Top Stories

Student Loan Forgiveness: Consequences and Gains

Published

3 years agoon

In the US, student loan debt grows six times faster than a nation’s economy. It’s alarming to see the numbers grow as months pass by, especially seeing the interest rate. Currently, the overall student loan totals a whopping $1.71 trillion. According to Education Data, at least 43.2 million student borrowers are in debt by an average of $39,351 each. So, as President Biden took office, let’s discuss one of his campaign promises— student loan forgiveness.

Student Loan Forgiveness: Gains

President Biden, along with other top Democrats, made student loan forgiveness their number one priority. The president advocated at least $10,000 worth of debt per borrower. Meanwhile, Senate Majority Leader Schumer (D-N.Y.) and Senator Warren (D-Mass) opted for an aggressive push for $50,000 per debt borrower.

As student loan forgiveness is in ongoing discussions, the state of entrepreneurship hangs on a thin thread of balance. We should also consider that the economy is still in its post-Covid recovery. The final decision will have a significant effect not only on entrepreneurship but also on the overall economy.

We are all aware that small businesses play a huge role in job creations following recessions. Meanwhile, the overall $1.7 trillion worth of student loan debt is spread across at least 45 million people. The ongoing payments limit the legion of young to middle-aged dreamers from taking an entrepreneurial leap.

Skyler Pearson, the CEO, and co-founder of Nexgarden, is a graduate of the University of Oregon in 2013. She has a student loan debt worth $50,000. After Pearson started Nexgarden in 2017, she didn’t foresee how the debt would tighten her overall operational budget. Recently, she obtained $100,000 worth of bank loans to help Nexgarden. According to Pearson, just talking about student loan forgiveness is enough to give her chills.

Imagine all the other entrepreneurs or professionals who are shackled with a growing student loan debt. Any loan limits a person’s professional growth and financial decisions. In the end, whichever amount the government decides to push forward, it’s an excellent benefit for millions of people. Student loan forgiveness would lighten off some load on their shoulders if not all.

Student Loan Forgiveness: Consequences

Karthik Krishnan’s research managed to highlight the most straightforward answer— “the more debt you forgive, the better it is for entrepreneurship.” However, the economist strongly warns against that idea. In 2015, Krishnan co-authored the first academic paper to create about:

- The rising student loan debt

- Decline in entrepreneurship

According to his research, the inverse of the idea should be accurate—fewer debt results in the rise of entrepreneurship. However, reality does not have a definitive cause and effect. Whichever the outcome of the government’s ongoing discussion, there’s always a consequence.

If too much debt is canceled at one swoop, it could send the economy’s interest rates skyrocketing. It could also balloon the federal deficit, mainly when it goes hand-in-hand with Biden’s proposed Covid-19 recovery package worth $1.9 trillion. Its effects will drag on a lot of factors such as:

- The economy

- The country’s recovery

- Small businesses at large

According to John Dearie, Center for American Entrepreneurship founder, these are enough to raise red flags for a Republican deficit. So, the more student loan debt the Democrats propose to forgive, the harder it is to get the GOP on board. In the end, Dearie suggests that both need to reach a compromise. He also explains why the administration’s proposal is limited as they take a more reasonable approach to provide relief.

A Band-aid Fix

Although President Biden’s plan of $10,000 is more feasible, critics say it won’t make an impact. As mentioned above, an average student has more than $30,000 worth of debt. After cutting the loan with the proposed $10,000, it could still leave a vast balance.

Meanwhile, Krishnan suggests the ideal number would be somewhere between $10,000 to $50,000. As for John Dearie, he pointed out that this is a “band-aid fix.” It’s only a temporary solution without addressing any more significant issues. The policies should be in longer-term targeting factors like loan repayment plans or rising college tuition fees. Besides, America’s next generation of entrepreneurs might find themselves back at square one.

However, for Skyler Pearson, co-founder of Nexgarden, those problems are for another day. If we think from the borrower’s perspective, chopping off $10,000 is already considered a huge help. It can be regarded as one step closer to finally paying the overall student loan debt. Let’s bear in mind that any amount helps. We can only hope that the final decision will greatly help millions who are still in student loan debt.

You may like

Top Stories

10 Environmental Organizations and Nonprofits To Save the World

Published

3 months agoon

January 25, 2024

Making positive changes in our lifestyle is a powerful way to tackle important issues. Supporting charities is another great way to help the environment, make a difference, and build a better future. In this light, now is a great opportunity for government, business, and individuals to back environmental nonprofits. Here are ten groups working for a sustainable future that you can support. Get started by choosing an organization that really connects with your values.

