Business

Who Does Tori Dunlap Think She Is?

Published

3 years agoon

If you haven’t heard of Tori Dunlap, you’re probably not seeking financial advice. If you are seeking financial advice, you can do a lot better than Tori Dunlap.

Tori Dunlap is an entrepreneur who claims to have saved $100,000 by the age of 25. After achieving such astonishing success so early in life, she simply had to quit her corporate job so she could devote her energy to helping women learn their financial independence and unassumed dominance in our white cis male-run society.

Her mission? To create the brand HerFirst100K and…

Idk man… seems kinda gimmicky.

Disclaimer: I am a cis white male with no financial expertise to speak of criticizing a cis white female financial pundit. I have zero doubts that Dunlap could balance a checkbook better than I ever could. I am not here to offer any financial advice. Rather, I am criticizing Dunlap’s approach to fiscal responsibility and her overall authenticity.

In short: We’re not buying it and neither should you.

How Did She *Really* Get $100K by 25?

At 25, I was working as a barback in a local gay bar and on the cusp of starting my first professional writing job. I had maybe $600 to my name and very poor financial instincts – you could call me a ‘spendthrift.’

My peers around the same age were all fairly financially inept or carefree. Sure, we would meet our responsibilities but we sure as hell weren’t saving – and not for lack of trying. We all worked incredibly hard, dirty, thankless jobs for very little money and could be fired on a whim. None of us would have been able to save up to $100K by 25.

By 25, I had been working steady jobs for 10 years. Even if I didn’t spend a single cent over those 10 years I don’t think the number would have ever reached $100K. Pardon my doubts, but how is a 25-year-old, any 25-year-old, able to save up to $100,000 all by themselves? After some digging, it turns out she did it with a lot of discipline and a lot of luck.

She graduated college with zero debt, landed a job in digital marketing with a salary of $55K/year, and put a disciplined percentage of her take-home into saving and an investment fund. These are all great, very privileged ways to save $100,000 in three years.

I’m curious to know how a 22-year-old snagged an investment fund and knew which investments would pay off and how much they earned but… I digress.

I don’t sneeze at this kind of discipline. Many people would benefit from a financial discipline such as that. I do sneeze a little by using this as a marketing tactic. While she qualifies this by admitting her privilege, she makes her achievement the main marketing point of Her First $100K.

“I did this and so can you!” the sentiment screams. Except most people can’t. And I think Ms. Dunlap knows that.

Tori Dunlap Is Not Qualified To Give Anyone Financial Advice

The only thing I trust Tori Dunlap to do is market and brand herself effectively. She’s cool, she’s hip, she can play along with the broader trends, she TikToks with the best of ‘em, and it all feels so desperately empty and deeply phony.

I think Tori Dunlap has a keen eye for self-promotion that masquerades as “woke financial advice.” This would be fine if it wasn’t potentially f*cking with people’s money. There are people out there with some serious financial issues and concerns. If they trust Tori Dunlap, they could be misled because she doesn’t know what she’s talking about.

I don’t mean she doesn’t know how to assert her value and practice financial discipline. I mean she doesn’t have the financial authority to be profiting off the advice she gives. It’s like getting medical advice from a sickly friend – they’ve got experience but no expertise.

TikTok Advice Isn’t Real Advice

If you take a look at Dunlap’s TikTok, it looks pretty much like every other TikToker out there. On her page, the financial advice is few and far between. It appears that TikTok is the space where she promotes her brand, podcast, and book – with a whole lot of cookie-cutter trends you will find on any account.

When you finally do get to her financial advice, it’s no different than if you were to ask your fiscally savvy friend. For example, “know your worth and advocate for it” is a great bit of advice, it’s one I tell my peers at work – but it’s not expertise. It’s a good ol’ fashioned, “you can do it!” Which is nice, but it’s not practically helpful. What you’re getting from Dunlap are educated tips from someone who is being nice to you.

When you present yourself as an authority figure you have a responsibility that comes with it. Telling people you are the savior from the patriarchy if you pay for her course doesn’t exactly scream “hero.”

There’s nothing wrong with providing a service and charging for it. There is, however, something really gross about masquerading as a feminist hero when you’re actually an unqualified financial nobody with no serious credentials to speak of.

