Business

Company Name Changes After Controversies

Published

3 years agoon

Rebranding signals new changes. Some companies may have partnered or joined forces with another organization. Meanwhile, others might have a change in product or service offerings. And in some cases, rebrands may help companies with a fresh start, particularly those caught in scandals. Here are the companies that changed their name after getting into scandals.

1. Livestrong Foundation

Before Livestrong Foundation became well-known, not only for its yellow wristbands, it was called the Lance Armstrong Foundation. At the time, Lance Armstrong beat the odds. He battled cancer and won the Tour de France.

However, things went downhill when it was found that Armstrong used performance-enhancing drugs. The foundation took a hit and many lost trust in the foundation. And the foundation never became the same since. However, they’re trying to reinvent themselves as the Livestrong Foundation.

2. Academi

Before Academi landed on its current name, let’s go back to when they were called Blackwater. They’re a private military contractor. Things didn’t go well for them in September 2007 when they killed Iraqi civilians. Eventually, they had to change their company name to look good in the press. Xe Services was the name.

However, things turned worse for the company when Afghan civilians died, all because of two mercenaries. In 2011, they became formally known as Academi.

3. Altria

This list isn’t complete without mentioning Altria. We all know them by a name that many people smoke Philip Morris. Its former name is famous for manufacturing and selling cigarettes. It appeared that Philip Morris changed its name to Altria after being absolved of responsibility for a wrongful death case in 2003. Plus, there have been reports that Philip Morris had thought of changing the name two years prior because they sold products aside from cigarettes.

4. Bausch Health

Public outrage is one reason why some companies change their name. That was the case for Bausch Health. Before calling themselves Bausch Health, you may have known them as Valeant Pharmaceuticals. Yes, the same company that prices their medicines way too high. Plus, as the New York Times reported, there was an executive who defrauded the company. And those were the two reasons Valeant became Bausch Health.

5. McAfee

Here’s one case where even if the brand’s reputation isn’t excellent, consumers still preferred the old name better. You probably know McAfee and it being an antivirus software. According to Mashable, in 2013, John McAfee, the man who started this company, left it to start a yoga retreat and eventually went into hiding after being named a murder suspect.

In 2014, Intel owned McAfee and named it Intel Security. However, most consumers did like how McAfee sounded more than Intel Security. They reverted the name to the original one, and it’s still one of the well-known antivirus software applications.

6. Meta

Of course, it was inevitable to add Meta to this list. After all, Facebook was notorious for spreading misinformation on the social media platform. Even after the name change, it still does. And the fact they wanted to become one of the leaders in the Metaverse. Even with the name change, it still doesn’t erase the fact that Facebook’s name is still associated with misinformation, among other things.

7. CoreCivic

CoreCivic is one of the companies that changed its name after a scandal. They’re a private prison company, and they have been known for their mistreatment of their inmates. And there was also a document that revealed that privately-owned prisons had higher chances of violence than federal-owned ones. Corrections Corporation of America (CCA) was a part of that list. Added to that, the Department of Justice had also stated they would no longer use privately-owned prisons. That said, CCA changed to CoreCivic.