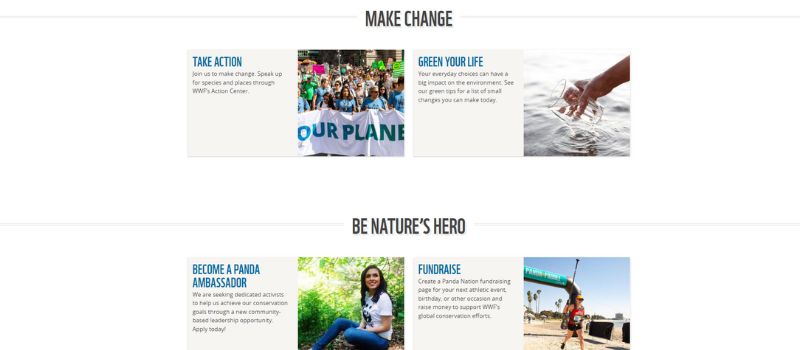

1. World Wildlife Fund for Nature

This Swiss-based NGO focuses on conserving nature and reducing human environmental impact. Acknowledged for its work with endangered species, WWF has expanded its mission to cater to specific animals and landscapes and to more significant issues that affect them.

WWF partners with governments, businesses, and other environmental organizations to implement policies and programs protecting wildlife, nature, and the global climate.

How to get involved: Sign up to take action on a particular campaign, adopt a species, participate in one of its partner-led conservation tips, or get updates on its causes.

2. One Percent For the Planet

One Percent For the Planet is a global convergence of businesses, environmental organizations, and individuals working together for a healthy planet. Founder Yvon Chouinard (also Founder of Patagonia) started the organization to bring ” dollars and doers” together to create change. Member brands commit one percent of their profits to support environmental action. The organization ensures those donations go to trusted nonprofits involved in wildlife and nature conservation, reforestation, ocean cleanups, and other environmental efforts.

How to get involved: Become a business member and donate 1% of your annual sales directly to One Percent for the Planet’sPlanet’s environmental partners network.

3. Fashion Revolution

Fashion Revolution is a worldwide movement bringing people and brands together towards creating a safer, cleaner, and fairer fashion industry. Founded after the Rana Plaza collapse in 2013, Fashion Revolution believes that collaboration across the value chain is the best way to transform the industry radically. It works with global coordinators to host events every year for an entire week in April to inspire consumers and brands to take a closer look at how and by whom their clothes were made.

How to get involved: Participate in the #WhoMadeMyClothes campaign all year round, especially during Fashion Revolution Week, which takes place annually in late April.

4. Earthjustice

Earthjustice attorneys support various significant environmental policies, such as the Endangered Species Act and the Clean Air Act. Earthjustice works with activists, national politicians, international policymakers, and individuals to protect and strengthen laws to benefit people and a healthy planet.

How to get involved: Make a one-time or monthly donation and support essential campaigns.

5. Natural Resources Defense Council (NRDC)

The Natural Resources Defense Council aims to safeguard the Earth, including its people, plants, and animals. Founded in the 1970s by a team of law students and attorneys, NRDC is now a membership-based organization that works with lawyers, activists, scientists, businesses, and individuals to identify problems and formulate sustainable solutions. NRDC also ensures that everybody has the right to clean air, clean water, and healthy wild spaces.

How to get involved: Make a one-time or monthly donation, or add your voice to essential campaigns.

6. Conservation International

Conservation International (CI) aims to protect the Earth to provide us with fresh water, adequate food, sustainable livelihood, and a stable climate. CI works with governments, business leaders, and individuals to implement doable solutions to climate change-related problems. In its 30 years of operation, the organization has successfully protected more than 601 hectares of land, marine, and coastal areas.

How to get involved: A $25 donation here will protect one acre of forest. Other ways to get involved with CI include:

- Subscribing to receive conservation news and calls to action in your inbox.

- Taking the “I Need Nature and Climate Action Pledge.”

- Reading their tips for greener living.

7. Rainforest Alliance

The Rainforest Alliance is a nonprofit working to create a better future for people and the Planet. They offer a certification program for brands selling rainforest-friendly products. They also work alongside activists, businesses, small farmers, and forest communities to drive positive social, environmental, and economic change across forest landscapes.

How to get involved: Promote their frog seal while shopping for rainforest-dependent products such as tea, coffee, chocolate, and paper. Environment-conscious travelers can even opt for Rainforest Alliance-certified hotels and tours worldwide.

