Business

Lisa Frank: A Look Behind The Rainbow

Published

3 years agoon

By

Akilah S

Ah, the ’80s and ‘90s; what a time to be alive. Any girl from that era will tell you all about her Tamagotchi pets, her My Little Pony toys, and, of course, her Lisa Frank everything.

In case you weren’t there, Lisa Frank was a massive brand created in 1979. The company is currently recognized for its nostalgic sparkles, unicorns, adorable pandas, and being

“the world’s sh*ttiest employer.”

No, I’m serious. That’s a true quote from Coraline, a Tuscon, Arizona resident. When she was looking for a new job, she happened to be near the headquarters. Fortunately for her, the locals had warned her about Lisa Frank Inc.’s constant rotating door.

This colorful firm, it turns out, wasn’t all sunshine and glitter. A chaotic, drunken shitshow of a business was hidden behind those brilliant blue panda eyes.

If you don’t want to have your childhood ruined, I recommend skipping this article. But, let’s be honest here, your innocence has already been damaged if you’re on the internet. So, let’s find out what happened to turn this rainbow paradise into a technicolor travesty.

The Neon Rainbow Forms

Lisa Frank is not only a brand name, but an actual person. Born on April 21st, 1955, Frank always had a passion for arts and crafts. Growing up in Detroit, she was the epitome of the “girly girl” archetype. Coloring, painting, crocheting, and ceramics were among her favorite activities. Her parents, who came from an affluent background, encouraged her to pursue her artistic passions.

During her senior year of high school, Lisa Frank made a whopping $3,000 by selling her art at an event. This notes the very first time her artwork gained monetary success. She went on to the University of Arizona to further her education.

To make some extra cash, Frank stated that she would acquire low-cost ceramics and jewelry from local Native American communities She’d then take them back home to Michigan, and slap a much higher price on them.

Yeah… kinda shady if you ask me. But I suppose from Lisa’s perspective; business was business! Of course, the overpriced artwork became a hit in her area, and she even began telling these indigenous artists exactly what to create. Chances are, they weren’t properly compensated. Regardless, Frank’s small business was her first step toward pursuing a career in entrepreneurship.

Around the age of 20, she launched the brand “Sticky Fingers,” which consisted of chunky jewelry with hand-crafted designs. This time, it was her own work, which was already being sold at places like Bloomingdales, and Neiman Marcus. Although Lisa was talented in her own right, her socioeconomic status provided a spotlight on said talent. Her family had connections to powerful people who saw the immense potential in her art style.

Lisa Frank soon renamed this brand after herself. And thus, the legend was born.

Lisa Frank EVERYTHING

Along with the name change, the brand began to offer new products. Lisa would tour a variety of museums and zoos, as well as speak with children. She was inspired to create something that reminded her of childhood; something that could transport people into a whimsical wonderland.

Backpacks, folders, pencils, notes, and stickers were among the items sold by her company. They were all covered in the most flamboyant graphics you’ll ever see. I’m talking rainbows, dolphins, multicolored leopards, bears, and of course, sparkles. You cannot forget the sparkles.

Lisa Frank, Inc. was a juggernaut. And that is putting it mildly. Not having anything Lisa Frank was social suicide in the 1980s and 1990s. At least, that’s how it went in the world of middle school girls. It was not uncommon in the ‘80s to come across a little girl decked out in Lisa Frank gear. Hell, you might’ve been one of them!

As for me personally, I, unfortunately, wasn’t around in the ‘80s or ‘90s. I was an early 2000’s kid. Regardless, shopping for back-to-school items meant coming across many Lisa Frank notebooks and folders. I may have not bought any myself (It was all about Bratz and Disney Princesses for me), but I saw plenty of classmates sporting them.

And if you were to ask 5-year-old me if she’d like to work for Lisa Frank, she would’ve jumped up for joy.

Behind The Scenes

Back when it first started, Lisa Frank INC. was just like any other big corporate business. I’m sure employees had their regular ups and downs, but it was an overall decent place to work.

That all changed, however, with the addition of Lisa’s then-husband, James Green.

James Green was originally the first in-house designer and illustrator. He worked in close proximity to Lisa Frank, and from there, they developed a relationship. Green rose through the ranks over time, eventually marrying Frank in 1994.

