Business

The Software As A Service Business Model Explained

Published

4 years agoon

Software as a service (SaaS) has been one of the largest and fastest-growing market segments since 2019. Businesses are now investing in SaaS companies, spending nearly 50% more on these cloud technologies than in previous years. For entrepreneurs, few industries are as exciting and lucrative. But it’s not enough to just dive in and go for it. The software as a service business model is a unique model that requires a specific, but reliable strategy.

What Is SaaS?

SaaS is a delivery model of centrally hosted software that is licensed to customers via a subscription plan. If a company leases its software through a central, cloud-based system is technically a SaaS company.

These companies maintain responsibility and oversight of servers, databases, and any relevant software that allows people to access and use their products. Some of the most popular SaaS companies are Adobe, Google, Salesforce, Slack, and more.

The way that SaaS companies lease their product is through subscription plans. These plans can vary greatly from company to company. SaaS business models offer different services and different applications within their systems. Different subscription plans give different access to different services. Many offer a regular plan with one or two other plans that offer more access and increased services.

What Is The Software As A Service Business Model?

The software as a service business model includes a number of factors that are unique to it. There are three in particular that are important to take note of.

Recurring Payments

In SaaS, clients do not buy hardware. The software as a service business model involves providing a subscription service for software. Recurring payments usually take the form of monthly recurring revenue (MRR). This makes accounting for revenue potentially difficult because SaaS offers a service, not a product per se.

When your customer signs up and subscribes, you will get some money upfront. It is imperative that this initial cash not be counted as revenue until it’s been properly earned. It is a liability until the terms of service have been completed. A customer can ask for that money back at any point if the service isn’t delivered.

Revenue recognition is one of the most fundamental aspects of running a successful SaaS company.

Heightened Customer Retention

All businesses care about customer retention. In SaaS business models, however, it is ten times more important. Customer retention is what keeps SaaS companies afloat. Because you cannot lay claim to all of your customers’ subscription money until a term of service has been completed.

If you sign a customer for one year or twelve months and they leave after two, then you’re without ten months of recurring revenue. As a result, it is critical to put a significant value on cultivating customer relationships and upselling.

An existing SaaS customer spends more money on average than a new one. It is in a SaaS company’s best interest to upkeep and maintain higher-quality customer service. If you don’t, or if the quality of customer service is poor, your customer is very likely to jump to a competitor.

No matter how great the product, poor customer service can break a company.

Consistent Updates

In order to maintain and increase customer retention, SaaS companies need to consistently provide small and frequent updates to their services. Plenty of companies provide “next-gen” product versions, but SaaS has to continuously update and patch to stay above water.

This is the nature of being in the software industry. Software vulnerabilities can put customer information at risk from hackers. Nobody wants that. That’s why continuously assessing and updating security fixes is a top priority in the software as a service business model.

Since SaaS companies host their own products, they can push updates as needed. They can release new features or enhance prior versions whenever they want. Between consistent updates and quality customer service, SaaS companies have the potential to be highly responsive to customer base feedback.

This is a real-time luxury that most other industries do not have.

How Are SaaS Companies Built?

Generally speaking, there are three critical stages as to how to build and develop a SaaS company: Setup, Growth, Stabilization.

Setup

This is the early stage where the foundation of the company is established. These are fairly typical processes. Founders discover the need for the products they intend to develop, identify their target market, and create the product.

This is also the opportunity to create an effective marketing campaign and sales strategy, consider various customer support plans, and organize finances.

Growth

Once the product has hit the market, it’s time to expand. This is arguably the fun part. Because there is seemingly no limit to how far a SaaS company can expand in its market, it’s possible for a SaaS to expect new customers. This creates a sudden demand for marketing, sales, and customer service teams.

This is when a company has to act quickly in order to capitalize and secure a loyal customer base. Ideally, this growth will be accompanied by additional revenue. Companies then reinvest the capital back into their products and services. That way they have the resources necessary to meet their customers’ needs.

