Business

How This Successful Entrepreneur Spent his 35th Birthday

Published

6 years agoon

Over the weekend I was going through my Twitter feed. Rather than seeing a ton of political “artistry” and random gifs, I stumbled across this incredible set of non-obvious business strategies (or better known as tweets) that maybe some of the largest pieces of gold someone can read when they want to start a business.

Twitter has received its fair share of opinions within the past year, but it’s safe to say that if used correctly; it’s the most powerful social network on the planet.

Scott Gerber, a New York-based entrepreneur, best selling author, father, and straight-up badass, celebrated his birthday in an unconventional way. The “Super Connector” took to Twitter to grace us with 35 “non-obvious business strategies and lessons” that he has learned over the past decade in business. Below are his tweets directly quoted from his Twitter feed. If you care to follow Scott, you can do so at @scottgerber.

Lessons From Scott Gerber

1. Beware of “boss metrics”

Macro trends are great IF they are based on the right micro trends. Macro trends can easily be manipulated to show a rosy picture while making major micro issues seem smaller or irrelevant. Ensure your KPIs align with your true performance.

2. Optionality is your lifeblood

Your job is to maximize optionality every day in everything you do. There should never only be one path. In fact, try never to only have two potential paths. Always have a variety of obvious and non-obvious traditional and non-traditional options.

3. Bad Decisions

Bad decisions are due to failures to ask the right people the right questions. Don’t be “surface level”. Ask follow up questions. Don’t mistakenly believe what you want to hear. Instead, probe deeper on what you actually hear.

4. Two rules

Two rules if your goal is to one day sell your business. 1) Be a revenue multiple companies. 2) If you aren’t a revenue multiple companies, see rule #1.

5. Anecdotal evidence

Never allow your team to use “anecdotal evidence”. First, anecdotes are not evidence of anything nor are they based in facts, science or statistical relevance. It’s simply opinions on top of gut feelings and emotions. Poor decisions come from this sort of “evidence”.

6. Train with fake fires.

Train with fake fires. Your company needs a good fire drill once in a while. What happens if you don’t raise money? What happens if your biggest client fires you? Get smart people in the room. Figure out how you would disrupt your own business and solve the issue.

7. Never give a “definitive yes”…

Never give a “definitive yes” to a contractual term without reviewing it in its proper context. A one-line term can easily become 100 lines or be defined by 100 terms that you never agreed to. It can also mess up other terms if everything is not contemplated as a whole

8. Don’t just listen

Don’t just listen to what’s being said–listen to what is not being said. More importantly, listen to what’s not being said on purpose. People that try to sell you something are often experts in the art of mindful editing.

9. Automating

Automating humans out of a process still takes lots of humans. Don’t be fooled by the concept of “automating a system”. It often takes more man-hours, money, time and technologies than the task itself is worth. Look at the full picture before you invest time or treasure.

10. Follow the bonus.

Follow the bonus. If you help others hit their financial goals, they are more likely to become an ambassador of your BD efforts with their colleagues. Building a partnership with someone who is top-line revenue based versus quota-based is different. Align incentives.

11. Never partner with adulterers or known cheaters.

11. Never partner with adulterers or known cheaters. If they are willing to screw over their spouse, they will have no problem screwing you tenfold if it suits their needs.

12. Sell with a “2-for-1” mentality.

Sell with a “2-for-1” mentality. Many companies get one big client name and are happy with that. BUT they forget the big client has dozens of divisions. One client could actually become 2 or 3 clients once you open the right doors. Don’t stop after the hardest one!

13. The 3rd party

Don’t let a 3rd party control your destiny, cash flow or your decisions. Whether you need an investment, a platform or a vendor, if a 3rd party becomes a vital piece of your plan you are taking a bet. Calculated bets can be smart, but don’t kid yourself. You’re making a bet.

14. Don’t be a conventional scheduler.

Don’t be a conventional scheduler. We’ve been taught to think in blocks of time (ie 30 minutes). Why have a 12-minute meeting, then burn 18? Think in smaller chunks like 2 or 5 minutes. When you adapt to this, you’re capacity and efficiency will dramatically increase.

15. The Final Offer

Know the final offer you’d take before the first offer. Before you do any deal, know your absolute last stand deal–the absolute worst terms you are willing to accept. Having that thought out beforehand will stop you from making bad deals that aren’t in your best interests.