You may like

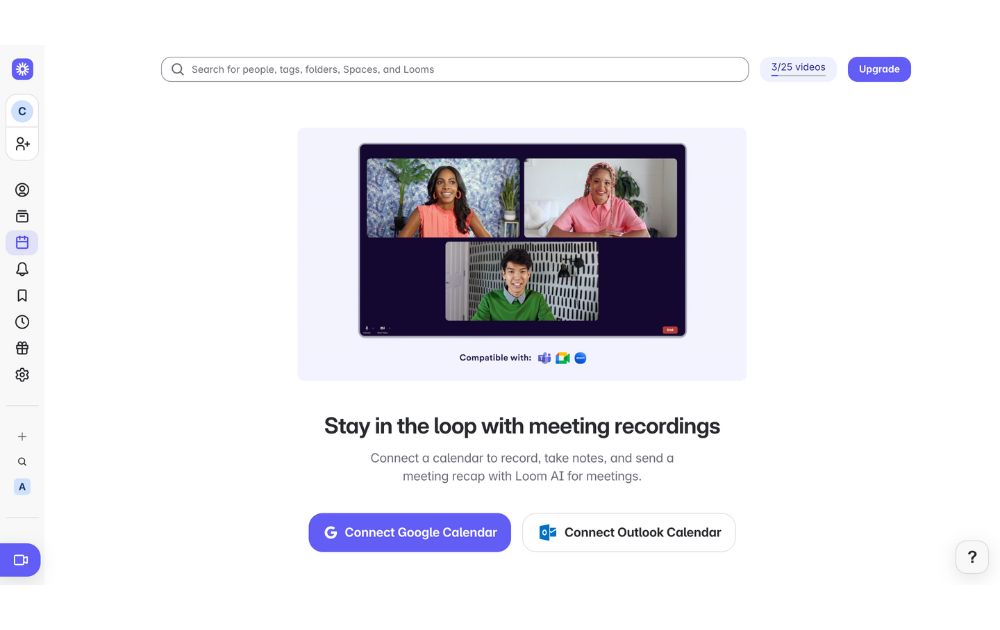

McKinsey & Company reveals that 73 percent of bank transactions worldwide now take place online, such as in digital banks and payment systems. The increasing demand of customers for more flexible banking options is attributed to the rise in online banking channels. People prefer online banks because they offer simple tools and resources to manage their money. With this trend, online banking is here to stay.

Best Online Banks: A Quick Guide

Image Source: Tima Miroshnichenko from Pexels

An online bank should cater to your financial needs like any traditional alternative. Here are a few factors to consider when choosing online banks:

Annual Percentage Yield (APY)

The annual average yield offered under each account will tell you how much interest your money will earn. When comparing online banks, consider one that offers competitive rates across all of its deposit accounts.

Products and Services

Some online banks offer a complete package of banking products, including checking, savings, certificates of deposit (CDs), and money market accounts. They also offer loans and credit cards. So, look at the products and services offered by online banks before making a decision. You may also combine the services of an online bank with a traditional brick-and-mortar bank.

Account Access

Typically, online banks offer 24/7 access to your account through their website or app. However, you should also consider how the bank handles deposits and withdrawals. It is crucial to know the restrictions, if any, on transfers, the limitations on withdrawals, and whether the bank accepts free cash deposits.

ATM Network

An ATM network is essential if you frequently withdraw or deposit cash. An extensive ATM network will help you avoid transaction fees. If the bank is not associated with a large ATM network, you should look for one that will reimburse out-of-network ATM fees.

Digital Tools

The best online banks offer innovative digital tools to help you accomplish financial goals. For example, Ally will help you organize your savings goals with savings buckets and analyze your spending habits to safely transfer available funds from your checking to your savings account.

Fees

You should avoid any bank, online or otherwise, that charges monthly fees or has extensive requirements to avoid them. Many online banks offer no-fee deposit accounts, require a low or $0 initial deposit to open the account, and don’t need a minimum balance to avoid maintenance fees. However, make sure you know whether the bank charges excessive withdrawal fees, paper statement fees, or fees for other services that you may want to use regularly.

Customer Service

Since you won’t have access to in-person customer service with an online bank, determine how you can contact a customer service representative if needed. Most online banks offer telephone support, live chats, or assistance via email. Some online banks also offer access to live support via extended hours or 24/7.

10 Top-Performing Online Banks

1. Alliant Credit Union

Alliant Credit Union is an NCUA-insured online credit union offering members competitive deposit account rates and minimal fees. Most accounts don’t charge maintenance fees, but these can be waived if you sign up for e-statements. Membership is available for current or former employees of Alliant’s partner businesses in the US. You can also become an Alliant Credit Union Foundation digital inclusion advocate to become eligible for membership. Signing up costs $5, but Alliant will pay the one-time fee on your behalf.

