challenging to optimize marketing decisions. Also, marketers feel that they lack the data they need to guide customers through the marketing funnel.

It’s evident that marketers still struggle to cope and analyze the data concerning their consumers. The number one reason appears to be the lack of quality data, which results in a barrier in lead generation. At least 42% of B2B marketing professionals admit to their struggles to generate quality data (BrightTALK).

Omnichannel Marketing Strategy

According to Dialogtech, omnichannel personalization drives better marketing results. Omnichannel is defined as a multi-channel type of sales approach. It provides an integrated and more personal experience for customers.

This type of approach is immersive and prioritizes the customer at its core instead of your brand’s product. It aims to deliver a seamless experience for the consumer as they shop online through different mediums. According to ClickZ, here are the benefits of utilizing an omnichannel approach:

- It generates at least an 18.96% engagement rate. Meanwhile, a single-channel strategy only generates a 5.4% engagement rate.

- It produces more than a 250% rate of purchase compared to single-channel campaigns.

- The customer retention rate is 90% higher when using an omnichannel approach.

- According to 80% of consumers, they will engage with a business if it offers a personalized experience.

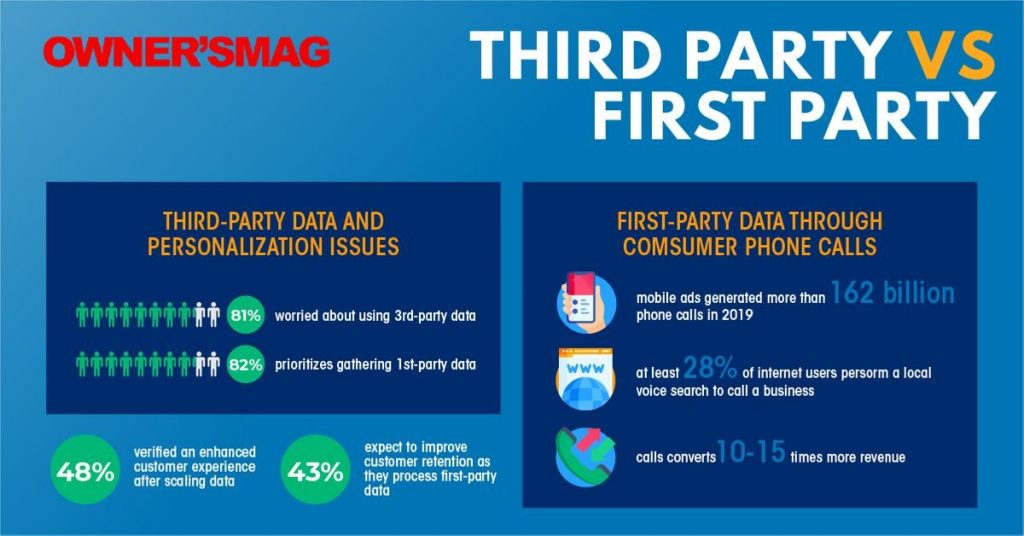

Third-Party Data and Personalization Issues

- According to eMarketer, 81% of marketers are worried about using third-party data as it raises their consumer’s privacy concerns.

- As per Signal’s statistics, 82% of marketers prioritizes gathering first-party data. It means that marketers are changing their strategies as they tap into internal data.

First-Party Data Through Consumer Phone Calls

As a solution to third-party data and privacy concerns, marketers opt to leverage first-party data through consumer phone calls.

- According to BIA/Kelsey, mobile ads generated more than 162 billion phone calls in 2019.

- After running Google search inquiries, consumers mostly call brands to inquire about their services (LSA).

- At least 28% of internet users perform a local voice search to call a business. (BrightLocal).

- Compared to web leads, calls convert ten to fifteen times more revenue (BIA/Kelsey).

- According to Forrest, 30% of calls convert more than web leads.

Although business calls are deemed unimportant because of our digital age, it is a valuable tool for conversion. However, most successful conversion happens as long as consumers are the ones who approach a brand for inquiries.