Tori Dunlap is not qualified to be giving financial advice to anyone. She says so on her site:

“LEGAL STUFF: I am not a licensed financial advisor. I offer education, not prescriptive advice. The information that is found here are my opinions and the opinions of other readers/contributors and should be taken as such.”

“Legal stuff.” Cute, so relatable.

All of Dunlap’s success stories are social media posts, texts, and emails. Hardly a case study.

Dunlap claims to be “leading a movement of financial feminists,” but a quick Google search on female financial advisors yields no results for Ms. Dunlap. What exactly is she leading? You cannot be a leader when you don’t show up on the first 12 pages of Google.

Here’s What An Actual Financial Expert Says

We spoke to Danetha Doe, an economist with over 10 years of experience in the financial industry. She has worked as an accountant and a CFO. She also created Money & Mimosas, a financial education resource for ambitious folks.

In short, Ms. Doe knows her sh*t.

We asked Ms. Doe about how the average person could save up to $100K by the age of 25.

“I don’t think it’s reasonable to believe the average person can save $100K by 25.

“In order to do that, they would either need to be born into wealth, have zero student loans, work for a startup that goes public or gets acquired, or start a business that is financially successful.

“All of those scenarios do not apply to the average person.

“The median salary for an individual is under $40,000. Therefore, the average person earns about $40,000. In order to reach $100K in savings on an average salary could take decades in the United States.”

Ms. Doe has a lot of excellent financial advice without being patronizing or weaponizing oppression for profit. She has a professional and personal background that makes her an effective authority when it comes to fiscal responsibility.

“My two grandmothers [are the financial experts I admire most].

“They came to the United States as immigrants and became real estate investors during a time when Black women were systematically shut out of wealth-building opportunities in this country.

“Their lasting legacy guides my financial decisions.”

If you want to learn finance tips from someone who can relate to or understand your experience fully, Danetha Doe is the way to go.

Besides, who doesn’t love a mimosa?

What In The Hell Is ‘Feminist Financial Advice?’

What is it about financial advice that needs to be tailored specifically for women? Let’s take a super casual and lazy glance at successful women, shall we?

Suze Orman is a trusted financial authority and has been around for a minute.

Madonna has built herself an entertainment empire by being unapologetically female.

Rihanna became a billionaire through her music and some super-savvy business moves.

Laverne Cox bulldozed expectations and helped establish a foundation for trans artists.

Sheryl Sandburg is the most powerful woman in Big Tech – did you see what happened when she resigned from Meta?

There is no shortage of female financial advisors. What kind of niche does Dunlap think she’s tapping into? Dunlap says on her site:

“I watched female friends get paid less than they were worth. I read stories about women being denied career opportunities because they were seen as ‘less.’

“Male colleagues said sexist, negative comments to me at work. I learned that women hold the majority of debt in America and that they invest less of their money than men, yet live for seven years longer.

“So I knew that I had to fight back.”

Sure, Jan.

Fighting Sexism By Leaning Into Sexism

I don’t think anybody disagrees (save for a few members of the Republican Party) that women have a tougher go of it than men. To be honest, it’s a bit of a stretch to connect general sexism with financial education. I learned how to budget from my mother, a woman who has had to fight her own battles with sexism and misogyny as the only female partner at her law firm.

Frankly, I think the assumption that women need help from an unlicensed non-expert in order to learn fiscal responsibility is teetering on sexism. At the very least, it’s grossly condescending and certainly inauthentic.

If you’re in a position where you need financial advice, you want it from someone who is a serious advisor, not a trending influencer with no qualifications. With inflation at a 40-year high and an underpaid workforce fighting for its value, we cannot afford to take financial advice from someone clearly more interested in self-promotion and branding.

Dunlap appears to be less focused on offering genuine financial advice and far more focused on hitting woke buzzwords in an effort to patronize marginalized communities for profit. If you want to find a female-focused financial authority, try Ellevest instead.

Tori Dunlap’s Communications Lead declined to comment.

Chris Blondell is a Philadelphia-based writer and social media strategist with a current focus on tech industry news. He has written about startups and entrepreneurs based in Denver, Seattle, Chicago, New Haven, and more. He has also written content for a true-crime blog, Sword and Scale, and developed social media content for a local spice shop. An occasional comedian, Chris Blondell also spends his time writing humorous content and performing stand-up for local audiences.