Alliant’s certificates earn solid APYs, with terms ranging from one year to five years. Its savings account earns a respectable yield of 3.10% APY on balances of $100 or more, but there are plenty of higher-yielding savings accounts with APYs over 5%. We like that Alliant’s High-Rate Checking account pays a better yield than other checking accounts and doesn’t require a minimum balance or charge service fees.

2. Varo Bank

Varo offers checking and savings accounts but doesn’t offer deposit certificates. Savings account comes with an APY starting at 2.50%. That rate becomes 5.00% for the first $5,000 if a customer meets the monthly requirements of the bank.

Cash deposits have limits and fees, and Varo customers can only deposit cash at a 3rd party retailer that joins the Green Dot network, including CVS, 7-Eleven, or Walgreens. On the other hand, cash withdrawals can be made through an ATM in the Allpoint network for free.

3. Ally Bank

Established in 2009, Ally Bank is full-service online bank that offers competitive rates on all deposit accounts. Customers can enjoy the highest rates for all balances, regardless of tier. Overall, the high APYs, minimal fees, and reliable customer service support makes Ally an excellent banking solution for millenials who want better savings and retirement plans.

4. Discover Bank

Discover Bank offers deposit accounts, credit cards, personal loans, and student loans. We like that Discover offers deposit accounts, such as CDs, savings, and a money market account, at competitive rates with no fees. While its $2,500 minimum deposit requirement for its CDs is steep, there is no minimum deposit required to open and maintain a savings, money market, or checking account.

5. Laurel Road

Laurel Road, powered by KeyBank, helps healthcare and business professionals achieve their financial goals. They offer student loan refinancing, mortgages, personal loans, credit card, and specialized savings accounts. Laurel Road also offer Loyalty Checking with a low APY. New customers can earn a sign-up and monthly bonus with qualifying direct deposits. In addition, both savings account and checking account has no monthly free or minimum balance requirement.

6. Capital One

Capital One offers an above-average 3.80% APY on its savings account, strong rates on its certificates of deposit, and 0.10% APY on all checking balances. All accounts are free, and customers can access over 70,000 free ATMs.

7. American Express National Bank

This bank offer High Yield Savings Account with a 3.80 APY. Likewise, certifcate deposits (CDs) have competitive rate and there is no minimum opening deposit. You don’t have to worry in case you encounter banking-related issues because American Express National Bank has 24/7 phone support and online chat support.

8. Marcus by Goldman Sachs

Launched in 2016, Marcus is the online-only banking arm of Goldman Sachs, one of the 15 largest banks in the US. The bank’s savings accounts and CDs offer competitive yields and no monthly maintenance fees.

While some online banks offer no minimum deposit requirement to open an account, Marcus requires a $500 deposit to get started with a CD. There’s no minimum deposit requirement for its high-yield savings account. Marcus doesn’t offer a checking account or money market account.

9. My Banking Direct

My Banking Direct is the online-only arm of Flagstar Bank, N.A., which New York Community Bancorp owns. The bank is a lean financial service that offers only savings, checking, and a five-month CD term. The APYs on its savings account and CD are among the best available today.

In addition, the bank doesn’t charge monthly or overdraft fees and provides surcharge-free ATM access through a 55,000 Allpoint and Presto network. To open a savings account, you must deposit $500. Checking accounts can be opened with just $1. During the week, you can access extended customer service hours until 8 p.m. ET and 2 p.m. ET on Sundays.

10. SoFi

SoFi (short for Social Finance) was the brainchild of Stanford Graduate School of Business students who created an alumni-funded lending source initially focused on refinancing student loans. Since then, SoFi has expanded into a variety of loan categories and now offers online checking and savings accounts.

