People

From Tragedy to Triumph: Entrepreneur Turns His Life Around After 8-Year Sentence

Published

3 years agoon

By

Akilah S

When most people hear about a teenager going to prison, they don’t think of success stories. However, it is what ultimately led Marcus Bullock to where he is today. As of 2022, he’s an entrepreneur with a company that helps prisoners connect with loved ones.

The Story of a Young Teen

Marcus Bullock was only 15 years old when he and a friend were arrested for carjacking a stranger. A very stupid mistake made by a teenager. Only this black teenager was tried as an adult, landing a sentence of 8 years in prison. And not just any prison; it was a maximum-security establishment made for adults.

By the two-year mark, Bullock believed his life to be over. It was a hopeless situation; he just couldn’t accept the fact he’d serve the entire sentence. He was depressed and anxious for a way to get out. Or at the very least, achieve some kind of normalcy while serving his time.

When he confided in his mother one day, she said this to him;

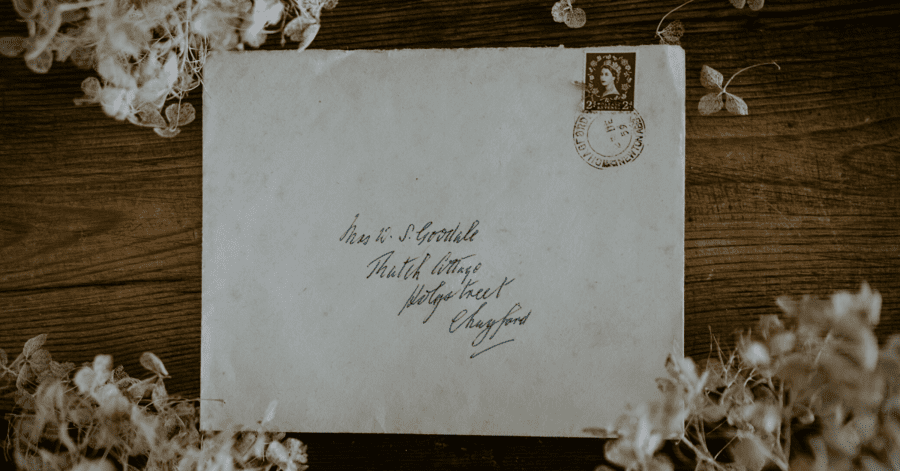

“Marcus, I’m going to write you a letter or send you a picture every day for the remaining six years of your sentence,”

Those were the words that saved Bullock from his downward spiral. For six years, his mother kept her promise, sending him constant reminders of her love. Her daily pictures and letters gave him a reason to live. It’s what kept him going throughout the rest of his term. It’s what made him look towards the future; what his life would be like after his sentence.

The System

Many people see prisoners as just that; bad people who commit crimes and get punished accordingly. They don’t stop to wonder what drives a person to engage in criminal activity. They don’t even think of the fact that prisoners are human beings; ones with a conscious, with emotions, and with a very high depression rate.

Doing a bad thing doesn’t always make someone a bad person. Of course, when people make terrible decisions, they must face the consequences. But this doesn’t mean that they have to live a life of endless suffering.

That’s why, when Marcus Bullock got out of prison, he created this awesome company called Filkshop.

What is Filkshop?

Bullock had considerable success starting a painting and construction business once he ultimately got out of prison in 2012. But still, he desired more. Bullock had pledged to send his prison pals postcards after leaving. In addition to sharing his experience of reentering society, he wanted his friends to feel the same sense of hope that he had. So, Bullock came up with an idea that would change his life for the better.

Filkshop is an app and website that allows people to seamlessly communicate with a loved one in prison. How it works is simple. For only $0.99, you can upload any picture or message to send to a friend, family member, or anyone doing their time. Flinkshop will print whatever message you have onto a postcard. It’ll then be shipped directly to the inmate in question.

At first, Bullock admitted to not knowing what he was doing. Though as he got the hang of entrepreneurship, he noticed that he was good at public speaking and taking advice.