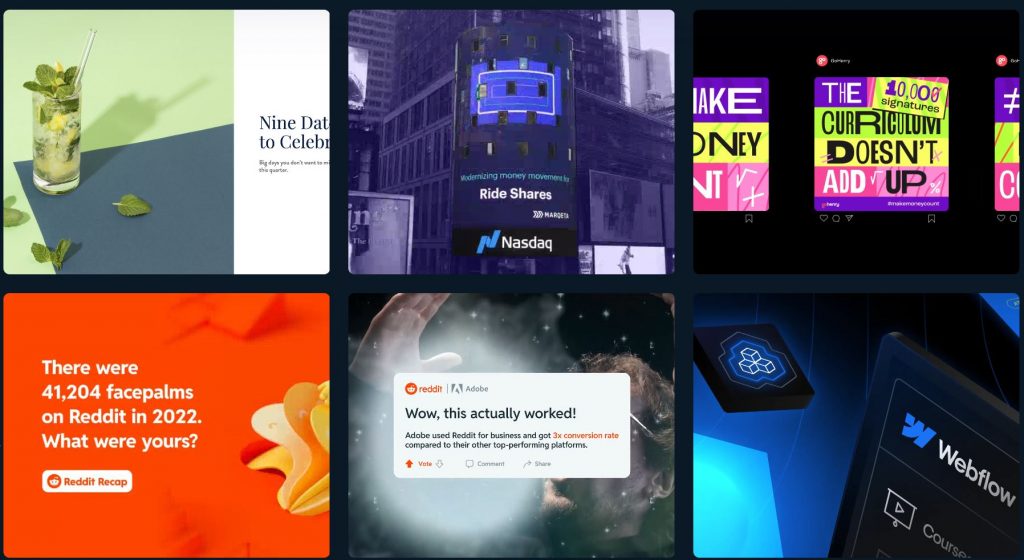

Graphic design subscription services like No Limit Creatives are popular among small businesses to get quick and quality designs. However, just like any other platform, it has its downsides. So, if you’re looking for No Limit Creatives alternatives, here is a list we made to help make the job easier for you.

Penji — Best Overall Alternative

If you’re looking for a reliable graphic service from start to finish, Penji is a great alternative. Penji significantly improves upon the things that No Limit Creatives lacks in comparison — turnaround time, user dashboard experience, and offers a consistent designer who helps your brand over time.

Why it Stands Out:

The biggest issues with No Limit Creatives are slow turnaround times and designs that lack brand cohesion. With Penji, you get consistent communication, consistent pricing, and over 120 design types without all the hassle.

Pros:

- Quick turnaround time (24-48 hours)

- A designer learns your style

- Easy user dashboard

- Consistent monthly pricing with no hidden fees

- 120+ types of designs (ads, branding, web, social, and more)

Cons:

- No communication through chatting with the designers

- No video/animation capability

GraphicsZoo — Best for Revision and Version Tracking

GraphicsZoo is a good alternative if you want more say in your revisions and need brand consistency across the board. GraphicsZoo can help with easy version tracking, making team collaboration simple.

Why it Stands Out:

If you’re struggling to get changes made or keep things on brand, GraphicsZoo gives you the tools necessary to do so.

Pros:

- Tracks versions and revisions in detail

- Team collaboration made easy

- Dedicated Design Team

Cons:

- Turnaround may vary depending on order

- The interface could be more modern

Content Beta — Best for SaaS and Tech Brands

If you’re a software or tech company that needs more modern design visual offerings like product explainer videos, UI design mockups, and onboarding videos, then Content Beta works best for you. Unlike No Limit Creatives, which primarily focuses on graphics, Content Beta specializes in design and video.

Why it Stands Out:

If you’re working on product videos, app UI, or anything tech-related, this is the choice for specialized help.

Pros:

- UI/UX combined services

- Great for explainer videos of products

- Video/design in one package

Cons:

- Non-ideal for basic branding or print materials

- Could be costly for smaller teams

SmartSites — Best for Marketing + Design Services

SmartSites is a marketing agency first and foremost. They provide SEO/PPC/web services along with graphic design so if you’re looking for heavy assistance in creative strategies as well as marketing brands and messaging, SmartSites is a suitable match.

Why it Stands Out:

If you want design solutions with tangible marketing results, then SmartSites provides you the growth potential to back it up.

