Business

What Type of Bookkeeping is Best for Business?

Published

5 years agoon

Regardless of industry or number of employees, every business requires bookkeeping in some capacity. Larger businesses might employ one, two or even more full time bookkeepers, while smaller businesses may hire a part-timer to review the books once a month. No matter the business, it’s important that owners and managers understand that there is no “one-size-fits-all” approach to bookkeeping.

While cost is always a dominant factor when choosing the bookkeeping process for a business, it is not the only one to consider – after all, businesses should not bank on a bargain when it comes to the person in charge of overseeing their finances. To better understand the different “types” of bookkeeping, here are three categories to consider:

1. Traditional bookkeeper

Whether your business is small or large, you’ll need to hire an experienced bookkeeper with a formal education and accreditations. Specifically, the bookkeeper should have substantial experience in business accounting, preferably in your particular industry. This way, you can rely on their previous learnings, which will allow for a shorter onboarding period.

It’s important to consider the role a bookkeeper will play in relation to your business’s Certified Public Accountant (CPA). Typically, bookkeepers are in charge of processing an organization’s financial transactions and documents, including purchases, receipts, sales and payments. Those transactions are recorded in a ledger or journal. In addition to the daily ledger, most businesses use software, (think QuickBooks or Sage), to keep track of entries, debits and credits. Keeping two separate recordings, one manual and one virtual, results in a trial balance with a final total of debits and credits that match. The ideal bookkeeper, particularly those who are certified, will classify and summarize financial information into financial reports, balance sheets, income statements and cash flow statements.

A CPA’s priority should be analyzing business processes and reporting, and providing advice to the business owner, especially for complex tax filing concerns. While a bookkeeper handles the businesses’ day-to-day transactions, the CPA will review and analyze the financials at specified times throughout the year. To ensure cohesion and integrity of the business’s finances, it is critical that the bookkeeper and CPA work as parts of a system.

2. Advanced bookkeeping technology

All businesses should implement some level of technology into the accounting workflow to lessen their financial and administrative burden. When considering advanced bookkeeping technologies, businesses must ensure that the technology works harmoniously across the board, while solving for particularly tedious tasks within the workflow.

For example, one of the more time-consuming, monotonous tasks in the average accounting workflow is data entry. From invoices to expense receipts, businesses are flooded with excessive yet necessary documents on a daily basis. For more streamlined and efficient data entry, businesses should employ expense tracking and management technology. Proper expense tracking ensures that employees are getting reimbursed for their expenses on the job while maximizing tax deductions and protecting the business in case of an audit.

To ensure the business’s expense management technology seamlessly plugs into their existing accounting workflow, owners and managers should be on the lookout for three features:

1. Mobile capture: Bulky scanners are office gadgets of the past. In today’s business world, mobile apps and software can turn your smartphone camera into a mobile scanner, allowing business owners and employees to simply snap a photo to extract data points, like totals, dates and vendor names, and import them into the proper location.

2. Integrate with advanced accounting software: Proper “locations” are often powerful accounting software, like QuickBooks or Sage. Through integration with the accounting software, the data entry process is not only streamlined, but ensures the correct information is being put into the correct data field.

3. Cloud Capabilities: In today’s increasingly-connected world, business owners and employees need access to their most important business documents at all times, so it’s important that their expense management systems are connected to the cloud. In addition to ease of access, the cloud promotes a collaborative work environment and allows coworkers to always be on the same page.

While most businesses use some combination of advanced technology and a traditional bookkeeper, those that are looking for a completely hands-off (and expensive) approach should consider a virtual bookkeeper.

3. Virtual bookkeeper

With the ubiquity of cloud technology and the popular practice of remote collaboration, some businesses are employing new virtual bookkeeping services. Virtual bookkeepers stand in as an entire outsourced accounting department for a business. With a team of bookkeepers, businesses have a unique system of checks and balances giving the owner peace of mind. While they may lose the personal approach of a single bookkeeper, they can rely on availability and speed with multiple bookkeepers available at a moment’s notice.

