Business

Fiverr’s Stock Value Took a Plunge, Here’s Why

Published

4 years agoon

You’re a freelancer in a booming gig economy increasingly under scrutiny. Is Fiverr right for you?

COVID-19 shook up our economy. That’s no secret. Employees relocated to their home offices, many were laid off entirely, and some took the opportunity to explore a new career. For some, freelancing was the stepping stone for millions curious about embarking on that personal journey.

If you work freelance, you’ve likely heard of Fiverr. The company is known for connecting freelancers with projects and the benefits one might reap. For someone about to dive into the scary world of freelancing, Fiverr sounds like a great place to start.

What Does This Stock Dip Mean

Unfortunately, the “safe bet” has had a bit of a tumble of 24.8% in the stock market lately. While some consider the dip a minor hiccup, it speaks to larger unreliability for freelancers. Whom the company relies on entirely. As people head back to work, they need freelancers less.

As we slowly recover from this pandemic, employees are moving back to work and freelance workers are taking the hit. Few people are relying on remote workers. For someone exploring freelancing as a new career option, this news should be waving a bright neon red flag.

The 24.8% dip in Fiverr’s stock value, they claim, is reflective of the world reopening. There’s a problem with that assessment. It ignores the possibility that freelancers and buyers may be transitioning to a platform that is more secure and reliable.

By saying, “it’s just people going outside,” Fiverr can reassure their stockholders that the company will bounce back a-ok. There has been, in fact, growth within the company itself by as much as 60%. If you’re looking for a sweet stock tip, it might be time to buy stock in Fiverr right now.

What Fiverr Offers

The top 10 highest paid side hustles in the United States on Fiverr are:

- Website Design – $700

- Social Media Manager – $675

- Proofreading and Editing – $660

- CV, Cover Letter, and Resume Building – $600

- Website Building – $580

- 3D and 2D Modeling – $550

- Business Consulting – $500

- Social Media Advertising – $500

- Graphic Design – $500

- Presentation – $450

Those numbers are the max price earned per job. Sounds pretty okay, right? Well, those are not guaranteed rates. The struggle of freelance is the unreliability of work. You, as a freelancer, are responsible for maintaining your own hours, keeping up business, and guaranteeing your own salary. For some, it’s nice to be your own boss. For others, it can be difficult to maintain that level of consistency. And that’s where Fiverr is supposed to make things easier for you.

Gig Economies Today

Gig economies are the sexy new thing to talk about. Companies like Fiverr, Uber, Lyft, and more love using freelancers because they legally do not count as employees. No health insurance, no benefits, no guaranteed hours. Basically, these companies reap all the benefits and return very little, or nothing, to the workers they rely on to exist.

As gig economy jobs are coming under more intense scrutiny, a person transitioning their career from one to the next and use freelance as the in-between may find themselves in the crosshairs.

So, in order to recover from this dip, Fiverr launched a Seller Plus program. Instead of being guaranteed work, freelancers can pay $29 a month to access:

- Dedicated Success Manager

- Faster Payment Clearance

- Priority Access to Growth Programs

- Priority Support

- Advanced Analytics

- Advanced Customer Engagement Tools

- Exclusive Events and Educational Content

If you want Fiverr to look out for you, you need to pay them. They need you in order to operate, but you have to pay them in order to safeguard your new career as a freelancer.

It seems that Fiverr’s mission “to change how the world works together” is actually a far more familiar and historically consistent “rely on the workers but keep all the benefits” model that has sustained billionaires for decades.

Fiverr and Its Freelancers

Fiverr doesn’t make anything but connections. You can think of them as a middle man. Someone to hook you up with work for a cut of the action. While it may seem a little unfair, the fee can be worth the price of reducing the hunt for projects.

This would all be well and good if Fiverr had a good track record for protecting its freelancers. But, for a company that needs freelancers in order to exist, they sure seem to have more interest in protecting the buyers than defending its freelancers.

Reviews across the board say similar things: Fiverr is good for buyers, not so great for sellers. The word “scam” comes up more often than not. Which is another bright neon red flag, except it’s now on fire.