Soon enough, Flinkshop was endorsed by none other than John Legend. As part of his criminal justice organization, #FREEAMERICA, Legend gave Flinkshop strong financial backing.

Marcus Bullock probably didn’t expect Flinkshop blow up the way it did. But he is very grateful for the opportunity to build his generational wealth.

You may like

The buzz on the headlines these past few years makes it impossible not to notice: “Only 21 lesbian bars remain in America,” or “The rise and fall of America’s lesbian bars,” and “Why lesbian bars are disappearing.”

The once-thriving niche of lesbian bars has indeed dwindled. The ones that remain have become clandestine tourist destinations littered around the heartland. These last bastions of the lesbian community are now few and far between.

However, we see a glimmer of hope with recent developments. It could be that grassroots campaigns are poised to save lesbian bars from the brink.

Let’s back up a little.

The origin of lesbian bars

If you’re a fan of Moulin Rouge (or French history, I guess), you might know a bit about the inception of the modern lesbian bar. Artist Toulouse Lautrec often chronicled the lesbian nightlife in turn-of-the-century France. Bars like Le Rat Mort were owned and frequented by lesbians.

This phenomenon spread to other areas of high society in the early 20th century. In Weimar Germany, lesbian entrepreneur Elsa Conrad owned multiple such bars. Bars for women were a rarity in the US at the time, but the upper-crust Cafe des Beaux-Arts, which operated in New York from 1911 to 1921, is cited as an early example.

Prohibition and its aftermath

When we talk about the modern history of lesbian bars, the clock usually starts after Prohibition’s repeal in 1933. Bars like Roselle Inn in Chicago and Mona’s in San Francisco opened shortly thereafter.

It’s worth noting, however, that lesbian bars truly started to pop up during Prohibition. Where women had previously been legally discouraged from drinking, the total prohibition of alcohol was ironically an expanding force. Women could drink freely in speakeasies, and even own them.

The lesbian bars that sprang up after Prohibition were the offspring of the lesbian speakeasies that came before, such as Eve’s Hangout, which was shut down after a 1926 police raid.

The golden age of lesbian bars

Lesbian bars and communities continued to grow, aided by the growth of cities and economic prosperity that followed World War II. Bars of this era still faced plenty of threats. Gay activity was still criminalized, organized crime was eager to capitalize, and internal debates split the community in twain.

In the ‘50s, de facto segregation and economic inequality kept many Black lesbians out of major lesbian bars. So did rigid attitudes about lesbian coupling built around butch/femme (or stud/femme) binaries.

Gay rights!

The first lesbian political organization, the Daughters of Bilitis, was formed in 1955. This was an early motion in the broader LGBTQ+ rights movement, which shone a national spotlight on lesbian and gay communities.

As the movement grew throughout the ‘60s, so did identification with/interest in lesbianism. As lesbian feminism developed in the ‘70s, lesbian bars became activist spaces in addition to social ones. By the ‘80s, there were over 200 lesbian bars nationwide.

There’s just one problem, and it’s a problem that emerges any time social spaces become political ones: politics create conflict. Divisions bubbled over who should and shouldn’t be included in lesbian spaces, from trans women to straight “political lesbians.” This fed into the damaging notion that “lesbian” itself was an exclusionary term.

The slow, painful fall

These divisions persisted, but lesbian bars remained fairly prevalent throughout the ‘80s and ‘90s. New movements led to new expansions. The Combahee River Collective helped open doors for lesbians of color. The community was ravaged by the AIDS crisis, but activism on that front helped bring the broader LGBT community together. By the mid-’90s, the Lesbian Avengers were bringing lesbian issues to the forefront of the community.

So, what did kill the lesbian bar? 9/11? The recession? Is it somehow Ellen’s fault?

The truth is, there was no one incident that sent lesbian bars into freefall. The more society as a whole accepted lesbians, the more patronage for these tight-knit neighborhood bars dwindled.