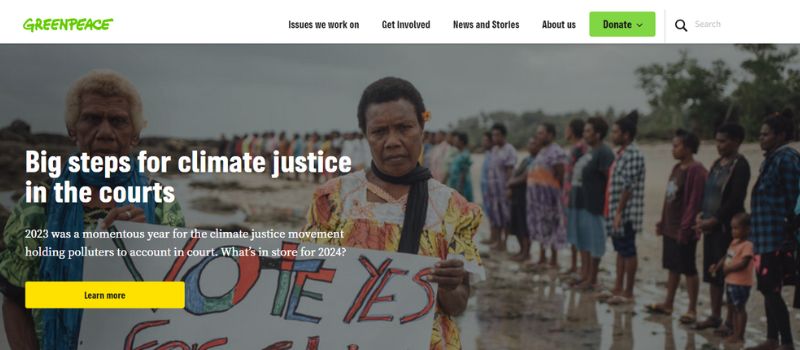

8. Greenpeace

Greenpeace is an international environmental organization whose mission is to create a green, peaceful, and ecologically diverse world. It relies on its membership of activists, students, educators, scientists, and environmentalists to investigate issues and solutions, lobby governments, and show up for actions against climate change.

How to get involved: Join a local group of activists and follow along with Greenpeace’s journalism site, Unearthed. Donations are also welcome.

9. Lonely Whale Foundation

Lonely Whale Foundation works with businesses and entrepreneurs to develop environmental business models, gets involved in communities to educate the next generation better, and initiates global movements to address plastic pollution in our oceans.

How to get involved: Check out current campaigns to get involved in or donate.

10. 350.org

With members in over 180 countries, 350.org uses social media campaigns, grassroots organizations, and collective public action to support clean energy solutions. Its primary objectives are to reduce carbon footprint, help build a zero-carbon economy, and make governments accountable for limiting their emissions.

How to get involved: Join a local group near you and support the initiatives they are working on. You can also start your own or donate if you are far from an existing group.

Top Stories

Up in the Air: The Dark Side of Balloon Releases

Published

3 months agoon

January 11, 2024

While balloons bring momentary delight in celebrations and events, this tradition poses ecological challenges we often forget. They are harmful to wildlife, marine ecosystems, natural resources, and even toddlers. Balloons filled with helium look so pretty in the sky. However, they can’t stay afloat for so long. Each of these balloons pops and plunges to the earth, turning into trash. This is why balloon releases should be banned.

How the Tradition of Balloon Releases Harms the Environment

Releasing balloons has become a customary practice in local events, including schools, weddings, and memorials, with origin tracing back to the 1940s. We acknowledge the emotional significance of traditions, like those we’ve seen in sporting events with fireworks, marching bands, and cool mascots. However, it is becoming more evident that haphazard balloon releases have several harmful implications for the environment.

Insert image: The Indy 500 balloon launch

Caption: The Iconic Indianapolis 500 Balloon Launch in May 2019. Source: speedsport.com

In May 2019, The Indianapolis Motor Speedway (IMS) continued its tradition of releasing balloons before the start of the Indianapolis 500. The IMS claims that its balloons are biodegradable. However, studies conducted to test these claims still raise a big question and pose a substantial environmental risk.

Then, in 2022, the IMS management confirmed that the pre-race “Balloon Launch” has been paused indefinitely.

Regardless of what the Indy 500 does, several people and organizations still do balloon releases. Here are some reasons they harm the environment and potential alternatives to flying balloons.

Balloons are bad for wildlife and marine ecosystems.

The National Oceanic and Atmospheric Administration (NOAA) emphasizes that wildlife can confuse a balloon’s small, bright pieces as food. The agency points out that the balloons released into the air don’t merely go away. They either get stuck on something like electrical wires or tree branches. Others may deflate and plummet into the ground, where they can create many problems.

Balloons that are not disposed of properly end up in the ocean and along the shores, and worse, they can be mistaken for food by wildlife and marine animals. Strings or ribbons attached to the balloon, on the other hand, can cause entanglement and other injuries.

Another major problem is marine debris.

Experts are also worried about balloons becoming marine debris. Solid waste, found in global water bodies and the accumulation of such waste along waterway shorelines, is termed marine debris. Marine debris is frequently cited as one of the most widespread issues in global marine pollution.

7 Alternatives to Balloon Releases

At first, we are hesitant to talk about this because we know how sentimental balloon releases are in many communities, organizations, and families. Fortunately, there are several alternatives to balloon launches.

A non-profit organization called Clearwater Marine Aquarium recommends seven potential alternatives to balloon launches, including the following:

- Flags

- Banners

- Streamers

- Kites

- Pinwheels

- Bubbles

- Floating Flowers

Do you want to make a meaningful contribution to save Mother Nature? Now is the best opportunity to help! Next time you’re thinking about celebrating, try these environmentally friendly replacements for balloons.