When deciding what kind of bookkeeper will work best, it’s important for businesses to realize that advanced technology can supplement (or even replace) certain aspects of the bookkeeping workflow. While a full-time bookkeeper can certainly manage the entire process, businesses that implement certain software can eliminate tedious steps of the process, saving time and money. By allowing technology to solve for menial tasks, business owners may be able to move to a part-time bookkeeper or even take over the role themselves.

Each option comes with pros and cons, and it is determining the best fit for each individual business that is paramount. Business owners and managers should keep their bookkeeping process current; both to the market and their businesses’ ever-changing requirements. There is always room for improvement, so constant evaluation and tweaking of workflows to ensure an efficient bookkeeping process, and ultimately, a better return on investment, should always be employed.

You may like

Should I Buy an Electric Scooter? What You Can Learn

Best Workflow Mapping Tools for Smarter Business Processes

Top White Label Marketing Tools for Agencies: Our 10 Best Picks

Virtual Reality Exhibit Carne Y Arena: The Refugees’ Plight

Top 10 Podcast Editing Software Applications for Beginners

What Is Tiktok Pink Sauce? The Viral Condiment, Explained

1 Comment

Leave a Reply

Cancel reply

Leave a Reply

Business

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Published

2 weeks agoon

July 4, 2025

What was once old is new again: mid century modern is back in style. From architecture to furniture, the postwar look is in, and the hype extends all the way to office chairs.

Do you need a mid century modern office chair in your life? If so, there’s plenty to choose from. Your office chair should be tailored to your style, whether you like luxury, utility, or something in between.

That’s why we’ve put together our 10 favorite places to find your ideal mid century modern office chair.

What is mid century modern design?

After World War II, spirits were high in the US, and new technology was taking the country by storm. Mid century modern refers to the design concepts that came about during this time.

As opposed to the frilly, ornate designs of classical furnishings, mid century modern designs are angular, material, and functional. Wood is a common design element, especially teak. Mid century modern furniture may also have materials like glass, vinyl, and metal. Designs are simple and geometric, with bold accent colors to make them pop.

The mid century modern aesthetic never really went away, but it’s made a noted comeback in recent years. Some have chalked it up to Boomer and Gen X nostalgia, others point to mid-century-set shows like Mad Men and The Marvelous Mrs. Maisel.

Why should I buy a mid century modern office chair?

Mid century modern is the perfect fusion of style and utility. If you want to cultivate an office space that commands respect without being ostentatious, mid century modern is the style for you.

When it comes to office chairs, an MCM one is often made with sturdy wood and vinyl. They combine the ergonomics of a modern office chair with old-fashioned grace.

If you’re concerned with utility and utility only, a more bog-standard office chair may suit you. But a mid century modern office chair is great for someone who wants to wow colleagues with a mature, thoughtful business space.

Where can I get a mid century modern office chair?

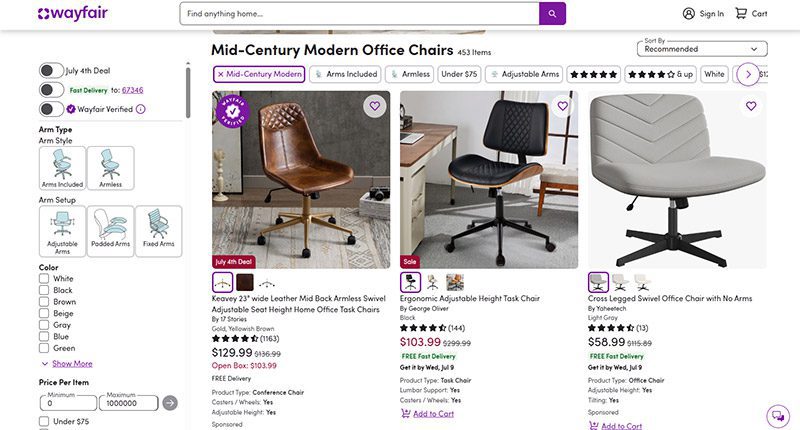

1) Wayfair

When it comes to furniture, Wayfair offers the best of both worlds. Their goods, including their mid century modern office chairs, are stylish and affordable. You can get a sturdy task chair for less than $100 or a more distinguished seat for less than $350.