16. About Acceptance

Don’t ram your model into new industries and assume the other side will understand it (or accept it). Engineer your model to adapt to the lingo, structures, and terms of the industry. Make the numbers work using the financial standards of that industry.

17. Always be the first salesperson.

Always be the first salesperson. If you don’t know how to sell your product, no one will! Even if you aren’t a professionally trained salesperson—or the tech guy!!—you need to learn to articulate your value proposition and see what people really need.

18. About Department Heads

Have your department heads always do every task in their department before they are allowed to assign it to anyone else. This will ensure that they know what success and failure look like beforehand.

19. About Sales Meetings

In sales meetings, always ask more questions than you answer. Answer questions with follow up questions until you have the most amount of detail possible before you fully answer. Most prospects will TELL YOU what they need and how they want it. You just need to ask and listen

20. Know your team’s real capacity.

Know your team’s real capacity. Break down your staff’s tasks into units and total task costs. You would be shocked to see how “busyness” and real-time communication gives the false impression of full capacity.

21. “Layer”

“Layer” your business over time, not all at once. Layering new revenue centers is certainly smart, just don’t try to do it all today.

22. Buying into passion and enthusiasm can be a disaster.

Buying into passion and enthusiasm can be a disaster. Don’t get caught up in hype and sexiness (or a good salesperson’s spin!). Never make instant yes decisions no matter how good you feel. Even if they feel right, you should still do your diligence.

23. Train your brain

Train your brain to think about what is wrong, not right. What could go badly, not well? And why something won’t work, not will. Your love for your idea, your process or your product can be your worst enemies.

24. Invest in the right systems BEFORE you scale.

Invest in the right systems BEFORE you scale. Failing to create the processes and systems needed when things are manageable will become incredibly costly longer-term—and more time consuming and tedious.

25. Rules of the DM

Expect that anything you send via email or send via DM to anyone about anything will get out there and will be made public at some point. It will. Don’t be an idiot.

26. Surprise Yourself

No matter how “conservative” you believe your internal projections or goals are—LOWER THEM AGAIN. Surprise yourself, don’t be surprised.

27. Sell your way out of financial trouble

Sell your way out of financial trouble. The idea of “raising money” or “raising debt” is not a good mindset to be in if you find your company in a cash crunched position. You might end up getting financing, but relying on it is a fool’s errand. Sell! Sell! Sell!

28. Are your customers asking the same question twice?

If customers ask you the same question twice, you’ve failed them. When customers ask a new question, write it down, formalize an answer, and find ways to promote that answer (eg FAQs, call center scripts, website, etc.) so that another customer will never need to ask again.

29. Never blindly listen

Never blindly listen to someone who doesn’t have to live with the consequences of the decision. Advisors are great but you must make final decisions. Getting an “I’m sorry it didn’t work out” from an advisor without any downside won’t won’t make you feel better in the end.

30. Unlock your entrepreneurial mind.

Unlock your entrepreneurial mind With everything that happens around you, go beyond the surface and ask “why”, “how”, “is it the best”, “what’s better”, and “how would I do it.” Feed on curiosity and your ability to ask great questions will be sharp when you need it.

31. User adoption isn’t simple or guaranteed.

User adoption isn’t simple or guaranteed. Changing user behavior is not easy. Remember: everyone is busy (life, family, work) and you want to add yet another thing. Remove as much friction as you can. Save as much time as you can.

32. Shut up after yes

Once you’ve got a ‘yes’ shut up and stop trying to further sell. You can’t go further than a win, so shut up. I’ve met more than my fair share of people that lost deals because they kept selling past the ‘yes’.

33. Everyone always has an angle.

Everyone always has an angle. Know the angle before you react to the situation. Don’t end up a pawn on someone else’s chessboard.

34. Community is crucial.

Community is crucial. The power of association and coalition is more powerful than being a lone wolf. Build one. Be a big part of many. Give more than you take (and don’t be a taker or a sleepy networker!).

35. A Quote to End Them All

Live by this quote from one of my mentors and you’ll be better for it: “You can’t cheat real-time. And real relationships take real-time.” With my addition: “But your job is to find ways to cheat your time to create more real-time.”

Here’s to liven out that last quote. Thanks for the free advice Scott and Happy Birthday.