Stabilization

Now that the business is beginning to acclimate with a steady incoming stream of customers, that means the company does not have to invest in more overhead. If the SaaS company has wisely invested in customer service software, marketing automation, and consistent product updates, they are on the right track to stabilization.

Why This Business Model Works

The software as a service business model is new but reliable. The evidence of this can be found in the amount of money that other industries have begun to invest in SaaS. How many office spaces use Slack to communicate? How many designers use Adobe? As our technology advances, so does the SaaS industry.

It’s never been a more exciting time to enter the SaaS industry. Entrepreneurs, take note.

Chris Blondell is a Philadelphia-based writer and social media strategist with a current focus on tech industry news. He has written about startups and entrepreneurs based in Denver, Seattle, Chicago, New Haven, and more. He has also written content for a true-crime blog, Sword and Scale, and developed social media content for a local spice shop. An occasional comedian, Chris Blondell also spends his time writing humorous content and performing stand-up for local audiences.

You may like

Business

Top 10 Best Places to Buy a Mid Century Modern Office Chair

Published

1 week agoon

July 4, 2025

What was once old is new again: mid century modern is back in style. From architecture to furniture, the postwar look is in, and the hype extends all the way to office chairs.

Do you need a mid century modern office chair in your life? If so, there’s plenty to choose from. Your office chair should be tailored to your style, whether you like luxury, utility, or something in between.

That’s why we’ve put together our 10 favorite places to find your ideal mid century modern office chair.

What is mid century modern design?

After World War II, spirits were high in the US, and new technology was taking the country by storm. Mid century modern refers to the design concepts that came about during this time.

As opposed to the frilly, ornate designs of classical furnishings, mid century modern designs are angular, material, and functional. Wood is a common design element, especially teak. Mid century modern furniture may also have materials like glass, vinyl, and metal. Designs are simple and geometric, with bold accent colors to make them pop.

The mid century modern aesthetic never really went away, but it’s made a noted comeback in recent years. Some have chalked it up to Boomer and Gen X nostalgia, others point to mid-century-set shows like Mad Men and The Marvelous Mrs. Maisel.

Why should I buy a mid century modern office chair?

Mid century modern is the perfect fusion of style and utility. If you want to cultivate an office space that commands respect without being ostentatious, mid century modern is the style for you.

When it comes to office chairs, an MCM one is often made with sturdy wood and vinyl. They combine the ergonomics of a modern office chair with old-fashioned grace.

If you’re concerned with utility and utility only, a more bog-standard office chair may suit you. But a mid century modern office chair is great for someone who wants to wow colleagues with a mature, thoughtful business space.

Where can I get a mid century modern office chair?

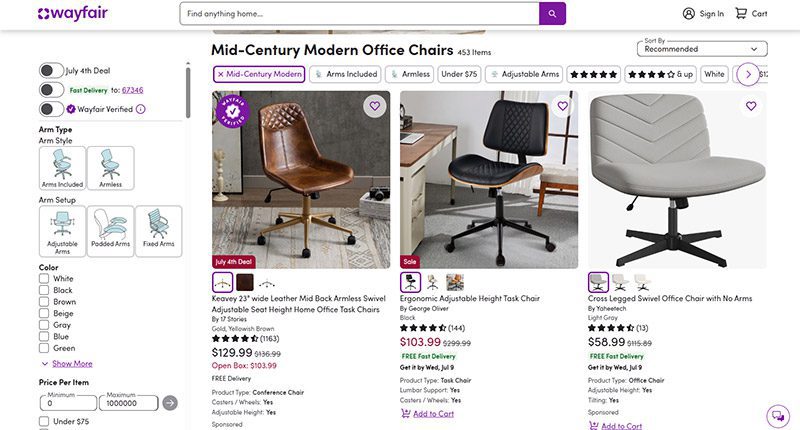

1) Wayfair

When it comes to furniture, Wayfair offers the best of both worlds. Their goods, including their mid century modern office chairs, are stylish and affordable. You can get a sturdy task chair for less than $100 or a more distinguished seat for less than $350.