Conversation Intelligence Data and Revenue

As a strategy to generate first-party data, businesses tap into conversations they receive from consumers. By doing this, it helps marketers to deliver a more personalized experience to their clients. Furthermore, it’s a proven strategy to drive more revenue. Here are some insights from Forrester:

- At least 48% of marketers verified an enhanced customer experience after scaling data from their enterprise conversation.

- 43% of marketers expect to improve customer retention as they process first-party data from consumers.

This type of approach shows that it’s essential to pay attention to your consumers and use your internal data. By doing this, you’ll gain valuable insights that will help you mold your digital marketing strategies.

Conclusion

As we go over the digital marketing statistics and trends, it only proves its evident popularity. The demand for digital ads is higher than ever as marketers try to keep up with the evolving trends. We know for sure that the number one priority is to give consumers a more personal and immersive approach. We’re at the digital age point where all our search queries, link clicks, and emails are closely tracked. It’s no wonder there’s a growing concern about data privacy.

In the end, COVID-19 left a lasting impact on our eCommerce industry. It completely rules over the rapid change in our digital marketing, content strategy, and digital ad spendings. The effect is expected to completely mold our digital trends into a more personal approach as the competition between brands grows more competitive.

You may like

Business

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Published

1 week agoon

July 4, 2025

What was once old is new again: mid century modern is back in style. From architecture to furniture, the postwar look is in, and the hype extends all the way to office chairs.

Do you need a mid century modern office chair in your life? If so, there’s plenty to choose from. Your office chair should be tailored to your style, whether you like luxury, utility, or something in between.

That’s why we’ve put together our 10 favorite places to find your ideal mid century modern office chair.

What is mid century modern design?

After World War II, spirits were high in the US, and new technology was taking the country by storm. Mid century modern refers to the design concepts that came about during this time.

As opposed to the frilly, ornate designs of classical furnishings, mid century modern designs are angular, material, and functional. Wood is a common design element, especially teak. Mid century modern furniture may also have materials like glass, vinyl, and metal. Designs are simple and geometric, with bold accent colors to make them pop.

The mid century modern aesthetic never really went away, but it’s made a noted comeback in recent years. Some have chalked it up to Boomer and Gen X nostalgia, others point to mid-century-set shows like Mad Men and The Marvelous Mrs. Maisel.

Why should I buy a mid century modern office chair?

Mid century modern is the perfect fusion of style and utility. If you want to cultivate an office space that commands respect without being ostentatious, mid century modern is the style for you.

When it comes to office chairs, an MCM one is often made with sturdy wood and vinyl. They combine the ergonomics of a modern office chair with old-fashioned grace.

If you’re concerned with utility and utility only, a more bog-standard office chair may suit you. But a mid century modern office chair is great for someone who wants to wow colleagues with a mature, thoughtful business space.

Where can I get a mid century modern office chair?

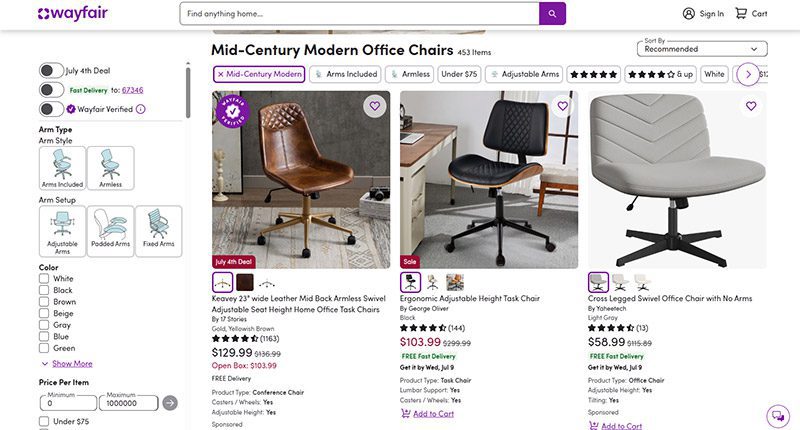

1) Wayfair

When it comes to furniture, Wayfair offers the best of both worlds. Their goods, including their mid century modern office chairs, are stylish and affordable. You can get a sturdy task chair for less than $100 or a more distinguished seat for less than $350.