MCM office chair examples: Dovray ($126), Bradford ($139), Lithonia ($133)

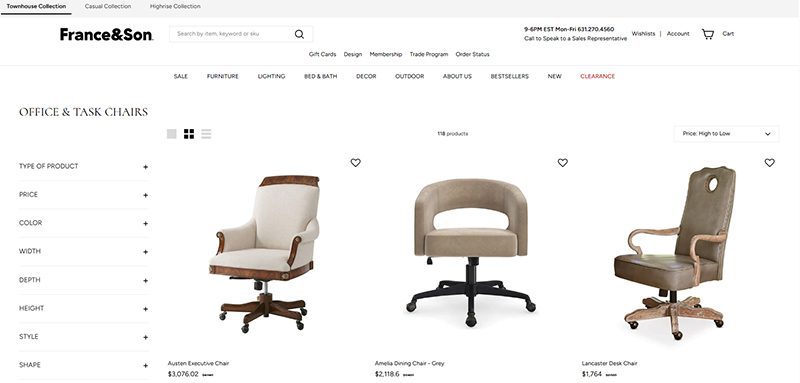

2) France & Son

Wayfair’s chairs are affordable, but France & Son is the perfect option for luxury shoppers. Their mid century modern office chairs are robust and sleekly designed. If you dress to impress and enjoy the finer things in life, these are the chairs for you.

MCM office chair example: Brooks ($695)

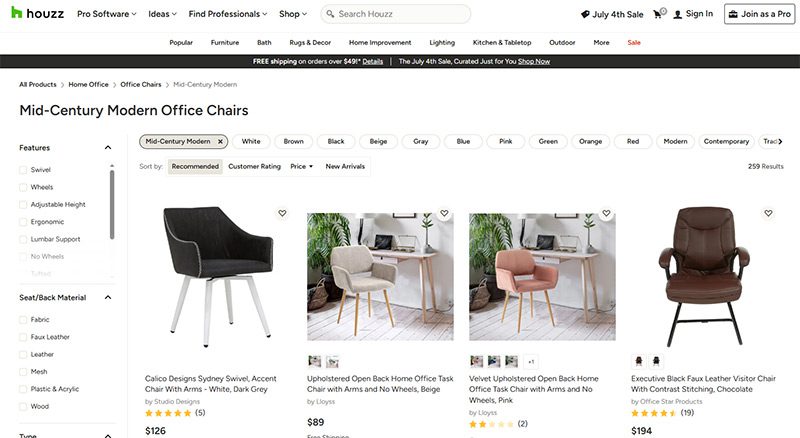

3) Houzz

Started as a community for people to share home decor tips, Houzz has become a great ecommerce platform for finding stylish furniture. They’re more known for home decor than desk chairs, but they have plenty of great, affordable finds if you know where to look.

MCM office chair examples: Arvilla ($173), Rathburn ($259)

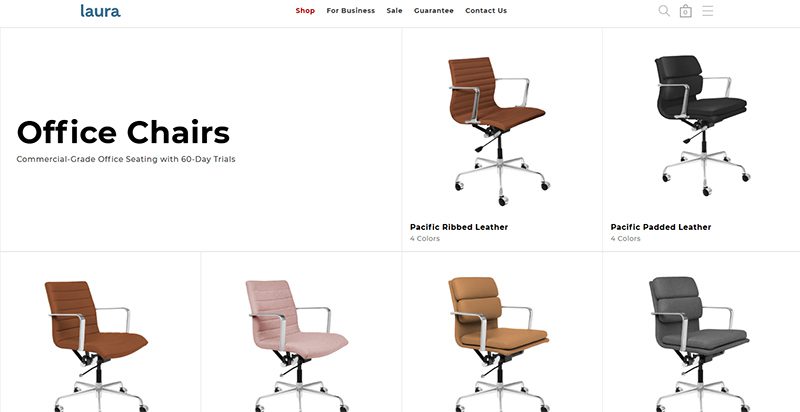

4) Laura Davidson

The Laura Davidson collection offers a fairly limited selection of classic office furniture. Still, there’s a reason they’re trusted by big-wigs like Apple, Disney, and Salesforce. Their chairs are sturdy and beautifully designed, reimagining classic Eames and Knoll designs.