Fiverr’s Freelancers Review

“Exceptionally awful seller policy. An astonishing amount of inconsiderate buyers who can freely get a refund while the seller gets nothing for their work if a cancellation is requested – ranging from reason as “I placed the order on accident” to crude insults.”

“System is rigged to take and hold onto your money. Both buyers and sellers pay high fees. Buyers cannot withdraw money if a job gets cancelled and refunded. Sellers have to wait two weeks to receive payments for completed work. It’s 2020, this is not a technical limitation. It’s a very poor ethics decision. Would leave a zero star rating if I could.”

“Just read the rest of the reviews. I was booted from the platform because a buyer (they told me they were going to do this) threatened me with negative reviews if I wouldn’t do more work. When I refused to do more for them than I agreed to initially they flagged my account with customer service and I was suspended with no warning, no explanation, and no due process. Then my funds were held hostage for 90 days with no possibility of withdrawal.”

What’s The Solution?

Unfortunately, stock market dips reflect on the company’s value to shareholders rather than a healthy work environment for its freelancers.

As mentioned above, governments both internationally and domestically are examining gig economies much more closely. The days of Fiverr, Uber, Lyft, and others using their freelancers or independent contractors as cannon fodder could be limited.

Freelance is a tough gig, no matter what industry you find yourself in. You may be your own boss, but there’s no guarantee of work. You may have the freedom to set your own hours and choose your own clients, but reality sets in.

The freedom that comes with freelancing comes with a price. While Fiverr blames vaccines for its significant stock dip of 24.8%, they’re ignoring their own underlying issue by leaving their freelancers to twist in the wind.

Fiverr seems to forget, without freelancers, they have no business. Fiverr doesn’t make anything. Freelancers use Fiverr to collect clients and gather projects, but Fiverr isn’t the only option out there. If a freelancer has an opportunity to work without worrying about being screwed by a client or middleman, why wouldn’t they take it?

What Are Other Options?

For freelancers looking to escape or avoid the risky cesspool that is Fiverr, there is plenty to choose from. Such as:

- Upwork

- 99Designs

- Guru

- Toptal

- PeoplePerHour

- Freelancer

- Truelancer

- Outsourcely

There are more options out there, including joining a company where you can have established hours, guaranteed work, and benefits. You may not be your own boss, but you’ll be able to keep the lights on at home.

In Conclusion…

Fiverr’s stock had a not-so-insignificant dip of 24.8%, they blamed vaccines, and their freelancers are still getting screwed by abusive buyers that Fiverr allows getting away with theft.

If you’re a freelancer and you’re taking the opportunity to explore a new career, Fiverr is probably not going to be a safe bet. There is too high a risk of scam, and there’s no guarantee that Fiverr will look out for their own freelancers. It’s like a sheep joining a flock where the shepherd lets a wolf in for a fee.

For freelancers, there are options out there. Freelancing ain’t easy, but it doesn’t have to be as difficult as Fiverr allows it to be. If this company continues to believe in its success at the expense of its own freelancers, there’s a fairly good chance that there will be more stock dips in the future.

That is unless, of course, Fiverr decides to correct this offensive mistake.

Chris Blondell is a Philadelphia-based writer and social media strategist with a current focus on tech industry news. He has written about startups and entrepreneurs based in Denver, Seattle, Chicago, New Haven, and more. He has also written content for a true-crime blog, Sword and Scale, and developed social media content for a local spice shop. An occasional comedian, Chris Blondell also spends his time writing humorous content and performing stand-up for local audiences.

You may like

Business

Top 10 Video Marketing Agencies You Must Check Out in 2026

Published

21 hours agoon

December 19, 2025

If you’ve been following the latest marketing trends, you would know that video marketing is popular. Factors like lower costs, the availability of video platforms, and the rise of social media influencers helped change how consumers interact with video content. Read on to learn the best video marketing agency to help you leverage the power of video.