MCM office chair examples: Dovray ($126), Bradford ($139), Lithonia ($133)

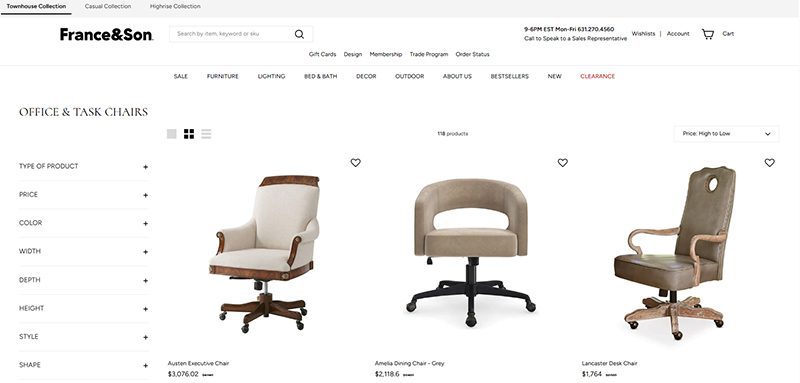

2) France & Son

Wayfair’s chairs are affordable, but France & Son is the perfect option for luxury shoppers. Their mid century modern office chairs are robust and sleekly designed. If you dress to impress and enjoy the finer things in life, these are the chairs for you.

MCM office chair example: Brooks ($695)

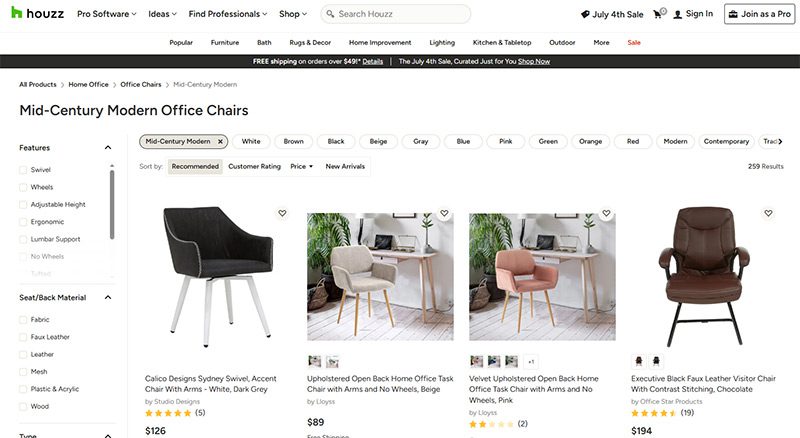

3) Houzz

Started as a community for people to share home decor tips, Houzz has become a great ecommerce platform for finding stylish furniture. They’re more known for home decor than desk chairs, but they have plenty of great, affordable finds if you know where to look.

MCM office chair examples: Arvilla ($173), Rathburn ($259)

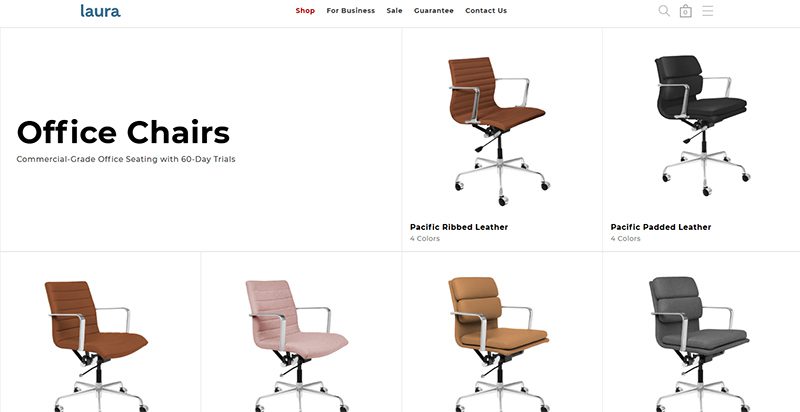

4) Laura Davidson

The Laura Davidson collection offers a fairly limited selection of classic office furniture. Still, there’s a reason they’re trusted by big-wigs like Apple, Disney, and Salesforce. Their chairs are sturdy and beautifully designed, reimagining classic Eames and Knoll designs.