MCM office chair examples: Dovray ($126), Bradford ($139), Lithonia ($133)

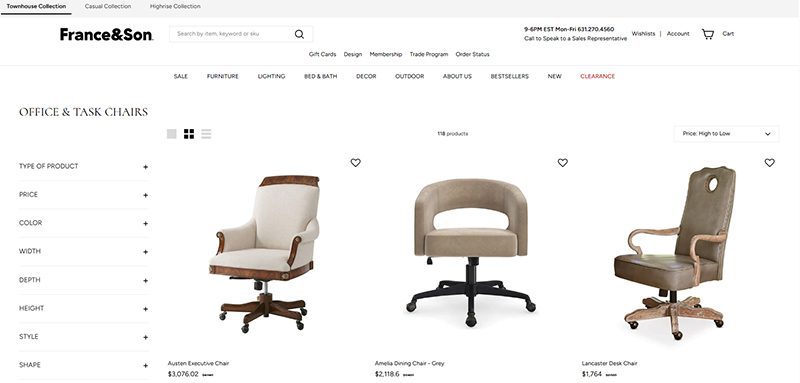

2) France & Son

Wayfair’s chairs are affordable, but France & Son is the perfect option for luxury shoppers. Their mid century modern office chairs are robust and sleekly designed. If you dress to impress and enjoy the finer things in life, these are the chairs for you.

MCM office chair example: Brooks ($695)

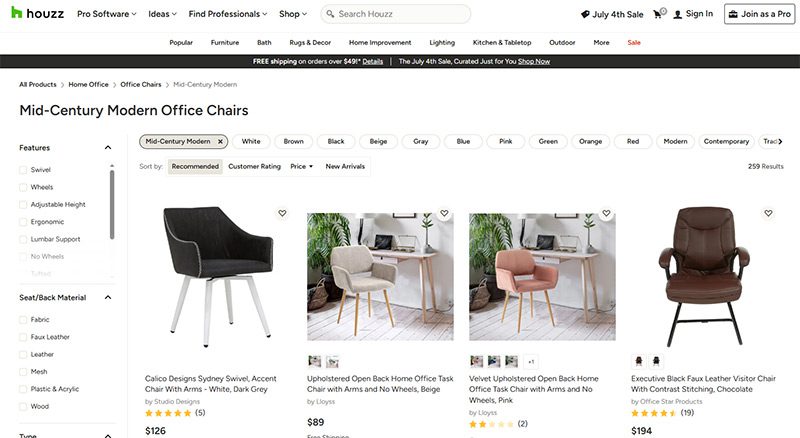

3) Houzz

Started as a community for people to share home decor tips, Houzz has become a great ecommerce platform for finding stylish furniture. They’re more known for home decor than desk chairs, but they have plenty of great, affordable finds if you know where to look.

MCM office chair examples: Arvilla ($173), Rathburn ($259)

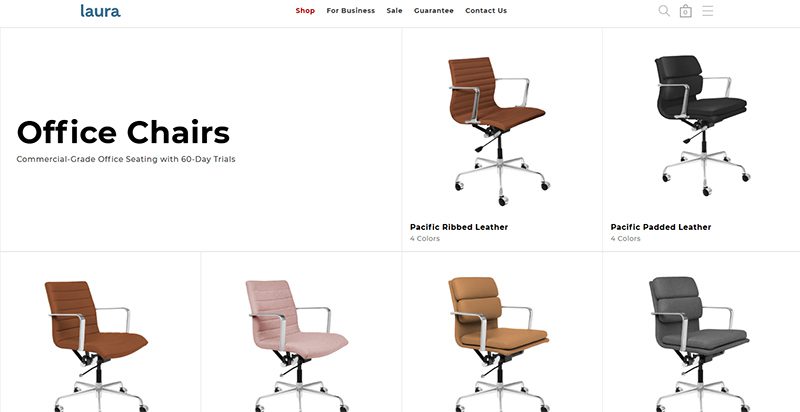

4) Laura Davidson

The Laura Davidson collection offers a fairly limited selection of classic office furniture. Still, there’s a reason they’re trusted by big-wigs like Apple, Disney, and Salesforce. Their chairs are sturdy and beautifully designed, reimagining classic Eames and Knoll designs.