After having kids, Frank seemed to reconsider her business ventures. Longing to focus solely on her artwork and children, she decided to step down and let her husband take over as CEO. Doesn’t sound like a bad idea, right?

As it turns out, letting James Green take over was probably the worst mistake she’s ever made. With his attitude, illegal activity, and consistent drama, Green is credited for running his wife’s company into the ground.

James Green ran his business as an abusive authority figure. He was rumored to house substance abuse issues, which he’d carry with him every day to the workplace. Communication was sloppy and overwhelming. While working for Lisa Frank, one would expect the office space to be filled with liveliness and color. Though while the headquarters were painted that way, employees were demanded to work in complete silence. A worker would not be brought aside to speak one-on-one if they stepped a bit out of line. James Green instead chose to shout, berate, and humiliate his staff in front of their coworkers.

To top it all off, despite the company being named after his wife, Green was also rumored to be having an affair. From the workers’ perspectives, it seemed rather obvious that he and his coworker, Rhonda Rowlette, had a less than professional relationship.

I can’t confirm whether the infidelity rumor is true. Though what I can say is that he and Rhonda made the headquarters a living nightmare. Here are just a few of the horror stories from people who’ve worked for and with Lisa Frank.

- Jeffrey L Buchanan stated that when partnering with Lisa Frank, Green would be “argumentative with my buyers and relationship sources.”

- Lisa Decristofaro stated Green was responsible for canceling her health benefits. Conversations between herself and coworkers were also illegally recorded, and then played within Rhonda Rowlette’s office.

- Betty Hack stated that emails and phone calls were hacked and monitored so that the CEO knew if anyone contacted Lisa.

Furthermore, many lawsuits arose from former employees who weren’t receiving proper and timely paychecks.

Outside The Office

Unfortunately, Lisa Frank couldn’t keep their controversies inside the office. The batshit business practices found their way outside the revolving doors.

Sure there has been some minor stuff over the years, such as Lisa Frank comparing her struggles, laughably, to Michael Jackson. Or the complaints surrounding the “sexualization” of Frank’s stylized human characters.

But I’m not here to talk about those things. Lord knows every company gets its fair share of criticism. I care more about the exploitation of other creators

That’s right, we need to discuss the Lisa Frank Hotel.

The Cloudland Catastrophe

Amina Mucciolo is a visual artist, designer, and online personality. She also goes by TasselFairy on YouTube. She blew up for creating this kick-ass apartment complex.

Just taking one glance at it, you can see the absolutely stunning color, the decorative artwork, and the fun furniture. It’s not hard to understand why she went viral.

While Mucciolo may have taken inspiration from Lisa Frank, and other colorful aesthetics, it’s clear that the apartment was her own design. A design that she poured her heart and soul into. She called it “Cloudland.”

Amina Muccio was a black creator living in her dream apartment, with her art being recognized by millions. And I mean millions. She was featured in multiple magazines and news articles.

It wasn’t long before Lisa Frank’s Instagram account reached out to the artist on multiple occasions. They simply shouted her out, direct messaged her, and complimented Mucciolo on her creativity.

Seems like harmless fun, right? Well, unfortunately, this is exactly where the pleasantries end.

In 2019 (yes, that recently!), Hotels.com announced a collaboration with Lisa Frank. It included the creation of an entire apartment dedicated to her work. When photos of this “Lisa Frank flat” were posted, many people noticed how similar the layout was to Mucciolo’s.

To make matters worse, Amina Mucciolo received notice from her landlord that she would have to vacate her apartment by October of that year. Interestingly enough, this new Lisa Frank flat was owned by Barsala, who just so happens to be affiliated with Hotels.com.

So, I believe we can all agree that this landlord was looking to profit from Lisa Frank’s popularity. They tried to accomplish this by evicting Mucciolo from her apartment and repurposing it for similar reasons.

Now, to be fair, it’s unclear as to whether Lisa Frank Inc. had any direct involvement in evicting this creator. All I know is that it’s eerily similar to how this business began: by exploiting and capitalizing on smaller artists. POC artists, to be precise.

A Deserted Neon Rainbow

As I’m writing this in 2022, the Lisa Frank headquarters are deserted. The once colorful walls have faded, the outside statues have decayed, and the grass has grown out of control.

Though our nostalgia may be saddened by Lisa Frank’s downward spiral, the truth is that it was a rare diamond of its time. And, as a result of its enormous success, similar products made by independent artists are now available. Artists who are satisfied with their work, are paid fairly and are not harassed by their superiors.