MCM office chair examples: Rockefeller ($275), SOHO II Soft Pad ($450)

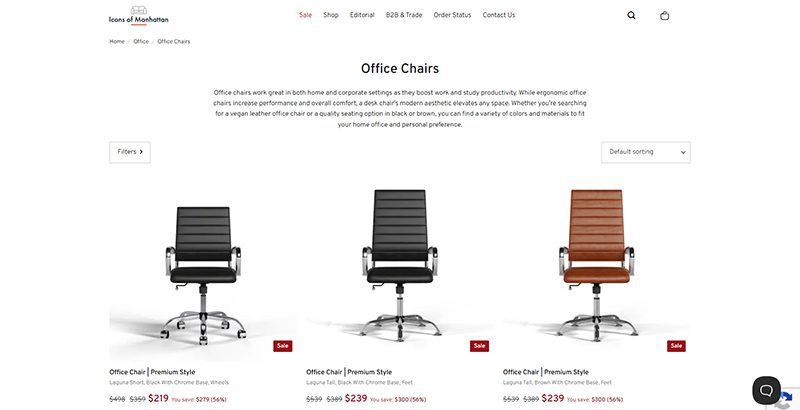

5) Icons of Manhattan

Icons of Manhattan has a simple philosophy: do one thing, and do it right. Their office chairs are handcrafted from premium materials and tailored to a mid-century modern style. If you want that Mad Men energy in your office (hopefully with a lot less angst), these are the chairs for you.

MCM office chair example: Ribbed Medium ($219)

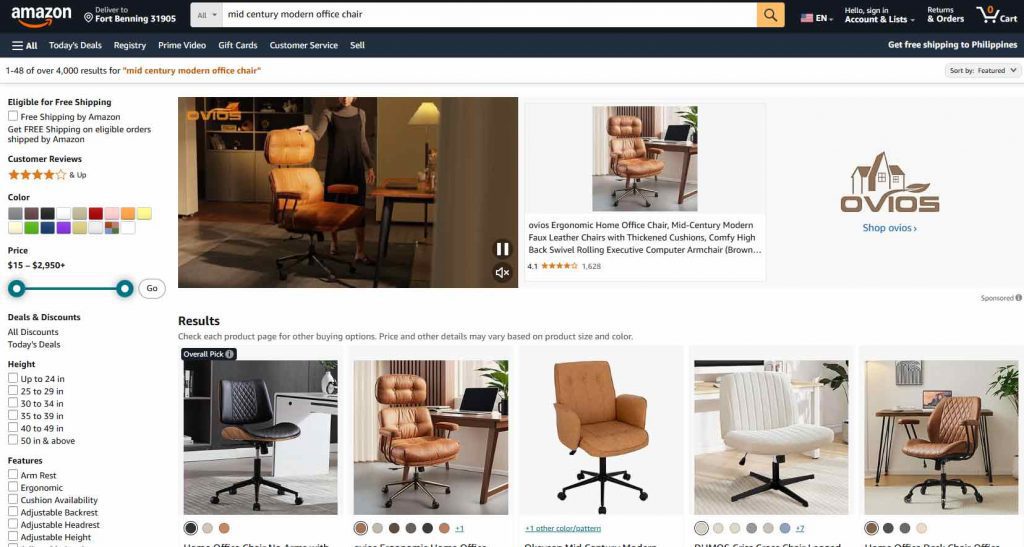

6) Amazon

Yes, the internet’s premier shopping destination has a robust collection of mid century modern office chairs. Like with most products, their selection of seats is vast and can be hit or miss. Still, they’ve got stunning chairs available for any style, whether you care about comfort, class, or ergonomics.