Pros:

- Agency full-service: design/se0/PPC/web solutions

- Good for branding long haul

- A lot of strategic thinking help

Cons:

- Not unlimited graphic designs subscription program

- Should avoid if you only need design work

Business

What’s the Best Graphic Design Service for Startups

Published

5 days agoon

October 30, 2025By

Flore

TLDR: Penji is the best graphic design service for startups because you get unlimited designs, 24-48 hour turnarounds, and flexible pricing that won’t drain your budget. Unlike premium agencies or inconsistent freelancers, Penji scales with your startup.

The best graphic design service for startups is Penji. For $499/month, get unlimited design requests delivered in 24-48 hours with a dedicated team that understands startup urgency. No contracts, no per-project fees, just reliable design support.

Startups burn through design work fast. One week, you need social posts. Next week, you’re updating your pitch deck. Then suddenly, you need a one-pager for investors. Freelancers cost too much per project, and full-time designers? Not in the budget yet. Here’s the graphic design service for startups that comes in, giving you unlimited work for predictable monthly costs.

Top Design Services Startups Actually Use

1. Penji

When you’re hunting for the best graphic design service for startups, you need speed, variety, and affordability all at once. Penji nails all three. Their design as a service platform gives you unlimited designs for $499/month with 24-48 hour turnarounds.

Why Penji works so well for startups:

They handle everything. Logos, pitch decks, social campaigns, you name it. No per-project charges. Your monthly rate stays flat whether you submit two requests or twenty.

Your dedicated team at Penji learns your brand fast. They remember your preferences for future projects instead of treating every request like the first time.

The creative support scales from simple graphics to complete brand guides. You don’t get forced into higher pricing tiers when your needs grow.

No contracts. You can pause when cash is tight and restart when you’re ready. Perfect for unpredictable startup budgets.

Startups choose Penji when they need graphic design services that match their pace without the agency price tag.

2. Superside

Superside brings agency-quality work through a subscription model. They’re great if you’ve raised significant funding and need premium creative for major campaigns. But plans start around $3,000-$5,000 monthly. Too steep for most early-stage startups.

3. Kimp

Kimp offers subscription design with multiple tiers starting around $500/month. They’re decent for basic needs. The catch? Turnaround times can stretch to 48-72 hours, and their design variety feels more limited than what Penji offers.

Conclusion

The best graphic design service for startups matches your speed and budget without compromise. Penji’s graphic design services handle everything from quick social posts to complex branding work. All for one flat monthly rate that makes financial planning actually possible.

Get Design Support That Moves at Startup Speed

Try Penji today and see why thousands of startups trust them for unlimited design work. Get your first project delivered in 48 hours.

Frequently Asked Questions

Why is Penji better than hiring a freelancer?

Freelancers charge per project and often have slow turnarounds. Penji gives you unlimited designs for one flat monthly rate with 24-48 hour delivery. No chasing invoices or waiting for availability.

How much does Penji cost compared to other services?

Penji starts at $499/month for unlimited designs. Superside costs $3,000-$5,000 monthly. Quality freelancers charge $100-$200 per project, which adds up fast when you’re launching.

Can I get revisions with Penji?

Yes. Unlimited revisions are included in your monthly subscription. Keep requesting changes until the design is exactly what you need.

Business

What’s the Best Graphic Design Service for Ecommerce Businesses?

Published

5 days agoon

October 29, 2025

Graphic design is a huge part of managing an ecommerce business. It attracts prospects and website visitors, builds a strong brand identity, and establishes authority and credibility. If you want your brand to possess all these, you need to explore these five best graphic design services for e-commerce businesses:

Penji

A leading name in the graphic design subscription landscape, Penji offers unlimited graphic design and revisions for a flat monthly rate. This allows ecommerce businesses to get all the landing pages, ad creatives, product packaging, and other visuals they need without breaking the bank. Penji also offers a quick turnaround time of 24 to 48 hours, making it ideal for multiple product launches or regular email campaigns.

Flocksy

Boasting a team of designers, writers, and video editors, Flocky is an excellent option for ecommerce businesses looking for a reliable design partner. Like Penji, it delivers within 24 to 48 hours with fixed-rate pricing plans. Also included in the plans are unlimited revisions, so you can get the exact designs you need.

ManyPixels

Another graphic design subscription platform that’s built for ecommerce businesses, ManyPixels lets you send as many design requests as you can in a month. Its higher-tier plans match you with a dedicated designer to provide consistent visual assets for your online store.