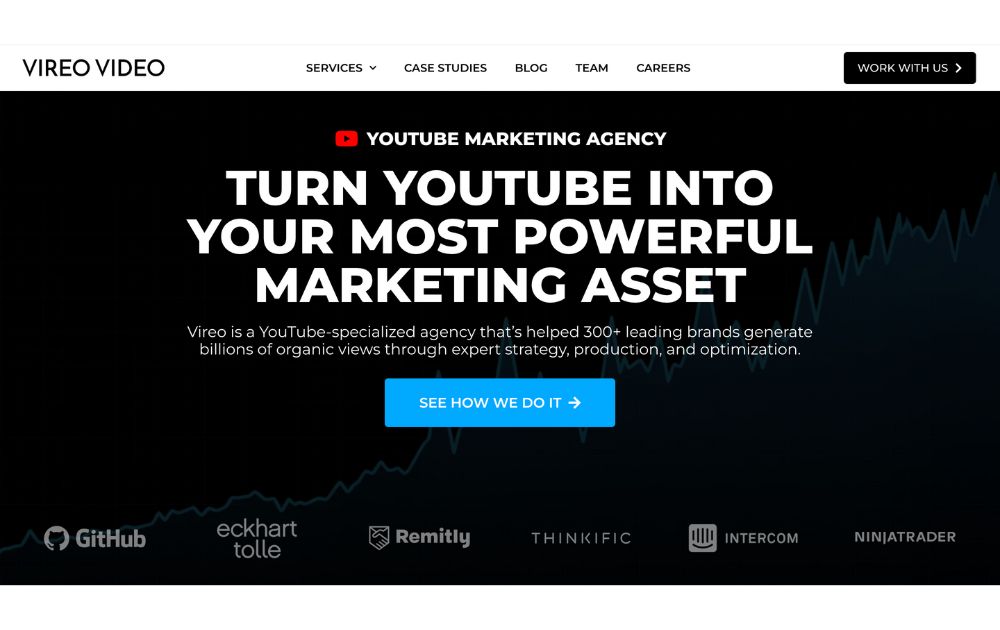

1. Vireo Video

If you need an expert in Youtube marketing, be sure to check the features of Vireo Video. The platform specializes in Youtube marketing and offers various video-related services, such as Youtube content strategy, SEO, and advertising.

Vireo Video is trusted by brands and influencers like bestselling author Eckhart Tolle. Vireo assisted in the optimization of his videos and helped grow his YouTube channel. As a result, his channel has 250 million views and 1.6 million new subscribers.

Key Services:

- Influencer marketing

- Video optimization

- Targeted YouTube advertising placements

- Strategy development

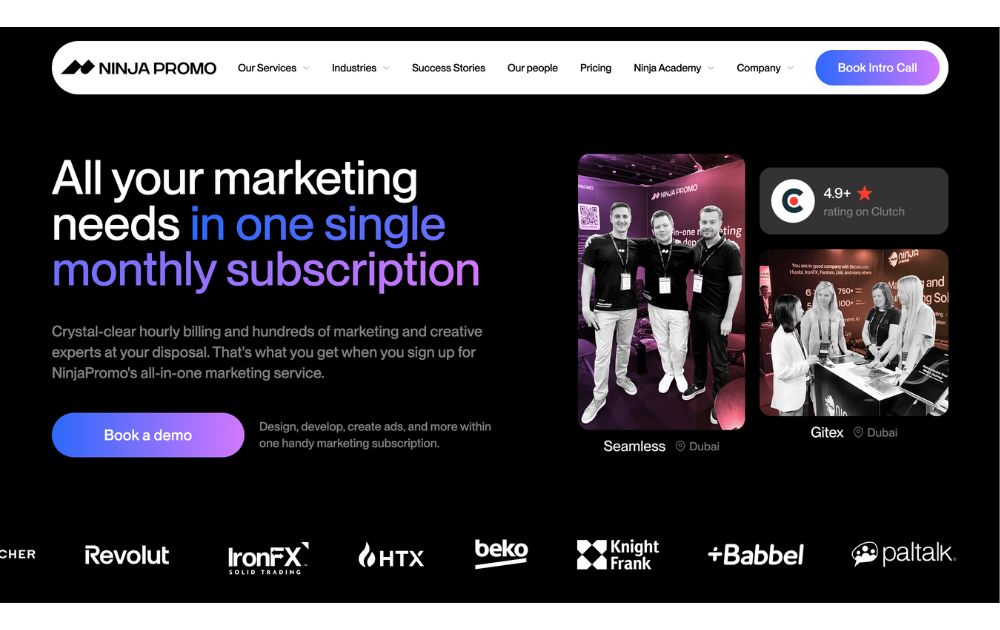

2. NinjaPromo

Video marketing is one of the many services offered by the digital marketing agency NinjaPromo. If you’re looking for a perfect partner to assist you in reaching your desired audience quickly, NinjaPromo is one of the best agencies to work with. The company can help you create creative, engaging, and practical videos to promote your brand and increase your online presence.

Key Services:

- Video Production

- Consultation

- SEO optimization

- Explainer videos

- Event and product videos

- Tutorials

3. Moburst

Moburst is a mobile and digital marketing agency that specializes in helping businesses grow their mobile apps. They offer different services to enable enterprises to improve their mobile app performance and increase user engagement. One of its clients is Samsung, which Moburst helped achieve +1,400% growth from downloads to social.

Key Services:

- App Store Optimization

- Video production

- Mobile User Acquisition

- Mobile App Analytics

- Mobile App Design and Development

- Mobile App Retargeting

4. Voy Media

Trusted by big brands like Lacoste, Voy Media is a full-service agency offering various marketing and creative services. Their services are designed to help businesses grow their brand. Likewise, the agency helps them generate leads and increase conversions through social media platforms. Voy Media also ensures its clients receive the necessary support by assigning a dedicated account manager.

Key Services:

- Video editing and production

- Product and lifestyle photography

- Graphic design and illustration

- Full studio production with talent and script

5. Pop Video

Pop Video was established in 2010 in Houston, Texas. They describe themselves as a business-first solution for a video-first world. Pop Video has a team of visual content creators with a specialization in video production and visual content marketing.

The agency has worked with various clients across different industries, including healthcare, technology, retail, and finance. Some of its notable clients include Microsoft, Adidas, and Coca-Cola.

In addition to its core video production services, Pop Video provides consulting and training services to help businesses develop their video marketing strategies and produce their video content in-house.

Key Services:

- Video Marketing

- Video production

- Animation

- Content creation

- Social media optimization

6. Epipheo

If you need help with educational videos, explore the services of Epipheo. Epipheo is a video marketing agency that creates animated explainer videos and other visual content to assist companies, organizations, and individuals in connecting with their audience effectively.

Key Services:

- Social video ads

- Storytelling testimonial videos

- Animated explainer videos

- Live action videos

- Strategy and consulting

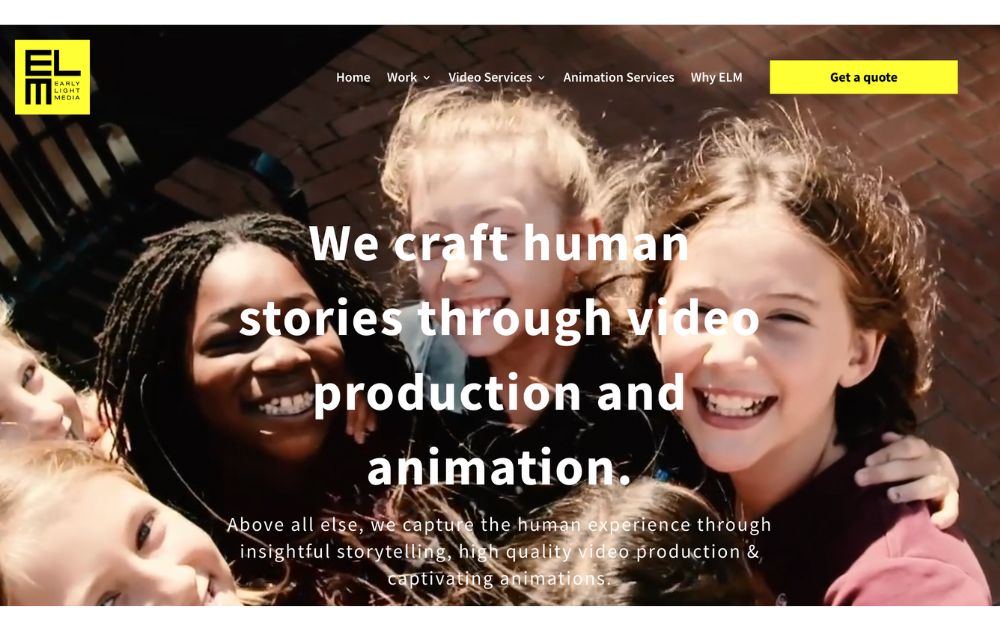

7. Early Light Media

Early Light Video is a full-service video production company that creates high-quality video content for businesses, nonprofits, and individuals. The agency is known for delivering top-notch video content that meets its clients’ needs. It was founded in 2013 by a team of Emmy Award-winning creative directors, with offices in Baltimore and Washington, DC.

Key Services:

- Video production

- Post-production

- Animation

- Voice-over casting

- Music Licensing

8. Indigo Productions

Indigo Productions is a full-service video production company based in New York City. They specialize in creating high-quality videos for corporate clients, advertising agencies, and individuals. Their team of scriptwriters, directors, producers, hair and make-up artists, and location scouts will handle all the logistics.

Key Services:

- Promo videos

- Web commercials

- Music videos

- Movie trailers

- Documentaries

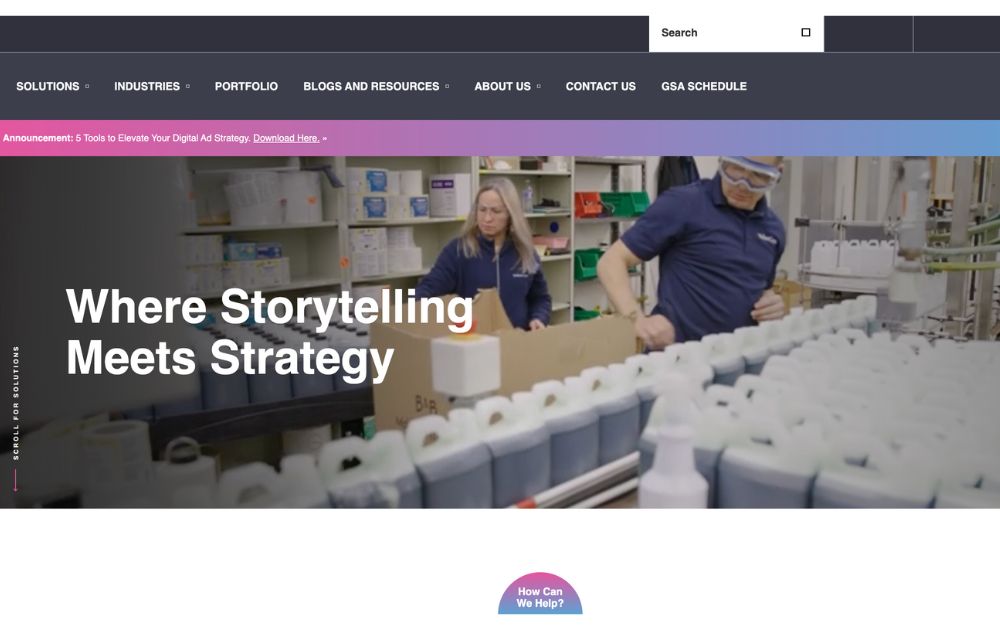

9. LAI Video

LAI Video is a Washington, DC-based boutique video production company specializing in creating visual stories that inspire and engage audiences. The company was established in 2013 and has become a leading video production agency in the DC metro area.

LAI Video has worked with various clients, including National Geographic, The World Bank, Georgetown University, and The Smithsonian Institution. Their skilled team of filmmakers, animators, editors, and producers works closely with clients to ensure that each video project meets their specific goals and objectives.

Key Services:

- Corporate videos and commercials

- Video communication campaigns

- Branding

- Video animation

- Marketing storytelling

10. SparkHouse

SparkHouse is a video production company based in Minneapolis, Minnesota, specializing in creating high-quality video content for businesses and organizations. The company was founded in 2013 by filmmakers and storytellers passionate about creating visually stunning and emotionally compelling videos.