Meanwhile, over the course of the ‘00s, people kind of stopped meeting each other in person. The social role that lesbian bars once played could now be fulfilled much more accessibly by online forums, and later social media.

Statistics show that interest in the “lesbian” label itself may have declined in the ‘00s and ‘10s as well. Post-lesbian discourse has tended to frame the label as too exclusive. While the broader LGBTQ+ community experienced substantial growth in the 21st century, the lesbian community didn’t share in the majority of those gains.

The ravages of COVID-19

Articles about the dramatic decline in lesbian bars started to pop up in the late ‘10s. In 2019, it was estimated that only 15 such bars remained; in fact, there were 21. A string of closings occurred throughout the 2010s as business dwindled and rents increased.

When COVID hit, activists like Erica Rose and Elina Street sounded the alarm. Rose and Street initiated the Lesbian Bar Project, a fundraising campaign aimed at preserving the remaining bars.

Lincoln, NE’s Panic Bar closed in November 2020. In Philly, Toasted Walnut shuttered in February 2021. Even as the Lesbian Bar Project and other campaigns shone a national light on the issue, it seemed like the institution was quickly becoming a thing of the past.

But wait, there’s more?

A confluence of factors led to increasingly dire conditions for the country’s remaining lesbian bars. Pandemic-era restrictions were the final straw for many. But then, something shifted.

See, the pandemic may have kept us apart from each other, but it also reminded us how much we miss sharing a space. As restrictions were lifted, grassroots movements started to form dedicated to providing new, in-person social spaces for lesbians.

The lesbian bar revival

As the tireless work of the Lesbian Bar Project kept the remaining bars afloat, social groups and pop-ups started to form across the country. Lesbian Social Detroit. SHELiFE in Miami. Sip City Mixer here in Philly.

These groups coordinate regular events that go beyond the narrow scope of a bar: picnics, beach parties, sporting events. At the same time, they reflect a growing, vibrant, and (contrary to the popular stereotype) inclusive lesbian community nationwide.

As You Are in DC began as a pop-up series, but has now set up a permanent home. The Sports Bra, the first women’s sports bar, is now open in Portland, where another lesbian bar (Doc Marie’s) is opening just this week.

You can thank Lesbian Bar Project for their tireless work keeping remaining lesbian bars alive. You can also thank the internet which, once thought a detriment to the lesbian label, has now invited a new generation of lesbians to flourish.

Looking ahead, more of these pop-ups are trying to set up brick-and-mortar locations. Dave’s Lesbian Bar in Queens is fundraising at its monthly events; so is Hot Donna’s in LA.

Thanks to a renewed focus on community organizing and mutual aid, things are finally looking up for the humble lesbian bar.

We’ve all seen it before: the tale of the gauzy self-made business entrepreneur swept into fame and wealth, touting a name for themselves, only for it all to come crashing down suddenly. In their joyride, the protagonist figure realizes that beneath the world of dizzy glitters, there’s a saddened space of existence reality awaiting, of gaping shadows where life isn’t as pleasing as it seems to be.

Experiencing poverty is, without a doubt, a challenging feat in itself. Being born into it, experiencing success, fame, then losing it all and falling back into poverty is what must be especially difficult. Where the majority see this cliche in fiction or television, some are unfortunate enough to experience it firsthand.

This is the story of Wally Amos, of the Famous Amos fame.

Who is “Famous” Amos?

When it comes to feelings about Famous Amos, I imagine people typically fall into one of three groups:

The first group—being made up of mostly young people (probably; I’ve no data)— has zero knowledge of the brand at all. If the name doesn’t conjure visions of second-rate vending machine options (D4 at best), then you’re likely in this group.

The second group knows of Famous Amos and is familiar with its underwhelming status as a dollar store checkout counter snack food. Reasonable.

But the third group has a different view of the matter. A much more romantic take on the treat. Because this group remembers Famous Amos as a mouthwatering gourmet delicacy. A top-shelf cookie purveyor with an outspoken, charismatic owner in Wally Amos.

Why such a harsh disparity? How can a company less than 50 years old have such contradicting reputations among different generations?