Duck.Design

Whether your business is on Amazon, Shopify, or DTC (direct-to-consumer), Duck.Design is an excellent graphic design service for ecommerce businesses. It also offers unlimited graphic design services for flat monthly rates. Like ManyPixels and Penji, it delivers in 1 to 2 business days.

DotYeti

A rising start in the unlimited graphic design landscape, DotYeti is well-suited for ecommerce businesses looking for quality, fast, and affordable designs. You can send requests for infographics, packaging design, landing page designs, ad creatives, and many more.

What’s the Best Merchandise Design Company?

Top 10 Tablets to Use in 2025

What’s the Best No Limit Creatives Alternatives?

What’s the Best Graphic Design Service for Startups

What’s the Best Graphic Design Service for Ecommerce Businesses?

What’s the Best Fiverr Alternatives?

What’s the Best Superside Alternatives today?

Top 10 Tablets to Use in 2025

What’s the Best Superside Alternatives today?

What are the Best Canva Alternatives for Designers and Marketers?

What’s the Best Fiverr Alternatives?

What’s the Best Graphic Design Service for Startups

What’s the Best Graphic Design Service for Ecommerce Businesses?

What’s the Best No Limit Creatives Alternatives?

Trending

- Technology6 hours ago

Top 10 Tablets to Use in 2025

- Business5 days ago

What’s the Best Graphic Design Service for Startups

- Business5 days ago

What’s the Best Graphic Design Service for Ecommerce Businesses?

- Business4 days ago

What’s the Best No Limit Creatives Alternatives?

- Uncategorized46 minutes ago

What’s the Best Merchandise Design Company?

Kat

December 29, 2022 at 1:14 am

You have not done enough research on Tori, her company, her podcast, or her investing platform. If you did, you would know that she never leads with, “If I can do it, so can you.” In fact, she admits that the information she shares is not going to be readily applicable to everyone’s life, depending on their circumstances. She constantly reiterates and validates that circumstances play a gigantic role in anyone’s financial state. She also owns up to not knowing everything and regularly calls in other experts, including the CEO of Ellevest, to speak on subjects with which she is less familiar. In her podcast, she is not afraid to learn with her audience. In her book, she interviews other financial experts to provide a wider scope of understanding than she, herself, can provide. Tori does what she does to provide not her just her knowledge but to guide her audience to other sources of information, resources, and tools. The goal is to amelliorate as many people’s lives as she can, not save everyone or to make it seem like everyone can save 100K at the age of 25. Most people cannot. She knows this. Her goal is to help people do the best they can with what they have, and she speaks to women/women-presenting individuals because we are typically left out of the conversation of personal finance. She does her best to bring the conversation TO us, instead of us having to seek it out. There are many women-owned companies working towards the same goal as she is. What’s unique about Tori is that, yes, she has blown up on social media. She happens to have that skill and background, but it does not negate her objective or the fact that she is successfully bringing attention to the importance and improvement of personal finance in the lives of women/women-presenting people. The fact that she is successful on social media is strategic, not discrediting, and doing so puts her company in front of younger adults, allowing it to be in a position to help people earlier in their lives, an advantage that is lost on other conventional personal financial experts.

You said you learned about personal fincance from your mom. First, I would like to mention that you are lucky you had a parent that taught you about money. Many people do not get to learn from their parents for a multitude a reasons. Was your mother a sound financial advisor? I’m not trying to make the point that your mother was bad with money. I’m saying that at one point, she knew more than you and taught you what she knew. Tori is doing the same. In addition to doing the same, Tori has access to a network of qualified individuals who are helping her along the way. Does Tori make money off of her audience? Yes. She is providing a service and utilizing her skill set to improve lives, which has value. There is nothing wrong with being compensated accordingly, be it directly or indirectly. With that said, she also provides a substantial amount of resources, links, and advice for free on her website and in her podcast/podcast shownotes. In summary, Tori is doing great work. She has managed to run a successful business while remaining accessible, and I recommend her to anyone looking to learn about personal finance.

Derek

August 11, 2023 at 12:40 am

Her parents are rich and sent her to University Of Portland, which costs $58,000+ a year in tuition ALONE.

How is this not easy to understand? Rich white girl with no financial credibility marketing herself.

Deckela

August 26, 2023 at 4:27 am

You sound jealous and patronizing. Who do you think YOU are?!