MCM office chair examples: Rockefeller ($275), SOHO II Soft Pad ($450)

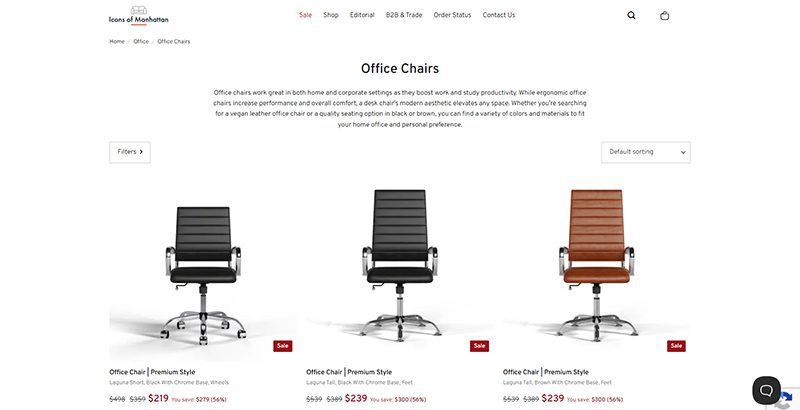

5) Icons of Manhattan

Icons of Manhattan has a simple philosophy: do one thing, and do it right. Their office chairs are handcrafted from premium materials and tailored to a mid-century modern style. If you want that Mad Men energy in your office (hopefully with a lot less angst), these are the chairs for you.

MCM office chair example: Ribbed Medium ($219)

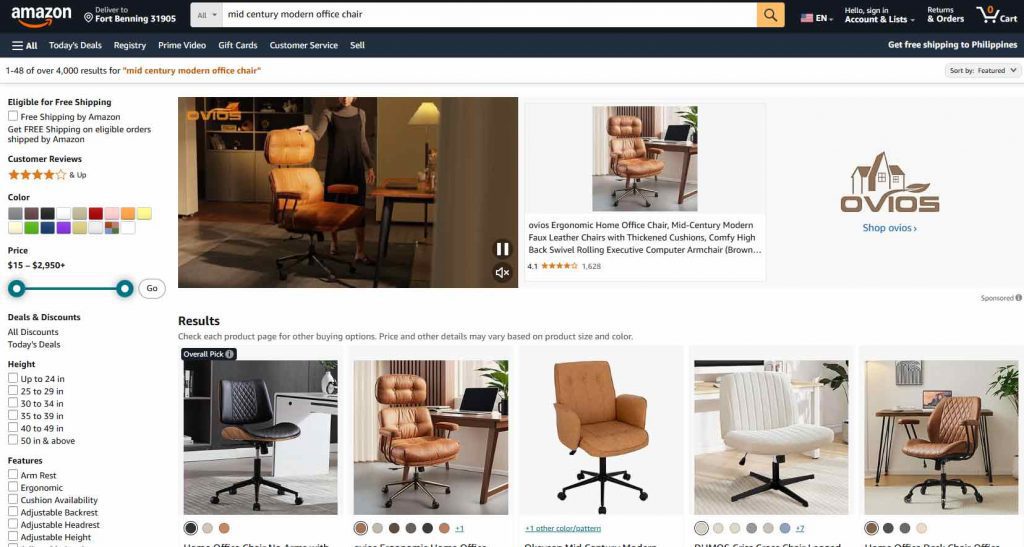

6) Amazon

Yes, the internet’s premier shopping destination has a robust collection of mid century modern office chairs. Like with most products, their selection of seats is vast and can be hit or miss. Still, they’ve got stunning chairs available for any style, whether you care about comfort, class, or ergonomics.