SparkHouse has worked with various clients, including Target, 3M, Best Buy, and General Mills. Their talented filmmakers, animators, writers, and producers work closely with clients to ensure each video project is customized to their unique needs and objectives.

Key Services:

- Brand Videos

- Corporate Videos

- Animation

- Event Videos

- Social Media Videos

- Documentary Films

Which Types of Videos Do You Get from a Video Marketing Agency?

A video marketing agency typically provides various video types, each with a specific purpose and target audience. Below are the common types of videos you can request from a video marketing agency.

- Brand videos

- Explainer videos

- Corporate videos

- Testimonial videos

- Social media videos

- Live stream videos

- Case studies

- Reviews

- Tutorials

Conclusion

Video marketing is essential for businesses looking to engage their audience, build brand awareness, and drive conversions. That said, the competition will only continue to grow, making working with a reliable video marketing agency more critical than ever.

Featured Image Credit: Photo by fauxels from Pexels

TLDR: Penji is unlimited graphic design for a flat fee; Colab is digital transformation focused on brand storytelling; Jacob Tyler is a full-service brand strategy powerhouse; Micro1 is AI-powered engineering and tech design.

Did you know that California’s creative economy is worth more than $500 billion to the state’s economy? That’s a lot of creative minds at work!

The search for the best design agency in Los Angeles can be quite daunting. After all, 1 in 6 people in L.A. work in a creative field. It’s no surprise there are thousands of candidates that would be an ideal extension of your dream team.

If your business requires a rebrand or continuous graphic design efforts you can rely upon day in and day out, then finding the right design agency will help your business thrive. You need more than just a creator, you need someone to bring your vision to life.

To ease your research, here are the top four contenders as the best graphic design agency in Los Angeles.

1. Penji

The future of design has arrived. Seeking a design service upon demand? Penji is your new graphic design service that acts as an extension of your team.

No hidden costs, no missed deadlines and For a monthly flat-fee subscription service, you will have access to the top 2% of designers in the world with little more than a submission request for us to take it from there!

This is perfect for marketers or agencies seeking cohesive quality over hiring needs.

Pros:

- Unlimited Revisions: We keep refining until you are 100% happy.

- Flat Monthly Rate: No surprise fees or hourly billing.

- Fast Turnaround: Most drafts are delivered within 24-48 hours.

- Vetted Talent: We hire the top 2% of designers, so you don’t have to vet freelancers.

Cons:

- Subscription-based: This model is best for those with ongoing design needs rather than one-off projects.

2. Colab

When it comes to a design as a service partner with digital transformation as its focus, Colab is the place to be.

A location-based agency that takes a data-led transformational, story-driven approach to seamless UX, Colab is where brands/agencies should go when seeking to merge strategy creation/implementation through execution from start to finish—especially with websites that merge look/functionality with success.

Pros:

- Strategic Focus: They rely heavily on data to drive design decisions.

- Local Expertise: A deep understanding of the LA market.

- Full-Service: They handle everything from the backend code to the frontend visuals.

Cons:

- Higher Cost: As a traditional agency, their project fees will be significantly higher than a subscription model.

- Timeline: Large-scale digital transformation projects can take months to complete.

3. Jacob Tyler

For nearly 20 years, Jacob Tyler has existed in the California Brand Design Agency game as a powerhouse. This full-service digital communications agency will trim the fat from your ultimate brand strategy to hone in on what you truly need moving forward.

If you’re looking for a major professional facelift with omni-channel marketing and integrated deep brand strategy, Jacob Tyler is a heavyweight brand—literally!—who’s worked with everyone from startups to credit unions!

Pros:

- Experience: Over 20 years of experience in the industry.

- Comprehensive: They can handle your entire marketing funnel, not just the design.

- Award-Winning: A strong portfolio of successful, high-profile campaigns.

Cons:

- Project Minimums: They typically work with project budgets starting at $10k+, which may price out smaller startups.