Conclusion

Our effort has exposed the environmental hazard that balloon celebration may bring to our plant. We must reassess our traditions and consider some eco-friendly alternatives to commemorate special events. Let us prioritize sustainability and make informed choices to make a lasting impact on the environment. It’s time to deflate the myths and rise above the challenges associated with balloon releases.

Lifestyle

Why Green Living Matters? Ways to Reduce Your Carbon Footprint

Published

4 months agoon

December 27, 2023

Green living has become a popular campaign in a world increasingly defined by rapid industrialization. It is about switching to an eco-friendly lifestyle and living a simple life that will help us combat the effects of climate change. Our combined efforts to practice a green, sustainable lifestyle will be a significant step to save the planet and our future. And that practice will be the ultimate guide to our green lifestyle.

What Does Green Living Entail?

Green living is a lifestyle that promotes creating a balance in preserving and protecting Earth’s natural resources, ecosystems, and biodiversity. In short, green living is a way of developing sustainable habits in one’s daily life. This way, their daily routines work alongside the natural resources instead of consuming them or damaging the environment permanently.

The vital aspects of green living are reducing pollution, protecting wildlife, and conserving natural resources. People need to recognize that green living can alleviate the rapidly increasing global warming and climate change rates.

What are the Benefits of Green Living?

The apparent advantage of green living is enhanced sustainability within individuals and the world. It also improves the state of the environment by taking into consideration the reduction of impacts of climate change and global warming.

However, there are many benefits to committing to green living, which include the following:

Mitigate Further Pollution

Green living directly reduces your carbon footprint and overall global emissions. You immediately make a difference in pollution through simple habits like lowering your electricity consumption or avoiding plastic use.

Preserve the Natural Resources

One of the primary aspects of green living is using what you already have. This is where the concept of “reduce, reuse, recycle” comes in.

Likewise, gardening was a green living trend that became popular due to the pandemic. More and more people have decided to grow their produce at home, reducing food waste and excessive use of plastic packaging.

Green Living is Economical

Did you know that most Eco-friendly products are becoming cheaper? So, if you join the green living movement, you’ll notice a decrease in your usual spending habits.

Lead A Healthier Life

Green living will help improve your diet and overall health because of increased fruit and vegetable consumption. Amidst the fast food era, most people no longer consume the recommended amount of fruits and vegetables. Green living can help encourage better eating habits while saving the planet.

The Domino Effect

If one person sees how well you’re doing in green living, they will be inspired to try the same. Remember, the battle against climate change requires collective efforts. If we can slowly create change in the community, we can drastically reduce the harmful effects of global warming.

7 Ways to Reduce Your Carbon Footprint

A few simple changes around your home can reduce your carbon footprint. You can prevent waste and pollution by using the shower instead of a bath and using your reusable grocery bags. Look at some fixes that WWF pushes for implementing green living in your own simple ways.

1. Dial it down. Turning your thermostat down to 2 degrees in winter and up two degrees during summer could save approximately 2,000 pounds of carbon dioxide annually.

2. Turn it off. Artificial lighting comprises 44% of electricity use in office buildings. Always turn off the lights for 15 minutes or more when leaving any room. Also, switch off power strips and unplug electrical devices when not in use.

3. Use cold water. Using cold water can as much as 80% of the energy needed to wash your clothes. Opt for a low setting on the washing machine to help save water.

4. Switch to electronic billing. Paper products comprise the most significant percentage of local solid waste in the United States, and printed bills alone generate almost 2 million tons of CO2. So, save paper by switching to electronic billing (e-billing).

5. Buy local produce. In North America, for example, fruits and vegetables travel 1,500 miles, on average, before reaching your plate. Buy fresh, local food to avoid long distances traveled and preserve nutrients and flavor.

6. Recycle. You can recycle plastic bottles, paper, electronics, batteries, etc. Practice proper disposal and learn how to recycle such products.

7. Switch to solar. Use solar panels to power your homes or offices. This can lower your electric bill and reduce your carbon footprint. Explore this option and help our planet through renewable energy.

Final Thoughts

Green living reduces the further impact of global warming. It is a simple way to lessen the adverse effects of climate change because it encourages individuals to reduce their carbon footprint. Collectively, it can help reduce global temperatures. Moreover, green living improves health and sustainability in your own life and paves the way for a brighter future.

Unlimited Graphic Design Companies Of 2023 + Promo Codes (Updated)

10 Best Banh Mi Restaurants In and Around Tulsa

99Designs: An Honest Review From a Non-Designer

Graphics Zoo Review: Is this unlimited graphic design service worth it?

5 Highest Rated Design Services Used by Big Brands & Agencies

The 3 Best Graphic Design Services to Try in 2024