Top Stories

New Crazy-A** Software Takes Internet by Storm: DALL-E Mini

Published

3 years agoon

By

Akilah S

If you’ve been on Twitter lately, you’ve noticed that people have been sharing all sorts of crazy images. Like, crazier images than usual.

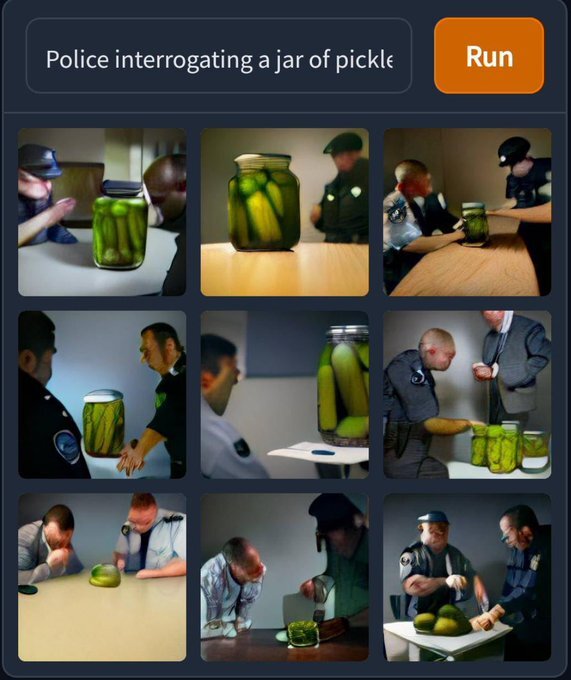

You’ve probably seen users combine so many words and phrases to generate these insane pictures. A rabbi holding an avocado? A group of police officers interrogating a jar of pickles? Why? How? What’s happening? The images in question can be anywhere from surprisingly realistic, or hysterically disturbing.

If you’re wondering how people create these images, you’ve come to the right place. Let’s take a look at the newest AI software that’s sweeping the internet; DALL-E Mini.

Where Did This Even Come From?

First off, you may be confused as to how these images were even made. Where the hell did they come from? Well, it can all be tracked down to two culprits: Google Imagen software along with OpenAI.

OpenAI is a startup that was backed by Microsoft. They are currently in the process of creating this new software called “DALL-E 2.” It is beautifully described as “a new AI system that can create realistic images and art from a description in natural language.”

In plain English, DALL-E 2’s objective is to generate images from text.

Now, unfortunately, this isn’t available to the general public. Not yet, at least. As for now, the only way to gain official access is to join a dreaded waitlist. You also have to prove that you are some kind of professional designer, illustrator, or in a related field.

The images you’re seeing likely are from DALL-E 2’s early users. Often friends or relatives of the employees work for OpenAI. Or, you’re seeing images generated from another system; DALL-E Mini.

The DALL-E Mini Tool

DALL-E Mini is an open-source code available to the general public. This was created by a different, smaller team of loosely organized developers. As you can probably guess, it’s a result of the constant demand and impatience for DALL-E 2’s release.

The process is rather simple. You can visit their website at any time, and type a word or phrase into the text bar. After that, you can press “Run” and the tool will create 9 images for you.

Much like its parent tool, these images are generated by pulling from multiple online sources. It identifies key parts of your text, then finds various images from across the web. This includes Flickr and Google Images, to name a few.

Due to the website’s popularity, things can get complicated on the technical side of things. Demand overload will cause users to often get a pop-up when running a prompt. “Too much traffic, try again later.” has become a notorious staple of the website. Though because the demand will almost always be overloaded, it’s best to not actually try again later. Instead, you want to keep clicking “Run” until the message disappears.

Yeah, things can get annoying like that sometimes. But in the end, you get these really sweet and hilarious pics to show off to your friends. I’d say it’s worth it. DALL-E is a simple and fun time-waster for the average user. And a future super-serious tool for professional designers.

If you’d like to try out the new technology for yourself, here it is. Be warned; you may get addicted.

You may like

Merck is currently in talks to acquire Seagen, a biotech company. The Wall Street Journal reports that the transaction is valued at $40 billion. And what happens if Merck acquires Seagen, and how would this acquisition benefit cancer research and treatment? Read more about the Merck Seagen buyout here.

Merck Seagen Buyout

Merck and Seagen are still deciding on their share prices. So far, talks have yet to reach an agreement on $200 per share. Both companies want to settle and finalize their deals before Merck announces its quarterly earnings on July 28. At the time of writing, Seagen’s stock was at $176.19.