MCM office chair examples: IDS Home Modern ($219), Art Leon MCM Swivel ($139)

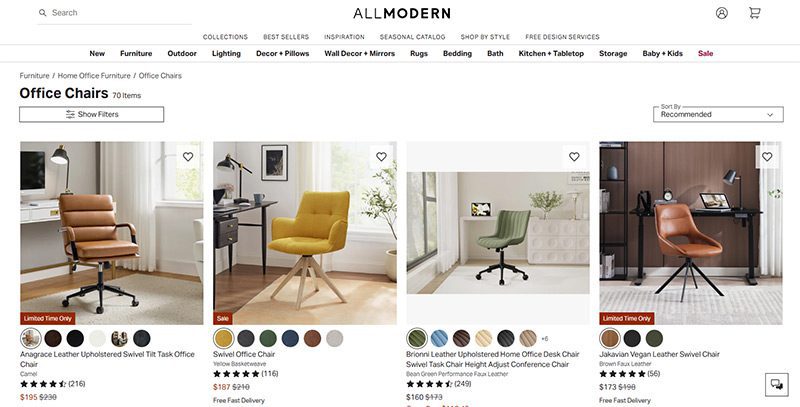

7) AllModern

AllModern’s collection of desk chairs and other furniture truly embodies the mid century modern spirit. Their work is tight, angular, and functional above all. They’re part of the Wayfair family and they traffic in a number of modern styles, but their sleek chairs are perfect for any mid century modern space.

MCM office chair examples: Frederick ($229), Kealey ($349)

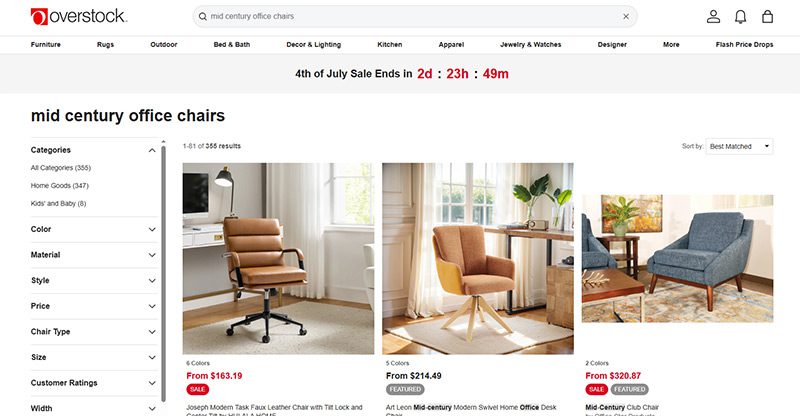

8) Overstock

Overstock is known as a one-stop shop for quality home goods at sub-wholesale prices. If you want a spiffy mid century modern office chair that won’t break the bank, they’re the first place to look. While they’re somewhat less reliable than the more upscale platforms on this list, their selection is massive.

MCM office chair example: Joseph Modern ($163)