MCM office chair examples: IDS Home Modern ($219), Art Leon MCM Swivel ($139)

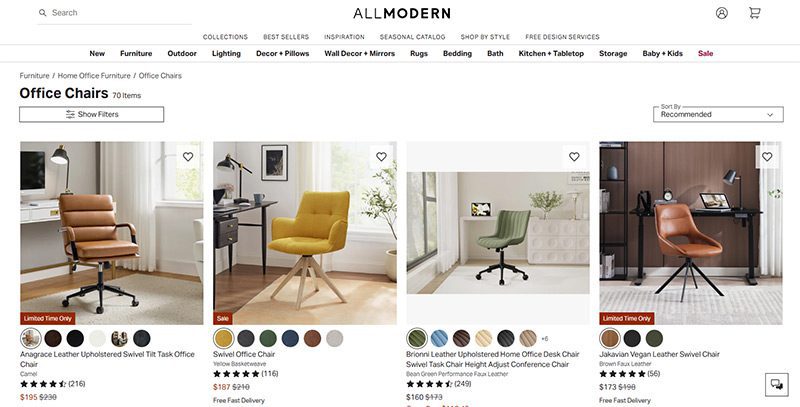

7) AllModern

AllModern’s collection of desk chairs and other furniture truly embodies the mid century modern spirit. Their work is tight, angular, and functional above all. They’re part of the Wayfair family and they traffic in a number of modern styles, but their sleek chairs are perfect for any mid century modern space.

MCM office chair examples: Frederick ($229), Kealey ($349)

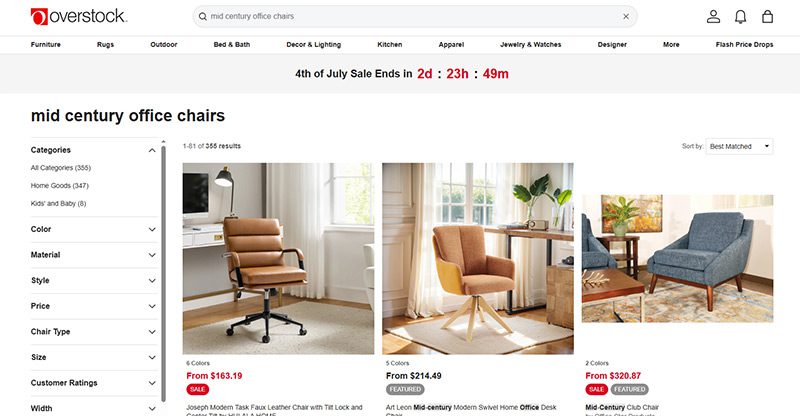

8) Overstock

Overstock is known as a one-stop shop for quality home goods at sub-wholesale prices. If you want a spiffy mid century modern office chair that won’t break the bank, they’re the first place to look. While they’re somewhat less reliable than the more upscale platforms on this list, their selection is massive.

MCM office chair example: Joseph Modern ($163)