With an estimated market value of $235 billion, Merck is looking to expand its presence in the cancer treatment space. The Merck Seagen Buyout could play a major role in that strategy. Since Seagen specializes in targeted cancer therapies, the acquisition would give Merck access to a broader range of oncology products.

Shareholder reactions to the new deal are overwhelmingly positive, and the stocks have been up since talks about the deal have been made public.

But this is not the first time that Merck and Seagen have made the news. Back in 2020, they collaborated because of cancer treatments. Seagen has a drug conjugate (ladiratuzumab vedotin) which would be used in conjunction with Merck’s Keytruda.

Merck reveals that Keytruda is its highest-selling product. It’s immunotherapy for cancer.

And this deal could help Merck offset the possibility of reduced sales because it will lose patent protection in 2028.

As promising as this deal is, there could be scrutiny from antitrust officials since there might be a litigation case from the Federal Trade Commission or Justice Department.

The Seagen buyout isn’t the only deal Merck has made recently. They’ve been busy closing another deal, but with Orion too.

Seagen

As a cancer biotech company, Seagen has therapies to ensure that patients benefit from the treatment and reduce any adverse side effects. Their treatments involve the therapy attacking tumors with toxins.

Merck partnering with Seagen isn’t a bad idea considering that Seagen made $1.4 billion in sales in 2021, most of it coming from Adcetris and Padcev (a treatment for urothelial cancers).

Merck-Orion Deal

In the middle of the Merck Seagen Buyout, Merck has recently partnered with Orion for the ODM-208 and other drugs. These drugs are related to the production of steroids. Orion found how it can combat hormone-dependent cancers and further developed this inhibitor.

Their deal includes that they should develop ODM-208 and promote it to the public together. And Orion will receive a $290 million payment from Merck.

Although they’re co-developing and marketing the new inhibitor, Orion will oversee the manufacturing side.

Co-developing the ODM-208 can help Merck with its current research and treatments for prostate cancer. President and CEO of Orion, Timo Lappalainen, says that this partnership will benefit Merck’s goals of treating cancer worldwide.

Other Ventures: Merck’s Role in the Pandemic

You may have heard about COVID-19 pills, which are a form of treatment for those diagnosed with mild to moderate COVID-19. Merck introduced an antiviral COVID-19 pill to the public. The name: Molnupiravir.

The COVID-19 pill is not a replacement for a vaccination. Instead, it stops the replication of the COVID-19 genetic code and keeps the patient out of the hospital. Not yet FDA-approved, Molnupiravir has been authorized for emergency use since December 23, 2021.

And for other stories, read more here at Owner’s Mag!

Technology

BeReal App: Will It Ever Survive Its Instagram Clone?

Published

4 weeks agoon

June 12, 2025

Social media trends come and go, everyone’s well aware of this by now. And currently, the app at the center stage is TikTok, the short-video hosting app. However, a new kid on the block is making waves, the BeReal app. Looking at the feedback from TikTok users, it seems that BeReal appears to have exploded so quickly.

What is BeReal App?

Source: Android Police

BeReal app is a new social media phenomenon that operates under a simple premise at works this way:

- Once a day, the app will alert you to take a photo. It will take one from your rear camera and one from your front camera a few seconds later.

- You will have a two-minute interval to take this photo to capture candid images.

- Then, the BeReal app will lay your front photo over your rear photo.

- You can share it with your friends. However, you won’t be able to see their posts until the next day. And if you missed the two-hour window, you’ll have to wait until the next day.

- You can also react to your friend’s posts by sharing a quick selfie attached to their post.

The premise behind these weird shooting windows is to encourage people to share snippets from their lives that aren’t just hand picked from parties or any planned events. But, it’s not the first app to go for the candid angle. Back in 2016, Casey Neistat of YouTube developed an app called Beme. The app encouraged users to take videos with their phones clasped to their chest so that, allegedly, they could stay focused on the moment. Later that year, CNN bought the app but ultimately shut it down in 2018.

BeReal vs Beme

What BeReal had that Beme didn’t was the ability to operate for two years with the increasing number of users showing for it. Based on a BeReal app job posting, the app has more than 10 million daiily users. It also says the company’s goal is to increase this number to over 100 million. Quite an ambitious goal but recent reports project the mid-size social media network Snapchat at about 350 million daily active users.