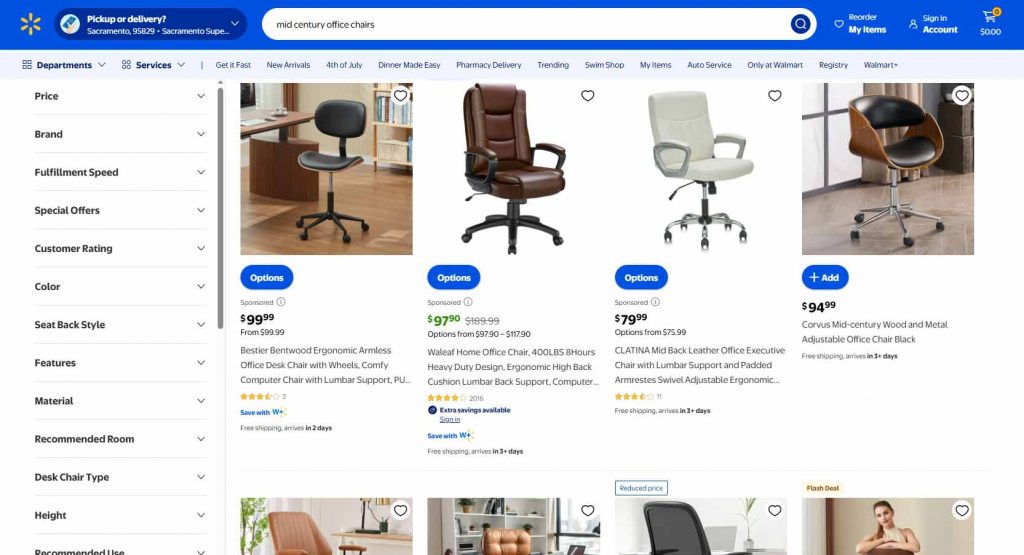

9) Walmart

Hayneedle’s selection of mid-century modern office chairs falls somewhere between the minimal Laura Davidson and the endless Amazon catalog. Their array of mid-century designs is affordable and versatile, with chairs that match almost any style. While they may be part of the Walmart family, these chairs are anything but second-rate.

MCM office chair example: Waleaf ($97)

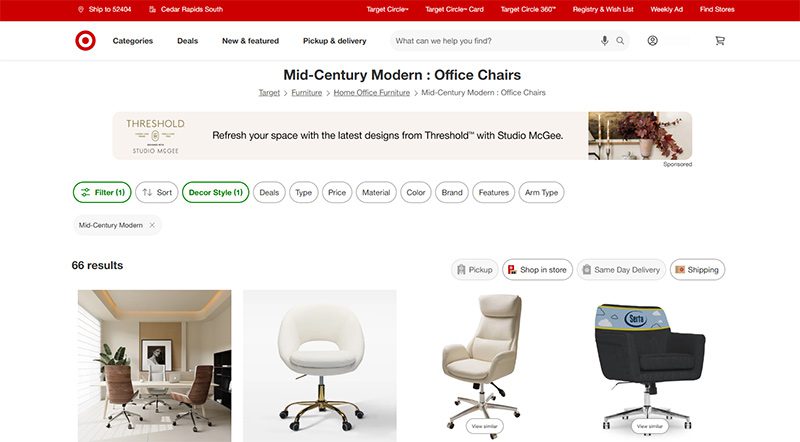

10) Target

Why splurge when you can save? As usual, Target is a hidden gem, offering a sturdy selection of mid century modern office chairs for some of the cheapest prices out there. Many of the chairs they offer are from the same designers as these other stores—Christopher Knight, LumiSource, Armen Living, etc.—at reduced prices.

MCM office chair example: Lombardi ($136)

A quality payroll service is one of the most invaluable tools any entrepreneur can have. Whether you’re a small business owner or an HR manager, paying your employees on time is crucial. This makes choosing a service even more weighty, after all, it is a heavy administrative burden. The good thing is, you can outsource this duty to an online payroll processor.

According to statistics, 49% of workers begin a new job search after just two paycheck errors, and with 65% of workers living paycheck to paycheck, it’s more important than ever to ensure an efficient, effective payroll process.

These services can save you precious time and mitigate potential issues. To make it easy for you to choose, we listed the best online payroll services for 2025.

Top 5 Online Payroll Services

Gusto

Gusto is a great option for both new and experienced payroll administrators, boasting an incredibly clean user interface and a first-rate payroll setup. Gusto lets you manage your employee’s time off (vacation and sick pay), company health insurance, and worker’s comp. Gusto offers excellent mobile access, too. This allows employees to manage aspects of their Gusto profiles, view payday insights, and access Gusto Wallet financial tools.

Gusto offers four tiers of membership, the most affordable of which is the Contractor’s Only plan, which offers unlimited U.S.-based and global contractor payments, supporting more than 100 countries, plus 1099 creation and filing at a rate of $6 per person per month with no base price.