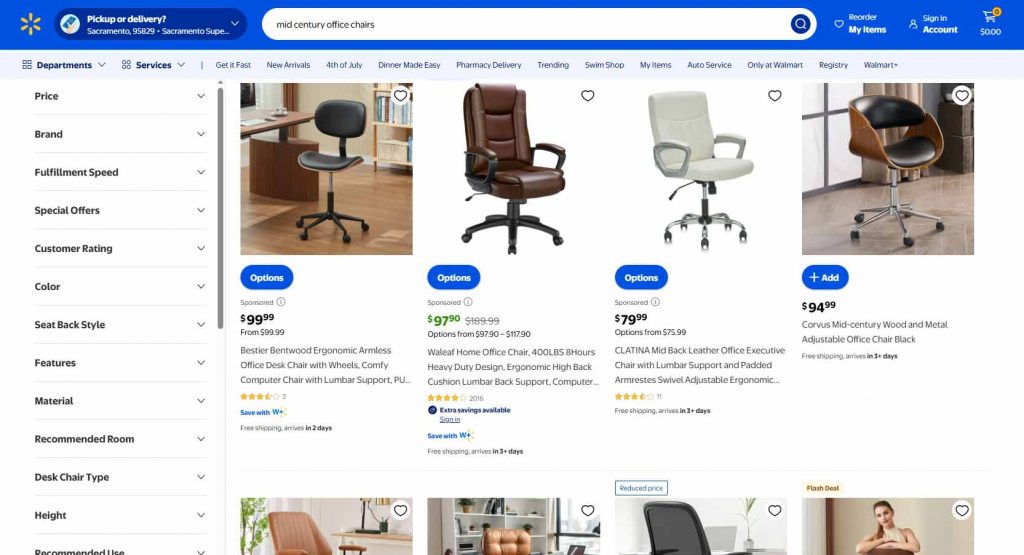

9) Walmart

Hayneedle’s selection of mid-century modern office chairs falls somewhere between the minimal Laura Davidson and the endless Amazon catalog. Their array of mid-century designs is affordable and versatile, with chairs that match almost any style. While they may be part of the Walmart family, these chairs are anything but second-rate.

MCM office chair example: Waleaf ($97)

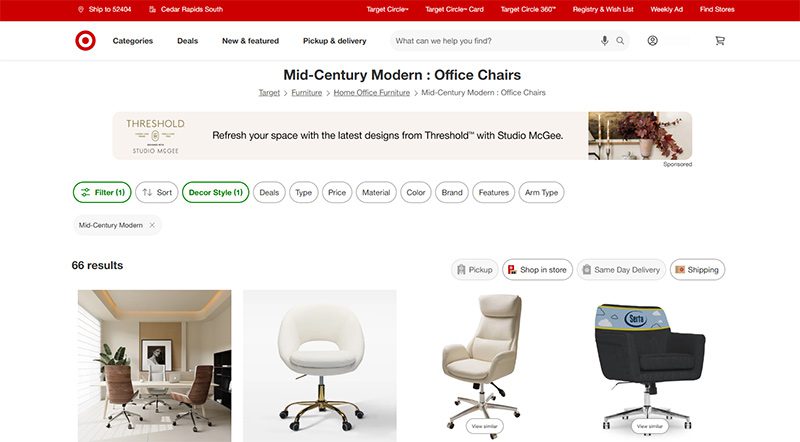

10) Target

Why splurge when you can save? As usual, Target is a hidden gem, offering a sturdy selection of mid century modern office chairs for some of the cheapest prices out there. Many of the chairs they offer are from the same designers as these other stores—Christopher Knight, LumiSource, Armen Living, etc.—at reduced prices.

MCM office chair example: Lombardi ($136)

A quality payroll service is one of the most invaluable tools any entrepreneur can have. Whether you’re a small business owner or an HR manager, paying your employees on time is crucial. This makes choosing a service even more weighty, after all, it is a heavy administrative burden. The good thing is, you can outsource this duty to an online payroll processor.

According to statistics, 49% of workers begin a new job search after just two paycheck errors, and with 65% of workers living paycheck to paycheck, it’s more important than ever to ensure an efficient, effective payroll process.

These services can save you precious time and mitigate potential issues. To make it easy for you to choose, we listed the best online payroll services for 2025.

Top 5 Online Payroll Services

Gusto

Gusto is a great option for both new and experienced payroll administrators, boasting an incredibly clean user interface and a first-rate payroll setup. Gusto lets you manage your employee’s time off (vacation and sick pay), company health insurance, and worker’s comp. Gusto offers excellent mobile access, too. This allows employees to manage aspects of their Gusto profiles, view payday insights, and access Gusto Wallet financial tools.

Gusto offers four tiers of membership, the most affordable of which is the Contractor’s Only plan, which offers unlimited U.S.-based and global contractor payments, supporting more than 100 countries, plus 1099 creation and filing at a rate of $6 per person per month with no base price.

