People

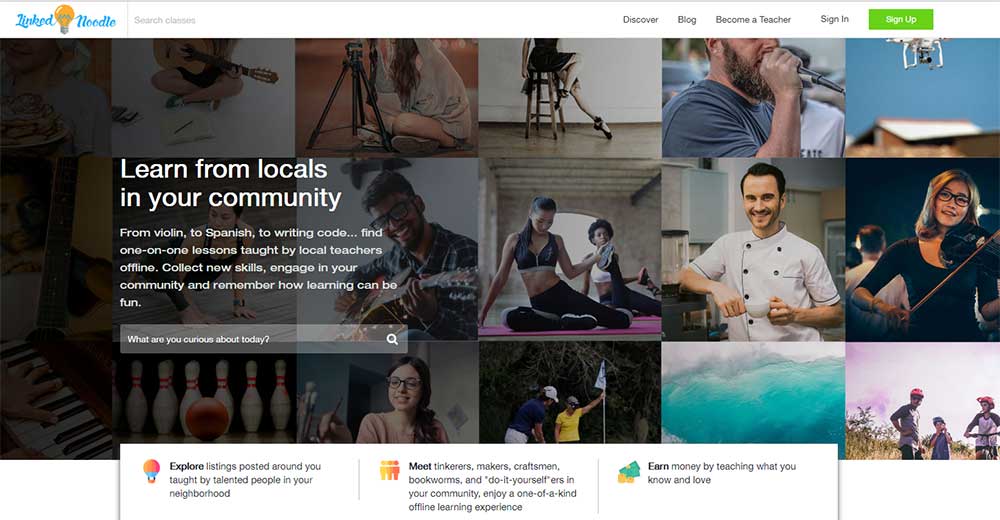

LinkedNoodle, A Startup That Will Bring People Together

Published

6 years agoon

By

Khai Tran

Owner Katrina Naidas is currently working with her team of developers and designers to create what is to be the next social platform that will connect people around their communities as well as promote healthy and diverse passion learning.

While in college, Katrina saw a huge problem with online education. Most of the online education platforms are accredited and owned by universities. Such platforms are often boring, monotonous, expensive, and anything but desirable for most people. Other platforms such as Udemy as skill based and offer an online experience that’s lonely and isolated from the world around the student. As a result, she came up with the idea of creating an online learning platform that’s fun, educational, and promotes a healthy community. Her platform (launch date TBA) will allow people from within the community to educate one another as well as create projects and enlist members of the community to participate.

The goal of the platform isn’t to change education, but more so to create a platform that makes learning fun, interactive, and allow adults to meet friends like we used to back in grade school.

At the moment, Katrina and her team are still in development and currently seeking funding to take her project to the next level. However, we should be seeing a beta release of the platform shortly. For more information, check out http://linkednoodle.com and signup for the Newsletter to receive updates and launch dates.

You may like

Business

5 Questions To Ask About Financial Sustainability

Published

2 years agoon

September 19, 2022

When it comes to financial sustainability, you’re going to want to know as much as possible. As the negative effects of climate change exacerbate, financial sectors are (finally) starting to shift their investments toward Environmental, Social, and Governance (ESG) considerations.

Sustainable finance is the process of taking ESG considerations into account when making viable investments. That means putting money into companies that develop renewable energy, hire and promote employ members of marginalized communities, and infrastructure that will help protect humans in at-risk environments.

This is a very serious, very complicated issue that we are running out of time to meaningfully tackle. There is also the risk that many of these efforts are performative (see: greenwashing), we have to make sure we are keeping those in power accountable.

Once again, we bring in our favorite finance expert, Danetha Doe Chief Economist at Clever Real Estate and creator of Money & Mimosas. There is a lot to consider when financing sustainability – and she’s here to break it down in a digestible way.

Here are 5 questions you should ask when considering financing sustainability, as explained by Danetha Doe.

Are these investments profitable? Or is this just charity for rich folks to pat themselves on the back?

Imperial College of London’s business school ran a multi-country analysis comparing the returns from each country’s largest fossil fuel and renewable energy stocks over the last 10 years. They found that renewable energy stocks delivered higher returns for both 5 and 10-year time periods.

Some people such as Kara Swisher and Chamath Palihapitiya think the next trillionaire will be someone that cracks a major problem in green energy. And for better or for worse, Elon is the richest person in the world based primarily on Tesla’s value.

All this to say, the answer is YES. You can care about the planet and make money at the same time.

Will these investments actually help the environment in tangible ways? How soon?

Broadly, yes, these investments will help – and are helping – the environment in tangible ways. Investing in solar panels, rainwater harvesting, and electric vehicles while divesting from fossil fuels will help to reduce the pollution from power plants.