You may like

Business

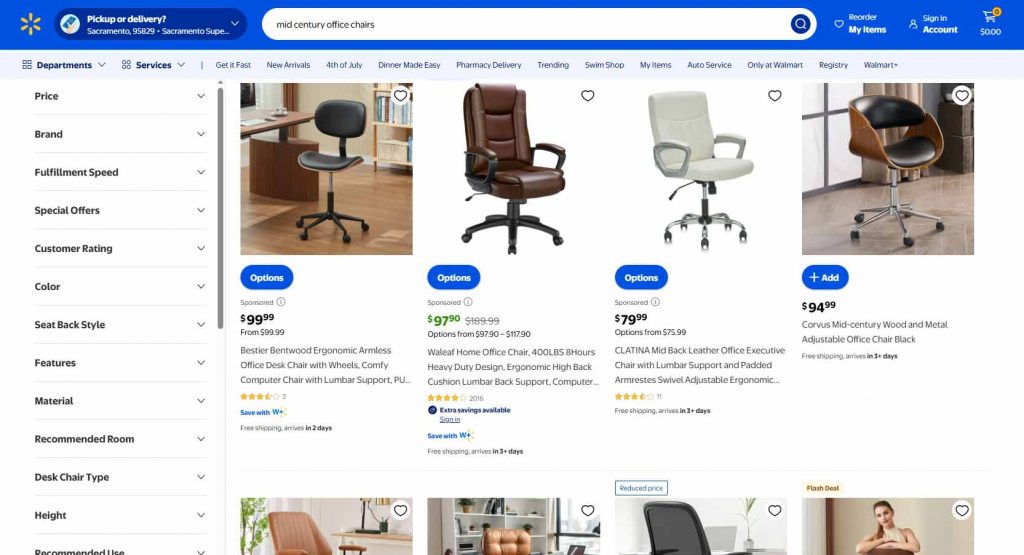

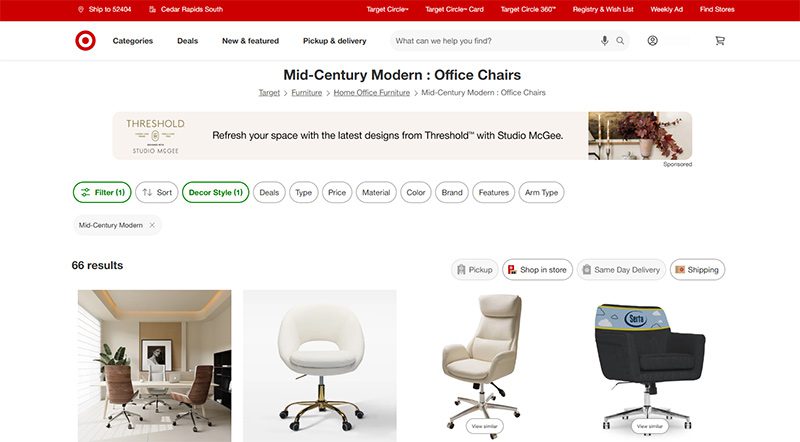

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Published

2 weeks agoon

July 4, 2025

What was once old is new again: mid century modern is back in style. From architecture to furniture, the postwar look is in, and the hype extends all the way to office chairs.

Do you need a mid century modern office chair in your life? If so, there’s plenty to choose from. Your office chair should be tailored to your style, whether you like luxury, utility, or something in between.

That’s why we’ve put together our 10 favorite places to find your ideal mid century modern office chair.

What is mid century modern design?

After World War II, spirits were high in the US, and new technology was taking the country by storm. Mid century modern refers to the design concepts that came about during this time.

As opposed to the frilly, ornate designs of classical furnishings, mid century modern designs are angular, material, and functional. Wood is a common design element, especially teak. Mid century modern furniture may also have materials like glass, vinyl, and metal. Designs are simple and geometric, with bold accent colors to make them pop.

The mid century modern aesthetic never really went away, but it’s made a noted comeback in recent years. Some have chalked it up to Boomer and Gen X nostalgia, others point to mid-century-set shows like Mad Men and The Marvelous Mrs. Maisel.

Why should I buy a mid century modern office chair?

Mid century modern is the perfect fusion of style and utility. If you want to cultivate an office space that commands respect without being ostentatious, mid century modern is the style for you.

When it comes to office chairs, an MCM one is often made with sturdy wood and vinyl. They combine the ergonomics of a modern office chair with old-fashioned grace.

If you’re concerned with utility and utility only, a more bog-standard office chair may suit you. But a mid century modern office chair is great for someone who wants to wow colleagues with a mature, thoughtful business space.

Where can I get a mid century modern office chair?