Conclusion

Online banks lets manage your money and account via a website, mobile device, or app. Also, online banks generally offer higher interest rates and fewer fees than traditional banks. You should remember that while technology makes everything accessible, online banks also have some limitations. For instance, online-only or internet-only banks lack in-person interaction. However, if you are comfortable managing your money online, online banks are a convenient and low-cost option.

Business

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

Published

4 days agoon

June 21, 2025

Are you tired of keeping up with long email chains or trying to sync everyone in the team for a live call? If you answered yes, then Loom could be an efficient tool for you. In this Loom review, we’ll unpack how you can use Loom to explain complex ideas, give feedback, or walk someone through a task without going on a live call.

We’ll also explore its standout features, use cases, pricing plans, and how it compares to Zoom so you can decide if it fits your team’s workflow.

What is Loom?

Loom is a video messaging app that lets users record and share video messages with teammates and clients. Using Loom, you can record your camera, microphone, and desktop screen at the same time.

According to online Loom review, this is especially useful for individuals to create tutorials, demonstrations, and presentations, as well as to share feedback.

Loom users can choose to record with the Loom Chrome extension, the desktop app, as well as the iOS and Android apps.

Some of Loom’s clients include Brex, Intercom, Postclick, and more.

Loom Features

Loom has various features that allow it to seamlessly integrate into a company’s existing workflows.

Users can play Loom download videos within platforms like:

- Slack

- Jira

- Confluence

- Github

Why does this matter? Users will no longer be led to an external link, increasing their productivity by playing feedback videos within the platform.

Next, Loom video has an AI suite that can help teams work more efficiently. Using AI, the tool can:

- Automatically generate meeting notes and recaps, among other things

- Instantly create chapters in your videos, as well as CTAs and tasks

- Create text transcription and generate closed captions

To refine your videos further, Loom has features that can remove filler words and silence in a video.

Besides this, Loom also has a video-to-text feature. This is especially useful for asynchronous teams that need help with logging a bug issue, documenting a process, or performing a code review.

Loom Pricing

Loom pricing is generally straightforward. If you want to know if Loom is free, yes, it does have a free tier.

It has a free Starter plan for users who want to try out the app’s key features. It can accommodate up to 50 Workspace users, who are each entitled to up to 25 videos with a five-minute length cap.

Next, the Business plan is for teams that want unlimited videos and basic editing. It costs $15 per user per month if billed annually. Here, you can have unlimited members get basic waveform editing, remove the Loom Branding, and more.

According to Loom review, their most popular plan is the Business + AI plan, where teams can get advanced editing and access their AI suite. This plan costs $20 per user per month if billed annually.

Their premium plan is the Enterprise plan, which is best for companies that want to control and securely manage video content for the organization. If you’re wondering, “Is Loom safe to use?” This plan has advanced security and content privacy features as well as admin insights. Teams need to contact Loom’s sales team first to get a price quote.

Finally, Loom has a discount plan for educators as part of the Atlassian Education Program.

Use Case Breakdown

Here are a few Loom use cases:

- Loom review can be especially helpful for tech teams, as it can be used to narrate a bug issue. When an issue occurs, developers or testers can simply record the issue with Loom and report the issue to the concerned developers. It saves time and increases the turnaround time for bug fixes.

- Hiring teams and internal teams can also use Loom to document an internal process for onboarding purposes. Apart from this, it can also be used by customer-facing teams to create user guides on a platform or a new product feature.

- Sales teams can also use Loom to reach out to prospective clients. When cold emails are not friendly enough, sales teams can create personalized video content through Loom and stand out.

- Taking too long to get feedback from all stakeholders? Loom is great for product design teams to get asynchronous feedback from a global executive team. It’s great for instances where it’s difficult to get stakeholders in one meeting.

- Finally, Loom is great for educators and academics who want to create videos for remote classes.

Loom vs. Zoom

While their names sound the same, Loom and Zoom have different fundamental use cases. In terms of Loom review, Loom is best used to record and send videos, which can be used for demos, tutorials, and feedback. In terms of use cases, Loom is more catered to asynchronous communication and screen recordings.