The timeline of course correcting the damage that has already been done depends on a lot of factors. addition to investments from individuals, we need governmental bodies, Wall Street, and other parts of the private sector to continue to get on board.

President Biden’s Inflation Reduction Act includes environmental measures that will go a long way to support climate change efforts. The fashion industry, one of the biggest pollution culprits, has started to place a bigger emphasis on resale which will help to reduce waste. Wall Street has pumped out ESG funds that are more greenwashing than helpful, so we will need to hold them accountable.

As an individual, the way you choose to spend and invest your money will go a long way because it will force corporations to prioritize sustainability efforts.

Will taxing the wealthiest people their fair share help? Would something like a ban on private jets help?

The short answer is maybe. The corporate tax structure may need to be reviewed, but I’m a bigger fan of adding fees to resource use to cover the externalities and then redistributing those funds to climate change efforts. For example, Kourtney Kardashian exceeded her water allotment budget by 101,000 gallons in June. Instead of increasing her base income tax percentage, maybe there’s a fee of $1,000 for each gallon over the allotment budget. The $101,000,000 fee is then redistributed to technology companies solving the freshwater scarcity crisis.

Instead of banning private jets, you should have to pay a carbon fee for each ride. These fees might not stop the behavior, but they could finance the changes needed to get us to a greener future.

There are wealthy people who are actively trying to help with climate change efforts. Instead of penalizing all of them with a blanket tax, I suggest adding fees to resource use.

What kind of expenses will we be looking at if we fail to address climate change?

Deloitte’s report shows that inaction will cost the U.S. economy $14.5 trillion by 2070. Utility officials in Illinois estimate the warmer summers could cost locals an additional $11 billion over the next 30 years. By 2040, extreme heat in Arizona could add up to $110 to residents’ electric bills each year, according to the Environmental Defense Fund.

The Federal Reserve Bank of Chicago predicts homeowner’s insurance premiums to rise due to climate change. In fact, some insurers have already stopped covering parts of California deemed too risky because of wildfires

Why me? Why do I have to make these changes? Should it just be the corporations since they’re the ones ruining the world?

This is an all-hands-on-deck scenario. Corporations should be held accountable, but they do respond to your spending and investing decisions. Greenwashing wouldn’t exist if corporations thought no one cared about the environment. At the very least, be selfish and think about the fact that the quality of the environment directly impacts you. The more you do your part, the greater chance you’ll have at being able to enjoy the beautiful outdoors without worrying about fire smoke ruining your lungs or extreme flooding wiping out your island vacation home.

Where Do We Go From Here?

Investing in ESG is critical – but we have to be selective where we divest and relentless in our pursuit to ensure accountability. Further things to consider when financing sustainability are:

- Are these ESGs contributing to organizations or projects that counteract environmental harms perpetuated by the company? Or are they arbitrary investments that let them greenwash their reputation/only investments that provide “accreditation” over genuine impact?

- Are ESGs investing in genuine solutions, or projects that perpetuate inequities and environmental harm?

- Are companies engaging with ESGs also changing their own practices? Probably not: “They found that the companies in the ESG portfolios had worse compliance record for both labor and environmental rules. They also found that companies added to ESG portfolios did not subsequently improve compliance with labor or environmental regulations.”

- Also – looking at ESG investments relative to a company’s other investments is imperative.

We send many thanks to Danetha Doe for her expertise in the financial field and her lovely disposition. Be sure to check out Money & Mimosas for other financial tips!

Big thank you to Molly Blondell for her perspective on sustainable finance as an expert in the field.

We can solve the climate crisis – we have a lot of work ahead of us. Get involved in your community, start in your neighborhood. Organize a clean-up, press your local officials to get serious about recycling programs, any little thing you can do helps.

Let’s get to work.

We live in distracting times. And with many of us operating remotely or in computer-dependent workplaces, it’s not hard to imagine why. But modern obstacles call for modern solutions. There are a number of apps on the market today to help you integrate a more efficient workflow.

What is a productivity app?

A mobile productivity app is a software program that allows smartphone, tablet, and wearable device users to perform essential day-to-day tasks.

Productivity apps are meant to increase the efficiency of their users. They can be useful for individuals and teams looking for transparent, collaborative methods of communication. A good productivity app can help you focus on work, track habits, manage time, and prioritize your obligations. Finding the best tool for your schedule and lifestyle is key.

What are the best productivity apps?

Here are 5 productivity apps to give you an extra push.