MCM office chair examples: Rockefeller ($275), SOHO II Soft Pad ($450)

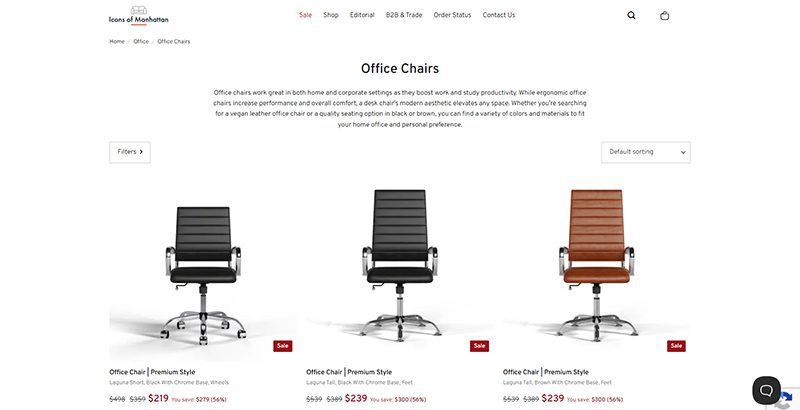

5) Icons of Manhattan

Icons of Manhattan has a simple philosophy: do one thing, and do it right. Their office chairs are handcrafted from premium materials and tailored to a mid-century modern style. If you want that Mad Men energy in your office (hopefully with a lot less angst), these are the chairs for you.

MCM office chair example: Ribbed Medium ($219)

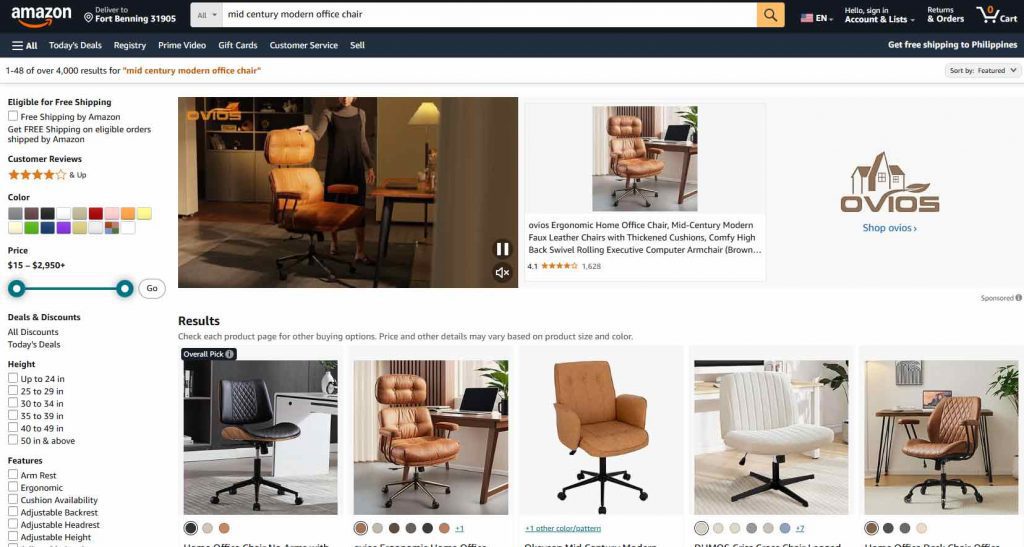

6) Amazon

Yes, the internet’s premier shopping destination has a robust collection of mid century modern office chairs. Like with most products, their selection of seats is vast and can be hit or miss. Still, they’ve got stunning chairs available for any style, whether you care about comfort, class, or ergonomics.