The other three are Simple, Plus, and Premium. Here’s a deeper look into each plan:

Simple

Price:

$40/mo + $6/mo per person

Plan details:

- Full-service single-state payroll including W-2s and 1099s

- Employee profiles and self-service

- Basic hiring and onboarding tools

- Gusto-brokered health insurance administration

- Employee financial benefits

- Payroll and time-off reports

- Custom admin permissions

- Integrations for accounting, time tracking, expense management, and more

Plus

Price:

$80/mo + $12/mo per person

Plan details:

(All Simple plan features +)

- Full-service multi-state payroll including W-2s and 1099s

- Next-day direct deposit

- Advanced hiring and onboarding tools

- PTO management and policies

- Time tracking and project tracking

- Workforce costing and custom reports

- Team management tools

- Full support

Premium

Price:

Bespoke pricing, reach out for a personalized quote

Plan details:

(All Plus plan features +)

- HR Resource Center

- Compliance alerts

- Access to certified HR experts

- Full-service payroll migration and account setup

- Health insurance broker integration

- R&D tax credit discount

- Waived fees and exclusive pricing

- Performance reviews

- Employee surveys and insights

- Dedicated support

QuickBooks Online Payroll

Founded in 1983, Intuit is a California-based financial software company. Since its inception, Intuit has developed into one of the best-known providers of accounting software. Their online payroll service, QuickBooks, includes the essential features you need to run payroll.

QuickBooks offers three tiers of membership. The least expensive membership covers basic accounting features, such as invoices. For more features, check out the Essentials and Plus memberships. Each plan’s features are as follows:

QuickBooks Simple Start (2025)

- Price: $38/month for 1 user

- Best for: Freelancers and small teams with basic payroll needs

Features:

- Automated bookkeeping

- 5 free ACH bank transfers/mo for bills

QuickBooks Essentials (2025)

- Price: $75/month for 3 users

- Best for: Small businesses needing deeper financial tracking

Features:

- Includes all Simple Start features, plus:

- Recurring invoices

QuickBooks Plus (2025)

- Price: $115/month for 5 users

- Best for: Growing businesses with HR and compliance needs

Features:

- Includes all Essentials features, plus:

- AI-powered profit & loss insights

- Anomaly detection and resolution

- Budgeting

QuickBooks Advanced (2025)

- Price: $275/month for 25 users

- Best for: Established businesses with HR and compliance needs

Features:

- Includes all Plus features, plus:

- Custom user management and permissions

- Custom report builder

- Data sync with Excel

- Revenue recognition

- Forecasting

OnPay

OnPay is a cloud-based full-service payroll processing system capable of running payroll according to a preset schedule, automatically disbursing wages, and calculating and withholding taxes.

OnPay can sync up with several other software your team is already using, making it easy to integrate the service into your team’s system. Another benefit of OnPays model is the simple, transparent pricing structure. No tiers; just one base rate.

Pricing:

$49/mo + $6/mo per employee

SurePayroll

SurePayroll’s award-winning service supports W-2 employees and 1099 contractors. Additionally, it handles 401(k) deductions and manages flexible spending accounts (FSA) and health savings accounts (HSA).

SurePayroll also offers a mobile app— available on both Apple and Android devices.

SurePayroll offers live support through its United States-based support team through chat, email, or phone.

Small Business Payroll

- Price: No Tax Filing: $20/month + $4 per employee, Full Service: $29/month + $7 per employee

- Best for: Small businesses and startups

Features:

- We file and deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports and pay stubs are available online 24/7

- Supports W-2 employees and 1099 contractors

Nanny & Household Payroll

- Price: Full-Service Household, $39/month, includes 1 employee, $10 per additional employee

Best for: Homeowners

Features:

- Signature-ready Schedule H

- We file & deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports & paystubs available online 24/7

- Supports W-2 employees & 1099 contractors

Be sure to choose a payroll service that works for your business, and provides you with the peace of mind that comes with a reliable bookkeeping system. Your employees will thank you.

Merck is currently in talks to acquire Seagen, a biotech company. The Wall Street Journal reports that the transaction is valued at $40 billion. And what happens if Merck acquires Seagen, and how would this acquisition benefit cancer research and treatment? Read more about the Merck Seagen buyout here.

Merck Seagen Buyout

Merck and Seagen are still deciding on their share prices. So far, talks have yet to reach an agreement on $200 per share. Both companies want to settle and finalize their deals before Merck announces its quarterly earnings on July 28. At the time of writing, Seagen’s stock was at $176.19.

With an estimated market value of $235 billion, Merck is looking to expand its presence in the cancer treatment space. The Merck Seagen Buyout could play a major role in that strategy. Since Seagen specializes in targeted cancer therapies, the acquisition would give Merck access to a broader range of oncology products.