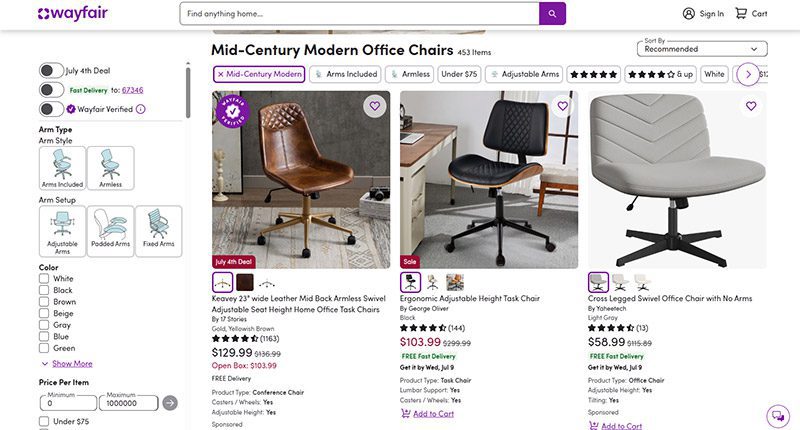

1) Wayfair

When it comes to furniture, Wayfair offers the best of both worlds. Their goods, including their mid century modern office chairs, are stylish and affordable. You can get a sturdy task chair for less than $100 or a more distinguished seat for less than $350.

MCM office chair examples: Dovray ($126), Bradford ($139), Lithonia ($133)

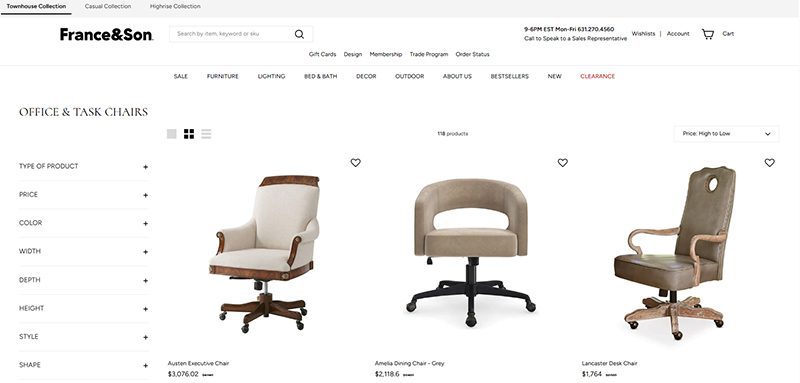

2) France & Son

Wayfair’s chairs are affordable, but France & Son is the perfect option for luxury shoppers. Their mid century modern office chairs are robust and sleekly designed. If you dress to impress and enjoy the finer things in life, these are the chairs for you.

MCM office chair example: Brooks ($695)

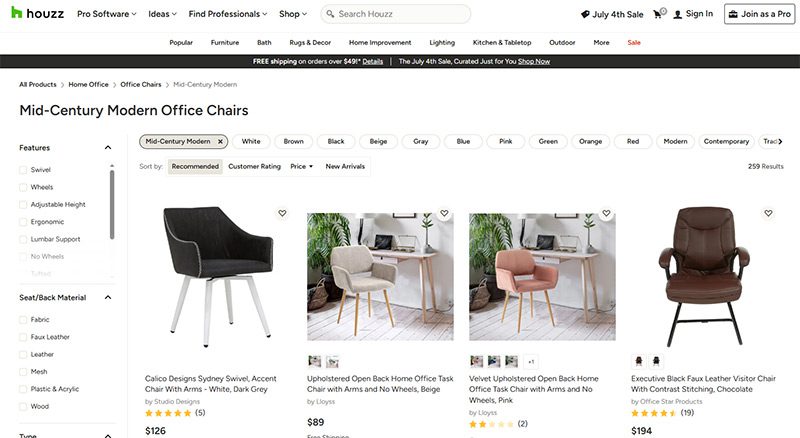

3) Houzz

Started as a community for people to share home decor tips, Houzz has become a great ecommerce platform for finding stylish furniture. They’re more known for home decor than desk chairs, but they have plenty of great, affordable finds if you know where to look.