The other three are Simple, Plus, and Premium. Here’s a deeper look into each plan:

Simple

Price:

$40/mo + $6/mo per person

Plan details:

- Full-service single-state payroll including W-2s and 1099s

- Employee profiles and self-service

- Basic hiring and onboarding tools

- Gusto-brokered health insurance administration

- Employee financial benefits

- Payroll and time-off reports

- Custom admin permissions

- Integrations for accounting, time tracking, expense management, and more

Plus

Price:

$80/mo + $12/mo per person

Plan details:

(All Simple plan features +)

- Full-service multi-state payroll including W-2s and 1099s

- Next-day direct deposit

- Advanced hiring and onboarding tools

- PTO management and policies

- Time tracking and project tracking

- Workforce costing and custom reports

- Team management tools

- Full support

Premium

Price:

Bespoke pricing, reach out for a personalized quote

Plan details:

(All Plus plan features +)

- HR Resource Center

- Compliance alerts

- Access to certified HR experts

- Full-service payroll migration and account setup

- Health insurance broker integration

- R&D tax credit discount

- Waived fees and exclusive pricing

- Performance reviews

- Employee surveys and insights

- Dedicated support

QuickBooks Online Payroll

Founded in 1983, Intuit is a California-based financial software company. Since its inception, Intuit has developed into one of the best-known providers of accounting software. Their online payroll service, QuickBooks, includes the essential features you need to run payroll.

QuickBooks offers three tiers of membership. The least expensive membership covers basic accounting features, such as invoices. For more features, check out the Essentials and Plus memberships. Each plan’s features are as follows:

QuickBooks Simple Start (2025)

- Price: $38/month for 1 user

- Best for: Freelancers and small teams with basic payroll needs

Features:

- Automated bookkeeping

- 5 free ACH bank transfers/mo for bills

QuickBooks Essentials (2025)

- Price: $75/month for 3 users

- Best for: Small businesses needing deeper financial tracking

Features:

- Includes all Simple Start features, plus:

- Recurring invoices

QuickBooks Plus (2025)

- Price: $115/month for 5 users

- Best for: Growing businesses with HR and compliance needs

Features:

- Includes all Essentials features, plus:

- AI-powered profit & loss insights

- Anomaly detection and resolution

- Budgeting

QuickBooks Advanced (2025)

- Price: $275/month for 25 users

- Best for: Established businesses with HR and compliance needs

Features:

- Includes all Plus features, plus:

- Custom user management and permissions

- Custom report builder

- Data sync with Excel

- Revenue recognition

- Forecasting

OnPay

OnPay is a cloud-based full-service payroll processing system capable of running payroll according to a preset schedule, automatically disbursing wages, and calculating and withholding taxes.

OnPay can sync up with several other software your team is already using, making it easy to integrate the service into your team’s system. Another benefit of OnPays model is the simple, transparent pricing structure. No tiers; just one base rate.

Pricing:

$49/mo + $6/mo per employee

SurePayroll

SurePayroll’s award-winning service supports W-2 employees and 1099 contractors. Additionally, it handles 401(k) deductions and manages flexible spending accounts (FSA) and health savings accounts (HSA).

SurePayroll also offers a mobile app— available on both Apple and Android devices.

SurePayroll offers live support through its United States-based support team through chat, email, or phone.

Small Business Payroll

- Price: No Tax Filing: $20/month + $4 per employee, Full Service: $29/month + $7 per employee

- Best for: Small businesses and startups

Features:

- We file and deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports and pay stubs are available online 24/7

- Supports W-2 employees and 1099 contractors

Nanny & Household Payroll

- Price: Full-Service Household, $39/month, includes 1 employee, $10 per additional employee

Best for: Homeowners

Features:

- Signature-ready Schedule H

- We file & deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports & paystubs available online 24/7

- Supports W-2 employees & 1099 contractors

Be sure to choose a payroll service that works for your business, and provides you with the peace of mind that comes with a reliable bookkeeping system. Your employees will thank you.