Meanwhile, Zoom is best used for hosting live meetings and large conferences. It has features like breakout rooms and virtual backgrounds. While you can use Zoom to record videos yourself, Loom is more optimized to share video links with teammates and clients.

Final Thoughts: Who Will Get the Most Out of Loom?

Loom is best for companies that need videos for their day-to-day work communication. Whether for external or internal communication, it is great for clients who work asynchronously. In fact, most of their clients include those in the tech and product space.

Their product is useful for tech, sales, and product design teams that need to align with cross-functional teams. Loom is also best for companies that want to tighten their internal feedback loop, demonstrate processes, and get quick updates.

Educators, coaches, and course creators can also benefit from Loom’s features. The platform makes it easy to create clear, engaging instructional videos that students or clients can watch at their own pace. With features like closed captioning, video chapters, and transcription, Loom helps streamline learning and knowledge sharing.

Finally, to sum up this Loom review, freelancers and consultants who want to build stronger relationships with clients may also find Loom useful. Just like gadgets that boost team connectivity, like the Deeper Connect Pico, the global workforce can benefit a lot from Loom. Personalized video updates, walkthroughs, or proposals can set them apart, adding a human touch to digital communication that static emails or text-based reports often lack.

Business

The Latest In The AI Boom: What Entrepreneurs Need To Know In 2025

Published

6 days agoon

June 20, 2025

Anyone unaware of how AI is revolutionizing almost everything we do daily could be living under a rock. Artificial intelligence has evolved at an unprecedented speed, transforming industries and reshaping how we operate businesses. Let’s explore the latest developments in the AI boom and what entrepreneurs can do to stay competitive.

AI’s Current State in Business

According to recent industry reports, the AI market is expected to surpass $1 trillion by 2030, with an annual growth rate of more than 35%. This is why businesses across all industries are investing heavily in AI technologies. Whether startups or global enterprises, they do this to stay competitive and meet the evolving expectations of their clients.

How Businesses Are Using AI to Gain a Competitive Edge

AI use by many companies is now commonplace thanks to its many benefits. There’s the enhanced efficiency, boosted productivity, and improved customer experience, among many others. Some of these applications include:

- AI-Powered Automation: Repetitive tasks such as data entry, customer service interaction, and marketing campaigns can now be done using AI. It frees you up to give you more valuable time and resources.

- Predictive Analytics: With AI technology, vast amounts of data to forecast trends, customer behavior, and market demands are easily within your reach. This helps you make better decisions.

- Personalized Customer Experiences: Chatbots and AI-driven recommendation engines are just two examples of how AI can help you provide more tailored customer experiences. It also allows you to deliver hyper-personalized content and services previously available.

- Operational Efficiency: AI optimizes supply chains, inventory management, and logistics. This helps reduce costs and improve your turnaround times.

Many businesses nowadays are using AI to disrupt industries while achieving success. You’ll find AI-powered chatbots handling customer support and content creation, while e-commerce platforms use AI-driven recommendations to boost sales, as Shopify exemplifies. In health care, AI improves diagnostics and treatment accessibility, while marketers use AI for data-driven campaigns and optimized ad spending.

Emerging AI Trends You Need to Watch

Source: Rahul Pandit on Pexels

It seems that entrepreneurs have no option but to embrace the transformative trends brought about by AI. The following are a few you must take note of:

- AI-powered automation is simplifying operations and cutting costs.

- Generative AI is revolutionizing content creation, marketing strategies, and product design.

- AI in customer service uses chatbots, personalization, and predictive analytics to meet growing demands.

- AI ethics and regulation ensure businesses comply with evolving laws and ethical standards.

- AI-driven decision-making helps businesses gather data insights for smarter, more strategic choices to drive long-term growth and success.

Must-Have AI Tools for Entrepreneurs in 2025

It’s not getting on the bandwagon but keeping up with the times. Here are a few examples of AI tools you can use for efficiency and growth:

- Marketing and SEO: Tools like Jasper and SurferSEO can help you craft optimized content, analyze trends, and improve search rankings with ease.