If Lisa Frank’s story teaches us anything, it’s that we should respect our employees as individuals. A positive work environment is conducive to long-term success.

Business

What’s the Best Graphic Design Service for Merchandise Design?

Published

1 day agoon

November 21, 2025

TLDR: Penji is the best choice for merchandise design, with unlimited revisions and a focus on quality. Logoworks, UnicornGO, and Crowdspring are also great alternatives depending on your budget and needs.

Have your merch line all ready to go but need assistance on the design? You’re not alone. Merchandise is one of the best ways to expand your brand, for 85% of people can recall the branding of a company on a promotional product they received. Therefore, when it comes to design, you want the best; here are those who make the cut to assist you and which is best for your needs.

1. Penji

Need a variety of designs for merch but a higher quality? Penji is your on-demand, unlimited graphic design services. Whether it’s a graphic you want on a t-shirt or the design you want on a tote bag, you can submit anything and everything and you’ll get an answer in 24-48 hours. Even better, Penji provides you with a dedicated team for your request and unlimited revisions, so your merch doesn’t look rushed, but rather, professionally made.

Pros:

- Unlimited requests and revisions.

- Fast turnaround time (1-2 days).

- Dedicated designers who get to know you and your vision.

- Access to all files needed for resale.

Cons:

- Not necessarily sustainable for a one-off request or even two-off requests.

- There is no 24-hour emergency turnaround.

2. Logoworks

Logoworks is a nice one-off option or a nice start-off kind of company to get new businesses off on the right path. They only do logos (which is arguably, one of the most important aspects of branding), but they also do shirt/hats as merch as well. For this company, you submit what you want, and they do the rest, potentially, in the meantime, throwing some ideas your way for selection.

Pros:

- Project based pricing – only pay for what you get.

- Multiple concepts possible through the package.

- Guaranteed satisfaction/revisions possible.

Cons:

- They only care about doing logos – no fun re-branding merch or anything like that.

- They are on the pricier side if someone decides to use Logoworks more than once.

3. UnicornGO

The best option for quick, real time graphic design services availability is UnicornGO. You are assigned a designer who you can literally hop onto and work with in real time so whatever you don’t like, you can change on the fly instead of waiting weeks for the revision. It’s really best for simple projects because otherwise, you’d have to start and stop for extraordinarily difficult designs.

Pros:

- Real time access to a designer with whom you can collaborate in real time.

- Quick turnaround (15-30 minutes for simple things).

- Pay-as-you-go for services rendered.

Cons:

- Real time access isn’t great for complex work – better for easier stuff.

- We need real time access too, to collaborate with you.

4. Crowdspring

Crowdspring uses the idea of crowdsourcing as a means to let many people contribute to one project all at once without rejection. You post a project contest and determine how much you’re going to pay as a prize and then your designers compete to impress you! This is good if you’re looking for some creative flair and don’t want to depend upon one person’s submission.

Pros:

- Lots of different submissions/designs can come through from various sources.

- Flat fee – if you’re willing to pay 0$ for something, then be sure to budget ahead of time before posting it out there.

- Once someone wins your project, you own the rights.

Cons:

- Some designs may not be as good as others in terms of quality over others.

- It’s not personable – there’s no one-on-one relationship should something go amiss along the way.

Image Credit: Photo by Hanna Pad on pexels

Business

Top 10 Resource Planning Tools Every Business Should Know About

Published

2 days agoon

November 20, 2025By

Carmen Day

Getting things done on time is paramount for any project, business, or endeavor. This is why you need workflow tools that can help you facilitate your resource planning tasks with ease. This crucial step in the project management cycle determines how you should use your people and equipment. Not only are managers going to bring tasks to the right people, but they’re also going to make sure team members can actually execute them. Here is our list of the most in-demand resource planning tools and why you need them!

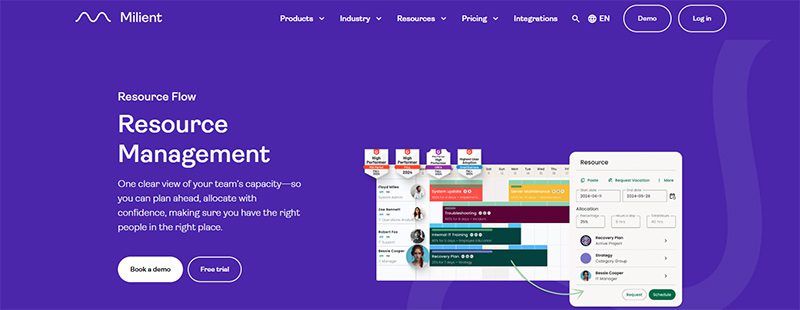

1. Milient Resource Management

Milient is one of the best resource management tools for big companies. For one, they provide a couple of business functions. They include skill matrices, tags, and GANTT charts, so you can connect and determine sources. HubPlanner also lets you request resources, so you know which ones are available.

Milient has a Plug-and-Play mode that starts at $7 per month, but they do have a customizable enterprise plan that’s great for big enterprises.

2. Mosaic

Are you also super tired of doing repetitive tasks? We get it. As a project manager, there are often many things on your plate. If you’re looking for reliable resource capacity planning software Mosaic is a solid choice.

It provides analytics for your resources and projects and is a highly efficient collaboration tool. Apart from that, we’ve also heard that Mosaic has incredible customer support. They offer three plans: the Starter, Professional, and Enterprise. Contact their sales team directly for pricing.

3. Smartsheet

Meanwhile, Smartsheet is another tool that lets you scale up projects quickly. What makes it an ideal tool for managers is its project forecasting tools. Most resource planning tools only help you plan how to use your resources. Here, they also forecast the resources you need for future projects.

Apart from that, Smartsheet has custom templates as well as advanced filtering. The tool starts at $12 per user per month.

4. Forecast

Are your account managers getting tired of keeping up with clients? Regarding work tools, we’ve found Forecast to be the best for service-oriented companies. Along with a visual dashboard, work reports, and timesheets, this tool lets you keep your clients up to date with projects without letting them see your current resources. You can even send them invoices from the platform. Handy!

This tool lets you receive updates and see your team’s availability status. Contact their sales team directly for pricing.

5. nTask

On the other hand, nTask is another reliable tool that helps you with all-around project tracking. Here, you get management software that helps set your team’s milestones, budgets, and to-do lists. It also comes with a built-in time-tracking tool to see the completion metrics of every project stage.

It’s hard to complete projects on time, so nTask sets a planned and actual due date. Finally, it’s a great option for companies that want to save a penny. Their entry-level plan starts at $4 a month.

6. Microsoft Planner

You might have a resource planning tool just sitting right under your nose. Microsoft Planner is Microsoft’s management tool. Like other items on the list, it provides a visual way to organize your resources. Apart from that, it also has built-in AI-powered analytics to help you get insights into your resources.

This is one of the best resource planning tools, free, but only if you already have an existing Microsoft 365 account.

7. Kantata

Next, Kantata has comprehensive tools to make your project management life easier. Aside from role-based and scenario planning, it also has resource forecasting, so you can check what resources you might need in the future.

This tool also works for capacity management. Plus, it integrates with dashboards like HubSpot, Jira, and G Suite.

8. Ganttic

As you can probably tell already from the name, Ganttic is a software that offers visual Gantt charts. This system will help you check which resources are overused, which projects lack capacity, and who you can tap for extra work. The tool is also highly customizable and comes with filtered tags—color-code and group people so you’ll stay on top of your teams.

Plus, Ganttic integrates with your current work dashboards. Whether it’s Google, Outlook, or a custom integration, they can fit into most work suites. Ganttic starts at $25 a month per user.

9. Resource Guru

If you’re looking for a detailed resource analytics tool, make Resource Guru part of your team. This tool offers simple features that allow you to schedule your resources with a drag-and-drop system. But what sets this tool apart is its clash management feature that prevents you from overbooking resources.

Here, you can monitor your resource data and even pull key metrics, such as billable time, into the mix. This tool costs $5 per person per month.

10. Teamdeck

Looking for a comprehensive platform for HR managers? Don’t worry; we’ve also got Teamdeck. Along with being one of the best resource management tools, it’s also reliable for HR teams. Here, you get various features like scheduling, time tracking, and timesheets. You can also list down your team’s current and future workload.

But Teamdeck lets your staff request vacation days and even track their time on the platform. Oh, and did we mention that this tool also integrates with Google Calendar, Slack, Asana, and more? Their entry-level plan starts at $6 per user a month.

Resource management tools and techniques help you analyze your resources to make smart decisions to boost productivity.

The best way to find the right tool for your team is to look at the tool’s integrations, UI, customizations, and overall work features. If you find that one suits your team’s needs perfectly, then that’s your secret sauce.

Each tool has its unique features and benefits, and choosing the right one depends on your organization’s needs and budget. With the help of these resource planning tools, project managers can streamline their workflows, optimize resource utilization, and deliver projects on time and within budget.

Business

What’s the Best Graphic Design Service for Modern Website UI/UX?

Published

2 days agoon

November 19, 2025

Today’s modern website goes beyond having impressive aesthetics; it strategizes. These sites guide users, build trust, and convert prospects. If you want all these incorporated in your web design, here are five of the best graphic design services for website UI/UX designs you can choose to work with:

1. Penji

Offering unlimited graphic design services, Penji has a team of top-caliber designers specializing in a wide range of services. You can send requests for UI/UX design, infographics, custom illustrations, and more. Its turnaround times of 24 to 48 hours allow you to get designs when you need them. All these for a flat monthly subscription fee.

2. DesignBro

An online graphic design platform, DesignBro, connects businesses with talented design experts. It gives you two options to get UI/UX designs. You can choose from its talent pool and work directly with a designer of your choice. Or you can hold a contest and wait for designers to submit entries, then choose from them.

3. Kimp

Another design-as-a-service platform like Penji, Kimp offers unlimited design requests and revisions for fixed monthly rates. Your projects will be handled by a dedicated design team, ensuring consistent quality. You can send requests for UI/UX designs, infographics, social media graphics, logos, and presentation designs, among others.

4. ManyPixels

For businesses that need a constant supply of visual assets, ManyPixels is an excellent choice. It offers unlimited design requests for flat monthly subscription fees. It frees you from the hassles of hiring freelancers or the expensive costs of design agencies.

5. Fiverr Pro

If you need a one-off UI/UX design, Fiverr Pro is an excellent option. It is one of the world’s top online marketplaces for freelancers. It lets you choose from a wide array of vetted designers from all over the world. This gives you the option to hire based on rates, location, experience, and expertise.

What’s the Best Graphic Design Service for Merchandise Design?

Top 10 Resource Planning Tools Every Business Should Know About

What’s the Best Graphic Design Service for App Interface Design

What’s the Best Graphic Design Service for Modern Website UI/UX?

The CHIPS Act: What It Means for the Semiconductor Industry

Meet the Speakers of Digital Cut 2026: Seth Godin, Ali Abdaal & Neil Patel

What’s the Best Graphic Design Service for Beauty & Wellness Brands

Our Top 10 Video Editing Tools for Smarter Content Production

How TikTok and Instagram Track You Using In-App Browsers

The CHIPS Act: What It Means for the Semiconductor Industry

10 Best AI Tools for Entrepreneurs

Top 10 Resource Planning Tools Every Business Should Know About

What are the Best Graphic Design Services for Fashion Brands?

What’s the Best Graphic Design Service for Education & eLearning?

Trending

- Business4 days ago

The CHIPS Act: What It Means for the Semiconductor Industry

- Business2 days ago

Top 10 Resource Planning Tools Every Business Should Know About

- Uncategorized4 days ago

Meet the Speakers of Digital Cut 2026: Seth Godin, Ali Abdaal & Neil Patel

- Featured2 days ago

What’s the Best Graphic Design Service for App Interface Design

- Business2 days ago

What’s the Best Graphic Design Service for Modern Website UI/UX?

- Business1 day ago

What’s the Best Graphic Design Service for Merchandise Design?

Robert A

June 14, 2022 at 7:48 pm

Very interesting read… didn’t know all of the behind the scenes details of the Lisa Frank story until now. My mom loved her stuff back in the 1980’s. Good stuff.

Tracy

June 18, 2022 at 6:39 pm

Love this article I remember Lisa Frank 😊

Nicky

August 20, 2022 at 4:42 pm

Well she’s blowing up all over again. Anything Lisa Frank co-branded such as Loungefly, Crocs, phone cases, Urban Outfitters, etc all sell out within minutes. Weird that the LF company doesn’t take advantage of the resurgence of interest & strike while the iron is hot.