MCM office chair examples: IDS Home Modern ($219), Art Leon MCM Swivel ($139)

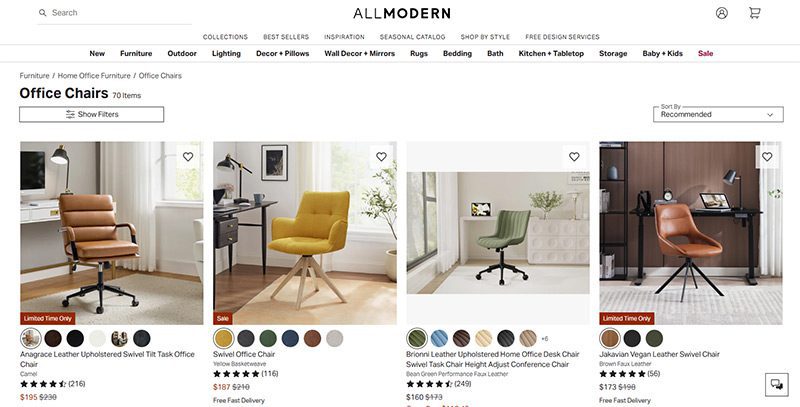

7) AllModern

AllModern’s collection of desk chairs and other furniture truly embodies the mid century modern spirit. Their work is tight, angular, and functional above all. They’re part of the Wayfair family and they traffic in a number of modern styles, but their sleek chairs are perfect for any mid century modern space.

MCM office chair examples: Frederick ($229), Kealey ($349)

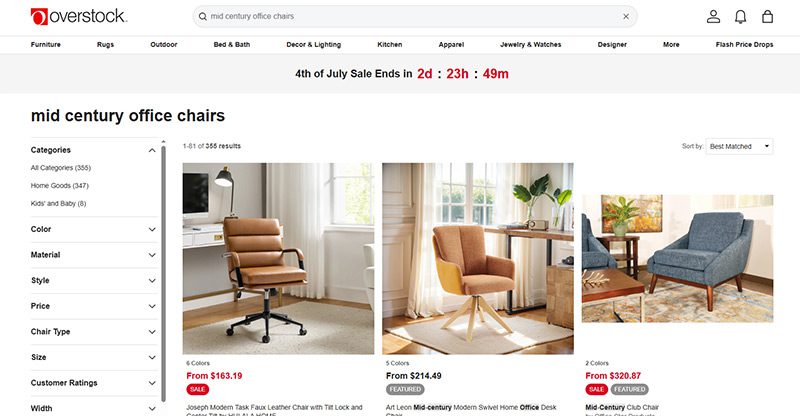

8) Overstock

Overstock is known as a one-stop shop for quality home goods at sub-wholesale prices. If you want a spiffy mid century modern office chair that won’t break the bank, they’re the first place to look. While they’re somewhat less reliable than the more upscale platforms on this list, their selection is massive.

MCM office chair example: Joseph Modern ($163)

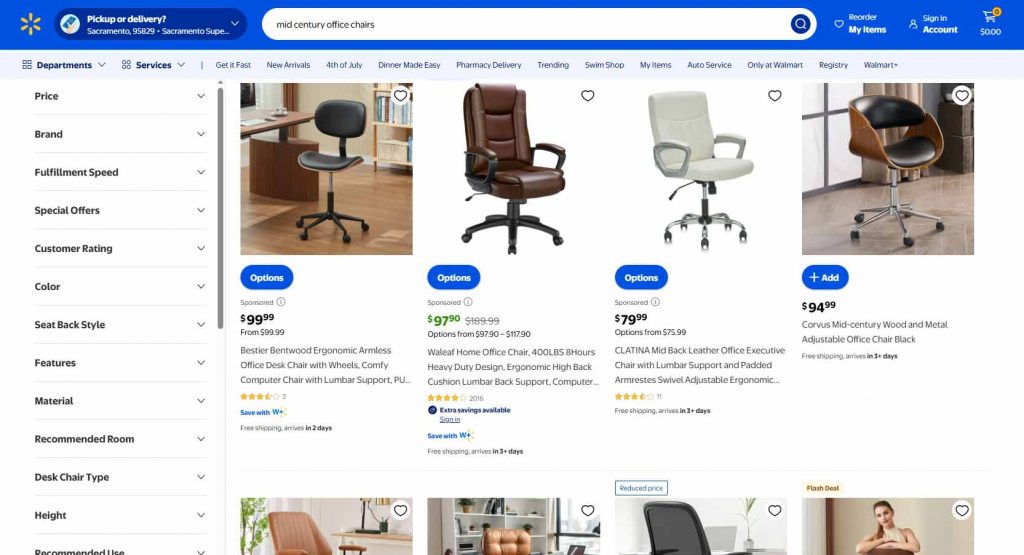

9) Walmart

Hayneedle’s selection of mid-century modern office chairs falls somewhere between the minimal Laura Davidson and the endless Amazon catalog. Their array of mid-century designs is affordable and versatile, with chairs that match almost any style. While they may be part of the Walmart family, these chairs are anything but second-rate.

MCM office chair example: Waleaf ($97)

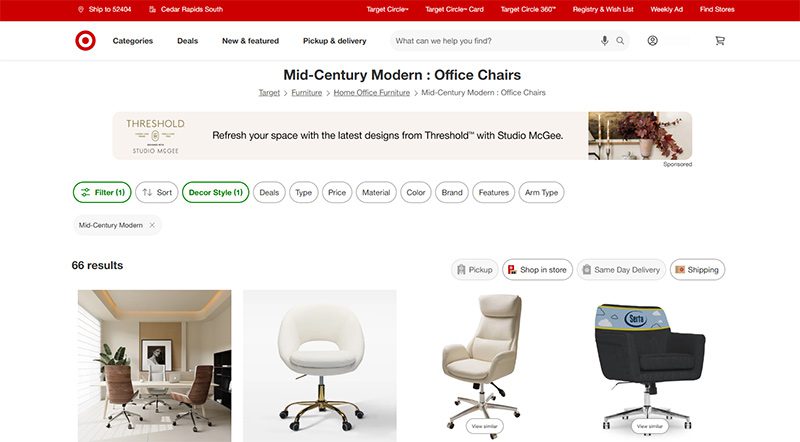

10) Target

Why splurge when you can save? As usual, Target is a hidden gem, offering a sturdy selection of mid century modern office chairs for some of the cheapest prices out there. Many of the chairs they offer are from the same designers as these other stores—Christopher Knight, LumiSource, Armen Living, etc.—at reduced prices.

MCM office chair example: Lombardi ($136)

A quality payroll service is one of the most invaluable tools any entrepreneur can have. Whether you’re a small business owner or an HR manager, paying your employees on time is crucial. This makes choosing a service even more weighty, after all, it is a heavy administrative burden. The good thing is, you can outsource this duty to an online payroll processor.

According to statistics, 49% of workers begin a new job search after just two paycheck errors, and with 65% of workers living paycheck to paycheck, it’s more important than ever to ensure an efficient, effective payroll process.

These services can save you precious time and mitigate potential issues. To make it easy for you to choose, we listed the best online payroll services for 2025.

Top 5 Online Payroll Services

Gusto

Gusto is a great option for both new and experienced payroll administrators, boasting an incredibly clean user interface and a first-rate payroll setup. Gusto lets you manage your employee’s time off (vacation and sick pay), company health insurance, and worker’s comp. Gusto offers excellent mobile access, too. This allows employees to manage aspects of their Gusto profiles, view payday insights, and access Gusto Wallet financial tools.

Gusto offers four tiers of membership, the most affordable of which is the Contractor’s Only plan, which offers unlimited U.S.-based and global contractor payments, supporting more than 100 countries, plus 1099 creation and filing at a rate of $6 per person per month with no base price.