There was a time, just a few decades ago, when Amos was a household name. A successful brand with big-name celebrity investors, upscale distribution, and a first-year total sales revenue of $300,000.

But by the mid-80s, the brand was hemorrhaging money. Amos would lose his house and eventually sell a majority stake of the company. Many people were left to wonder: How did one of the most successful snack companies of the last decade so quickly decay into financial shambles?

How did Amos find himself on the butt-end of a bad break?

These are interesting questions, and sure to be answered. But first, it’s worth understanding Famous Amos’ rise to popularity, understanding what made this gourmet cookie company so successful, so, well— I’m not gonna say it, I am not going to—famous.

Wally Amos’ Rise to Fame

Wally Amos came from a classically humble upbringing, born in 1936 in Tallahassee, Florida, to poor, illiterate parents. At age 12, he moved to New York to live with his Aunt Della. It was here that he learned of the famous recipe. (More on this in a bit.)

Amos, who dropped out of high school, would receive his G.E.D. after joining the Air Force. Returning to New York as a mature, educated man, he found work in the William Morris Agency, a Hollywood-based talent agency once considered “the best in show business.”

He began in the mailroom, eventually working his way up to becoming the first black talent agent in the entertainment industry.

This was more than just a side-quest for an aspiring baker; Amos now headed the rock’n’roll department at William Morris, where he signed Simon and Garfunkel and worked with Motown legends like Diana Ross, Sam Cooke, and Dionne Warwick.

It was only after growing disillusioned with the industry that Amos sought refuge in his aunt’s baking once more.

Wally’s son, Shawn Amos, said:

“Cookies were a hobby to relieve stress.”

It wasn’t long before the cookies took the main stage.

Amos told The New York Times in 1975:

“I’d go to meetings with the record company or movie people and bring along some cookies, and pretty soon everybody was asking for them.”

Amos’s connection with the entertainment business helped his business aspirations tremendously. He received significant contributions from industry stars Marvin Gaye and Helen Reddy, who gave Amos $25,000 for his new venture.

In 1975, Amos launched his first brick-and-mortar location. 7181 Sunset Blvd. in Los Angeles.

And it was a big deal. The grand opening was a star-studded gala attended by 1,500 people.

Success was sudden. After selling $300,000 worth of cookies in its first year, the brand continued to climb in popularity. By 1982, Famous Amos was making $12 million in yearly revenue.

Famous Amos’s success was the result of exploiting a hole in the market. In the mid-70s, the grocery store shelves were loaded with preservative-dependent snack options. Amos carved out a lucrative niche by marketing the product as a gourmet, zero-preservative, craft-made cookie. A risk well rewarded.

From “What’s Going On?” to “What’s Going On???”

With any great market advancement, a plethora of eager competitors emerge. And shortly after arriving on the scene, Famous Amos was met with rival brands like Mrs. Fields, and new, upmarket product lines from Nabisco and Duncan Hines.

Combining these market competitors and Amos’s inability to keep up with his success led to the first cracks in the business. By 1985, Famous Amos reported a $300,000 loss on sales of $10 million.

Later that year, Amos officially gave up the reigns of his company, selling a majority stake to Bass Brothers Enterprises for $1.1 million.

Two years later, the new owners upended the recipe entirely, adding preservatives and shelf-stable ingredients. Famous Amos was rebranding as an affordable brand. It wasn’t entirely unexpected; such mission-statement-defying practices are common for newly bought companies, but the decision prompted original owner Wally Amos to depart.

In 1992, President Baking Company bought Famous Amos for $61 million—more than 55 times what Wally Amos sold his controlling stake for just a few years earlier.

Amos wasn’t through with the cookie business, however. Later in 1992, he launched his new venture…

And was promptly sued.

Turns out: the latest Amos product— Wally Amos Presents Hazelnut Cookies— stood in direct violation of the contract he had signed years prior when selling his first business. The one that expressly prohibited Amos from using his own name and likeness in the selling of any product.