MCM office chair examples: Arvilla ($173), Rathburn ($259)

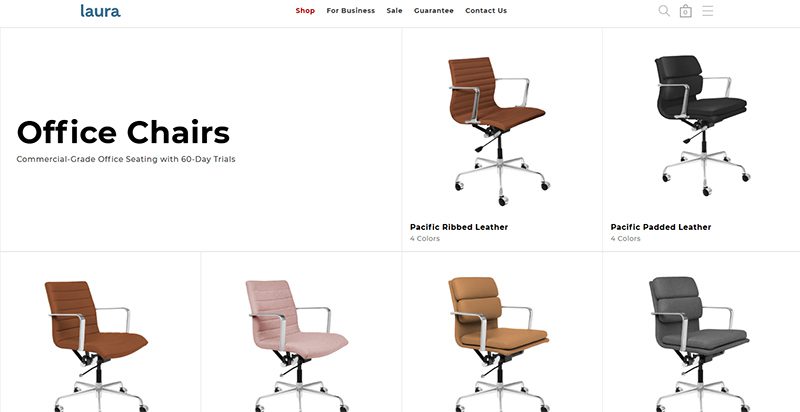

4) Laura Davidson

The Laura Davidson collection offers a fairly limited selection of classic office furniture. Still, there’s a reason they’re trusted by big-wigs like Apple, Disney, and Salesforce. Their chairs are sturdy and beautifully designed, reimagining classic Eames and Knoll designs.

MCM office chair examples: Rockefeller ($275), SOHO II Soft Pad ($450)

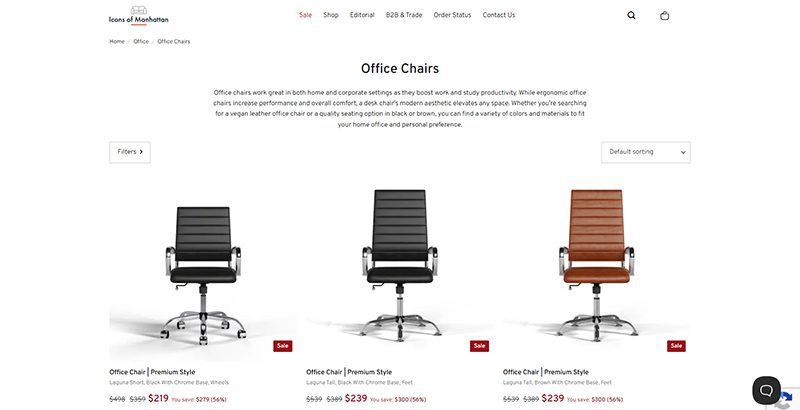

5) Icons of Manhattan

Icons of Manhattan has a simple philosophy: do one thing, and do it right. Their office chairs are handcrafted from premium materials and tailored to a mid-century modern style. If you want that Mad Men energy in your office (hopefully with a lot less angst), these are the chairs for you.

MCM office chair example: Ribbed Medium ($219)

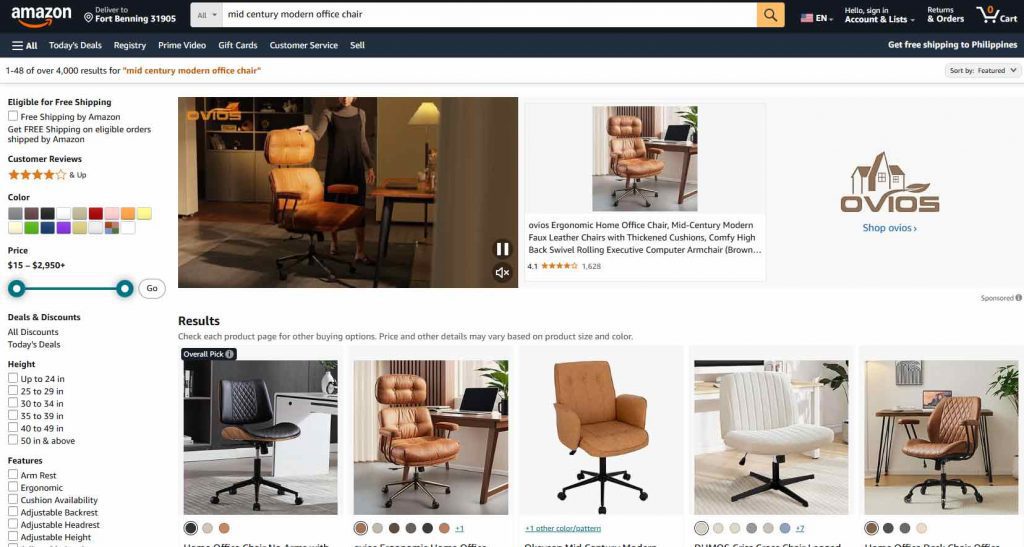

6) Amazon

Yes, the internet’s premier shopping destination has a robust collection of mid century modern office chairs. Like with most products, their selection of seats is vast and can be hit or miss. Still, they’ve got stunning chairs available for any style, whether you care about comfort, class, or ergonomics.