As Snapchat popularized the concept of communication through disappearing messages, BeReal may be relying on its own style to continue and encourage future partnerships with other businesses. Clubhouse, an audio-based social app that went live around the same time as BeReal, had plenty of activities to back it up, but things have quickly cooled down. It is recently experimenting with new features to make the app nteresting enough to attract more users. Meanwhile, the novelty of BeReal is still fresh, but once the surge of interest from TikTok has mellowed down, it will need to learn to be independent and beat the competitors.

What is an Instagram Candid?

Meta seems to be working on a feature called “Candid Challenges” for Instagram. Discovered by self-described reverse engineer Allessandro Palluzzi, users would be notified once a day to take and share a “candid.” It also copies BeReal right down to the last detail, giving users just two minutes to take the candid.

An Instagram spokesperson told Engadget that the feature was an “internal prototype” and with no users testing the feature. Still, we are yet to see this announced soon in an Instagram update.

While Meta has been the only company confirmed to be working on a BeReal clone, it wouldn’t be surprising if Twitter or TikTok followed suit as well. Twitter, specifically, might see BeReal candid shots a fit for the microblogging platform, but considering its brave attempt at copying Snapchat’s stories and the on-going buyout buzz with Elon Musk, it’ll need to stride carefully.

While BeReal is becoming popular, it faces an uncertain future. Will it end up being defeated by Meta as have many other successful startups that even vaguely have a conflicting interest with its existing properties? Or will it fail to innovate like Clubhouse did and die off after its 15 minutes in the spotlight? It might be a welcome change to the airbrushed faces and saturated filters from Instagram, but BeReal might just end up being a little too real for its own good.

If you’re interested in trying out the BeReal App, download it from the Play Store. Just remember you know how to take a selfie before you start aad that you’ll only get one shot daily.

Looking for an alternative to Design Pickle? We have just the list for you.

Design subscriptions are now popular amongst entrepreneurs, small businesses, and even corporate giants. The model is simple: you pay a flat monthly rate and get as much design help as you need – websites, custom illustrations, branding assets, ad design, packaging design, and more.

In a world where traditional agencies charge exorbitant fees and the freelance market is hit or miss, more and more brands are opting for this simple, comprehensive design solution. If you have no time to vet freelancers for every project and no budget for a team of in-house designers, this might be a perfect fit for you.

We went ahead and ranked the top unlimited graphic design companies in the industry that rival Design Pickle.

1. Penji

One of the top competitors of Design Pickle is Penji. This is because Penji offers a very comparable gamut of design services at a lower price point. Penji is one of the biggest unlimited graphic design providers in the industry and has consistently received strong reviews (4.8 average) across sites like Trustpilot, Facebook, and Google.

Penji stands out for its responsive customer service and exceptional designers. Their user-friendly platform makes requesting designs simple, allowing users to easily navigate and communicate with their designer. Each tier of Penji’s subscription is tailored to cater to diverse requirements, be it ad creatives, presentation designs, or motion graphics, ensuring various types of clients get the most value for their dollar.

Why we recommend:

– Designers are matched to your project based on their skillset and your specific need

– Penji offers logo designs, illustrations, and UX/UI for apps & websites

– Their customer support is responsive and quick

– There are over 100 design services to choose from

– You get access to a Project Manager or Art Director at higher tiers

Price: $499-$1497

2. Superside

Superside is a well-known company offering scalable design solutions that are suitable for brands of various sizes, from startups to large enterprises. Their services are priced significantly higher than other graphic design services, so they’re best for companies with larger budgets.

Why we recommend:

– You get access to a dedicated design team

– They offer static and motion ad creative for testing ads

– They’ve worked with big brands like Google, Shopify, and Meta

– Superside’s video production quality is top notch

– If you run out of design credits, you can order more at any tier

Price: $5,000-$13,000 (50-150 credits)

3. Fiverr

Fiverr is the only non-subscription service on the list, but many people don’t realize that individual freelancers can now offer subscriptions on Fiverr. The platform is famous for its wide range of freelance services at an incredibly affordable price. Typically, Fiverr matches you with a freelancer for a one-off project like a logo or website design. You might be able to get a logo for just $15, but in-demand designers might charge you $1000-2000 for a website.

Why we recommend:

– Fiverr manages the relationship, making financial transactions safer

– There’s no need to waste time or money hiring a full-time designer if you don’t need one

– You can choose from hundreds of designers to find the exact style you like

Price: varies widely (You might be able to get a logo for just $15, but in-demand designers might charge you $1000-2000 for a website.)

4. Flocksy

Flocksy is another unlimited graphic design service much like Penji and Superside. The company has a decent reputation online and offers comparable services to other design subscriptions. However, there are two major differences: They offer copywriting and video editing. Flocksy gives you access to an easy-to-use platform for submitting requests, tracking progress, and communicating with the creative team.

Why we recommend:

– Flocksy offers video editing and copywriting in their two highest tiers

– You can get Zapier integrations at every tier if desired

– They offer a 14-day money back guarantee if you choose not to continue

Price: $499-$1695

5. ManyPixels

Manypixels is another growing company that offers a similar service to Design Pickle at a comparable price. The company boasts clients like Teachable and Buffer. You can also get free stock assets from Manypixels, which is a nice perk to complement unlimited designs.

Why we recommend:

– Have an intuitive online platform for communication and storing files

– Pay monthly, quarterly, or yearly (save 10% quarterly, 20% yearly)

– Get a designated designer at the highest tier and collaborate in real-time

Price: $549-$1299

6. Kimp

Kimp is similar to other graphic design subscription services but offers unique pricing tiers. Unlike its competitors, Kimp provides both design and video services without requiring separate plans, ensuring a comprehensive creative solution. Clients also benefit from dedicated design and video teams, ensuring consistent quality and brand alignment across all projects.

Why we recommend:

– Choose only what you need: video, graphics, or both

– A speedy 2-4 day turnaround for video projects

– Kimp offers a 2-month discount as you’re getting started

– Get free stock video, audio and images in their top tier

Price: $599-$995

7. DesignJoy

DesignJoy came along just two years after Superside and have similar price range. They’re a big name in the design industry because they’ve worked with brands like Google and Verizon. Their standard tier allows you the manage unlimited brands along with unlimited users and stock photos.

Why we recommend:

– Webflow development available on both tiers

– Unlimited users on their higher tier

– You can refer a friend and get 5% monthly recurring commissions

Price: $4,995-$7,995

8. Delesign

Delesign has existed since 2017 and has leveled up its services each year. For the same price as many others on the list, Delesign also offers 2D animation videos. We’re not sure of the quality, length, or requirements, but this is a great bonus for brands that want to incorporate it.

Why we recommend:

– 2D animation videos are included in the package

– Guarantees quick turnaround times for initial drafts: 24 to 48 hours

– Zapier and Slack integrations on every plan

Price: $599 – $1799

9. No Limit Creatives

Roughly the same age as Delesign, No Limit Creatives is another design services that has grown in notoriety in recent years. They’re unique in that they offer 4 tiers for graphic design while most offer 3. Like Kimp, they have a tier for graphics and video, and each tier allows a different number of requests at a time. Their lowest price tier uses design credits much like Superside’s model.

Why we recommend:

– Get a dedicated design team on 3 out of 4 tiers

– A whopping 3 requests at a time are available at the highest tier

– The highest tier also offers real-time communication through Slack

– NLC provides video editing and video creation

Price: $499-1499

10. Kapa99

Kapa99 is a small company but they compete well with larger competitors like Design Pickle. They’ve been around since 2014 and thus have had plenty of time to perfect their craft. Kapa’s tiers are split into just two: Business and Business Express. Express offers speedier delivery for clients with more pressing deadlines.

Why we recommend:

– They offer a significant discount for the first two months of your subscription

– There’s no limit to how many ‘active tasks’ you can have on your dashboard

– Native Adobe source files

– Canva file delivery

Price: $499-$999

Top 12 Uses for The Metaverse That Will Change Your Life

Top 10 Best Places to Buy a Mid Century Modern Office Chair

The Best Online Payroll Services [Updated for 2025]

Top 10 Small Business Organization Tools for 2025

8 Best Equipment for YouTube Every Content Creator Needs

Merck Seagen Buyout: What to Know About the Deal

The Rise and Fall of Juul: Once a Silicon Valley Darling, Now Banned by FDA

What’s the Deal With Elomir? Is Axis Klarity a Scam?

Why Having an Advisory Board Could Make or Break Your Startup

Top 10 Best Places to Buy a Mid Century Modern Office Chair

8 Best Equipment for YouTube Every Content Creator Needs

The Rise and Fall of Juul: Once a Silicon Valley Darling, Now Banned by FDA

The Best Ways to Recession Proof Your Business