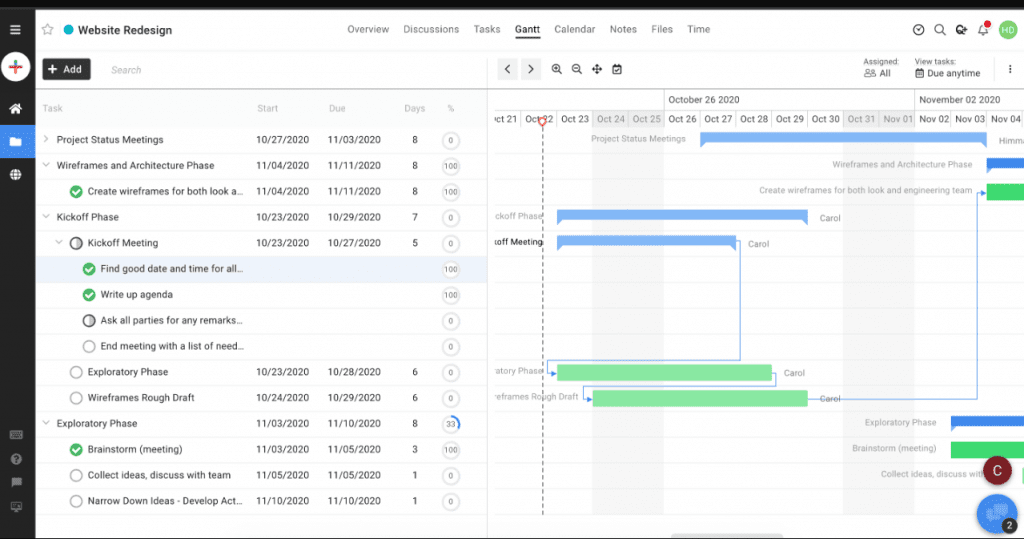

Proofhub

Proofhub helps teams organize and track their projects, facilitating a smoother collaborative process. What makes ProofHub one of the best project management apps, however, is that it has tools that help your team discuss visual materials.

Proofhub isn’t without its compromises. It doesn’t have budgeting, invoicing, or resources management tools. But you can integrate Proofhub with your accounting software if needed!

Pricing:

- Essential – $45/month. 40 projects, unlimited users, and 15GB storage.

- Ultimate Control – $89/month. Unlimited projects, unlimited users, and 100GB storage.