MCM office chair examples: IDS Home Modern ($219), Art Leon MCM Swivel ($139)

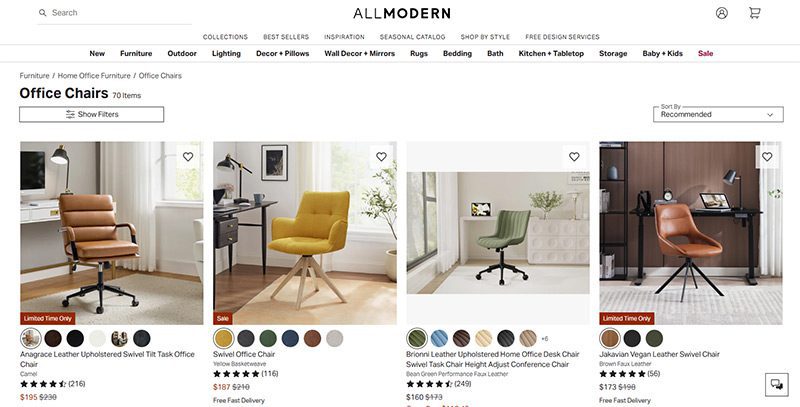

7) AllModern

AllModern’s collection of desk chairs and other furniture truly embodies the mid century modern spirit. Their work is tight, angular, and functional above all. They’re part of the Wayfair family and they traffic in a number of modern styles, but their sleek chairs are perfect for any mid century modern space.

MCM office chair examples: Frederick ($229), Kealey ($349)

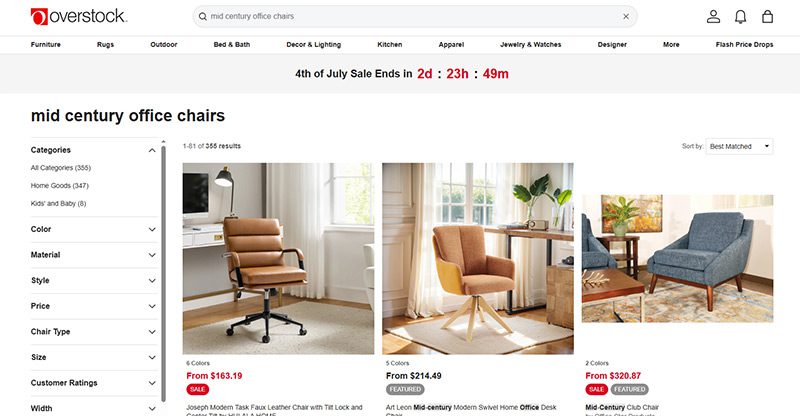

8) Overstock

Overstock is known as a one-stop shop for quality home goods at sub-wholesale prices. If you want a spiffy mid century modern office chair that won’t break the bank, they’re the first place to look. While they’re somewhat less reliable than the more upscale platforms on this list, their selection is massive.

MCM office chair example: Joseph Modern ($163)

9) Walmart

Hayneedle’s selection of mid-century modern office chairs falls somewhere between the minimal Laura Davidson and the endless Amazon catalog. Their array of mid-century designs is affordable and versatile, with chairs that match almost any style. While they may be part of the Walmart family, these chairs are anything but second-rate.

MCM office chair example: Waleaf ($97)

10) Target

Why splurge when you can save? As usual, Target is a hidden gem, offering a sturdy selection of mid century modern office chairs for some of the cheapest prices out there. Many of the chairs they offer are from the same designers as these other stores—Christopher Knight, LumiSource, Armen Living, etc.—at reduced prices.

MCM office chair example: Lombardi ($136)

A quality payroll service is one of the most invaluable tools any entrepreneur can have. Whether you’re a small business owner or an HR manager, paying your employees on time is crucial. This makes choosing a service even more weighty, after all, it is a heavy administrative burden. The good thing is, you can outsource this duty to an online payroll processor.

According to statistics, 49% of workers begin a new job search after just two paycheck errors, and with 65% of workers living paycheck to paycheck, it’s more important than ever to ensure an efficient, effective payroll process.

These services can save you precious time and mitigate potential issues. To make it easy for you to choose, we listed the best online payroll services for 2025.

Top 5 Online Payroll Services

Gusto

Gusto is a great option for both new and experienced payroll administrators, boasting an incredibly clean user interface and a first-rate payroll setup. Gusto lets you manage your employee’s time off (vacation and sick pay), company health insurance, and worker’s comp. Gusto offers excellent mobile access, too. This allows employees to manage aspects of their Gusto profiles, view payday insights, and access Gusto Wallet financial tools.

Gusto offers four tiers of membership, the most affordable of which is the Contractor’s Only plan, which offers unlimited U.S.-based and global contractor payments, supporting more than 100 countries, plus 1099 creation and filing at a rate of $6 per person per month with no base price.

The other three are Simple, Plus, and Premium. Here’s a deeper look into each plan:

Simple

Price:

$40/mo + $6/mo per person

Plan details:

- Full-service single-state payroll including W-2s and 1099s

- Employee profiles and self-service

- Basic hiring and onboarding tools

- Gusto-brokered health insurance administration

- Employee financial benefits

- Payroll and time-off reports

- Custom admin permissions

- Integrations for accounting, time tracking, expense management, and more

Plus

Price:

$80/mo + $12/mo per person

Plan details:

(All Simple plan features +)

- Full-service multi-state payroll including W-2s and 1099s

- Next-day direct deposit

- Advanced hiring and onboarding tools

- PTO management and policies

- Time tracking and project tracking

- Workforce costing and custom reports

- Team management tools

- Full support

Premium

Price:

Bespoke pricing, reach out for a personalized quote

Plan details:

(All Plus plan features +)

- HR Resource Center

- Compliance alerts

- Access to certified HR experts

- Full-service payroll migration and account setup

- Health insurance broker integration

- R&D tax credit discount

- Waived fees and exclusive pricing

- Performance reviews

- Employee surveys and insights

- Dedicated support

QuickBooks Online Payroll

Founded in 1983, Intuit is a California-based financial software company. Since its inception, Intuit has developed into one of the best-known providers of accounting software. Their online payroll service, QuickBooks, includes the essential features you need to run payroll.

QuickBooks offers three tiers of membership. The least expensive membership covers basic accounting features, such as invoices. For more features, check out the Essentials and Plus memberships. Each plan’s features are as follows:

QuickBooks Simple Start (2025)

- Price: $38/month for 1 user

- Best for: Freelancers and small teams with basic payroll needs

Features:

- Automated bookkeeping

- 5 free ACH bank transfers/mo for bills

QuickBooks Essentials (2025)

- Price: $75/month for 3 users

- Best for: Small businesses needing deeper financial tracking

Features:

- Includes all Simple Start features, plus:

- Recurring invoices

QuickBooks Plus (2025)

- Price: $115/month for 5 users

- Best for: Growing businesses with HR and compliance needs

Features:

- Includes all Essentials features, plus:

- AI-powered profit & loss insights

- Anomaly detection and resolution

- Budgeting

QuickBooks Advanced (2025)

- Price: $275/month for 25 users

- Best for: Established businesses with HR and compliance needs

Features:

- Includes all Plus features, plus:

- Custom user management and permissions

- Custom report builder

- Data sync with Excel

- Revenue recognition

- Forecasting

OnPay

OnPay is a cloud-based full-service payroll processing system capable of running payroll according to a preset schedule, automatically disbursing wages, and calculating and withholding taxes.

OnPay can sync up with several other software your team is already using, making it easy to integrate the service into your team’s system. Another benefit of OnPays model is the simple, transparent pricing structure. No tiers; just one base rate.

Pricing:

$49/mo + $6/mo per employee

SurePayroll

SurePayroll’s award-winning service supports W-2 employees and 1099 contractors. Additionally, it handles 401(k) deductions and manages flexible spending accounts (FSA) and health savings accounts (HSA).

SurePayroll also offers a mobile app— available on both Apple and Android devices.

SurePayroll offers live support through its United States-based support team through chat, email, or phone.