The other three are Simple, Plus, and Premium. Here’s a deeper look into each plan:

Simple

Price:

$40/mo + $6/mo per person

Plan details:

- Full-service single-state payroll including W-2s and 1099s

- Employee profiles and self-service

- Basic hiring and onboarding tools

- Gusto-brokered health insurance administration

- Employee financial benefits

- Payroll and time-off reports

- Custom admin permissions

- Integrations for accounting, time tracking, expense management, and more

Plus

Price:

$80/mo + $12/mo per person

Plan details:

(All Simple plan features +)

- Full-service multi-state payroll including W-2s and 1099s

- Next-day direct deposit

- Advanced hiring and onboarding tools

- PTO management and policies

- Time tracking and project tracking

- Workforce costing and custom reports

- Team management tools

- Full support

Premium

Price:

Bespoke pricing, reach out for a personalized quote

Plan details:

(All Plus plan features +)

- HR Resource Center

- Compliance alerts

- Access to certified HR experts

- Full-service payroll migration and account setup

- Health insurance broker integration

- R&D tax credit discount

- Waived fees and exclusive pricing

- Performance reviews

- Employee surveys and insights

- Dedicated support

QuickBooks Online Payroll

Founded in 1983, Intuit is a California-based financial software company. Since its inception, Intuit has developed into one of the best-known providers of accounting software. Their online payroll service, QuickBooks, includes the essential features you need to run payroll.

QuickBooks offers three tiers of membership. The least expensive membership covers basic accounting features, such as invoices. For more features, check out the Essentials and Plus memberships. Each plan’s features are as follows:

QuickBooks Simple Start (2025)

- Price: $38/month for 1 user

- Best for: Freelancers and small teams with basic payroll needs

Features:

- Automated bookkeeping

- 5 free ACH bank transfers/mo for bills

QuickBooks Essentials (2025)

- Price: $75/month for 3 users

- Best for: Small businesses needing deeper financial tracking

Features:

- Includes all Simple Start features, plus:

- Recurring invoices

QuickBooks Plus (2025)

- Price: $115/month for 5 users

- Best for: Growing businesses with HR and compliance needs

Features:

- Includes all Essentials features, plus:

- AI-powered profit & loss insights

- Anomaly detection and resolution

- Budgeting

QuickBooks Advanced (2025)

- Price: $275/month for 25 users

- Best for: Established businesses with HR and compliance needs

Features:

- Includes all Plus features, plus:

- Custom user management and permissions

- Custom report builder

- Data sync with Excel

- Revenue recognition

- Forecasting

OnPay

OnPay is a cloud-based full-service payroll processing system capable of running payroll according to a preset schedule, automatically disbursing wages, and calculating and withholding taxes.

OnPay can sync up with several other software your team is already using, making it easy to integrate the service into your team’s system. Another benefit of OnPays model is the simple, transparent pricing structure. No tiers; just one base rate.

Pricing:

$49/mo + $6/mo per employee

SurePayroll

SurePayroll’s award-winning service supports W-2 employees and 1099 contractors. Additionally, it handles 401(k) deductions and manages flexible spending accounts (FSA) and health savings accounts (HSA).

SurePayroll also offers a mobile app— available on both Apple and Android devices.

SurePayroll offers live support through its United States-based support team through chat, email, or phone.

Small Business Payroll

- Price: No Tax Filing: $20/month + $4 per employee, Full Service: $29/month + $7 per employee

- Best for: Small businesses and startups

Features:

- We file and deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports and pay stubs are available online 24/7

- Supports W-2 employees and 1099 contractors

Nanny & Household Payroll

- Price: Full-Service Household, $39/month, includes 1 employee, $10 per additional employee

Best for: Homeowners

Features:

- Signature-ready Schedule H

- We file & deposit your federal and state taxes!

- Run payroll in 3 simple steps

- Schedule payroll to run automatically

- Unlimited payroll runs and free 2-day direct deposit

- Reports & paystubs available online 24/7

- Supports W-2 employees & 1099 contractors

Be sure to choose a payroll service that works for your business, and provides you with the peace of mind that comes with a reliable bookkeeping system. Your employees will thank you.