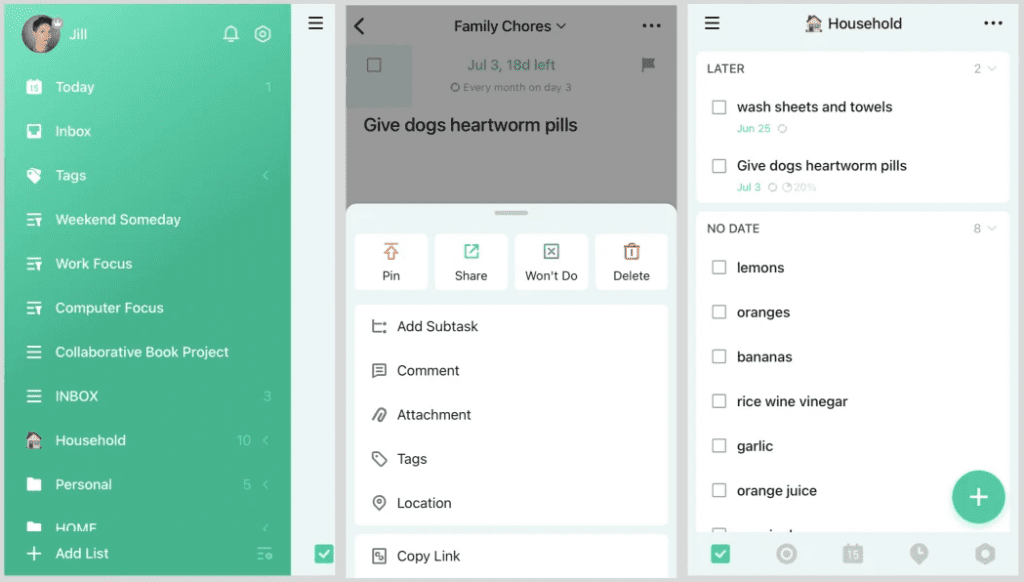

TickTick

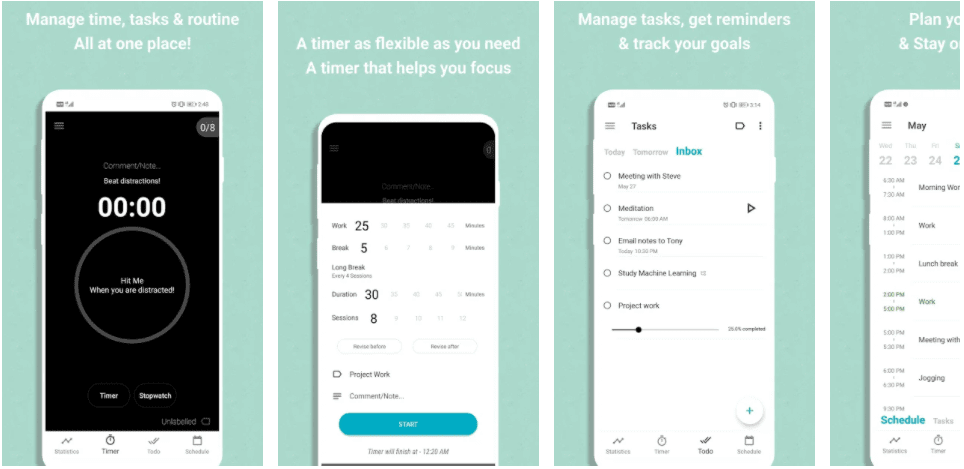

TickTick is a cross-platform and collaborative to-do app that has a few neat features suited to the Getting Things Done (GTD) method of working and the Pomodoro Technique. TickTick offers two membership tiers: free and premium. Both tiers offer strategies for focusing to get hard work done without wasting time or procrastinating.

However, TickTick’s free account does carry some restrictions. For example, you can only make 9 lists, with 99 tasks per list, and 19 subtasks in any task. In terms of collaborating, free account holders can only invite one person per list.

TickTick’s Premium service allows you to add up to 5 reminders on each task, and share a task list with up to 29 members, making collaboration easier for your team. Additionally, you can upload 99 attachments every day.

Pricing:

- Free

- Premium: $2.99/month. $27.99/year ($2.33/m).

Trello

Trello is a great choice for fans of simplicity and those looking for the most user-friendly project management solutions. It’s easy to use and has almost no learning curve at all.

Trello’s free plan may actually suffice for smaller teams with lighter task management needs. This is especially true for individuals looking to manage their own workflow, rather than to oversee the work of others. However, the free plan does miss out on some helpful features, such as Trello’s priority support.

Pricing:

- Free: $0/month per user.

- Business Class: $12.50/month per user.

- Enterprise: $17.59/month per user.

Engross

Engross can be useful for those looking to improve their focus while working from home or manage a bustling life on the go. This app offers a clean, minimalist design that saves you the trouble of acclimating to a busier, more feature-laden app.

Engross includes a Pomodoro clock, a planner and calendar, and reminders alongside statistical analysis of how you use your time.

Pricing:

- Free: $0/month per user.

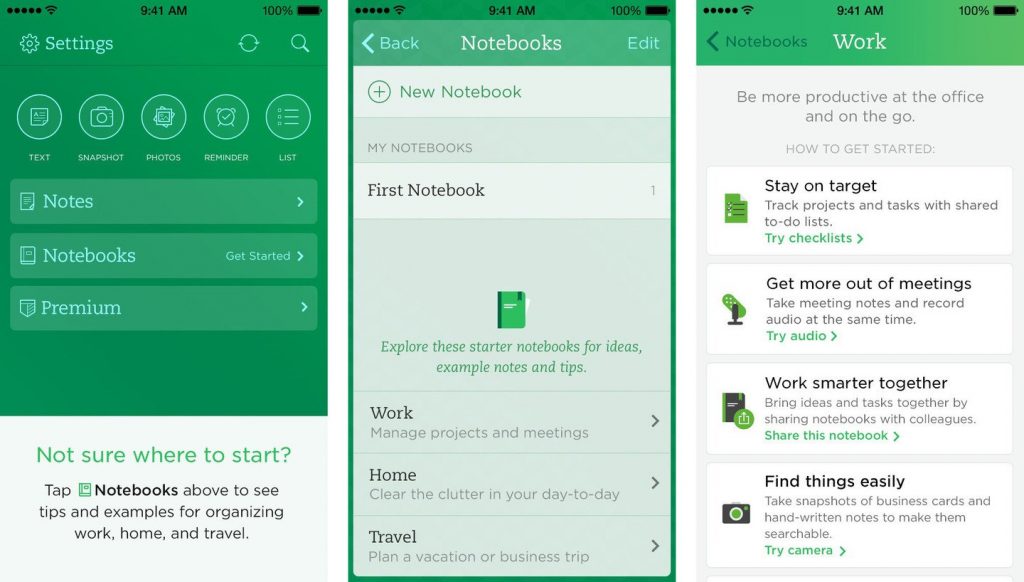

Evernote

Evernote has been regarded as the king of note-taking apps. But this has as much (if not more) to do with its tenured status as its effectiveness. It’s been around since 2004, which means it’s seen a lot of changes to the way we integrate technology into our task management.

The primary strength of Evernote is, of course, note-taking. Individual files are saved in Notes, which can then be organized into thematic Notebooks. Multiple Notebooks can be combined to create Notebook Stacks.

Evernote is known for its straightforward, intuitive interface. On both desktop and mobile, Evernote’s UI is clean and makes use of familiar icons to indicate the tool’s core functions.

Pricing:

- Free: $0/month per member.

- Personal Account: $8/month.

- Professional Account: $10/month per user.

- Endnote Teams Account: $15/month per user.

Trader Joe’s employees at a store in Hadley, Mass., have voted 45-31 to unionize, becoming the first location in the company to do so, according to the National Labor Relations Board.

The election marks yet another victory for working people and continues the promising trend of unionizing efforts across the country. The petition for the election was announced in June, with workers expressing a desire to have more say when it comes to compensation, benefits, and workplace safety.

“We would like to have a system that guarantees accountability from management,”

said Jamie Edwards, a Trader Joe’s Crewmember.

“A system that guarantees our benefits won’t be stripped away whenever they feel like it. But, overall, it’s about us having that power, and being able to make those decisions as a team.”

The election results achieve the first step towards that end.

Labor Movements

But for the workers in Hadley— a small town located about 100 miles west of Boston— the fight for a union began in May, when workers issued an open letter to company CEO Dan Bane. The letter cited concerns about pay, benefits, and safety.

The letter, dated May 14, was posted through the workers’ social media pages under the name “Trader Joe’s United.”

The 81 workers at the store — called crew members by the company — were eligible to vote in the election supervised by the National Labor Relations Board.

The letter claims that two years ago, in March 2020, Bane sent a letter to the employees of Trader Joe’s. He asserted that unions were “falsely” claiming only they can protect the pay and benefits employees “currently enjoy”.

A Contract in the Works

In a statement to the press, a Trader Joe’s spokesperson said,

“We are prepared to immediately begin discussions with union representatives for the employees at this store to negotiate a contract. We are willing to use any current union contract for a multi-state grocery company with stores in the area, selected by the union representatives, as a template to negotiate a new structure for the employees in this store; including pay, retirement, healthcare, and working conditions such as scheduling and job flexibility.”

Trader Joe’s may be the latest company to see a successful attempt at unionizing, but their effort comes on the heels of several other labor victories around the country.

A Growing Wave of Labor Victories

The National Labor Relations Board (NLRB) has seen a 58% increase in union representation filings over the past year alone, as well as a 16% increase in claims of unfair labor practices.

In December, a Starbucks in Buffalo became the first of its company-owned U.S. locations to form a union. Since then, at least 150 of the 9,000 company-run U.S. stores have voted to unionize, with 10 stores rejecting the union.

In January, engineers and other Google workers announced that they had formed a union—the Alphabet Workers Union— named after Google’s parent company, Alphabet. It represents about 800 Google employees.

April saw Amazon workers in Staten Island, New York vote to unionize, marking a first for the retail giant.

In May, video game workers at a division of game publisher Activision Blizzard voted to unionize, making them the first to create a labor union at a large U.S. videogame company.

What’s Next for Trader Joe’s Hadley Location?

The Hadley location employees are celebrating their organizing victory, but now comes the task of coming together for contract negotiations.

“Today, Trader Joe’s Hadley became the first unionized Trader Joe’s location, ever,”

the group said in a statement Thursday.

“We now begin the difficult work of sitting down at the negotiating table as equals with our employer, and securing a contract that will benefit and protect us, the crew, instead of the company’s bottom line,”

the statement continued.

The corporation has more than 530 locations across the U.S., with 10,000 employees and an estimated 2022 revenue of $13.3 billion.

Workers at two other Trader Joe’s locations have begun their own unionizing efforts as well. More Perfect Union reported Thursday that workers at a location in Minneapolis had filed for a union election, following the vote in Hadley. Workers at a Boulder, Colorado, store filed an election petition with the National Labor Relations Board on Tuesday.

8 Popular Mobile Payment Systems

Omnichannel Marketing Platforms: Definition, Examples & Tools

10 Camping Tech Tools for a Fun Adventure

10 Adventure Travel Destinations You Don’t Want to Miss

10 Sustainable Outdoor Gear Brands

10 Sustainable Activewear Brands