Undeterred, he changed the name of his company, operating instead as Uncle Nonamé. Boldness had treated him well in the past— and I think it’s an undeniably ballsy way to approach being sued over your own identity— but the market operates in mysterious ways. In 1996, Uncle Nonamé filed for bankruptcy.

What Became of Wally Amos?

By 1999, Amos was in talks with Keebler, the new owner of Famous Amos. An agreement had been reached: Wally Amos would become a paid spokesperson for the brand under the condition that they craft the recipe closer to the original.

And it feels like a solid ending to the story. The sweet embrace of a father and son after a long, arduous journey, complete with lawsuits, bankruptcies, and foreclosure. Ending up together would be fitting— if a bit too good to be true.

“It was bittersweet,”

says his son, Shawn Amos.

“He was happy to be back in the center of the brand he started, but he also had a hard time accepting the fact that at the end of the day, he was just a paid spokesperson.”

The feeling of being alienated from one’s own brainchild eventually led to a short-lived reunion between Amos and the brand that bears his name.

After leaving once and for all, Amos pivoted to making muffins with Uncle Wally’s Muffin Co., opening a bake shop in Hawai’i.

Amos wrote multiple books about his experience over the years, including Power In You, Man With No Name: Turn Lemons into Lemonade, and The Famous Amos Story: The Face That Launched 1,000 Chips. He has also been a vigorous advocate for literacy and was granted a National Literacy Honors Award by President George H.W. Bush.

At age 80, Amos appeared on the hit television show, Shark Tank, pitching another new business, “The Cookie Kahuna”. The business ultimately failed.

In 2017, he launched a GoFundMe, announcing he was struggling to pay for food, gas, and rent.

No longer famous, Wally Amos continues on with his baking and entrepreneurial spirit. His life is a statement of hard work and resilience, but also a cautionary tale about success, hubris, and the risks we make along the way.

Business

5 Questions To Ask About Financial Sustainability

Published

3 years agoon

September 19, 2022

When it comes to financial sustainability, you’re going to want to know as much as possible. As the negative effects of climate change exacerbate, financial sectors are (finally) starting to shift their investments toward Environmental, Social, and Governance (ESG) considerations.

Sustainable finance is the process of taking ESG considerations into account when making viable investments. That means putting money into companies that develop renewable energy, hire and promote employ members of marginalized communities, and infrastructure that will help protect humans in at-risk environments.

This is a very serious, very complicated issue that we are running out of time to meaningfully tackle. There is also the risk that many of these efforts are performative (see: greenwashing), we have to make sure we are keeping those in power accountable.

Once again, we bring in our favorite finance expert, Danetha Doe Chief Economist at Clever Real Estate and creator of Money & Mimosas. There is a lot to consider when financing sustainability – and she’s here to break it down in a digestible way.

Here are 5 questions you should ask when considering financing sustainability, as explained by Danetha Doe.

Are these investments profitable? Or is this just charity for rich folks to pat themselves on the back?

Imperial College of London’s business school ran a multi-country analysis comparing the returns from each country’s largest fossil fuel and renewable energy stocks over the last 10 years. They found that renewable energy stocks delivered higher returns for both 5 and 10-year time periods.

Some people such as Kara Swisher and Chamath Palihapitiya think the next trillionaire will be someone that cracks a major problem in green energy. And for better or for worse, Elon is the richest person in the world based primarily on Tesla’s value.

All this to say, the answer is YES. You can care about the planet and make money at the same time.

Will these investments actually help the environment in tangible ways? How soon?

Broadly, yes, these investments will help – and are helping – the environment in tangible ways. Investing in solar panels, rainwater harvesting, and electric vehicles while divesting from fossil fuels will help to reduce the pollution from power plants.

The timeline of course correcting the damage that has already been done depends on a lot of factors. addition to investments from individuals, we need governmental bodies, Wall Street, and other parts of the private sector to continue to get on board.