Shareholder reactions to the new deal are overwhelmingly positive, and the stocks have been up since talks about the deal have been made public.

But this is not the first time that Merck and Seagen have made the news. Back in 2020, they collaborated because of cancer treatments. Seagen has a drug conjugate (ladiratuzumab vedotin) which would be used in conjunction with Merck’s Keytruda.

Merck reveals that Keytruda is its highest-selling product. It’s immunotherapy for cancer.

And this deal could help Merck offset the possibility of reduced sales because it will lose patent protection in 2028.

As promising as this deal is, there could be scrutiny from antitrust officials since there might be a litigation case from the Federal Trade Commission or Justice Department.

The Seagen buyout isn’t the only deal Merck has made recently. They’ve been busy closing another deal, but with Orion too.

Seagen

As a cancer biotech company, Seagen has therapies to ensure that patients benefit from the treatment and reduce any adverse side effects. Their treatments involve the therapy attacking tumors with toxins.

Merck partnering with Seagen isn’t a bad idea considering that Seagen made $1.4 billion in sales in 2021, most of it coming from Adcetris and Padcev (a treatment for urothelial cancers).

Merck-Orion Deal

In the middle of the Merck Seagen Buyout, Merck has recently partnered with Orion for the ODM-208 and other drugs. These drugs are related to the production of steroids. Orion found how it can combat hormone-dependent cancers and further developed this inhibitor.

Their deal includes that they should develop ODM-208 and promote it to the public together. And Orion will receive a $290 million payment from Merck.

Although they’re co-developing and marketing the new inhibitor, Orion will oversee the manufacturing side.

Co-developing the ODM-208 can help Merck with its current research and treatments for prostate cancer. President and CEO of Orion, Timo Lappalainen, says that this partnership will benefit Merck’s goals of treating cancer worldwide.

Other Ventures: Merck’s Role in the Pandemic

You may have heard about COVID-19 pills, which are a form of treatment for those diagnosed with mild to moderate COVID-19. Merck introduced an antiviral COVID-19 pill to the public. The name: Molnupiravir.

The COVID-19 pill is not a replacement for a vaccination. Instead, it stops the replication of the COVID-19 genetic code and keeps the patient out of the hospital. Not yet FDA-approved, Molnupiravir has been authorized for emergency use since December 23, 2021.

And for other stories, read more here at Owner’s Mag!

Should I Buy an Electric Scooter? What You Can Learn

Best Workflow Mapping Tools for Smarter Business Processes

Top White Label Marketing Tools for Agencies: Our 10 Best Picks

Virtual Reality Exhibit Carne Y Arena: The Refugees’ Plight

Top 10 Podcast Editing Software Applications for Beginners

What Is Tiktok Pink Sauce? The Viral Condiment, Explained

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Top White Label Marketing Tools for Agencies: Our 10 Best Picks

History of the NBA: The Success Behind the Big League

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Did You Drop Your Smartphone in The Ocean? Here’s How to Retrieve It

Virtual Reality Exhibit Carne Y Arena: The Refugees’ Plight

Best Workflow Mapping Tools for Smarter Business Processes

Gift Guide: 25 Best Gifts for Women for All Occasions

Trending

- Technology17 hours ago

Top White Label Marketing Tools for Agencies: Our 10 Best Picks

- Technology23 hours ago

Virtual Reality Exhibit Carne Y Arena: The Refugees’ Plight

- Technology16 hours ago

Best Workflow Mapping Tools for Smarter Business Processes

- Technology23 hours ago

Top 10 Podcast Editing Software Applications for Beginners

- Lifestyle6 hours ago

Should I Buy an Electric Scooter? What You Can Learn

Sarah P

November 20, 2018 at 5:07 am

Great post. There are some valid points here and the most important thing to remember is that you should choose a bookkeeper that is well-suited to your business and your needs. If you’re an online-only business, you may find that a cloud-based bookkeeper is sufficient. By considering your own needs, you’ll be able to choose the right option for you.

Keep up the great content!