- Complexity: Their comprehensive approach might be overkill if you just need graphic design execution.

4. Micro1

Micro1 takes creative human design efforts and merges them with AI functionality. As a critical graphic design agency, they use artificial intelligence for beauty and brains on websites/apps like never seen before!

Micro1 builds engineering teams behind major apps (think Tinder, Uber…) so if you’re a tech-based startup in need of cutting edge product development based on extraordinary UX/UI look no further!

Pros:

- Tech-Forward: Ideal for SaaS and app-based companies.

- AI Integration: Uses AI to enhance efficiency and speed.

- Scalable: Great for ambitious startups looking to grow their engineering and design capabilities simultaneously.

Cons:

- Niche Focus: They are heavily focused on product and app development, rather than general marketing graphics.

- Development Heavy: If you don’t need coding or software engineering, their full suite of services might not apply to you.

Credit for Cover image: Photo by Mikael Blomkvist on Pexels

Business

What’s the Best Graphic Design Service for Ongoing Marketing?

Published

2 days agoon

December 17, 2025

One constant part of managing a business is marketing: it’s a never-ending process. So, if you need a steady supply of social media posts, ad campaigns, and other visuals, you need to work with a reliable graphic design subscription service. Here are our top five:

1. Penji

Who doesn’t want unlimited graphic design for a fixed monthly fee? Penji offers plans with unlimited revisions, access to a team of design experts, fast turnaround times, and cost-effective pricing. This is the best option for business owners, marketers, agencies, and internal teams to get social media graphics, custom illustrations, logos, web and app designs, and many more.

2. Flocksy

Next, having a dedicated team of creatives without worrying about overhead expenses makes Flocksy an excellent design solution for marketers. Like Penji, it offers flat-rate pricing that’s predictable and suitable for businesses of all sizes. It provides graphic design services, video editing, motion graphics, and more.

3. Designity

Offering you the guidance of a US-based creative director, Designity is a graphic design service platform that’s ideal for modern businesses. It can provide you with a wide range of services, including motion graphics, videos, digital ads, social media graphics, and mobile app design and coding, among others.

4. ManyPixels

With a fast turnaround time for their unlimited design requests, ManyPixels is another reliable creative service platform for marketers. It provides ongoing support for your marketing efforts, including branding, illustrations, social media posts, print design, and video editing, to name a few.

5. Superside

Another creative-as-a-service platform, Superside, suits every size business and marketing team. It is ideal for those with high-volume design needs and a larger enterprise marketing network. You can get a wide array of graphic design services, including ad creatives, branding services, illustrations, and even eBooks and report designs.

21 bit casino bonuscode

Top 10 Video Marketing Agencies You Must Check Out in 2026

Casino mobile apps

The Top 8 Webinar Platforms For Your Next Virtual Event or Demo

Hash casino

Bizzo casino deposit bonus

Geheime casino tricks de erfahrung

Top 10 Presentation Software To Use in 2026

Top 10 Video Marketing Agencies You Must Check Out in 2026

Top 10 Social Media Scheduler Apps to Automate Your Postings

How Marketing Optimization Tools Level Up Your Marketing Game

The Top 8 Webinar Platforms For Your Next Virtual Event or Demo

What’s the Best Unlimited Graphic Design Subscription Platform?

Pinco Casino — a dominant platform throughout the 2025–2026 casino market in Canada

Trending

- Business21 hours ago

Top 10 Video Marketing Agencies You Must Check Out in 2026

- Technology24 hours ago

The Top 8 Webinar Platforms For Your Next Virtual Event or Demo

- Uncategorized4 days ago

BDMBet Sito web ufficiale 450 di bonus + 250 giri gratis

- cresuscasino3 days ago

Cadoola casino review

- Business3 days ago

What’s the Best Design Agency in Chicago

- azurcasino3 days ago

888 casino willkommensbonus

- cresuscasino3 days ago

Casino 400

- leonbetcasino3 days ago

Doubledown casino free chips bonus collector

- leonbetcasino2 days ago

Essence geant casino annemasse

- Business2 days ago

What’s the Best Graphic Design Service for Ongoing Marketing?