Small Business Payroll

- Price: No Tax Filing: $20/month + $4 per employee, Full Service: $29/month + $7 per employee

- Best for: Small businesses and startups

Features:

- We file and deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports and pay stubs are available online 24/7

- Supports W-2 employees and 1099 contractors

Nanny & Household Payroll

- Price: Full-Service Household, $39/month, includes 1 employee, $10 per additional employee

Best for: Homeowners

Features:

- Signature-ready Schedule H

- We file & deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports & paystubs available online 24/7

- Supports W-2 employees & 1099 contractors

Be sure to choose a payroll service that works for your business, and provides you with the peace of mind that comes with a reliable bookkeeping system. Your employees will thank you.

Merck is currently in talks to acquire Seagen, a biotech company. The Wall Street Journal reports that the transaction is valued at $40 billion. And what happens if Merck acquires Seagen, and how would this acquisition benefit cancer research and treatment? Read more about the Merck Seagen buyout here.

Merck Seagen Buyout

Merck and Seagen are still deciding on their share prices. So far, talks have yet to reach an agreement on $200 per share. Both companies want to settle and finalize their deals before Merck announces its quarterly earnings on July 28. At the time of writing, Seagen’s stock was at $176.19.

With an estimated market value of $235 billion, Merck is looking to expand its presence in the cancer treatment space. The Merck Seagen Buyout could play a major role in that strategy. Since Seagen specializes in targeted cancer therapies, the acquisition would give Merck access to a broader range of oncology products.

Shareholder reactions to the new deal are overwhelmingly positive, and the stocks have been up since talks about the deal have been made public.

But this is not the first time that Merck and Seagen have made the news. Back in 2020, they collaborated because of cancer treatments. Seagen has a drug conjugate (ladiratuzumab vedotin) which would be used in conjunction with Merck’s Keytruda.

Merck reveals that Keytruda is its highest-selling product. It’s immunotherapy for cancer.

And this deal could help Merck offset the possibility of reduced sales because it will lose patent protection in 2028.

As promising as this deal is, there could be scrutiny from antitrust officials since there might be a litigation case from the Federal Trade Commission or Justice Department.

The Seagen buyout isn’t the only deal Merck has made recently. They’ve been busy closing another deal, but with Orion too.

Seagen

As a cancer biotech company, Seagen has therapies to ensure that patients benefit from the treatment and reduce any adverse side effects. Their treatments involve the therapy attacking tumors with toxins.

Merck partnering with Seagen isn’t a bad idea considering that Seagen made $1.4 billion in sales in 2021, most of it coming from Adcetris and Padcev (a treatment for urothelial cancers).

Merck-Orion Deal

In the middle of the Merck Seagen Buyout, Merck has recently partnered with Orion for the ODM-208 and other drugs. These drugs are related to the production of steroids. Orion found how it can combat hormone-dependent cancers and further developed this inhibitor.

Their deal includes that they should develop ODM-208 and promote it to the public together. And Orion will receive a $290 million payment from Merck.

Although they’re co-developing and marketing the new inhibitor, Orion will oversee the manufacturing side.

Co-developing the ODM-208 can help Merck with its current research and treatments for prostate cancer. President and CEO of Orion, Timo Lappalainen, says that this partnership will benefit Merck’s goals of treating cancer worldwide.

Other Ventures: Merck’s Role in the Pandemic

You may have heard about COVID-19 pills, which are a form of treatment for those diagnosed with mild to moderate COVID-19. Merck introduced an antiviral COVID-19 pill to the public. The name: Molnupiravir.

The COVID-19 pill is not a replacement for a vaccination. Instead, it stops the replication of the COVID-19 genetic code and keeps the patient out of the hospital. Not yet FDA-approved, Molnupiravir has been authorized for emergency use since December 23, 2021.

And for other stories, read more here at Owner’s Mag!

What Is Tiktok Pink Sauce? The Viral Condiment, Explained

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Gift Guide: 25 Best Gifts for Women for All Occasions

History of the NBA: The Success Behind the Big League

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Top 12 Uses for The Metaverse That Will Change Your Life

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Top 10 Best Places to Buy a Mid Century Modern Office Chair

History of the NBA: The Success Behind the Big League

8 Best Equipment for YouTube Every Content Creator Needs

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Top 10 Small Business Organization Tools for 2025

Top 12 Uses for The Metaverse That Will Change Your Life

Trending

- Entertainment4 days ago

History of the NBA: The Success Behind the Big League

- Reviews4 days ago

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

- Lifestyle3 days ago

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

- Lifestyle4 days ago

Gift Guide: 25 Best Gifts for Women for All Occasions

- Top Stories3 days ago

What Is Tiktok Pink Sauce? The Viral Condiment, Explained