Merck is currently in talks to acquire Seagen, a biotech company. The Wall Street Journal reports that the transaction is valued at $40 billion. And what happens if Merck acquires Seagen, and how would this acquisition benefit cancer research and treatment? Read more about the Merck Seagen buyout here.

Merck Seagen Buyout

Merck and Seagen are still deciding on their share prices. So far, talks have yet to reach an agreement on $200 per share. Both companies want to settle and finalize their deals before Merck announces its quarterly earnings on July 28. At the time of writing, Seagen’s stock was at $176.19.

With an estimated market value of $235 billion, Merck is looking to expand its presence in the cancer treatment space. The Merck Seagen Buyout could play a major role in that strategy. Since Seagen specializes in targeted cancer therapies, the acquisition would give Merck access to a broader range of oncology products.

Shareholder reactions to the new deal are overwhelmingly positive, and the stocks have been up since talks about the deal have been made public.

But this is not the first time that Merck and Seagen have made the news. Back in 2020, they collaborated because of cancer treatments. Seagen has a drug conjugate (ladiratuzumab vedotin) which would be used in conjunction with Merck’s Keytruda.

Merck reveals that Keytruda is its highest-selling product. It’s immunotherapy for cancer.

And this deal could help Merck offset the possibility of reduced sales because it will lose patent protection in 2028.

As promising as this deal is, there could be scrutiny from antitrust officials since there might be a litigation case from the Federal Trade Commission or Justice Department.

The Seagen buyout isn’t the only deal Merck has made recently. They’ve been busy closing another deal, but with Orion too.

Seagen

As a cancer biotech company, Seagen has therapies to ensure that patients benefit from the treatment and reduce any adverse side effects. Their treatments involve the therapy attacking tumors with toxins.

Merck partnering with Seagen isn’t a bad idea considering that Seagen made $1.4 billion in sales in 2021, most of it coming from Adcetris and Padcev (a treatment for urothelial cancers).

Merck-Orion Deal

In the middle of the Merck Seagen Buyout, Merck has recently partnered with Orion for the ODM-208 and other drugs. These drugs are related to the production of steroids. Orion found how it can combat hormone-dependent cancers and further developed this inhibitor.

Their deal includes that they should develop ODM-208 and promote it to the public together. And Orion will receive a $290 million payment from Merck.

Although they’re co-developing and marketing the new inhibitor, Orion will oversee the manufacturing side.

Co-developing the ODM-208 can help Merck with its current research and treatments for prostate cancer. President and CEO of Orion, Timo Lappalainen, says that this partnership will benefit Merck’s goals of treating cancer worldwide.

Other Ventures: Merck’s Role in the Pandemic

You may have heard about COVID-19 pills, which are a form of treatment for those diagnosed with mild to moderate COVID-19. Merck introduced an antiviral COVID-19 pill to the public. The name: Molnupiravir.

The COVID-19 pill is not a replacement for a vaccination. Instead, it stops the replication of the COVID-19 genetic code and keeps the patient out of the hospital. Not yet FDA-approved, Molnupiravir has been authorized for emergency use since December 23, 2021.

And for other stories, read more here at Owner’s Mag!

What Is Tiktok Pink Sauce? The Viral Condiment, Explained

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Gift Guide: 25 Best Gifts for Women for All Occasions

History of the NBA: The Success Behind the Big League

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Top 12 Uses for The Metaverse That Will Change Your Life

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Top 10 Best Places to Buy a Mid Century Modern Office Chair

History of the NBA: The Success Behind the Big League

8 Best Equipment for YouTube Every Content Creator Needs

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Top 10 Small Business Organization Tools for 2025

Top 12 Uses for The Metaverse That Will Change Your Life

Trending

- Entertainment1 day ago

History of the NBA: The Success Behind the Big League

- Reviews2 days ago

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

- Lifestyle17 hours ago

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

- Lifestyle1 day ago

Gift Guide: 25 Best Gifts for Women for All Occasions

- Top Stories17 hours ago

What Is Tiktok Pink Sauce? The Viral Condiment, Explained