Merck is currently in talks to acquire Seagen, a biotech company. The Wall Street Journal reports that the transaction is valued at $40 billion. And what happens if Merck acquires Seagen, and how would this acquisition benefit cancer research and treatment? Read more about the Merck Seagen buyout here.

Merck Seagen Buyout

Merck and Seagen are still deciding on their share prices. So far, talks have yet to reach an agreement on $200 per share. Both companies want to settle and finalize their deals before Merck announces its quarterly earnings on July 28. At the time of writing, Seagen’s stock was at $176.19.

With an estimated market value of $235 billion, Merck is looking to expand its presence in the cancer treatment space. The Merck Seagen Buyout could play a major role in that strategy. Since Seagen specializes in targeted cancer therapies, the acquisition would give Merck access to a broader range of oncology products.

Shareholder reactions to the new deal are overwhelmingly positive, and the stocks have been up since talks about the deal have been made public.

But this is not the first time that Merck and Seagen have made the news. Back in 2020, they collaborated because of cancer treatments. Seagen has a drug conjugate (ladiratuzumab vedotin) which would be used in conjunction with Merck’s Keytruda.

Merck reveals that Keytruda is its highest-selling product. It’s immunotherapy for cancer.

And this deal could help Merck offset the possibility of reduced sales because it will lose patent protection in 2028.

As promising as this deal is, there could be scrutiny from antitrust officials since there might be a litigation case from the Federal Trade Commission or Justice Department.

The Seagen buyout isn’t the only deal Merck has made recently. They’ve been busy closing another deal, but with Orion too.

Seagen

As a cancer biotech company, Seagen has therapies to ensure that patients benefit from the treatment and reduce any adverse side effects. Their treatments involve the therapy attacking tumors with toxins.

Merck partnering with Seagen isn’t a bad idea considering that Seagen made $1.4 billion in sales in 2021, most of it coming from Adcetris and Padcev (a treatment for urothelial cancers).

Merck-Orion Deal

In the middle of the Merck Seagen Buyout, Merck has recently partnered with Orion for the ODM-208 and other drugs. These drugs are related to the production of steroids. Orion found how it can combat hormone-dependent cancers and further developed this inhibitor.

Their deal includes that they should develop ODM-208 and promote it to the public together. And Orion will receive a $290 million payment from Merck.

Although they’re co-developing and marketing the new inhibitor, Orion will oversee the manufacturing side.

Co-developing the ODM-208 can help Merck with its current research and treatments for prostate cancer. President and CEO of Orion, Timo Lappalainen, says that this partnership will benefit Merck’s goals of treating cancer worldwide.

Other Ventures: Merck’s Role in the Pandemic

You may have heard about COVID-19 pills, which are a form of treatment for those diagnosed with mild to moderate COVID-19. Merck introduced an antiviral COVID-19 pill to the public. The name: Molnupiravir.

The COVID-19 pill is not a replacement for a vaccination. Instead, it stops the replication of the COVID-19 genetic code and keeps the patient out of the hospital. Not yet FDA-approved, Molnupiravir has been authorized for emergency use since December 23, 2021.

And for other stories, read more here at Owner’s Mag!

Gift Guide: 25 Best Gifts for Women for All Occasions

History of the NBA: The Success Behind the Big League

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

Top 12 Uses for The Metaverse That Will Change Your Life

Top 10 Best Places to Buy a Mid Century Modern Office Chair

The Best Online Payroll Services [Updated for 2025]

Top 10 Small Business Organization Tools for 2025

Top 10 Best Places to Buy a Mid Century Modern Office Chair

History of the NBA: The Success Behind the Big League

8 Best Equipment for YouTube Every Content Creator Needs

Demio SaaS 2025 Review: Features, Pricing, Pros & Cons

The Rise and Fall of Juul: Once a Silicon Valley Darling, Now Banned by FDA

Top 10 Small Business Organization Tools for 2025