- Sales and CRM: HubSpot AI and Salesforce Einstein offer intelligent automation, customer insights, and predictive analytics to boost sales performance.

- Productivity and Automation: Zapier AI is an excellent option for task automation, while Notion AI is great for smart content organization.

- Finance and Analytics: Quickbooks AI and Tableau AI provide real-time financial insights, forecasting, and data visualization.

When choosing the right AI tools for your business, consider scalability, integration capabilities, ease of use, and cost-effectiveness. Make sure they align with your business goals and your workflow needs.

The Challenges Entrepreneurs Face in Their Adoption of AI

Source: Google DeepMind on Pexels

Admittedly, AI has immense potential; however, adopting it comes with challenges that entrepreneurs must navigate. Below are a few:

- Cost Consideration and ROI Expectations: When you implement AI solutions, you may need significant upfront investment. Also, measuring long-term returns can be complicated.

- Skills Gap: You will wonder if you need AI expertise or if you can rely on external support to use AI in your business effectively.

- Data Privacy and Security Concerns: Protecting sensitive customer information while ensuring compliance with data protection regulations can be challenging.

- Overcoming Resistance to AI Integration with Your Team: Your team members may fear job displacement or struggle adapting to new AI-driven workflows and tools.

Practical Steps to Integrate AI into Your Business

Here are a few easy steps to take if you want to integrate AI into your business:

- Assessment of Your Business Needs: Identify which areas of your business would benefit from the technology. Is it customer service, operations, or marketing?

- Start with Low-Risk Implementations: Look for small-scale projects that are easy to implement and carry minimal risk. You can start by adopting AI-driven tools for marketing, chatbots for customer support, or simple automation tasks.

- Measure AI Impact and Scaling: Assess the performance and impact of your chosen AI solutions on your business. Measure key metrics like productivity, cost savings, and customer satisfaction. This way, you’ll find out if your AI adoption is giving the value your business needs. Scale its use as you gain confidence and see more positive results.

- Partner with AI Consultants: Work with AI experts or consultants to guide the integration process. This ensures you’re using the right tools and strategies. This can also help you overcome any technical challenges you may face.

The Future of AI in Entrepreneurship

Market research firms, AI experts, and thought leaders see AI going through the following:

- AI’s role in startups and small businesses will become essential, providing them with affordable solutions to automate tasks, enhance marketing, and improve customer service, leveling the playing field with larger companies.

- AI will transform industries such as healthcare, retail, and finance. It can dramatically improve efficiency and customer experiences. It will also create new job roles, requiring business owners to adapt and upskill their workforce.

- Additionally, entrepreneurs must stay ahead of the curve with continuous learning and adaptation. This will keep them competitive and ensure long-term success.

Conclusion

Entrepreneurship has been and will continue to be impacted by AI, but most of it will be transformative. The technology presents significant opportunities to help businesses thrive, leaving no option for business owners but to embrace these emerging trends. You need to start now, keep learning, and integrate strategically.

Discover 2025’s Top 10 Online Banks for Smart Savings

Digital Nomads Flock To These 10 Amazing Tax-Free Cities

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

10 Adventure Travel Destinations You Don’t Want to Miss

The Latest In The AI Boom: What Entrepreneurs Need To Know In 2025

Taylor Swift’s Fortune: The Billionaire Behind The Eras Tour

Explained: What Is the Deeper Connect Pico and How Does It Work?

BeReal App: Will It Ever Survive Its Instagram Clone?

Loom Review: Features, Use Cases, and How It Stacks Up Against Zoom

Failure to Launch: Why Pixar’s Lightyear is a Box Office Dud

Explained: What Is the Deeper Connect Pico and How Does It Work?

10 Social Media Marketing Tools to Check Out in 2025

The 10 Best Small Business Budgeting Software for 2025