President Biden’s Inflation Reduction Act includes environmental measures that will go a long way to support climate change efforts. The fashion industry, one of the biggest pollution culprits, has started to place a bigger emphasis on resale which will help to reduce waste. Wall Street has pumped out ESG funds that are more greenwashing than helpful, so we will need to hold them accountable.

As an individual, the way you choose to spend and invest your money will go a long way because it will force corporations to prioritize sustainability efforts.

Will taxing the wealthiest people their fair share help? Would something like a ban on private jets help?

The short answer is maybe. The corporate tax structure may need to be reviewed, but I’m a bigger fan of adding fees to resource use to cover the externalities and then redistributing those funds to climate change efforts. For example, Kourtney Kardashian exceeded her water allotment budget by 101,000 gallons in June. Instead of increasing her base income tax percentage, maybe there’s a fee of $1,000 for each gallon over the allotment budget. The $101,000,000 fee is then redistributed to technology companies solving the freshwater scarcity crisis.

Instead of banning private jets, you should have to pay a carbon fee for each ride. These fees might not stop the behavior, but they could finance the changes needed to get us to a greener future.

There are wealthy people who are actively trying to help with climate change efforts. Instead of penalizing all of them with a blanket tax, I suggest adding fees to resource use.

What kind of expenses will we be looking at if we fail to address climate change?

Deloitte’s report shows that inaction will cost the U.S. economy $14.5 trillion by 2070. Utility officials in Illinois estimate the warmer summers could cost locals an additional $11 billion over the next 30 years. By 2040, extreme heat in Arizona could add up to $110 to residents’ electric bills each year, according to the Environmental Defense Fund.

The Federal Reserve Bank of Chicago predicts homeowner’s insurance premiums to rise due to climate change. In fact, some insurers have already stopped covering parts of California deemed too risky because of wildfires

Why me? Why do I have to make these changes? Should it just be the corporations since they’re the ones ruining the world?

This is an all-hands-on-deck scenario. Corporations should be held accountable, but they do respond to your spending and investing decisions. Greenwashing wouldn’t exist if corporations thought no one cared about the environment. At the very least, be selfish and think about the fact that the quality of the environment directly impacts you. The more you do your part, the greater chance you’ll have at being able to enjoy the beautiful outdoors without worrying about fire smoke ruining your lungs or extreme flooding wiping out your island vacation home.

Where Do We Go From Here?

Investing in ESG is critical – but we have to be selective where we divest and relentless in our pursuit to ensure accountability. Further things to consider when financing sustainability are:

- Are these ESGs contributing to organizations or projects that counteract environmental harms perpetuated by the company? Or are they arbitrary investments that let them greenwash their reputation/only investments that provide “accreditation” over genuine impact?

- Are ESGs investing in genuine solutions, or projects that perpetuate inequities and environmental harm?

- Are companies engaging with ESGs also changing their own practices? Probably not: “They found that the companies in the ESG portfolios had worse compliance record for both labor and environmental rules. They also found that companies added to ESG portfolios did not subsequently improve compliance with labor or environmental regulations.”

- Also – looking at ESG investments relative to a company’s other investments is imperative.

We send many thanks to Danetha Doe for her expertise in the financial field and her lovely disposition. Be sure to check out Money & Mimosas for other financial tips!

Big thank you to Molly Blondell for her perspective on sustainable finance as an expert in the field.

We can solve the climate crisis – we have a lot of work ahead of us. Get involved in your community, start in your neighborhood. Organize a clean-up, press your local officials to get serious about recycling programs, any little thing you can do helps.

Let’s get to work.

Lesbian Bars Were Dying. Now They’re Making a Comeback

Wally Amos: From Cookie Mogul to Life’s Tough Lessons

What’s an MLM? How Does It Work and Why Is It Controversial?

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

Explained: What Is the Deeper Connect Pico and How Does It Work?

The 10 Best Gifts for Coffee Lovers

Digital Nomads Flock To These 10 Amazing Tax-Free Cities

Wally Amos: From Cookie Mogul to Life’s Tough Lessons

Lesbian Bars Were Dying. Now They’re Making a Comeback

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom